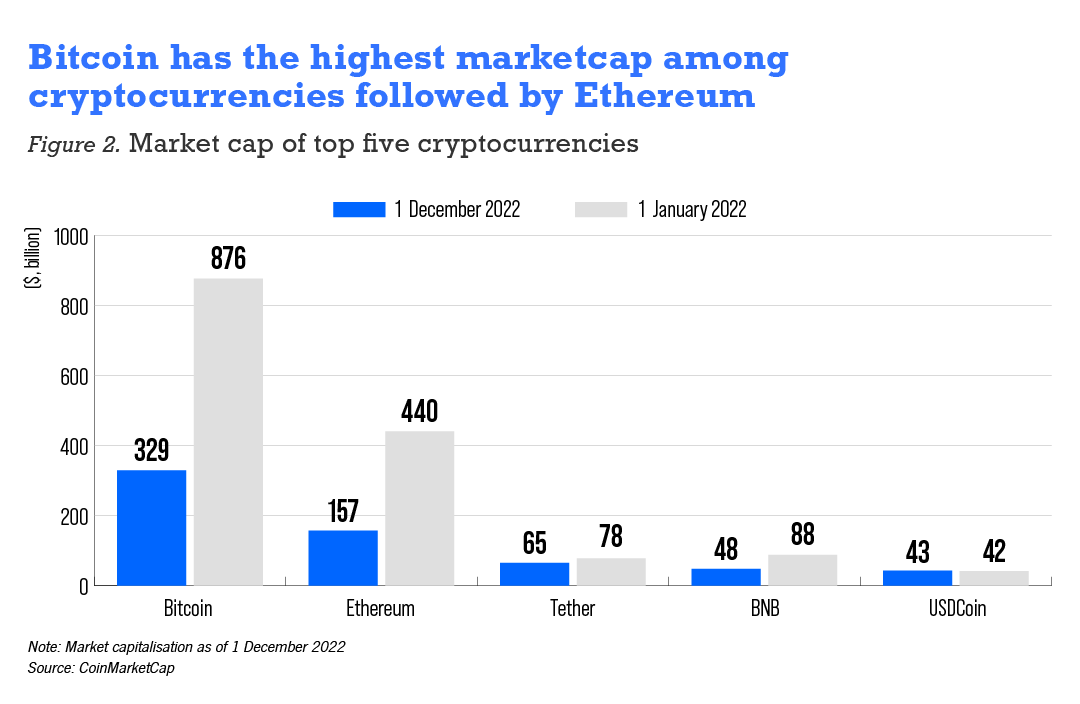

Ethereum, the second most valuable blockchain on which a large number of the decentralised finance (DeFi) systems operate, recently undertook a major software overhaul. On 15 September, as part of its broader multi-year development, Ethereum undertook the ‘Merge’ that switched it from Proof of Work (PoW) mechanism to the Proof of Stake (PoS) validation algorithm.

The PoW mechanism, also used in Bitcoin, entails an energy intensive mathematical computational process but it leads to a significant carbon footprint. The PoS validation instead is a consensus mechanism wherein cryptocurrency owners validate block transactions proportionally to the coins staked. This move does away with the need for crypto miners and mining farms, resulting in a more sustainable Ethereum blockchain and reducing the energy cost by almost 99.95%. This addresses the ecological concerns, one of the headwinds in blockchain adoption, and could potentially also make it more attractive for institutions.

However, the blockchain technology is still early in development stage and is yet to address several challenges. The most prominent of these being high energy costs, issues in transaction speed, security, low scalability and interoperability and high volatility of cryptocurrencies.

The Merge will be a key step towards Ethereum’s roadmap of planned upgrades to improve its scalability and security. But the move is not likely to immediately improve its transaction speed or reduce transaction costs. A Deutsche Bank analyst note that a subsequent update of “sharding” that will split the entire network into small parts (shards) is expected to improve transaction speeds, lower fees and open possibilities for scalability.

Meanwhile, there have been some concerns over the impact of the Merge. The Merge prompted a hard fork, giving rise to an offshoot chain Ethereum PoW. Some platforms and exchanges have shown support for the forked version which could result in a divergence in the Ethereum community. Ethereum is also seen as having the risk of becoming less decentralised as few entities will command a majority share in ETH. It could result in potential concentration of power with the biggest Ethereum stakers such as Coinbase, Lido, which is not desirable from a decentralisation point of view.

One of the unintended and unexpected consequences may also be that Ethereum gets closer to regulatory overview. As validators stake their holding in PoS to generate returns, the shift makes it closer to the definition of a security. This appears to have caught Security Exchange Commission’s attention.

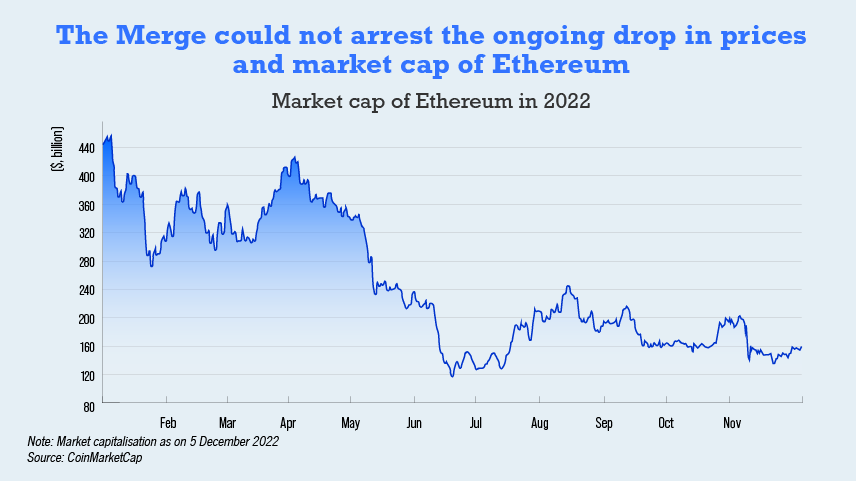

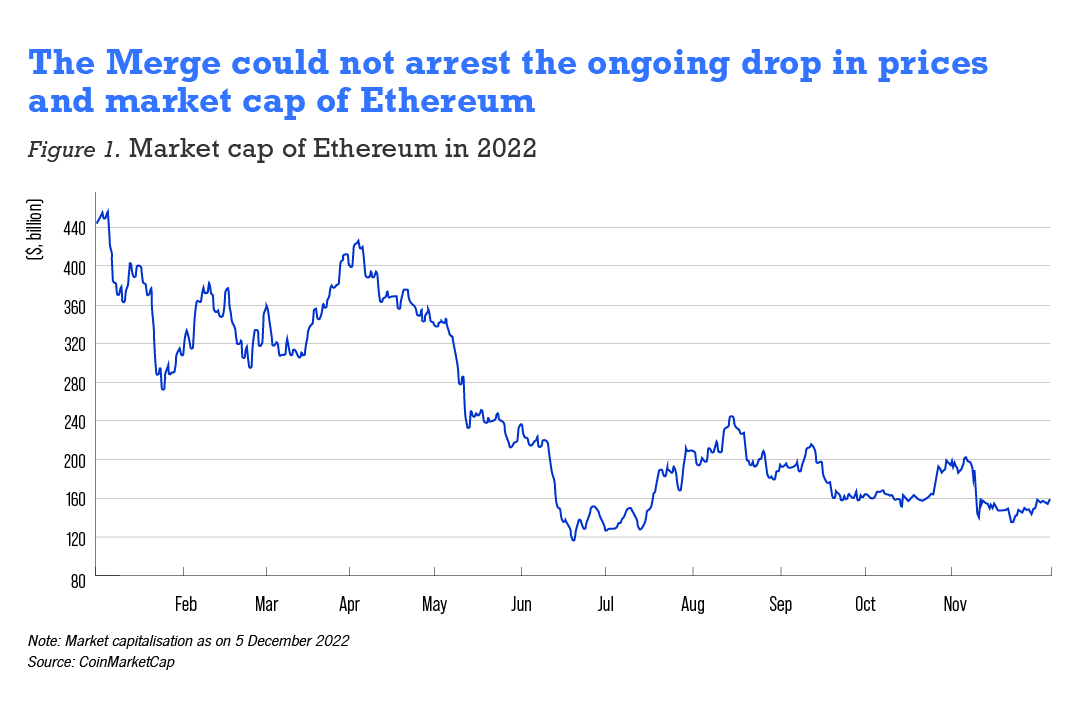

In the meantime, Ethereum’s price continue to drop as the market sees as environment of general weakness in risk assets and cryptocurrencies amid rising interest rates and increased regulatory scrutiny.

Ethereum has gained traction in the market in last couple of years especially with the growth of DeFi. Since Jan 2020, the total number of unique addresses in Ethereum has doubled to over 200 million and the transactions have surpassed an average of over one million per day over the last 12 months, according to Ethereum software company Consensys.

In the long run, the Merge seems to be a positive step that will pave way for its future development and adoption. Ethereum already has roadmap for further upgrades. These include ‘Surge’ that will entail sharding, ‘Verge’ will improve storage and scalability, ‘Purge will reduce hardware requirements and network congestion and finally ‘Splurge’ will be smaller upgrades to fine tune it further. There clearly remains a long road ahead in its future development and evolution.