- Financing gap remains an issue, especially in APAC

- Regulatory measures have improved sustainability reporting

- FIs embrace climate change considerations

- Tech developments for green infrastructure in Singapore

The UN Climate Change Conference (COP26) marks a new milestone to tackle climate change through pragmatic approaches. The COP26, or Glasgow summit, gathered 25,000 decision makers and aimed to achieve a set of promises, specifically a cleaner, greener and restored planet.

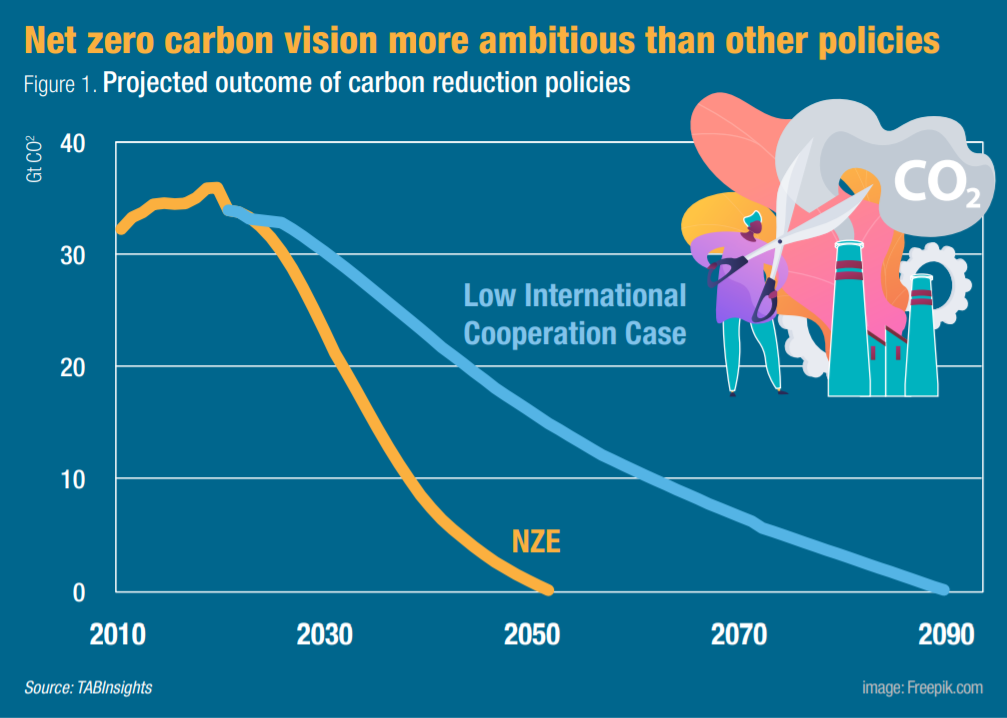

The conference series was proposed in 1972 during a summit in Stockholm, Sweden, that focused on the theme of Human Environment. Some five decades later, the Glasgow summit materialised its focus on the mid-century net zero emission (NZE) vision.

The NZE vision builds upon and intends to reinforce the objective to reduce global warming that was agreed upon in 2015 in Paris. Among several targets, the Paris agreement envisioned to keep global warming below 1.5 degrees Celsius by 2030.

The climate change considerations and its various communication outlets such as the Paris and the Glasgow summits are introducing their vision into some sectors more than others. For example, the Green Deal is requiring the reduction of emissions from cars with 55% by 2030 and 100% by 2050. In conjunction, it also demands the transportation sector to make transports sustainable for everyone. However, such a demand is not only affecting the transportation sector, it also necessitates collaboration among different set of partners.

To highlight the importance of such collaborations, in October 2021, the Singapore-based joint venture CO2X announced its partnership with representatives from the transportation, logistics and finance sectors. The company was founded by technology firms Ascent Solutions, Evercomm Singapore and Hashstacs (STACS). Cherie Goh, chair of Singapore Transport Association, commented on the announcement by stating, “Rapid global industrial and economic developments are making the lives of humans easy and comfortable but also exacerbating climate and public health. Humanity is on the verge of facing extreme health and quality of life crisis.”

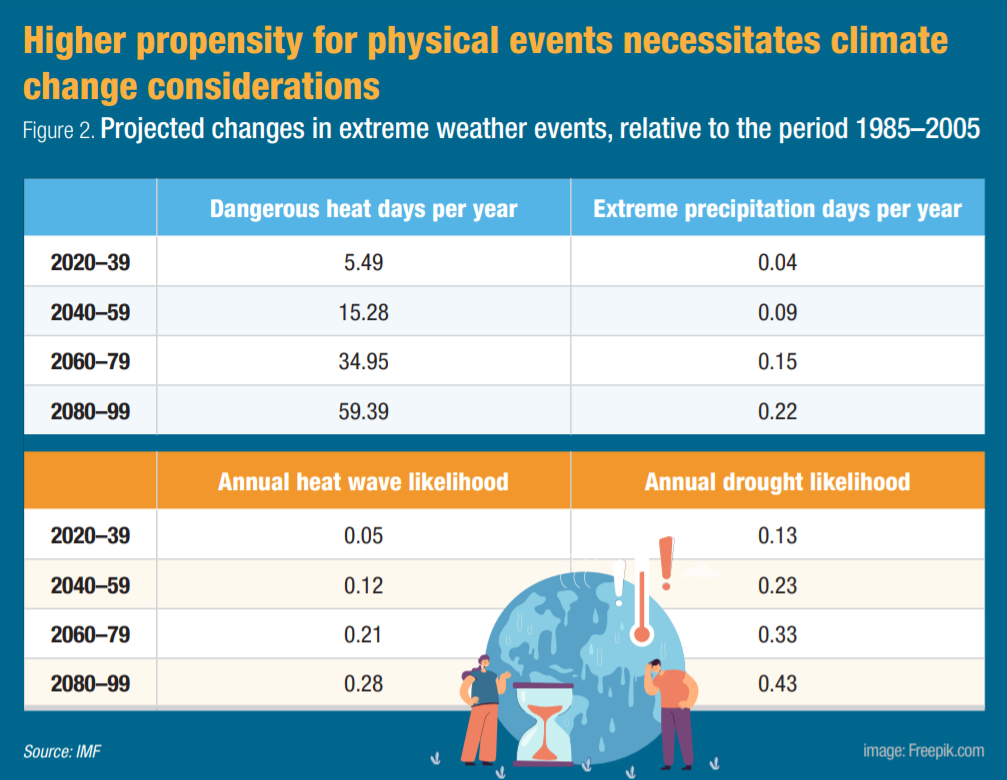

Some of these dangers are based on observations of events such as the wildfires in Australia and southern Europe, the flooding in Europe, and heat waves elsewhere. Decision makers have suggested the events heighten the imperative of reaching the objective of the Paris agreement quickly. The International Monetary Fund (IMF) forecasts that such extreme events are likely to increase in the future (see Figure 2).

Besides the physical risks mentioned above, the dangers in inactions have been estimated to put companies’ assets and the world economy at risk. According to United Nations Environment Programme, an estimated 11-14% reduction of the global GDP by 2050 and about $1 trillion in assets (the estimated asset value of the 215 biggest companies in the world) are at risk. The situation has made investors aware of the danger of not setting up an account for the “transition risk”.

Investors are encouraged to make changes to their strategies and shift investments away from companies contributing to carbon and emission. Kimin Tanoto, CEO of Indonesia-based Gunung Capital that focuses on impact investments, underscored the importance of attending to transition risk. “Concerns of being left with carbon-heavy ‘stranded assets’ are serving as a wake-up call to legacy industries that must chart the difficult path to net zero,” he highlighted.

In view of the prologues before the Glasgow summit, numerous decision makers reiterated the urgency of climate change and the related consequences such as negative social implications that may produce both financial and non-financial risks for the financial sector and financial services companies.

Moreover, in the invitation letter to COP26, Boris Johnson, prime minister of the UK and the host of the summit, called for ambitions, courage and collaboration to mobilise the forces globally and turn the tide on climate change through collective actions. The summit concluded in mid-November and resulted in several priorities such as the need for more investments in vehicle charging infrastructure, fuel efficiency standards and regulations, and the importance of reaching consensus regarding suitable technologies.

Financing gap remains an issue, especially in APAC

Climate change considerations imply new opportunities and obligations for financial systems participants such as banks and insurance companies and other financial companies such as pension funds.

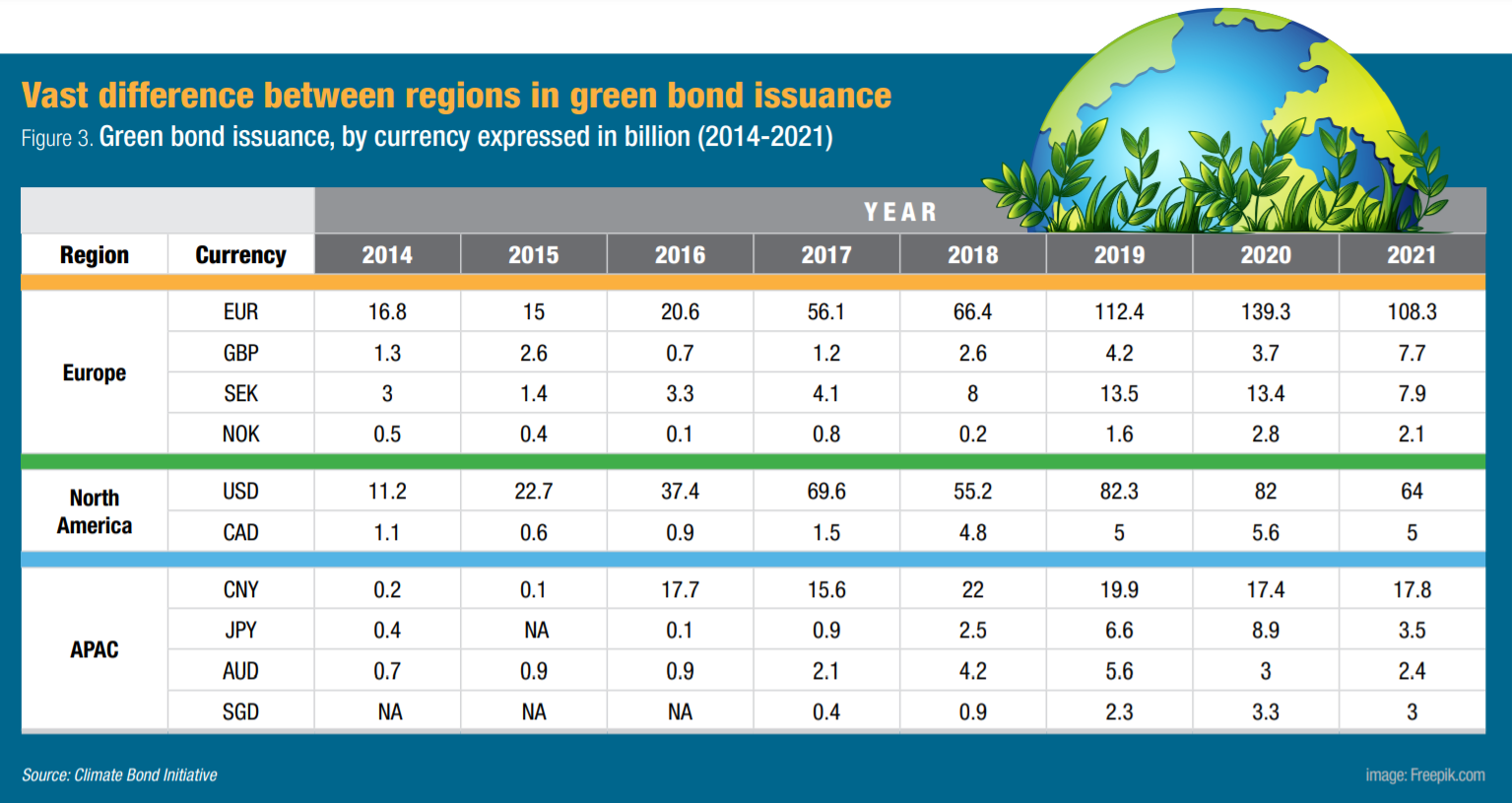

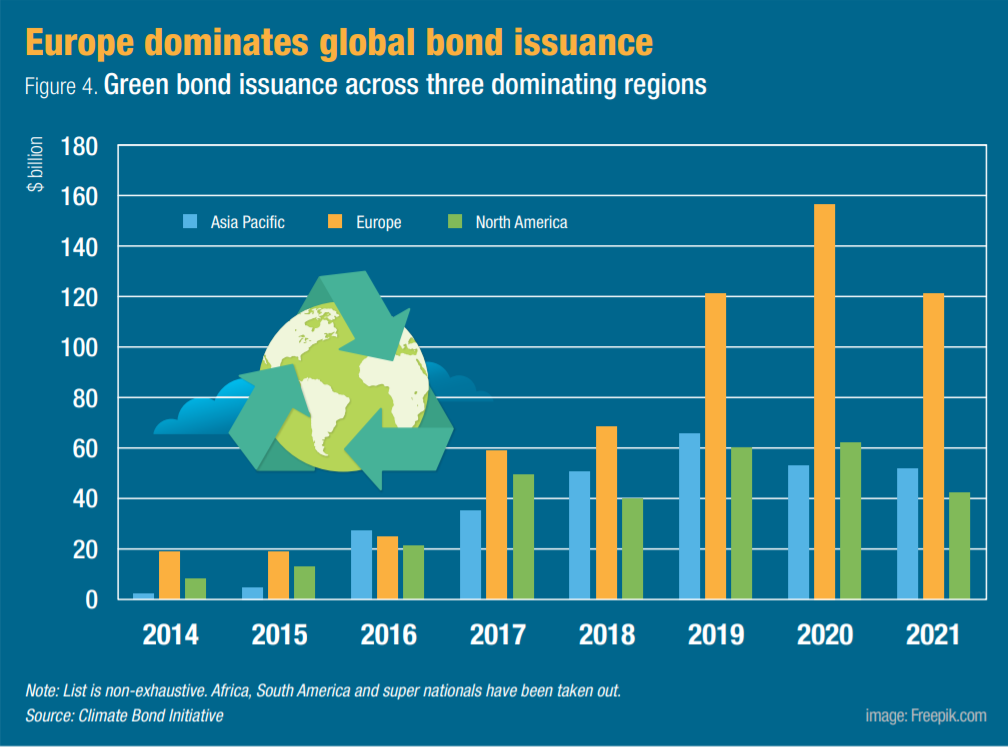

There are opportunities for incumbent financial institutions (FIs) to issue new products. The World Bank issued the first ever green bonds in 2008, and today the green bond market is an estimated $1.3 trillion market, according to the Climate Bond Initiative.

Green bonds are issued to finance environmental and climate projects including areas such as clean transportation, green buildings, renewable energy and sustainable water.

Despite the significant growth of green-tagged bonds, they account for just around 2% of the total bond volume issued globally, according to the European Commission. Currently, the EU leads the green bond markets, capturing 51% of the global issuance in 2020 from EU-based entities and 49% of global green bonds denominated in euros. In July 2021, the European Commission announced that about 2.6% of the total EU bond issuance can be considered green bonds issuance. Meanwhile, Morningstar reported in June 2021 that although fund flows are increasing, green bonds barely account for 1% of the global bond market.

Before COP26, institutions including the World Bank and the European Bank for Reconstruction and Development also announced their plans for more climate-oriented lending.

Moreover, to speed up the market for green bonds, alliances among FIs have gained traction, most recently the Glasgow Financial Alliance for Net Zero has attracted some 250 FIs. In Asia Pacific (APAC), alliances among FIs have been encouraged by agreements such as the New International Land-Sea Trade Corridor, which was set up to connect China and Singapore-based banks.

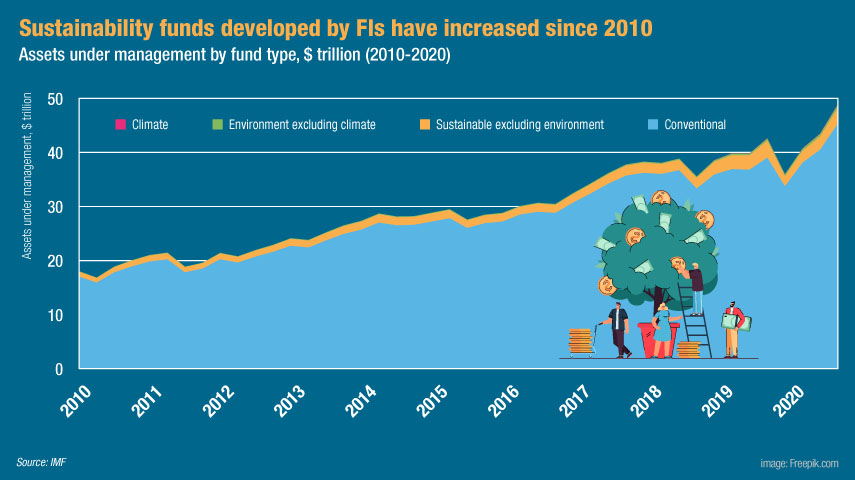

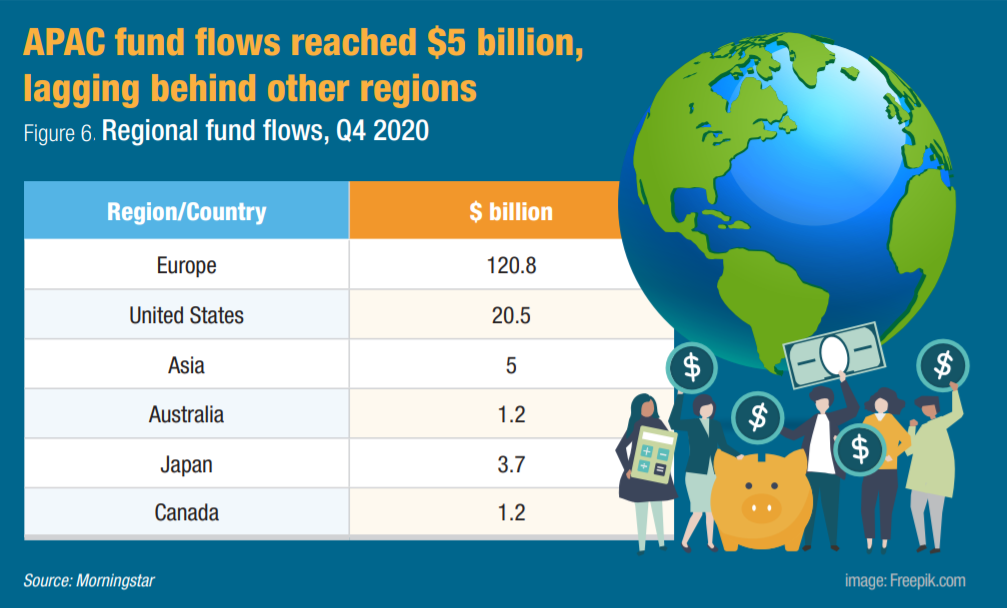

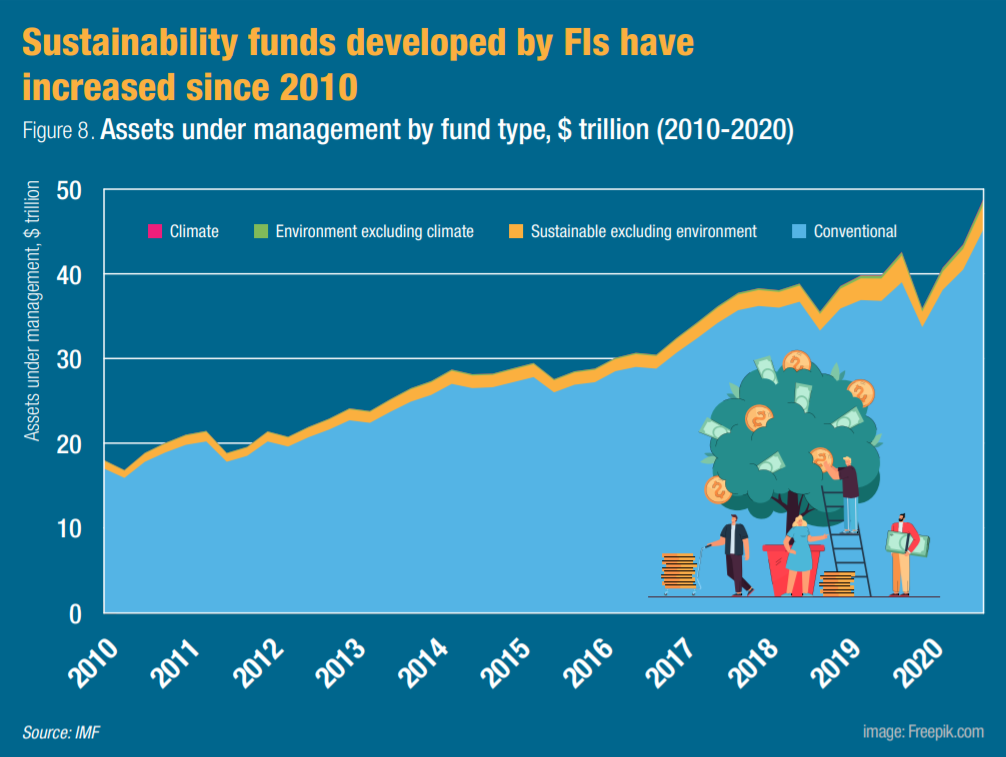

There are opportunities for many FIs to launch new investment products. In an assessment of sustainable fund flows, Morningstar highlighted the growing size of sustainability funds. In 2020, assets under management reached nearly $1.7 trillion. In the last quarter of 2020, an additional $152.4 billion were channelled to sustainability funds.

The opportunities are also attractive for new companies that operates in interfaces of various industries and technology. Benjamin Soh, managing director of STACS, commented, “The financial sector needs to build up its sustainable financing capacity, which is currently hampered by a gap of $2.5 trillion in annual financing towards the United Nations Sustainable Development Goals (UN SDGs).”

Singapore startup Tribe controls a talent pool focused on deep technology and connects specialists with companies. Ng Yi Ming, CEO of Tribe, elaborated, “Hundreds of billions of dollars will be needed to finance green energy projects and much of this will need to come from private investors. We have already seen the global green bond market issue a record $269.5 billion in 2020, increasing from $266.5 billion in 2019, and it is estimated that more than $1 trillion cumulatively in green bonds have been issued to date.”

FIs have reportedly diversified their sustainability funds offerings into different product categories to include and exclude different concerns such as the environment and the climate. It is during the last few years that climate-related funds have been picking up speed.

Besides green bonds and investment products, Gunung Capital sees the possibility that carbon could emerge as a new asset class. Tanoto said, “Global capital markets and strategic partners are eager to raise funds and invest in ESG-focused opportunities, as well as carbon credits, to contribute towards a shift to sustainability.” ESG refers to the three central factors, i.e. environmental, social and corporate governance, in measuring the sustainability and societal impact of an investment.

The drive towards climate finance offers new opportunities for the financial services industry but could also lead to a financing gap due to issue of regional differences and how FIs will tackle new regulatory requirements. Ng stated, “No region will need green investment more than Southeast Asia, yet a lack of robust, trusted ESG data is putting a break on green investments.”

Regulatory measures to improve sustainability reporting

The Paris agreement marks the start of a wave of regulatory measures for FIs. For the financial services industry, compliance with complex regulatory measures and additional reporting obligations are hurdles before the industry’s ability to fetch the potential opportunities. To add to the complexity, various jurisdictions have launched respective frameworks and rules to improve the climate reporting of companies.

In his closing remark to the Sibos 2021 conference, Mark Carney, the UN special envoy on climate action and finance, stated, “The six years old Climate Related Financial Disclosures has recently been ratified by both G7 and the G20 to support mandatory disclosures. These requirements are then planned to be mapped into regulations and have recently been adopted by the international body International Accounting Standards Board that has some 120 members states.”

In a parallel process, the EU has taken further steps to reinforce several reporting requirements. It has proposed the Corporate Sustainability Reporting Directive (CSRD), launched the Capital Requirements Regulation (CRR2), and the European Banking Authority has issued its guidelines.

The regulatory trend has also been noted by the newly created resource pools and requirement of specialists to strengthen regulators’ purview. In June 2021, the European Central Bank (ECB) appointed Irene Heemskerk to head the Climate Change Centre that is mandated to coordinate ECB’s work on climate and to shape and steer the ECB’s climate agenda. In a similar move, the Monetary Authority of Singapore (MAS) appointed Darian McBain in September 2021 to head the newly launched Sustainability Group.

The Swedish Supervisory Authority has gone in the same direction. Magnus Schmauch, senior legal advisor at the Sustainable Finance Centre, Swedish Supervisory Authority, commented, “These high-level appointments mainly provide opportunities to channel the policy aspects of climate change actions at the strategic level of the organisation of the agency but they wouldn’t take over supervision of banks’ climate risk reporting.”

Currently, various frameworks, regulations and standards set requirements for disclosure whether it is for the purpose of the broader concerns captured by the ESG framework, biodiversity, NZE or more. ECB requires supervised banks to present assessment of key risks and vulnerabilities on an annual basis, and climate change has featured as a key risk driver for the last two years.

One central expectation with such reporting obligations is that the disclosures of climate risks should provide signals to decision makers to address climate change considerations swiftly align the industry with current objectives, for example, a drive to reduce the global emissions substantially by 2030. For this purpose, decision makers have agreed on hard measures and facts produced through various scientific endeavours and calculated practices already common in the supervision of the financial services industry.

Carney stated, “There are similarities between climate policies and banking monitoring policies. One is that disclosures can provide financial markets the basis to anticipate what companies are going to do. Then based on the provided information from predictable and credible institution, the market can direct investments towards the goals.”

FIs embrace climate change considerations

The climate change considerations have resulted in several changes for FIs. Firstly, the mission statements of banks have been adjusted to reflect the current push. For example, Thomas von Hohenhau, head of client solutions at VP Bank AG, explained that the bank’s current banking business philosophy “to always put the clients’ needs first” is complemented with “Investing for Change”.

Secondly, on the demand side of the business, FIs have designed their products to also include features that offer their clients’ climate-smart choices. VP Bank launched new product features in September 2021 that lets clients choose investment products with up to five different sustainability dimensions including environment and climate action, health and demographic change, renewable energies and a circular economy, equal opportunity, education and security, and sustainable infrastructure.

Felix Brill, VP Bank’s chief investment officer and chair of the sustainability board, stated, “There are different ways of taking sustainability aspects into account in a portfolio, and investors usually want to approach it in their own way.”

Regulations such as the corporate sustainability reporting stipulated in the EU are part of the reason for banks attending to clients’ sustainability preferences. Under the Directive 2014/95/EU, large companies in EU have to publish information related to environmental matters, social matters and treatment of employees, respect for human rights, anti-corruption and bribery, and diversity on company boards (in terms of age, gender, educational and professional background).

FIs need to consider the clients’ sustainability preferences when marketing their products as these preferences are expected to impact corporations’ choices. Through this setup, corporations are supplied with the funds to consider ESG before making investment decisions and develop policies towards ESG.

Given that the access, processing and presentation of ESG data can face various challenges, FIs are employing advanced technologies to mitigate these challenges and access sustainability savvy market segments, with differentiated investment products, and to meet the regulatory demands to attend to climate change considerations.

The Singapore-based social trading platform Spiking offers its members solutions to make better investments decisions through the use of artificial intelligence. Clemen Chiang, CEO of Spiking, said, “Finance companies can put on display investment products and market them via the UN SDGs. Such marketing attempts are powered by advanced technologies that enable clients to consider their own personal sustainability preferences while making investment choices.”

Recently, VP Bank launched ORBIT, an open investment and structuring platform that provides access to the asset class of private market investments. Von Hohenhau commented, “We noticed the increasing relevance of private markets in today’s portfolio and observed how cumbersome accessing this asset class is for many investors. Hence, this triggered us to create systematic solutions through ORBIT.”

Blockchain is an emerging technology that is designed as a decentralised ledger and is capable of data collection, monitoring, steering and reporting operations that fit the purposes of the reporting obligations motivated by the climate change considerations. Blockchain can offer investors several benefits such as insights into value chains. Ng stated, “Blockchain can help measure adaption-related activities such as carbon reductions initiatives in factories and agriculture. Further down the chain it can be leveraged for making faster transactions and for making supply chains more predictable. A lack of such a transparency means that investors have fewer ways to evaluate how the investment money are being spent and consequently how green the projects are.”

Ng added, “By tokenising projects through blockchain, we will also be able to add traceability and provenance to green investments. With access to more information, investors can better diversify their portfolios and tokenisation allows smaller investors to take part in further expanding the pool of green capital available.”

Tech developments for green infrastructure in Singapore

Singapore has a vested interest in creating a suitable environment for developing blockchain and encouraging their use as blockchain can provide tokenisation of environmental impact, which in turn comes with various benefits and provides transparency. For example, MAS launched Project Greenprint in December 2020, which aims to promote a greener financial ecosystem through three pillars, i.e. mobilise capital, monitor commitment and measure impact. STACS participates in the initiative and Soh highlighted, “Project Greenprint is an inspired example of the good a regulator can do by enabling firms to connect with FIs and investors to access a wider pool of green financing options and solutions.”

By supporting blockchain-related sandbox experiments, Singapore has reached a unique position. Ng commented, “Singapore is a regional (and arguably, global) leader when it comes to blockchain research and use. It has invested significant amounts into the technology including $12 million in 2020 to expand the blockchain ecosystem.”

Recently, Singapore extended support to Project e-VCC, which involves InvestaX, UBS, State Street and CMS, as well as STACS as the provider of an enhanced ethereum-permissioned blockchain for the project. The project was announced in mid-October 2021 and intends to showcase a new structural format for companies.

Meanwhile, blockchain carries the complexity of requirements that arise with the diversity of standards such as the ISO standards, Global Reporting Initiative standards and the International Capital Market Association frameworks. Soh commented, “A drive towards a common platform for ESG is necessary to support different standards. It is important that companies can plug and play the standard of choice depending on their use case.”

Ng stated, “Blockchain-enabled data platforms could standardise the way ESG is reported, provide more transparency and trust and thus encourage more investors and financial (and non-financial) institutions to invest in green infrastructure.”

The financial services industry has been accused of being late with incorporating ESG. The investments in blockchain capabilities works on a set of promises and could provide a solution for the industry. Ng commented, “The ability to accurately measure and record greenhouse gas emissions is vital if we are to transition to a low-carbon world; hence, any ESG strategy needs to be based on accurate data. By integrating blockchain technologies into traditional infrastructure and reporting mechanisms, we will be able to improve data provenance and accuracy.”

Angelica Lips da Cruz, CEO of Innorbis, a predictive impact and sustainable investments business intelligence accelerator, highlighted that blockchain is a revolutionary protocol; however, she added, “It is still a long journey for any technology regarding how it is used, by whom, and for what purposes. There is still much work to do on the ‘G’ in ESG.”

Diversity in sustainable data and reporting standards will prevail, and investors and their intermediating FIs will continue to look for efficient risk management facilities. Meanwhile, entrepreneurial firms in the financial services industry can leverage blockchain technology to tackle the problem of verifying the greenness of an investment and how ESG data are obtained and processed.