- Evergrande pursued business opportunities outside of property development as revenue contribution dropped to below 90%

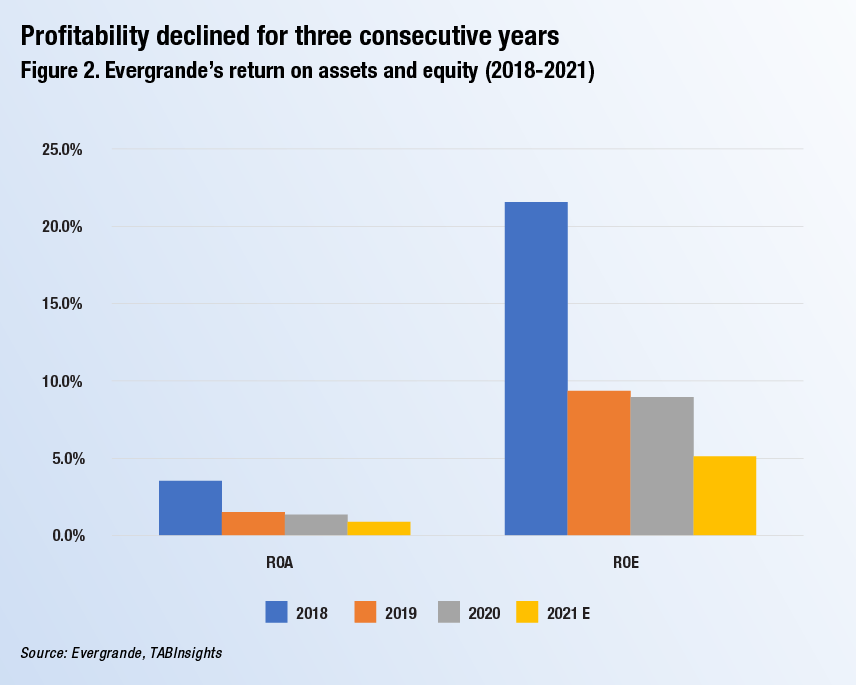

- Horizontal expansion was unprofitable as the group’s ROE and ROA declined from 3.5% and 21.6% to 1.4% and 9.0% respectively in 2020

- The precedence of potential collapses of Chinese institutions signals the government’s approach to resolving the crises

Evergrande reached its peak profit in 2018 and has since plunged year-on-year (YoY) with total liability reaching a record high of RMB 2 trillion ($302.5 billion) at the end of June 2021. The group missed a $83.5 coupon payment on one of its dollar bond due on 23 September, which caused turbulence for the capital market with the expectation of another “Lehman Brothers moment”.

Searching for business opportunities

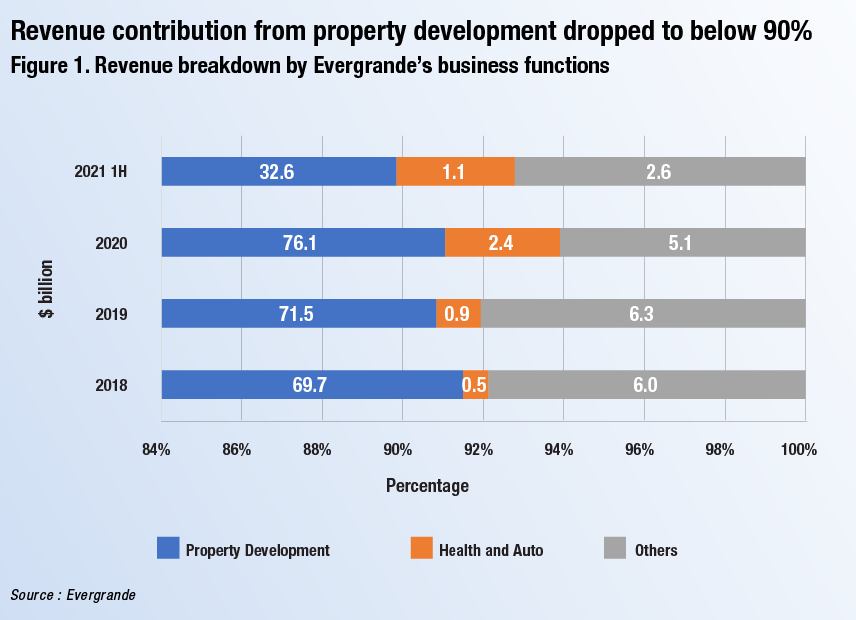

Property development has been Evergrande’s core business since its founding in 1996. The sector contributed over 95% of the group’s total revenue. However, with the slowdown of China’s economy and the central government’s cooling measures on the property market, Evergrande began to look for other business opportunities to drive the company’s growth. By the first half of 2021, revenue from property development has dropped below 90% for the first time in Evergrande’s history.

Company income continued to spiral downwards

Evergrande diversified its business into industries such as hotel operations, tourism, healthcare and finance. The latest move was entering the electric vehicle (EV) sector, competing against domestic and global producers such as BYD and Tesla. However, the horizontal expansion was unprofitable. Since 2018, the group’s return on assets (ROA) and return on equity (ROE) recorded a decline for three consecutive years. ROA and ROE dropped from 3.5% and 21.6% to 1.4% and 9.0% respectively in 2020 They are expected to drop further in 2021 to 0.9% and 5.1% respectively.

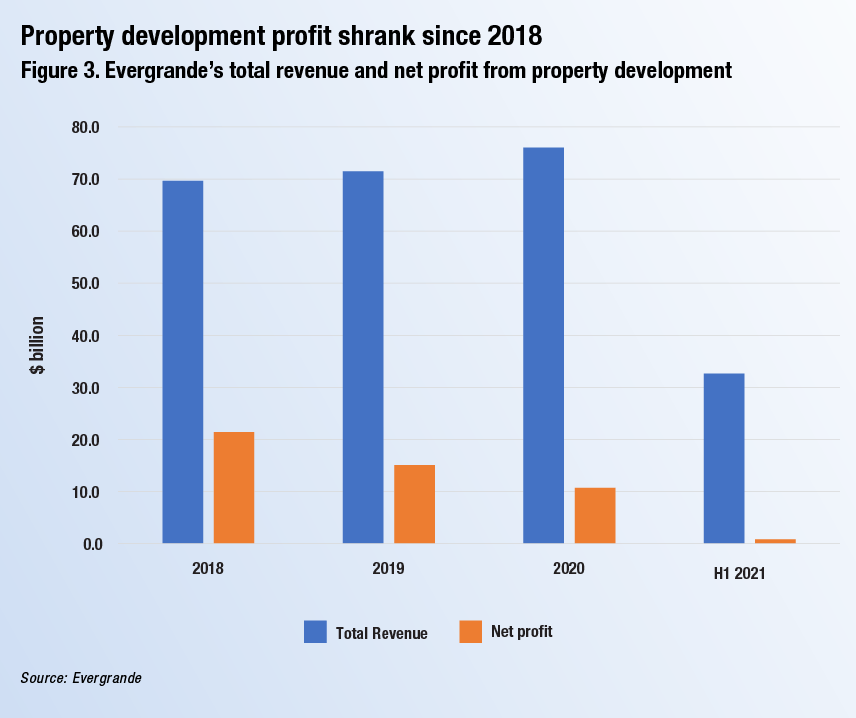

The key driver for the drop in Evergrande’s profitability is its core property development business. Its annual report showed that although sales revenues were still growing for the period 2018 to 2020, its net profit shrunk YoY due to skyrocketing cost of goods sold.

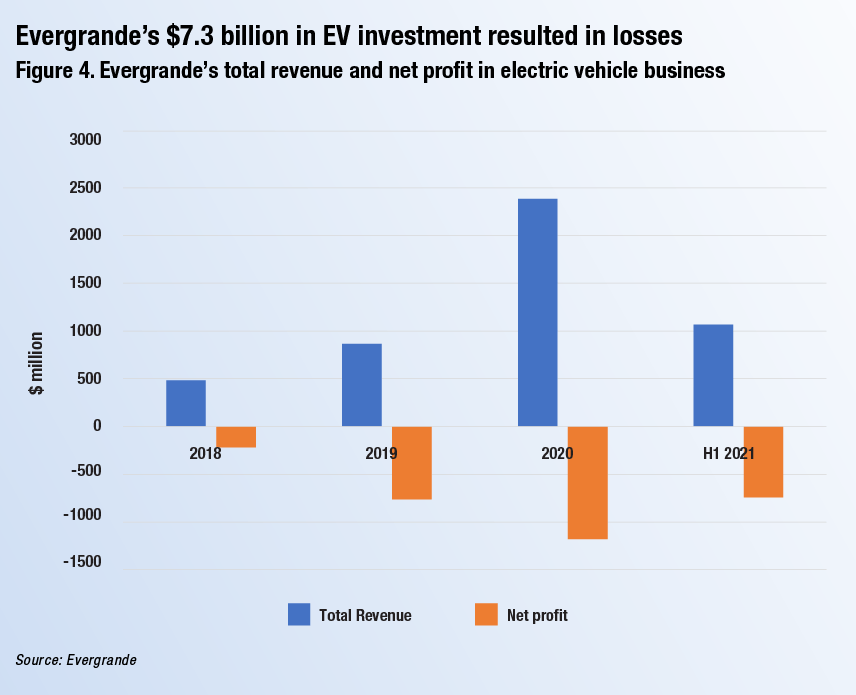

Evergrande’s new EV business worsened the situation. Since launching its auto business, the group has burned RMB 47.4 billion ($7.3 billion) for construction and research and development. However, the market has not seen the commercialisation of its EV. In 2020, Evergrande Auto reported a $1.2 billion loss. The company’s stock price plunged from HKD 72.45 ($9.3) per share on 19 February 2021 to HKD 2.75 ($0.35) per share on 20 September 2021. On 24 September, Evergrande Auto disclosed the halt of production on several projects because of the delay in payment to the construction vendors.

Chinese Estates Holdings, Evergrande’s second largest shareholder, disclosed on 23 September that the company has reduced its holding position of the group by 0.82% to 5.66%. It will continue to reduce the holding position depending on the market situation. On 26 September, Evergrande Auto cancelled its initial public offering initiative in A-share market, which further shadowed the group’s downfall. “Most likely the government has to inject capital into Evergrande so that it can continue construction and then sell residential property units to get cash to repay debts,” said Iris Pang, chief economist for Greater China, ING.

Policy shifts in China lands heavy blow on real estate market

In August 2020, China imposed the “three red lines” on real estate developers. It refers to three regulatory requirements for real estate liabilities. First, a 70% ceiling on debt-to-asset ratio after excluding advance receipts. Second, a 100% cap on net debt ratio. Third, more than 1x cash-to-short-term debt ratio. Evergrande aggressively expanded during the past few years through massive debt borrowing. As a result, the company failed to meet the requirements due to its debt snowball, and this led to its liquidity crisis. Evergrande is among the 75% of real estate developers that failed to meet the three red lines in 2020, according to S&P. There are growing concerns that other Chinese real estate companies are not far behind with mounting debts and the inability to service them. The deleveraging work is still in progress for the whole market.

Historical cases present possible solutions

On 17 October, the central bank announced that the Evergrande spillover risks can be controlled as relevant authorities and the local government is currently resolving the situation in accordance with laws and market principles.

In an Asia Society programme, Kevin Rudd, president and CEO of Asia Society and former prime minister of Australia, highlighted that 41% of the country’s $45 trillion in banking assets are exposed in one way or another to the property sector and 27% of its $30 trillion in loans are tied up in swollen property market. The precedence of potential collapses of Chinese institutions, such as Anbang Insurance, Baoshang Bank, HNA Group and Huarong, highlights the Chinese government’s approaches to resolving such crisis.

Rudd noted, “The arguments in favour of orderly distribution of assets would seem to be based on both precedents, referring to what happened in the case of Anbang, what is happening in the case of Huarong, and what is happening in the case of HNA. There also seems to be reflected in the evidence of the behaviour of certain officials, be it at the local and provincial levels now, as they deal with instructions from Beijing to prepare for the purchase of certain distressed assets from the Evergrande Group”.

Public auction and bondholders taking a haircut are other routes to resolve the potential collapse, along with the introduction of foreign capital participation. In the same Asia Society programme, Henry Cornell, senior partner of Cornell Capital, stressed, “If China opened its doors a little bit and allow foreign capital as well as domestic capital to intermingle, it wouldn’t put as big a strain on the entire Chinese system. No one's moving the assets, at least the existing operating assets. And I think they would find a home you can package these ‘operating assets’ in Shanghai, for example, and just sell them off in tranches. And you do this over a period of years in an orderly fashion”.

Meanwhile, the share price of the beleaguered developer recovered some lost ground on 12 November as it averts default by making coupon repayments on its latest outstanding bonds through the sales of a stake in an Internet company. Investors are also turning to regulators in hope that they will provide some respite to these heavily indebted firms by easing up current financing and liquidity restrictions.