- Banks are following third-party payment service providers into the multi-currency wallet business

- Some banks and fintechs are focusing on SMEs to grow their market share

- The increase of non-bank players is the result of dissatisfaction with the traditional banking model

Banks such as Citibank and Banco Santander, and fintechs such as Wise, Revolut, and YouTrip have been offering contactless money transfers through their multi-currency wallets as early as 2011. In May 2021, HSBC launched its first global wallet to enable small and medium-sized enterprises (SMEs) to send and receive international payments simply and securely from a single global account.

Banks are following third-party payment service providers into the multi-currency wallet business

HSBC launched Global Wallet, its multi-currency digital wallet for SMEs to gain competitive advantage over fintechs. “Making international payments can be complex for SMEs, weighing on cost and precious resources. Global Wallet removes the pain points by enabling our customers to virtually, quickly and securely transact with their suppliers and clients around the world,” said Winnie Yap, head of global liquidity and cash management at HSBC Singapore.

HSBC’s Global Wallet is a step towards growing its SME business globally. It removes the need for businesses to use third-party providers for international transactions. For example, clients can pay in 10 currencies within the same day and receive funds in these currencies from across the world into their HSBC Global Wallet US dollar, Great Britain pound and Hong Kong dollar accounts.Furthermore, HSBC has removed correspondence and beneficiary bank charges for its SME customers. According to its 2020 annual report, the platform has more than 1.3 million commercial banking business customers in 53 countries and territories.

Diane Reyes, HSBC’s global head of liquidity and cash management, said, “HSBC Global Wallet makes it just as easy for our customers to deal with a supplier or a client on the other side of the world as it is to deal with one on the other side of town. By fully integrating this solution into our everyday business banking platform, we are giving our clients a virtual presence in markets around the world”.

Meanwhile, Citibank and Banco Santander have also launched their own cross-border payments platforms, Citibank Global Wallet and PagoFX respectively.

While Citibank Global Wallet does not allow cross-border transactions between businesses, it allows customers to make online purchases without incurring foreign transaction and currency conversion fees in over 150 countries. As of 2020, Citibank serves 100,000 SMEs in 32 countries.

Banco Santander’s PagoFX is available in theUK, Belgium, and Spain and offers 32 currencies. The service specifies minimum and maximum payment limits. PagoFX is regulated by the Financial Conduct Authority in the UK. However, payments can only be funded by a debit card. Banco Santander serves more than four million SME clients worldwide, of which more than 200,000 conduct international business.

However, it would not be easy to convince customers who are already satisfied with their respective fintechs to make the switch. Fintechs have already been offering multi-currency wallets for individuals and businesses alike in more currencies and territories around the world. On the one hand, WISE offers 0.5% FX margin (FX transfer fees) for most currency routes. The minimum transfer is $1, EUR1 or GBP1. Revolut, on the other hand, has no minimum value for transfers but has a daily maximum limit of GBP100,000 ($138,000) or a weekly maximum limit of GBP250,000 ($345,000) combined. Revolut charges a 0.5% margin fee on transactions over EUR6,000 ($7,000) per month. Therefore, despite having digital wallet offerings, banks must still present competitive products and services that are convenient and efficient in order to entice customers to use their platform.

The increase of non-bank players is the result of dissatisfaction with the traditional banking model

Kristo Käärmann and Taavet Hinrikus launched TransferWise in 2011 because they found that international bank transfer fees were too high. They believed that money should flow with greater ease. The company’s rebranding as Wise in February 2021 indicates its drive towards differentiating and growing its services beyond local and international money transfers. The Wise business account is designed for businesses and freelance customers, offering them a continuous global money transfer and currency exchange service.

Revolut was launched by co-founders Nikolay Storonsky and Vlad Yatsenko in July 2015 to address the traditional banks’ slow pace in launching digital banking services for customers who wish to access services via their mobiles. The fintech’s main services are global money transfers and currency exchanges across its multi-currency account. Revolut has added new services such as banking services for Euro and Pound Sterling accounts, cryptocurrency exchanges, stock trading, and peer-to-peer payments. The Revolut Business account offers features for businesses and freelance customers. These include API integrations, online payment processing, and business debit cards.

PagoFX, is a multi-currency cross-border payment application for individuals and businesses to make international payments. It operates in three countries, namely the UK, Spain and the US, and offers 32 currencies. Cedric Menager, CEO at PagoFX, said, “We have been looking forward to launching PagoFX in Spain since we started the project. In Spain, there are people who often send money to family and friends from other countries. Now they will have it easier than ever with PagoFX thanks to the speed, security, transparency, and low cost. Our vision is to be the world’s most trusted and loved way to send money abroad, and we want all our customers to feel confident about sending money overseas”.

In addition, YouTrip has been challenging traditional banks in Singapore as the fintech launched its first multi-currency travel wallet that allows customers to make payments in over 150 currencies with no transaction fees. It also supports in-app exchanges of 10 currencies. However, customers are only allowed to top up or hold up to $5,000 in their account. Moreover, there is an annual transaction limit of $30,000.

Digital wallets can offer services for individuals, businesses or financial institutions that want to transfer funds across countries. Merchants that operate globally should be able to accept payments across all their target countries.

The need to stay up to date with technological advancements and the slow response of traditional banks have driven fintech players to launch their respective digital wallets, making them an attractive option for SMEs that are seeking for faster services and reduced costs.

Future of cross-border payments for traditional banks and fintechs

The increase of non-bank players is a result of dissatisfaction with the traditional banking model, which is less convenient and costly. Fresh players and solutions are competing with banks and card-based solutions at scale. An increase of cross-border, instant, and B2B payment options are expected in the coming years from both traditional banks and fintechs. This is supported by the adoption of ISO 20022, a globally developed methodology for transmitting data that provides a reliable messaging standard for payments. A recent model by Faster Payments Service saw the quickest payment ever sent from Australia to a UK beneficiary, with confirmation of credit and funds available in 36 seconds. Singapore and Thailand recently linked their respective national systems PayNow and PromptPay, allowing registered users to immediately send money between the two countries using only a mobile number.

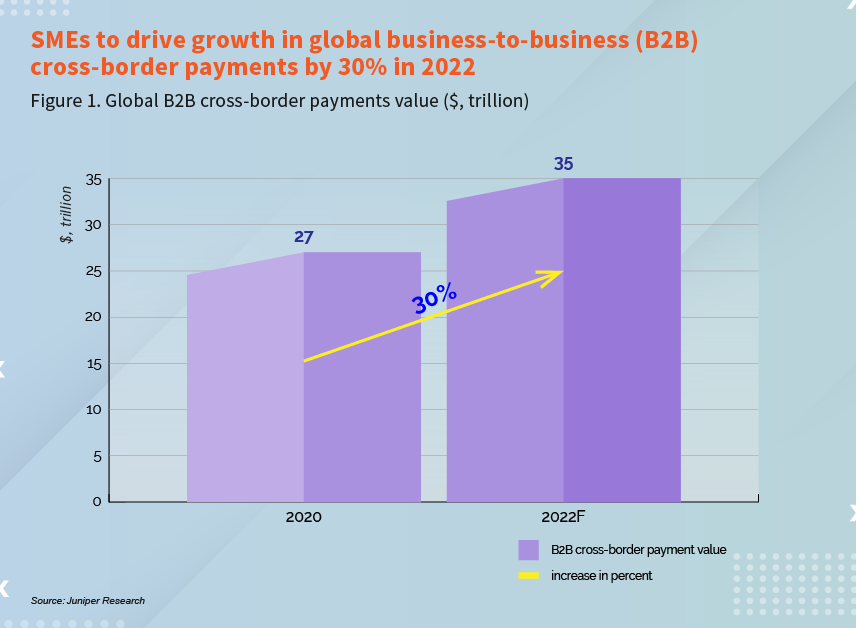

The SME sector has a significant economic impact, contributing $2.77 trillion to the UK economy alone each year and expanding. However, SMEs that trade abroad face a complex infrastructure as well as a plethora of lenders, brokers, financial institutions, processes, and systems that lack adequate integration or have none. The current system, particularly for SMEs, is unable to handle the demands of cross-border payments. The aim is to make international payments more accessible to businesses and build a new norm of commerce without borders in the global cross-border payments industry that is now valued over $22 trillion.