• Credit underwriting and collection for subprime segments are highly challenging

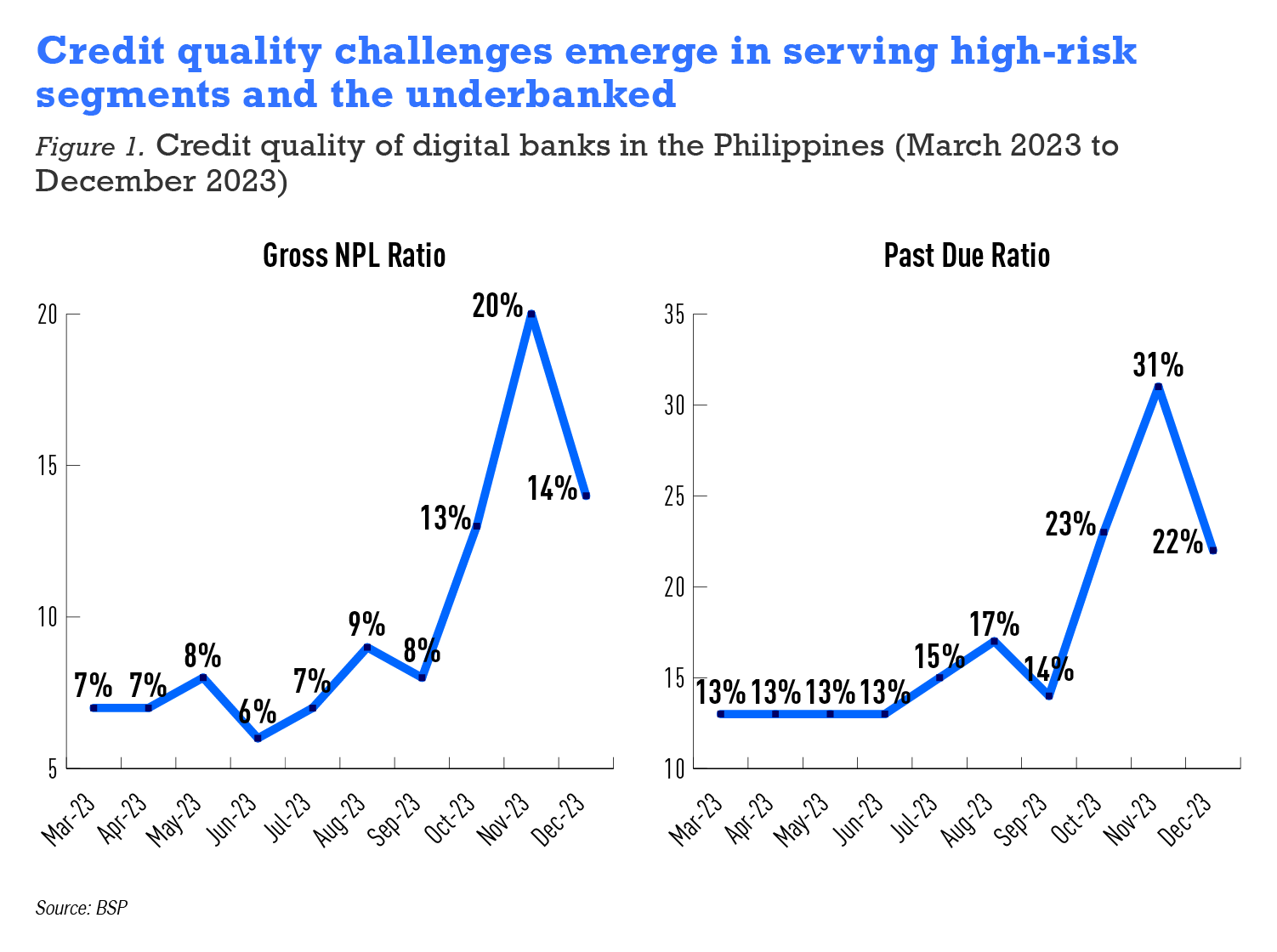

• Gross NPL rose from 7.2% in March to 14.5% in December 2023

• Loans past due rose to 31% in November and fell back to 22% in December 2023

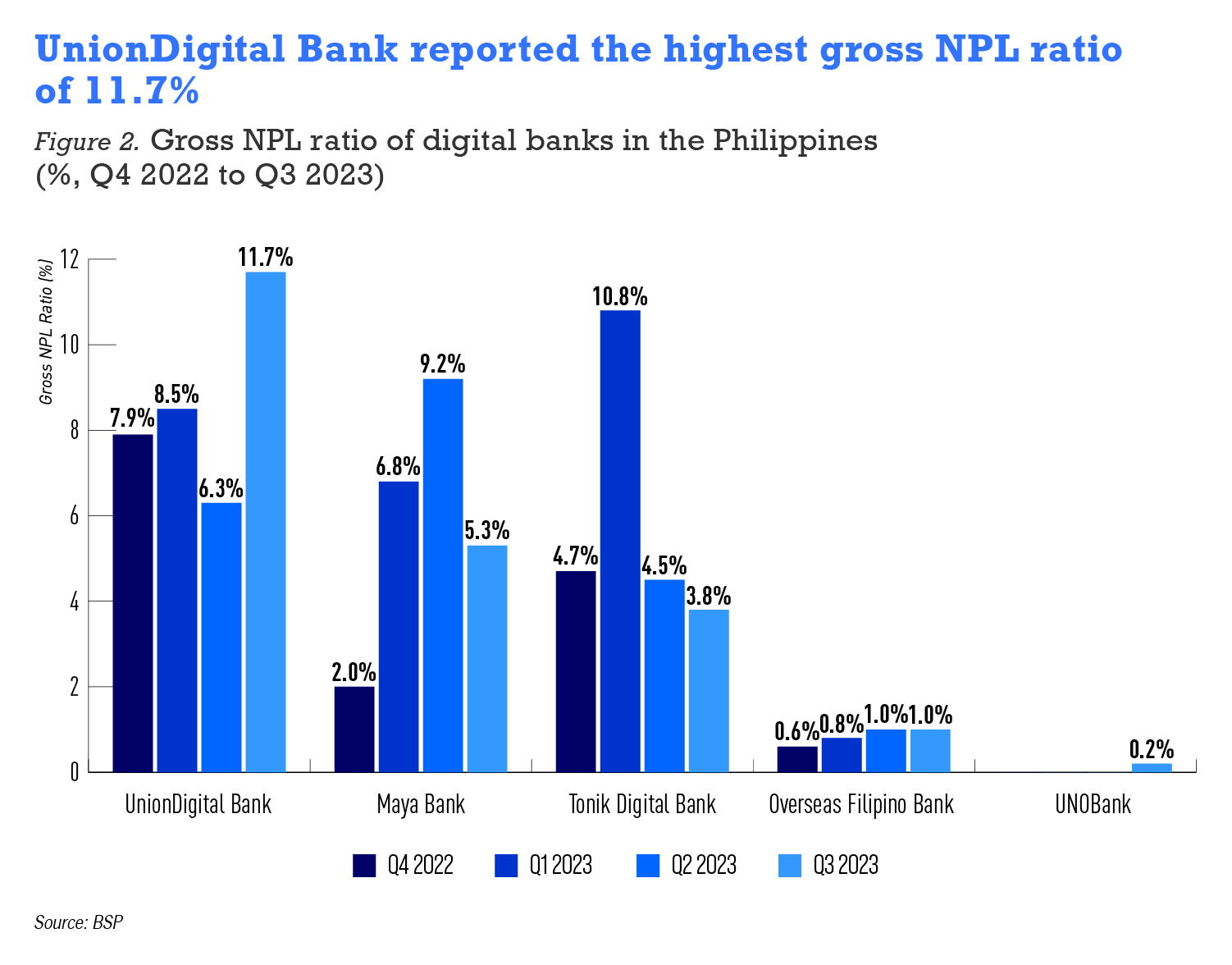

The digital banking sector in the Philippines reflected a dual narrative of rapid growth and emerging credit quality concerns in 2023. The country’s six digital banks, Union Digital Bank, GoTyme, Tonik Digital Bank, Maya Bank, Overseas Filipino Bank—the subsidiary of LandBank—and UNObank, expanded their reach with the aim of integrating a significant portion of the Filipino population into the wider financial system, and leverage rising interest rates to build net interest margins (NIM).

The total loans issued by these banks have expanded by 27% year-on-year from PHP 19.6 billion ($377 million) in December 2022 to PHP 24.8 billion ($477 million) in December 2023. Most banks have expanded rapidly into non-salary-based consumer finance. The average NIM climbed from 1.8% in March 2023 to 7.9% in December 2023.

Despite the growth, the sector’s ambitions were roundly thwarted, particularly in maintaining credit quality. The average non-performing loan (NPL) ratio rose from 7.2% in March 2023 to 14.5% in December 2023. Past-due ratios increased from 13% in March 2023 to 30.6%, though easing significantly to 21.6% in December 2023, suggesting more efficient collection efforts. Return on assets has trended downwards from -3.7% in March 2023 to -4.9% in the same period.

These institutions will continue to evolve in 2024, balancing growth with sustainability in the face of elevated interest benchmark rates and persistent inflation. The Bangko Sentral ng Pilipinas’ target reverse repurchase rate may only fall from 6.5% to 5.5% by the end of the year, as posited by former Finance Secretary Benjamin Diokno in a recent Bloomberg interview.

.webp)