Thailand’s retail financial services industry, once a top growth engine, is losing steam. Profitability from retail banking is under pressure from lower loan growth, higher nonperforming loans, and product saturation in the wider Bangkok area. Against the backdrop of a low interest rate environment and further rate cates by Bank of Thailand (BOT) in 2015, the ability to capture low-cost deposits will be a decisive factor for profitability.

Higher costs should be lesser in banks with large, cost-efficient distribution channels offering convenience of access and a larger contribution of savings and current account deposits.

The challenge

Given the current beleaguered retail banking environment, Krung Thai Bank (KTB), which caters mainly to the government employee sector, is looking beyond the big brother that guarantees it a stable and low-cost funding source.

“We have a strong base of deposits from the government sector,” begins Chainarong Eursithichai, KTB executive vice president and director for retail strategy, product, and segmentation. “This success is based on our understanding of the mechanics of government transactions and our continuing process improvements in disbursement and payments. We want to be the deposit bank of choice for government entities, and so far, are managing 4 million government employee payroll accounts, which translates into a market share of 93%.”

Nevertheless, KTB, which has the largest retail deposit to total bank deposits ratio in Thailand (Figure 1), would like to expand its private deposits while maintaining leadership in government deposits. On top of this, there is room to grow especially in consumer finance and the small and medium enterprise (SME) sectors, whichremain underserved in Thailand. Although the SME market is smaller with higher risks. all banks have been

aggressively scaling up their SME businesses to offset slowing corporate and retail loans. They are offering better cash management solutions and packages to effectively cross sell, but Krung Thai Bank has just begun building its capabilities in these fields.

“In the Thai market, marginal price differences do little to sway customers in terms of savings and current account deposits. For the bank to grow assets, we need to find more low-cost funding. The bank is developing a more standardised instrument to monitor key pricing variables and customer behaviour. Understanding customers’ needs are key to achieving that goal,” Chainarong stressed.

The solution and process

KTB has the largest retail asset size in Thailand of 739.4 billion Baht (B) ($22.1 billion). Between 2008 to 2014, the retail bank increased its retail asset contribution to the KTB Group from 15% to 35%, making it the fastest growing retail banking portfolio in Thailand.

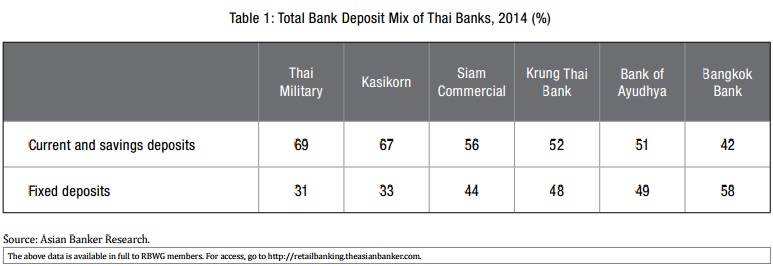

Choosing not to rest on its past achievements and avoid the success trap, the bank initiated a private retail banking deposit program by launching a series of deposit products, such as “KTB Bonus Savings” in March 2015. Other campaigns are in the pipeline to be launched in 2016. It has also further improved its deposit mix to 52% for current and savings accounts deposits (Table 1).

To gain ground in the private deposits sector, which is dominated by Kasikornbank, Krung Sri, and Siam Commercial Bank, KTB set up a new business unit, Global Transaction, for private transaction banking.

“The unit focuses on B2B or B2C cash management and transactional products project management for corporate customers, both on the loan and the deposit side . We are putting a lot of focus on retail payment transactions, small payment transactions, which should increase our current account base even further,” Chainarong added.

KTB has one of the largest branch networks in the country, with a network of 1,196 branches as of end-2014, accounting for more than 17% market share. Size, however, is often not enough when it comes to channel efficiencies. The bank thus pays close attention to downtime and user convenience.

“Deposit yield and channel convenience are key success factors in deposit collection,” Chainarong stated. “We are thriving to improve customer experience in all channels. Almost all of our ATM terminals are less than 5 years old. We have replaced more than 50% of our old ATMs since 2013 to improve efficiencies and downtime. Out of all automatic machines, 10% are cash deposit machines.”

With changes in customer behaviour, digital banking has become more crucial in everyday banking. Keeping technology updated and improving and using data analysis to respond faster is critical. In order to keep up with new developments and technology, KTB launched an improved user interface in 2015, and in 2016, plans to revamp its entire digital banking platform.

The bank was the first in Thailand to launch virtual teller machines (VTMs), which are currently in a pilot phase, to enable customers to open accounts via straight-through processing without going to the branch. Tight regulations and KYC rules usually prevent these services from being introduced, but the bank was the first to work closely with the Bank of Thailand (BOT) to reach a solution.

Account opening in branches has been reduced from an average of 30 minutes to 14 minutes processing time. Customers also receive debit card and digital banking access codes on the spot, a practice that is not common in many banks. For account maintenance, internet and mobile are fully integrated into a single platform that offers the customer the same icons and processes, as well as a single ID to access the system. Today, 56% of all KTB retail banking transactions are nonbranch transactions.

The bank has also improved its bill payment offerings by adding more billers, and by customising auto debit functions, thereby increasing its bill payment transaction volume by 82% in 2015.

KTB continues to deploy new products that match the needs of its customers. The bank has a main suite of four headline fixed deposit products with varying interest rates and tenor, and special promotion rates depending on market movements. It is in the process of further segmenting its customer base to include offers that will attract young depositors. The bank’s deposit propositions are also linked with other businesses such as wealth management, credit cards, and SME banking. For instance, some SME lending products are offered with better terms when linked to a deposit account. The bank also wants to create better synergies with its card unit, Krung Thai Card, where customers currently are able to convert their card bonus points to a special deposit rate.

KTB has been closely monitoring market movements, tracking deposits in and out of accounts for the bank and its competitors, and trying to roll over maturing deposits. In determining the pricing for its products, KTB takes into account key pricing determinants such as customer profile, products, channel, market competition, and liquidity, though it admits it is currently less driven by analytics than it would like to be.

In the first half of 2015, most banks in Thailand lowered their deposit base rates to preserve their net interest margin (NIM). Banks have limited room to cut funding costs further as industry funding costs have dropped to 2.16% in 2014 from 2.38% in 2013. The largest banks have a relatively low funding cost due to their ability to gain low-cost deposits from their strong branch networks. The average funding cost for the largest banks was 2% compared to 3.2% for small banks as of end-2014. Much of the cost is the deposit itself, while the cost of operating a deposit account is minimal. Further reduction will come with full online deposit account opening, but that is not possible until the regulator changes KYC rules.

KTB’s NIM for the first half of 2015 was on average 2.56%, and cost of funds was 2%–2.5%. It aims to have improved its NIM by about 20% by end-2015.

Finally, the bank will improve its asset yield by focusing on higher-yielding loan types such as SME or personal loans instead of mortgages.

A future on the upswing

KTB has seen significant deposit growth. At the end of 2014, deposits became the bank’s major source of funds, accounting for 78.6% of total funds (Figure 2). The share of interbank and money market borrowings (5.9%), and debt issued and borrowings (3.8%) actually contracted in 2014 compared to 2013.

Specifically, the bank had collected more retail deposits per branch than any of its peers (Figure 3). The retail deposit base, including government retail deposits, increased from B1,762 billion ($48.5 billion) to B2,015 billion ($55.5 billion) between 2012 and 2014, a 14% increase, while the sector as a whole grew by 8%. KTB’s market share in retail deposits also increased to 25.6% in 2014 from 25.3% in 2012 (Figure 4).

In an environment with potentially declining interest rates, banks in Thailand are focusing on building their current and savings account deposit bases. Location and proximity to customers matters, but so does investment in cash management services and payments. KTB is looking into how to increase data automation for its ATM fleet. To retain and better serve existing customers as well as attract new ones, which is costly and time-consuming, it is exploring how to further harness analytics in pricing.

With the low-interest-rate environment and rate cuts by BOT in 2015, the ability of Thai banks to capture low-cost deposits will be the decisive factor for profitability. Banks with large, cost-efficient distribution channels offering convenience of access and with a larger proportion of savings and current account deposits could weather market vagaries.

This is the call of the times that KTB is suiting up to tackle.