The People's Bank of China has played a dominant role in constructing the payment infrastructure of China.

As the world’s second largest economy, China needs an integrated payment infrastructure to support the growth of economic activities and the clearing and settlement of retail, wholesale, and financial market transactions. In 2015, nationwide payment transactions amounted to RMB5,920 trillion ($913.5 trillion), an increase of 74.5% over 2014.

As the Chinese economy undergoes structural reform, retail consumption will account for a bigger part of gross domestic product (GDP) growth. In 2015, the total transaction value of retail payments surged to RMB31.97 trillion ($5.2 trillion), a 22% increase from the previous year, and is estimated to reach RMB39.06 trillion ($6.03 trillion) in 2018.

Payment infrastructure

The bulk of the payment infrastructure in China is developed and operated by the People’s Bank of China (PBOC) at the national level; and at the regional (city and rural) level by city commercial and rural commercial banks. The main retail payments processors are China UnionPay and third party payment institutions.

National payment systems operated by People’s Bank of China

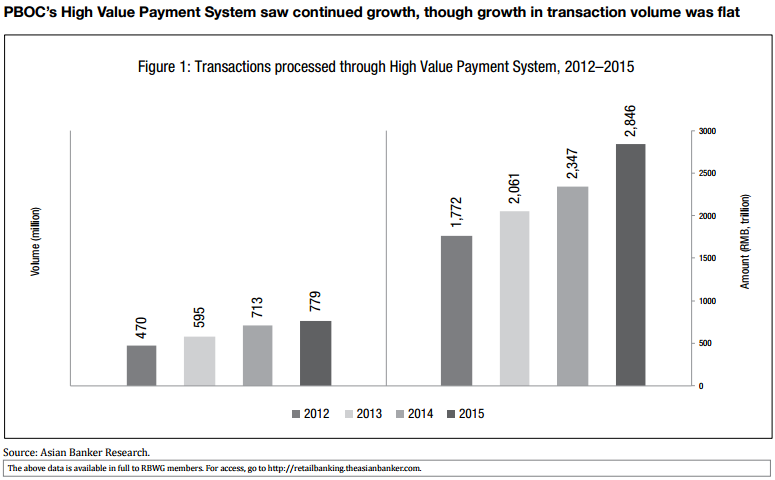

The PBOC, which oversees China’s payment and clearing systems, plays a dominant role in payment infrastructure construction. Over the past 10 years, PBOC has established several payment systems to facilitate economic and financial activities of various financial institutions. These include high-value payment system (HVPS), bulk electronic payment system (BEPS), internet banking payment system (IBPS), cheque image system (CIS), and domestic foreign currency payment system (DFCPS). In 2015, payment systems operated by PBOC processed transactions worth RMB3,898.6 trillion ($601 trillion), up by 60% compared with theprevious year. Among all PBOC payment systems, HVPS dominated transaction activities in 2015, at RMB2,846.2 trillion ($439.2 trillion), accounting for 73% of total payment transaction nationwide. However, the growth of transaction volume has slowed since 2012 (Figure 1).

Intra-bank payment systems operated by provincial and rural sector banks

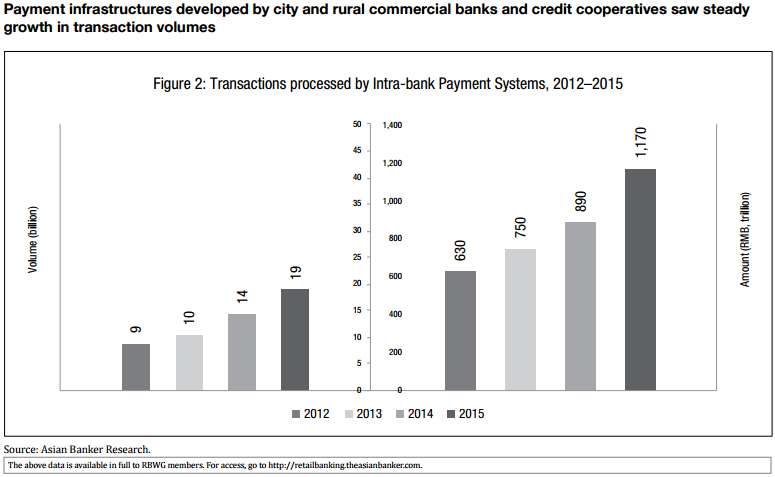

With the development of China’s urban and rural areas, banking institutions, namely, city commercial banks, rural commercial banks, and rural credit cooperatives have grown rapidly, as has the payment infrastructure. The Clearing Centre for City Commercial Banks (CCCCB) and Rural Credit Banks Funds Clearing Centre (RCBFCC) were set up to serve these institutions. By end-2014, some 4,164 business units had access to the CCCCB clearing system. For RCBFCC meanwhile, 38,371 rural cooperative financial institutions from 16 provinces and cities have started mobile payment services via its shared mobile banking platform. In addition, 9,428 rural cooperative financial institutions from 15 provinces and cities have begun to use the RCBFCC self-service financial service platform.

In 2015, the number of transactions processed by the Intra-bank Payment Systems (IBPS) of banking institutions numbered 18.9 billion, with a total value of RMB1,170 trillion ($180.5 trillion), accounting for 19.8% of total payment transaction nationwide. Led by PBOC, some local banks ran pilot programmes to facilitate payments for various purposes. Industrial Bank of China, for example, was hand-picked by PBOC to build an integrated system to support the Ministry of Finance in collecting nontax income. Jiao Jian, senior managerof IBC, remarked that the project has helped improve institutional clients’ payment experience by providing a system that is integrated nationwide.

Retail payment systems

Over the last decade, China has built up a nationwide payment infrastructure dominated by People’s Bank of China (PBOC) and large banks, to facilitate payment and settlement within financial institutions in both urban and rural areas. At the same time, UnionPay, along with other third-party payment institution such as Alipay and Tenpay, play an important role to process payment operations between merchants, consumers, and banks.

UnionPay

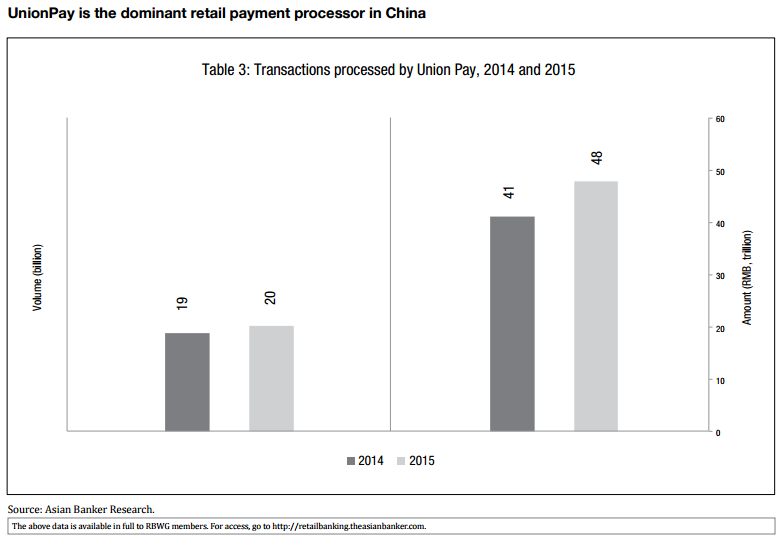

UnionPay, the dominant Chinese bank card clearing player, formulates business protocols and technical standards for interbank bank card transactions. It operates the interbank bank card clearing system, and provides interbank bank card information exchange services. In 2015, the number of POS and ATM terminals operated by UnionPay had reached 19.8 million and 0.84 million, rising, respectively, by 25% and 33% year-on-year (YoY).

The volume of transactions processed by UnionPay‘s Interbank Bankcard Clearing System has grown dramatically. In 2015 alone, the system processed 20.2 billion transactions worth RMB47.86 trillion ($7.38 trillion), up by 8.2% from 2014 and 16.4% from 2014, respectively. Among these transactions, volume and value of transactions via ATM reached 7.51 billion and RMB4.52 trillion ($0.69 trillion), up by 13.13% and 25.01%, respectively. Transactions via POS reached 9.77 billion and RMB29.18 trillion ($4.5 trillion), up by 28.10% and 16.22%, respectively (Figure 3).

Third party payment institutions

Third party payment institutions are playing a more and more important role in retail payments. Since the first third party payment licence was issued by PBOC in May 2011, the third party payment industry has witnessed tremendous growth. By 2015, 270 nonfinancial institutions had received payment licenses with accumulated transaction volume amounting to RMB45.77 trillion ($7.06 trillion) since 2011. These institutions provide diversified and tailored payment services, becoming important components in the retail payment service market.

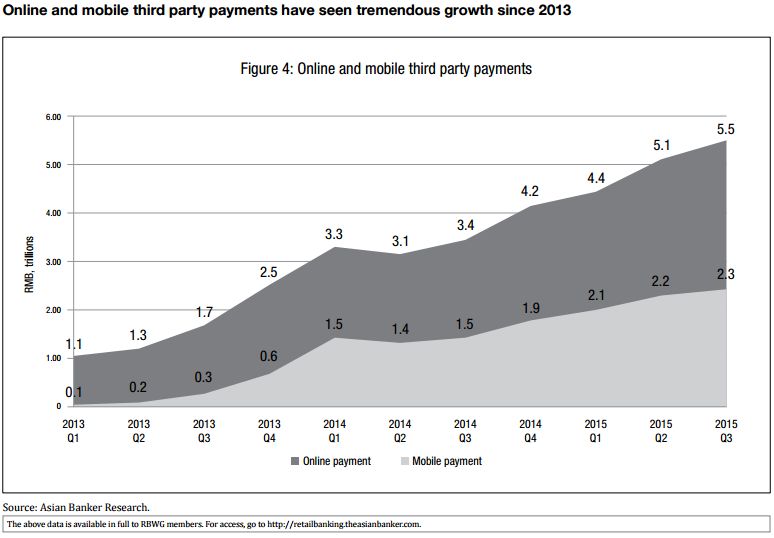

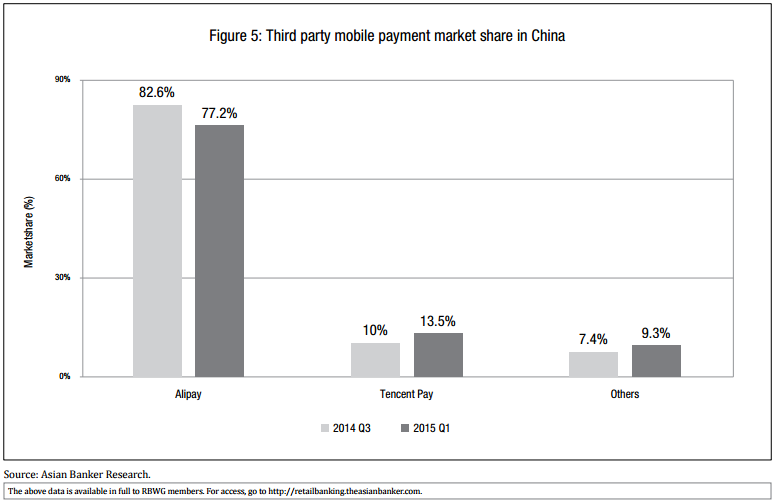

China’s third party payment industry has seen rapid growth in both online and mobile platforms. By the third quarter of 2015, online payment transaction value reached RMB3.07 trillion ($0.47 trillion) while mobile payment amounted to RMB2.42 trillion ($0.37 trillion), for YoY growth of 52.5% and 68.9%, respectively (Figure 4). In terms of the mobile payment market, Alibaba and Tencent accounted for over 90% of market share, leveraging on their premium business platforms like Taobao, Tmall, and Wechat. Alibaba’s market share shrank from 82.6% in the third quarter of 2014 to 77.2% in the first quarter of 2015, while Tencent’s market share increased from 10% to 13.5% during the same period (Figure 5). To face fierce competition from third party payment institutions, several banks including Bank of Shanghai, CITIC Bank, and Bank of Jiangsu waived transaction fees through their online channel.

Future directions

With all the initiatives and development from different financial and nonfinancial institutions, China has set up a holistic advanced payment infrastructure to meet the financial needs of retail clients. Looking forward, international players will play a more important role in the country. For the last 12 years, UnionPay has dominated the bank card clearing network in China and became the third largest bank card association after VISA and MasterCard worldwide. In 2015, China opened its clearing network to foreign players including VISA and MasterCard. Now, VISA and MasterCard have the chance to tap into the Chinese market to acquire merchants and settle for local card issuers. On the other hand, new payment solutions such as Apple Pay and Samsung Pay are also entering the local market and, together with homegrown players like Alipay and Tenpay, are poised to provide a more integrated payment experience to Chinese retail customers.