- Bitcoin price drop casts new doubts

- The crypto market beyond bitcoin

- The number of users exceeds prior projections

- The crypto market causes structural changes to financial markets

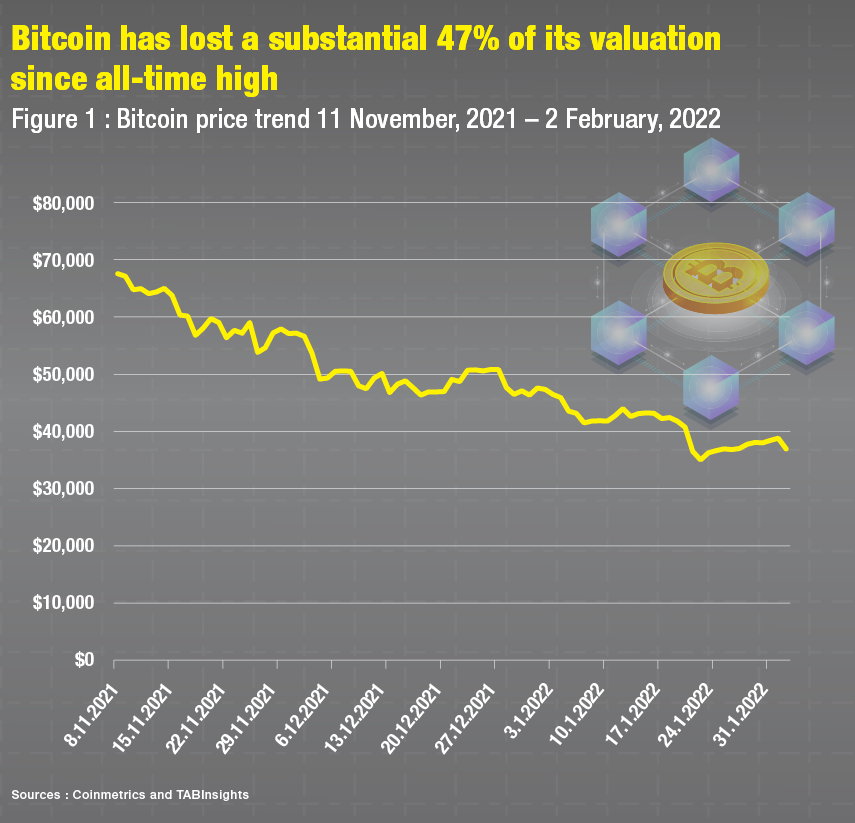

Bitcoin reached the staggering $68,700 valuation on 11 November 2021, pushing its market capitalisation above $1 trillion, on par with the market capitalisation of companies like Tesla and Meta.

The downward trend has cast doubts over the valuation of cryptocurrencies and posed existential threats to the entire market.

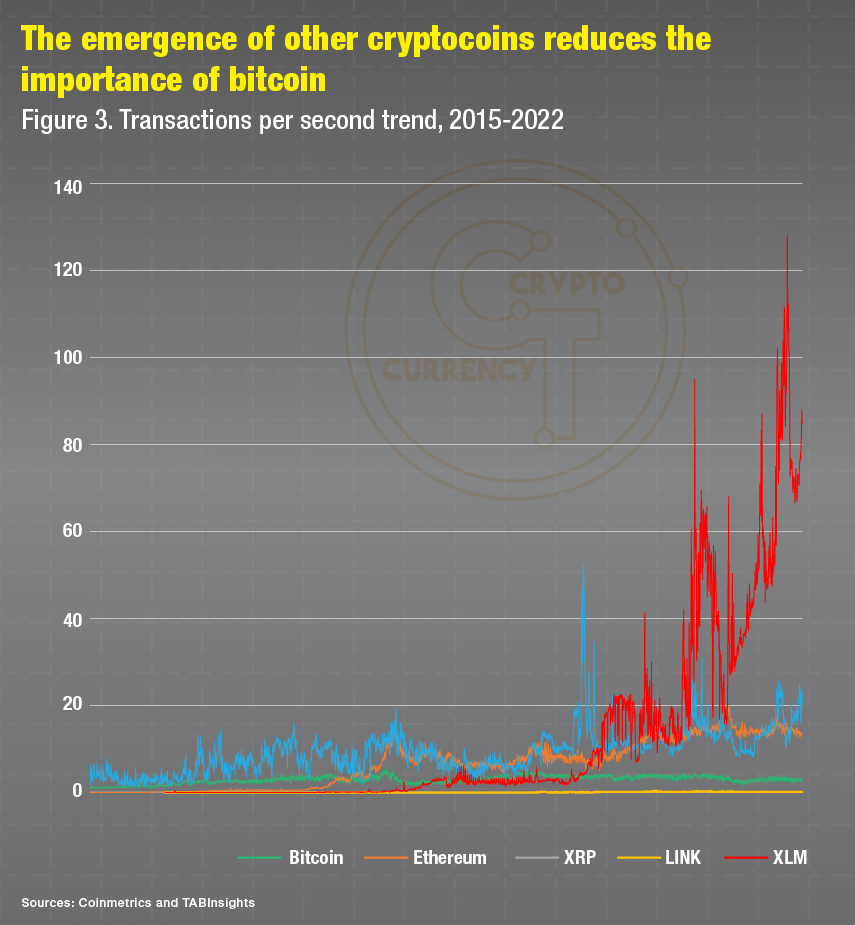

The inception of cryptocurrencies is often credited to Satoshi Nakamoto, the pseudonym of the designer of bitcoin, the prototype of the first decentralised currency meant to replace fiat money. According to Coinmarketcap, bitcoin accounted for about 42% of the cryptocurrency market and is dominant among some 17,200 cryptocurrencies as of 2 February 2022.

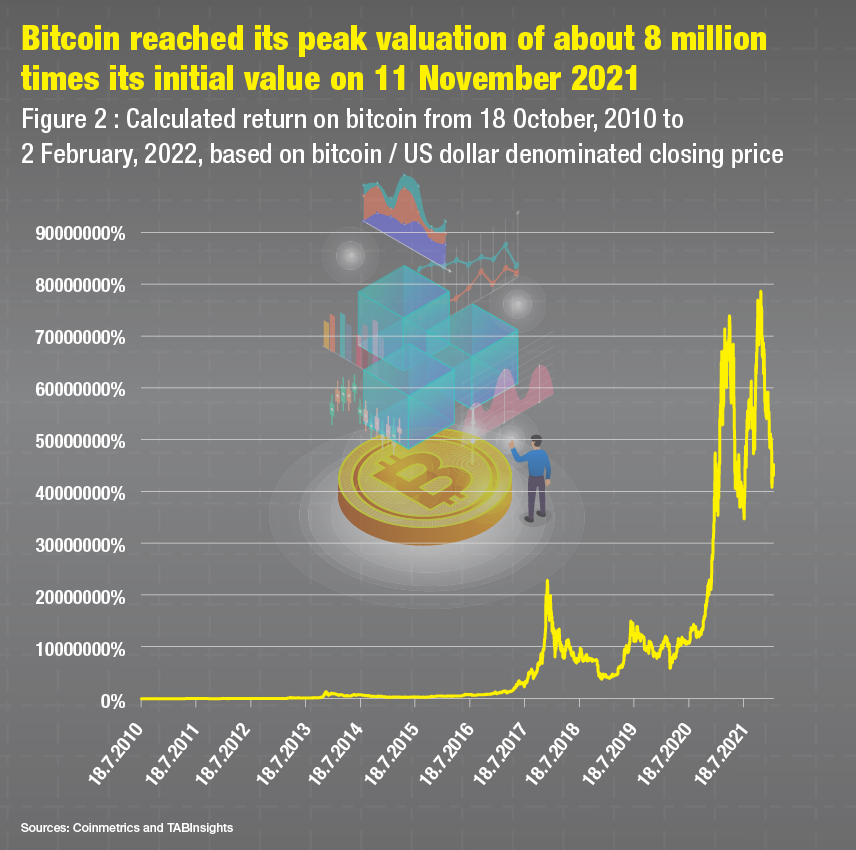

When Nakamoto released “Bitcoin: A Peer-to-Peer Electronic Cash System”, in October 2008, the crypto market did not exist. Today, miners and investors of those early batches of bitcoins sit on assets that are worth thousands of times their initial value.

Since 2017, the crypto market has been on a bullish run. Here are some milestones, total market capitalisation was $17 million on 1 January 2017, $760 billion on 1 January 2021, and $2.25 trillion on 1 January 2022. Since 8 November 2021 however, the crypto market has moved along a bearish trend. By the end of 31 January 2022, the market capitalisation of the entire market was $1.7 trillion, down from almost $3 trillion.

These days, bitcoin is not only a cryptocurrency that investors use for trading and store of value; it has also become a legal tender, a medium of exchange, in countries such as El Salvador, and included in cash management requirements s of companies such as MicroStrategy and Tesla. In addition, hundreds of online and retail stores accept bitcoin as a means of payment.

Evie Zhang, co-founder and CEO Coinomo, remarked, “The global acceptance of cryptos as a mainstream, long-term investment option is unmistakable. The latest Bitcoin Futures ETF launch seems to be the last signal that mainstream investors need to cross over to the cryptos.” Coinomo launched its OMO Finance platform, which provides investment-grade products using advanced derivatives trading strategies for underlying crypto assets.

The crypto market beyond bitcoin

Another highly valued cryptocurrency is Ethereum which is used to power numerous smart contracts. These are basically programmes stored on a blockchain and can be executed automatically according to the rules and terms set out in the respective contracts. in.

Ethereum fuels many decentralised finance (DeFi) applications. Between January 2021 and December 2021, the total value locked in DeFi went from $25 billion to $144 billion, as reported by Dapp Radar.

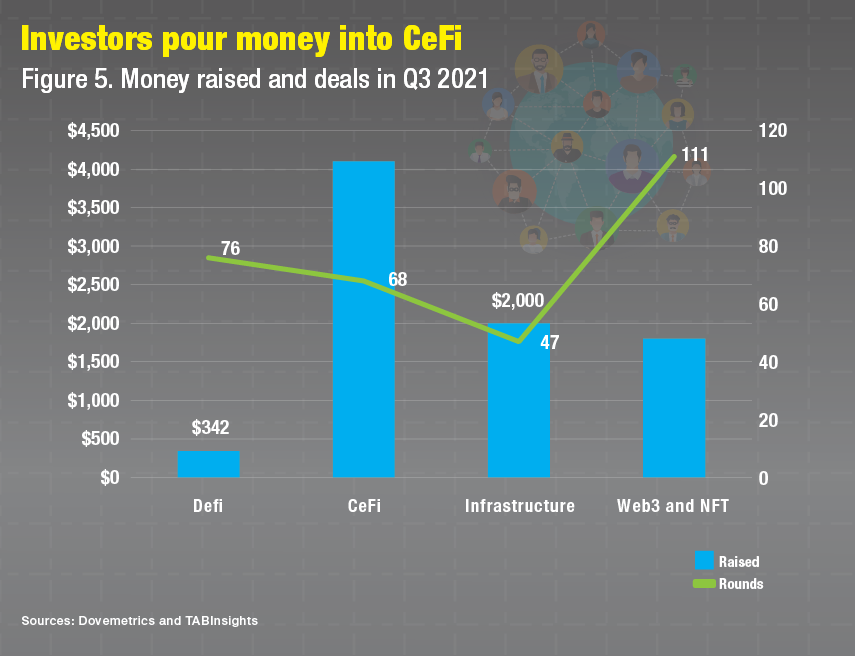

According to Dove Metrics, during the third quarter (Q3) of 2021, $342 million were raised to fund 76 DeFi deals. The capital raised was about 50% less than in the second quarter (Q2) of 2021 and about 4% of the total amount raised by crypto companies during the same period. However, the majority of the money raised targets financial services. For instance, about $72 million or 21% of the money went into the lending and borrowing vertical. The other verticals include asset management, decentralised exchanges, payment, options, risk management, stablecoins, and yield.

In December 2021, Chainalysis reported that non-fungible tokens (NFTs) have skyrocketed in popularity based on the records of value transfers sent through Ethereum smart contracts. Ethereum, together with Solana, WAX, BSC, Polygen, Flow, Tron, Tezos, Avalanche, and Wave, are among the major networks that power NFTs.

NFTs have become very popular with investors. Dove Metrics reported that $1.4 billion was raised from 53 deals during Q3 2021. The capital raised was about three times of the money raised in Q2 2021 and about 7% of the total amount raised by crypto companies during the same period.

NFTs are blockchain-based digital assets that are typically designed for gaming, marketplaces, social network curation, music, and the art, etc. They allow artists and content creators to monetise their work through digital tokens and are designed to be unique and not interchangeable. In this way, NFTs are different from cryptocurrencies, which are designed to be interchangeable.

Dapp Radar lists some 2300 plus NFTs and OpenSea displays more than 3200 NFTs for trading. As an example, the Scottish whisky distillery Dalmore announced on 7 December 2021, that it would make its Decades No. 4 Collection available as an NFT, and the collection of four bottles was sold for $137,000 on the same day. In October 2021, Dalmore sold its Decades No. 6 collection at Sotheby’s in Hong Kong for $1.1 million. In comparison, when Dalmore launched the Constellation Collection in 2012 without the NFT feature, the 21 bottles were valued at $335,000.

For Dalmore, the NFT feature bridges the physical and the digital worlds and allows the 180-year-old company to digitise its products directly to the buyers while guaranteeing the authenticity and ownership verification and offering a storage solution and handle insurance.

The number of users exceeds prior projections

Another development indicator is the number of wallets that users set up for storing and keeping cryptos. Based on a combination of on-chain data on bitcoin and Ethereum, survey analysis, and internal data, Crypto.com estimated that the number of global crypto users had reached 221 million by June 2021. This number was about twice the number of users measured in February 2021.

Coinbase, the biggest exchange in the United States (US), has 73 million verified users.

TripleA keeps track of the number of worldwide holders and users of cryptocurrencies. It projected in January 2020 that the number of users would be 250 million by 2030. However, in January 2022, it reported more than 300 million registered users.

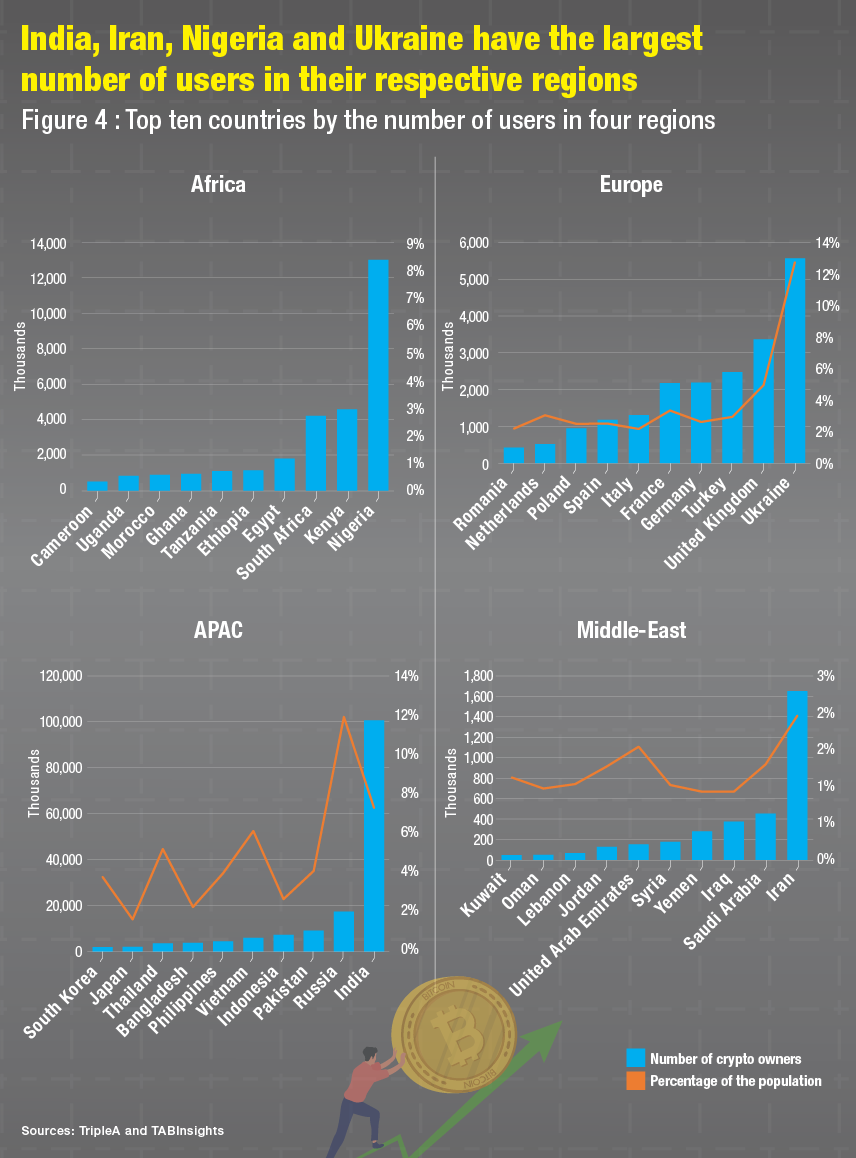

About 160 million of the 300 million users reside in Asia and the Middle East, 40 million in Europe, 32 million in Africa, 28 million in North America and 24 million in South America. The increase of users correlates with the ever-increasing valuations of crypto companies.

Crypto market drives structural changes and innovations in financial markets

To put the barely decade-old crypto market in context, the value of global equity markets was $117 trillion in the first quarter of (Q1) 2021. The World Bank in its 2020 economic statistics reported that the market capitalisation of the listed domestic companies in the three largest economies, China, Japan, and the US, was $12 trillion, $6,7 trillion, and $40 trillion, respectively.

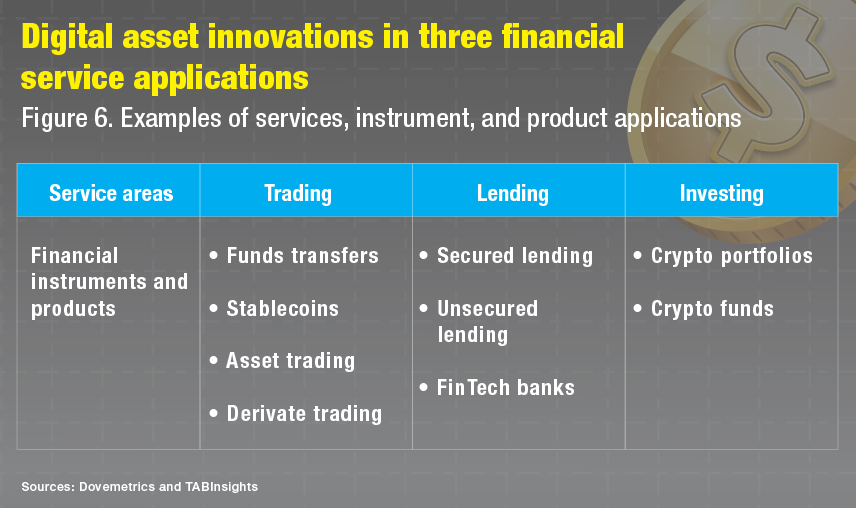

The appreciation in value of the crypto, DeFi, and NFT markets has led to greater circulation of financial products and the creation of alternative financial systems of their own, broadly categorised as decentralised finance (DeFi) and centralised finance (CeFi).

Dove Metrics reported in Q3 2021, that 68 CeFi deals, including companies like Fireblocks and Revolut received more than $4.1 billion in funding. FTX operates within the CeFi space, offers trades with derivatives, options, volatility products, and leveraged tokens that received a $32 billion valuation on 31 January 2022.

The Indonesian-based Coinomo leverages the developing crypto market and has launched a series of products. Zhang elaborated, “Coinmo offers typical hedge fund products such as straddle, cover call, option trading strategies and we reapply them on crypto derivatives.”

However, the growth rate of the crypto market is difficult to estimate as Zhang confirmed, “The only thing we know is that the market size can be extremely big for both the retail and the premium segments of the market.”

In estimating the future contribution of the crypto markets to the overall financial markets, Zhang said, “In a few years, at least 10% to 20% of financial markets will be crypto-based, but it doesn’t mean that cryptos will take over the entire market.”

Nevertheless, crypto market participants anticipate the growth to continue. Mavis Mok, CEO of blockchain payments provider HWGCash App stated, “Cryptos are currently focused on stocks, portions of large bundles of assets representative of companies, and real estate, old-timers and art, but in 2022 it will be applied to industrial goods, making them accessible to investors.” Founded in 2017, the Malaysian-based HWGCash App offers brokerage services to institutional clients and companies.

Neil Sheppard, chief product officer of EQONEX Group pointed to two trends that will facilitate the development, “Both the introduction of central bank digital currencies and the moves by countries such as Australia to invest in digital transformation strategy will develop the market further.” In Singapore, the Monetary Authority of Singapore has launched a series of projects to embrace digital finance.

The crypto market is an emerging part of the financial system with immense developmental potential. The recent negative price movements of cryptocurrencies need to be balanced with the ever-greater diversification of cryptocurrencies and emergence of new assets classes such as DeFi and NFTs, new use cases, along with structural changes and innovation that they bring to financial markets.