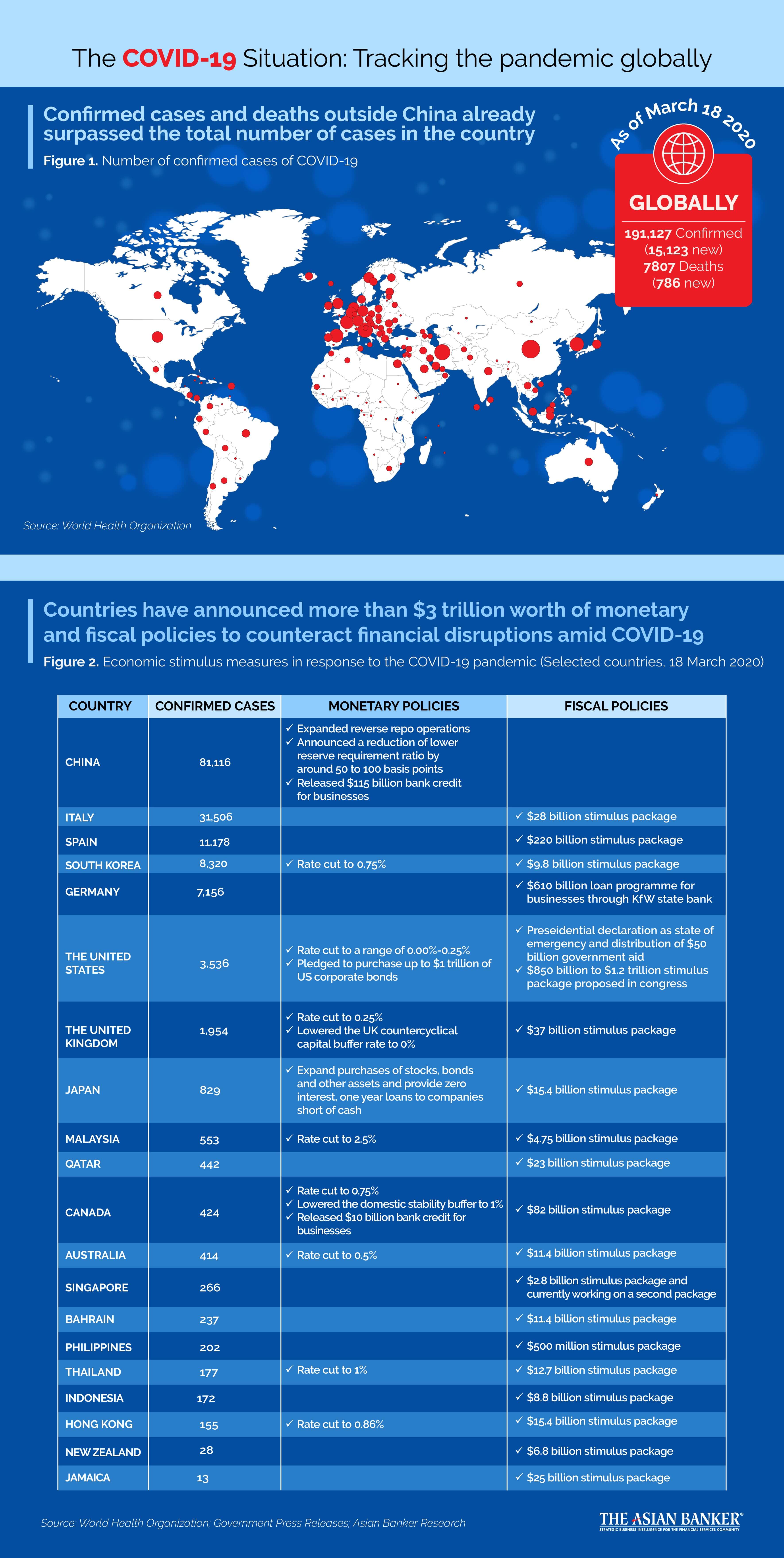

- Confirmed COVID-19 cases have reached 191,127 with more cases happening outside of China, thus creating a global crisis

- Regulators and governments have deployed traditional monetary and fiscal tools totalling to $3 trillion to manoeuvre market disruptions caused by the pandemic

- Economic activities remain restrained as countries are undergoing lockdowns and consumer sentiments further dampen

The World Health Organisation (WHO) released a worldwide tally of 191,127 confirmed cases of COVID-19 as of 18 March 2020, with 15,123 new cases reported in the past 24 hours. Of which, 58% occurred outside of China with mounting cases in Italy, Iran, Spain, South Korea and Germany.

As the situation has transformed from a crisis in China to a global emergency in just a span of three months, governments and regulators in major countries have taken radical steps in protecting their respective jurisdictions. In 15 March, the United States Federal Reserve slashed interest rates by a full percentage point to a range of 0.00% to 0.25%. This is the largest rate cut from the Fed since the 2008 financial crisis. It has also committed to spending $1 trillion in purchasing corporate bonds.

Other markets such as South Korea, the United Kingdom, Canada and Australia have also lowered interest rates in an effort to stimulate the economy. Meanwhile, China has expanded its reverse repo operations and reduced its reserve requirement ratio to pump money into its financial system. Japan, with its interest rates already at negative 0.1%, committed to aggressive purchasing of assets, bonds and stocks to aid its credit market.

Aside from monetary policies, governments have also announced stimulus packages to support affected residents and businesses. As of 18 March, the estimated fiscal aid of various governments totalled to an estimated $2 trillion with the United States negotiating a stimulus package ranging from $850 billion to $1 trillion. The packages include a range of programs including tax cuts, cash grants and subsidies, increased benefits and job retraining workshops.

However, the efficacy of these monetary and fiscal policies is still up for debate. The situation caused by COVID-19 is quite unique and unprecedented, with countries announcing nationwide lockdowns, travel restrictions, school and business closures and postponement of activities. So far, investors seem unconvinced that these measures are enough, with the US stock market experiencing another crash and the Dow Jones Industrial Average plummeting by 10% on 11 March even after the Fed’s announcement of a rate cut.