- Revenues from transaction banking have risen over time with most of the growth drivers coming from the smart phone revolution and internet penetration

- Rapidly changing technology has exacerbated cut-throat competition among banks, pushing them to create innovative solutions

- Asia Pacific banks have been quick to catch the bandwagon of quick and reliable payment services

The current consumer-centric environment sweeping the banking industry demands innovative and customised solutions to keep up with the evolving transaction banking business. As customers continue to venture into new overseas and more challenging markets, industry players need to stay ahead of the curve in meeting complex payment needs and knowing their client behaviours.

Banks have been transitioning to new technology driven areas, with a greater thrust towards digital transactions. This endows dual benefits, both to them and their clients. For banks, it has been driving cost and operational efficiency, making their systems more automated and consistent. Clients on the other hand are reaping benefits of real-time experience across a wide spectrum of underlying products and services coupled with minimum efforts on login. In tune with increasing regulatory processes, banks in Asia Pacific can learn from the implementation of Single Payment Areas and Faster Payment Services in Europe and UK, respectively.

Customers today are demanding a one-stop shop for all services as far as payment services are concerned. Banks have followed suit in putting in place, state-of-the-art technology based platforms that are more cost-effective, faster, and help manage risks judiciously. With China’s financial system closely becoming more market linked, there has been a rapid surge in cross border cash management services.

Following the full liberalisation on foreign exchange flows between businesses of multinational companies in China and elsewhere, and permitted pooling of renminbi (RMB) in cross-border operations, these initiatives are bound to boost cross-border cash management activities.

Explosion of opportunities for digitised transactions through continued investments in technology

Revenues from transaction banking have risen over time through development of new products in Asia. Interestingly, most of the growth drivers are coming from smart phone revolution and internet penetration. Banks are embracing these drivers to leverage strategies aimed at reducing costs associated with payment channels and to further enhance overall accessibility for these services. Over the counter services are constantly being replaced by electronic payment channels, resulting in significant savings, lower operational overheads therein creating more fiscal room for renewed plow backs in technology.

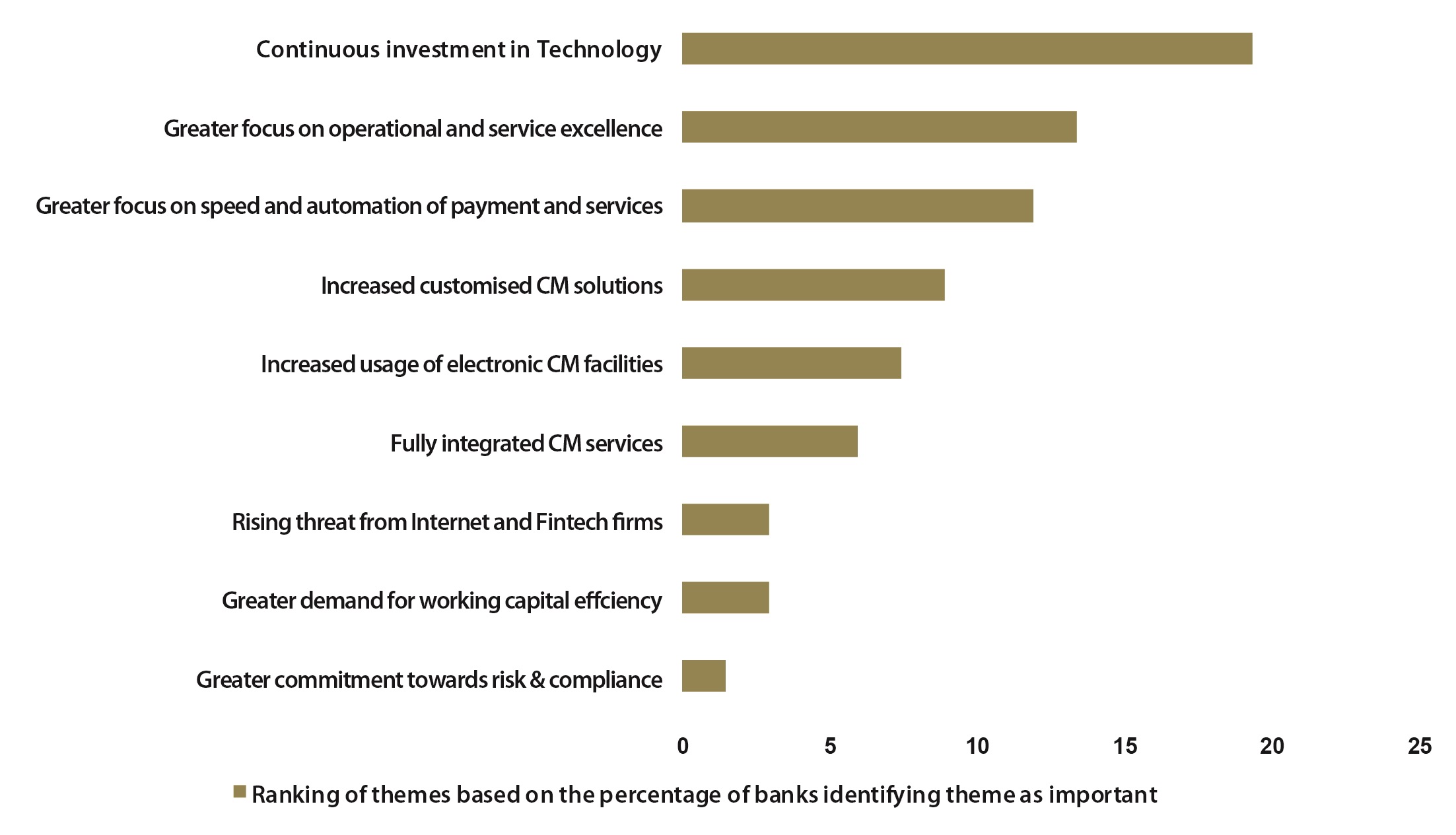

With focus on creating value for customers, regional banks have identified key emerging themes incash management. On the top of the chart, Asia Pacific banks have listed continuous investment in technology as their top priority. Commonwealth Bank of Australia (CBA) has recognised innovation and digitised service orientation as key strategies to better serve its clients. With the Belt and Road initiative in China, China Merchants Bank (CMB) has been stepping up its initiatives on building global cash management (GCM) services and systems.

With extensive client base comprising corporates and multinationals, the Bank of China Hong Kong (BOCHK) has leveraged technology to facilitate real-time gross settlement transfers quoted in RMB.

India’s thrust to push the digitisation agenda has created new opportunities for banking sector to ‘bank the unbanked’. ICICI and Kotak Mahindra are determined to become champions in electronically linking their online branches across the country and explore new methods to conduct transactions.

Indonesia’s Bank Mandiri wants to serve its clients better by knowing their business processes and systems from within via channels that transcend beyond traditional banking. The Indonesian division of United Overseas Bank (UOB) intends to capture local market by understanding local financial needs, and in doing so, it wants to promote more cashless transactions and straight through processing.

Thailand’s Krungthai Bank has laid a strategic focus on taking advantage of the national e-payment policy for conducting micro and digital payments. It also has a vision to become a multi-channel settlement bank catering to customer traffic from all walks of life.

Technology and innovation: The ingredients to operational and service excellence

Technological innovation is having deep rooted impact on cash management services. Rapidly changing technology has exacerbated cut-throat competition among banks, pushing them to create innovative solutions. Moreover, banks now have to meet customer expectations and at the same time remain competitive in terms of pricing. For example, OCBC Bank has taken client servicing to next level, where it is advising its corporate client to stay competitive by reducing its working capital requirements as a strategy to counter ballooning costs. On the other hand, Deutsche Bank had undertaken a strategy of “guaranteed US plus” to preserve non-urgent US international payments, for its clients, without compromising on transparency in its fee structure.

Complying with Basel III capital requirements, banks have introduced innovative deposit products to suit the specific needs of their clients, which help them reap maximum return on their surplus deposits. These banks in Asia Pacific understand the need to channel resources and drive operational excellence: CBA considers reducing manual processes is the best way to reduce errors and redundancies and identifies process automation and streamlining as a medium through which its frontline staff can frequently engage with clients.

By setting up integrated supply chain services, the China Construction Bank (CCB) aims to improve industrial chain capital flows. Philippine’s Metrobank is primarily focusing on building relationship on the principle of customer centricity, as a way to become a one stop shop for cash management. UOB Thailand has implemented product ‘bundling’ strategy, for which it has studied the nature of business flow and developed bundled product packages to suit the business requirement of each segment.

Technology dominates regional bank’s agenda on speed and automation of payment services

Owing to the advent of electronic platform, real-time, low-cost payments are now a close reality. Payables, receivables and subsequent account reconciliation are now being automated, creating a holistic 360 degree view of customer’s entire portfolio. Some of the international banks like Deutsche Bank are on the forefront of electronic platform, collaborating with developed Asian countries like Singapore and South Korea, to facilitate swift clearing of domestic and foreign currency transactions.

Asia Pacific banks have been quick to catch the bandwagon of quick and reliable payment services (Figure 1). BOCHK identifies continued investment in product development to satisfy client needs through their feedback, which it uses to further develop new transaction banking products. By improving working capital and trapped cash through automated forecasting of receivables and scheduled payables, Kotak Mahindra Bank has minimised idle fund flows. YES Bank has adapted to increased electronic modes of transactions through robust E-governance mechanism.

Continued investment in technology dominate Asia Pacific transaction banks’ priorities in 2017

Figure 1. Key themes in cash management 2016/2017

UOB Singapore’s swift initiative is in itself a global innovation to dramatically improve customer experience in cross border payments. However, with opportunities, challenges. Switching fully to electronic based cash management system has been obstructed by the need for physical signatures on documents. By virtue of its paper-intensive processes for managing a company’s authorised bank account signatories and the fact that corporates have to physically submit documentation to initiate transactions, efforts are being made to fully adopt electronic systems.

Banks cannot ignore the importance of signatures as they provide solid, legal evidence and protection in case of commercial agreements; however shift to paperless transactions is also the need of the hour. Interestingly, technology is making a strong footing in Asia, and private banks have been active to engage themselves in use of digital instruments. With rapid developments in the cross-border cash management businesses, new challenges have emerged.

Existing challenges reflect the difficulty in linking several banks and partners while also simultaneously maintaining a harmonised system of different standards and protocols. To overcome these challenges, banks are expected to adopt a standardised set of protocols that aim to deliver greater flexibility and convenient access to their banking platforms.

.jpg)