- Internet of Things gives banks the opportunity to integrate environmental, behavioural and financial data for clients to simply click a button to utilise what’s already made available

- Banks use Internet of Things already to combat fraud, a field which will grow hugely in the next years

- IoT’s impact is more fundamental in how future market places are run, maintained and serviced

For some, the Internet of Things (IoT) is yet another technology that has the potential to optimise operations, increase productivity and generate new business models - the standard impact model for transformative technologies. Others call it the “Fourth Industrial Revolution” with consequences as far reaching as changing the nature of humanities role.

The traditional view of IoT is limited to devices that produce telemetry type data. Banks have been monitoring banking infrastructure with IoT devices already for years such as in buildings or data centres where real-time information becomes critical in terms of maintaining the uptime of the organisation which ultimately impacts customer experience the moment those systems are not performing optimally. In banking, on the contrary, data often relates to human behaviour requiring more sophisticated analysis to extract the right value. The potential is bigger spilling over into a wide field of financial transactions.

“If you think back to the dim and distant past of the Third Industrial Revolution - which was centred on information technology (IT) and digitisation - applications were about people or IT processes communicating. But now it’s machines and devices that are communicating, continuously and in ever greater numbers. The promise of real-time enterprise - organisations that can respond to need and demand instantaneously - is finally becoming a reality,” wrote Jean-Marc Frangos, chief innovation officer, BT, United Kingdom in a June 2017 World Economic forum article.

To understand the next evolution in IoT, banks need to look at it along the intersection of a variety of emerging technologies, and the way the industry is starting to see this is centred on big data, artificial intelligence, blockchain technology and the intelligence behind what it can do.

“It is about the unification of processes. It’s about sensors that are deployed in the physical world, maybe in our homes, maybe on ourselves, maybe in our transport infrastructure, maybe on our grids, maybe in our factories, maybe in our schools, maybe in our hospitals, maybe across the agricultural land. Effectively, its sensors are deployed across the entire landscape of human civilisation, measuring information from the physical world,” said Matthew James Bailey, who is internationally recognised as a pioneer in the third wave of global innovation or IoT.

In reality, however, much of what is currently covered around IoT is related to manufacturing and, within the financial institutions (FI) space, wealth, investment and insurance. Those are the biggest adopters as those industries have tangible use cases because there is real value generation within the organisation. Discovery Insure, the telematics short-term vehicle insurer under the South African insurance group, had IoT since it was established in 2011. Its IoT based customer solution ‘vitality drive’ monitors driving behaviour and reward clients for good driving.

“We use IoT technology to monitor the driving risk and that helps the insurer and creates value back to the client. We deploy what we call a shared value model, which ultimately encourages our clients to better their driving behaviour and therefore creating financial surplus, which translates into rewards back to the client and a better society as a whole as there are less accidents on the road. The key is to find this value from the data that the technology delivers working closely with the risk and actuarial departments to unlock this value. From a business point of view, we can see a direct correlation, since we have been running this for a few years, between people driving well and the severity and claims frequency. Thus, IoT for us creates real value that we can pass on to the client in the form of cash back rewards. In the field of emerging home telematics, you want to see a similar trend in loss ratios and claims and the severity of claims,” said Ilan Ossin, head of telematics at Discovery Insure.

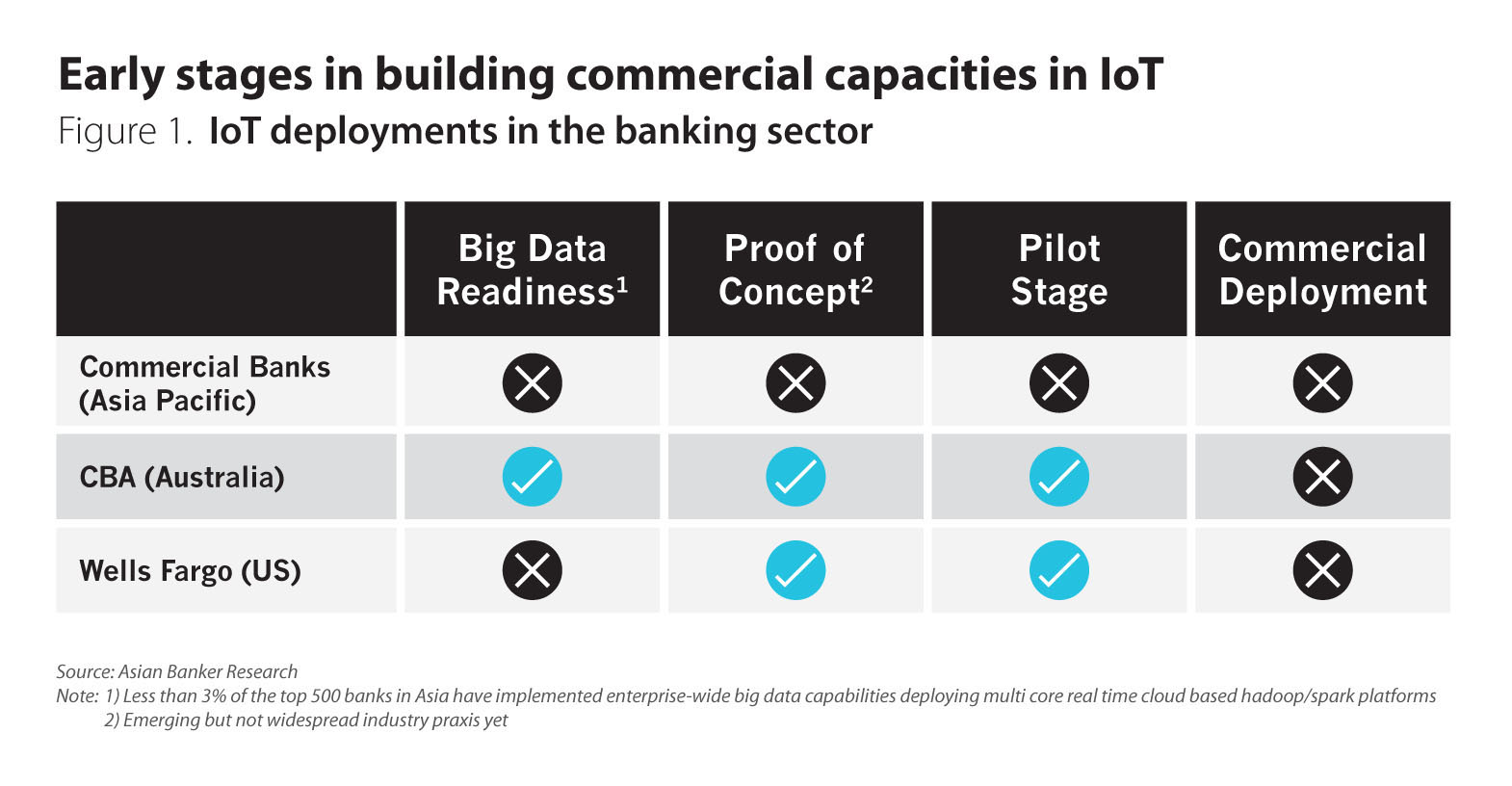

The commercial banking sector is in the early stages of implementation around proof of concept or pilot stages, and at best have achieved modest benefits from IoT programmes. The reason why banks are not yet able to build a more connected experience in conjunction with other financial players and service providers is because they don’t know yet what to do with the data available to them. Banks already have billions of lines of data about customers and often struggle how to translate these into meaningful metrics.

“If you think only about devices, you are missing the big picture. As FIs, we need to think about it differently in order to truly understand its significance and how to translate those measurements into more meaningful customer experiences. I look at it simplistically, and say that there is a business case for using IoT to save time for our customers. In other words, how do we use the volumes of data being produced by all the devices we plug into every single day, to give us an indication of which type of person we are dealing with and where they are spending their time? How do we use it to make banking ubiquitous and customised to each person’s unique needs at any given time or place? How do we use IoT to strip out all the time customers have to spend interacting with apps, websites and other banking solutions, and give that time back to them,” asked Kevin Rolfe, head of technology cluster at Barclays Africa Group.

Banking use cases

IoT gives banks the opportunity to integrate environmental, behavioural and financial data to the point that customers don’t need to apply for a product or service anymore, but simply click a button to utilise what’s already made available by the bank (Figure 1). For example, financing a new car could be as simple as clicking yes in response to a note from your bank, which knows you’re at a car dealership, knows which car you’re test driving, and whether or not you can afford it.

Emergence of succinct smart micro payments

In the field of retail financial transactions, clients would be enabled to undertake succinct smart payments, or micro payments against a fraction of utilisation, for example, when paying for electricity or water consumption or any other service, such connectivity, airtime or even office space. IoT enables to pay for precisely what is needed at any given time. To do so banks need to start sharing data with each other and run this against centralised databases or shared environments with other FIs to quantify in real-time patterns of spending and behaviour and to understand what the credit space can be.

Cybercrime and fraud

The upcoming boom in IoT applications hold the promise of a far more interconnected and efficient world but it equally increased the threat of fraud, identity theft and customer verification. At the same time, banks use IoT already to combat fraud, a field which will grow hugely in the next years. “As a bank, we are focusing on how we manage and secure employee devices to better protect our staff and customers. Cybercrime is escalating at a rate not seen before, and IoT and the patterns revealed in the data mean that we can now detect crime in real time. IoT allows the intelligence sitting at the back-end of a system to start working through scenarios that allow us to be one step ahead,” Rolfe said. Currently, IoT use cases are generated more often outside retail banking in areas such as lending, asset leasing, and trade finance. Here too, banks do not have a sufficient amount of information in order to make real-time decisions.

Speeding up trade claims

A case at hand was a real experiment with IoT and blockchain in October 2016 between CBA, Wells Fargo and Brighann Cotton which conducted the first cross-border trade transaction using blockchain technology. The trade transaction was a cotton shipment bound for China with a value of $35,000, which CBA demonstrated as proof of concept combining the emerging disruptive technologies of blockchain, smart contracts and IoT. The IoT played a key role; the trial included a GPS device to track the cotton’s movement. All parties could see when the shipment left port, where it was on the seas, and when it left the ship. This linked payment and risk to the actual physical flow of goods. Historically these were linked to the paper flow. It takes days, even weeks, to physically move the documents advising the exporter that the importer has the necessary funds to pay for the goods. The importer undergoes a similar ordeal awaiting notification of the goods’ arrival at their destination before authorising payment. Funds and insurance are therefore unduly tied up at both ends, but IoT provides real-time signals as to when funds can be released and insurance is needed or no longer required as specified in the contract.

Improving the quality of trade

In future, those traders could leverage IoT to measure the quality of the cotton in real time. “Take the shipping container, for example. Rather than merely monitoring location you can deeper integrate this with artificial intelligence (AI) and IoT so that one can provide ahead the best insurance pay-out in relation to a customer’s history. Let’s say if the quality of the cotton would drop below a certain level, IoT could trigger in real time an insurance policy rather than waiting to discover the drop of quality of cotton at the port, receiving the letter and then filing the claim through a lengthy paper based insurance process. If you start meshing these technologies together you are really getting a powerful value propositions,” explained Dilan Rajasingham, head of emerging technology at Commonwealth Bank of Australia.

Autonomous agents and market places

Still, for Dilan it’s not just about insurance claims or internal process improvements in offices and data centres. IoT’s impact is more fundamental in how future market places are run, maintained and serviced. Indeed, IoT and AI may create self-sustaining market places with autonomous robotic agents as the bank’s next generation of clients.

“One can take that a step further; if devices are connected with AI as a means to view the outside world, it has the potential to become a marketplace where it can be self-sustained. What does this mean to us as a financial institution when you create sufficient autonomous agents? Imagine you have a technology device that is somewhat a sentient information processing system which is self-sustaining. What does this mean for service companies as AI systems gain more knowledge and start becoming part of an ecosystem as an autonomous robot? For example, does a robotic customer equal the financial consumption behaviour of a person? Can we – and should we – provide lending facilities to sustain their activities. These are some of the critical questions we will face as IoT can significantly alter the way we interact with our environment,” Rajasingham said.

The rise of smart cities

The United Nations expects that the planet will be adding an additional three billion people who will be living in and around cities across the world by 2050 putting a huge strain on city resources and public services.

“We have to build intelligence into our cities in order to optimise usage of resources such as water and energy, and also to actually become sustainable economically. The second big problem that the world faces is around food security. We need to increase our food output by about 70%. That’s a huge challenge. Those two phenomena are driving something called the Internet of Things and smart cities. I think there’s a big opportunity for banks to participate around funding smart cities. Where the banks can play here is creating new types of bonds such as new type of social impact bonds,” said Baileys.

“In China, there’s been an announcement of a $30 billion new smart city that will be rebuilt entirely on blockchain. What this means is if my washing machine needs a new part, the blockchain will automatically order and select the best deal for me in line with my cultural profile, in line with my economic potential. Blockchain will automatically negotiate the best part of that. I’m involved with a new smart region initiative in Colorado in Denver South, with the Denver South Economic Development Agency. At the moment, that region [Denver South] delivers 20% of $300 billion that Colorado generates in revenue. The aim of the Alliance is to accelerate the adoption of smart cities and IoT-based initiatives throughout Colorado to improve quality of life for residents and businesses and create an economic development draw to Colorado. They are partnering with technology giants, with developers, with city mayors and government, with academia, with the entrepreneurial community, with the citizens, to create and develop a roadmap and deliver a roadmap for the next 20 years to make this region sustainable. This network will deal with common challenges such as congestion and transportation, with issues around affordable housing, public health care and issues around air quality, and many other types of intelligent services that we need to bring to the region to make it thrive not just now, but also in the future, he adds.

Building shared value systems together with clients

For Discovery Insure, the embedded IoT technology infrastructure and the solutions it offers are based on a shared value, meaning how people conduct themselves on a daily basis in traffic situations and to offer that value back in form of premium refund. The insurer does not penalise for not opting into this IoT programme and it is a client’s choice to get the value back. We do not use the data to repudiate any claims, explained Ossin, we only use the telematics data to confirm location and time in event of an accident.

“85% of our clients who take out a vehicle insurance policy also take out the ‘Vitality drive’ IoT based programme. They can choose not too but they do. Generic telematics programme may not position those solutions in a way we do and thus you might have client which resist enrolment,” said Ossin. The Discovery group has been executing on the shared value Vitality model in their health and life insurance business since 1997. Customers who exercise more ultimately pay less for their Life and Health insurance by obtaining a myriad of rewards through the Vitality programme. There are currently 1.7 million members of Vitality in South Africa.”

Apart from offering safety support such as in the event of an impact, Discovery Insure calls out to the client in case of an accident and dispatch safety services or monitoring vehicles in theft cases. It also deploys a panic feature when a client taps the mobile phone in a certain sequence sending a panic alert to the 24/7 in house call centre. Deploying IoT, it is not a simple solution and needs to take in mind the entire ecosystem to create that seamless value proposition to customers.

“As telematics insurer you have to integrate the entire telematics supply chain which includes being able to deliver on the technology, making sure the data is correct, and handling a number of different technical queries which a traditional insurer would not typically be able to facilitate Working closely with the suppliers is key. You cannot just give out devices without running the entire programme, monitoring it, and having the expertise to facilitate it. There is a lot more in this ecosystem compared with traditional insurance cover, the technology, the monitoring, the analytics part, the communication, the logistics that will play through in all offerings,” Ossin added.

Impact on market competition

Banks are increasingly forced to think like technology companies to understand the risk involved with a locally and globally interconnected infrastructure. Where IoT devices are easily pluggable in the broader digital ecosystem, banks need to improve the customer experience without compromising security and privacy. In addition, IoT will increase the competitive dynamic as it will force banks into more transparency into how they make their money.

“When it comes to financial power, banks don’t have the monopoly anymore. Customers have enough information at the fingertips to know exactly what they are paying for. The value is no longer in the product, it’s in the experience. The power of information and decision making is back in the hands of our customers,” Rolfe concluded. Most banks are still discussing what bet they should take in IoT and other emerging technologies.

Rajasingham’s advice: Banks should not wait to deploy IoT solutions until this technology becomes more mature. Setting up a capability where a bank can experiment and understand this technology for the betterment of its customers is the first step.

“What we are trying to do in CBA is work with banks across the world to experiment and learn from each other. We do it as part of an ecosystem. IoT and other emerging technologies encourage banks to come together to look for collaborative opportunities, because not one bank but all can win. This is the future. It’s going to be less about process efficiency, and more about the experiences we can provide to a customer in collaboration with a larger ecosystem of players. That ecosystem approach is the future in banking.”