- Beyond full interoperability, additional service features plus extension to SMEs and waiving of fees were proven to drive the adoption of payment themes

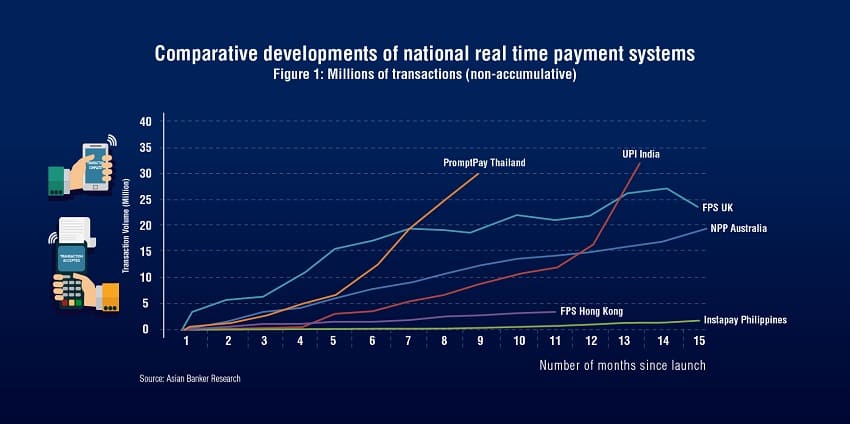

- PromptPay in Thailand and UPI India have shown the fastest adoption of real time payment systems in Asia (excluding China) with UPI transactions crossing the one billion mark in October 2019

- The creation of relevant services vastly increase the consumer experience

Real time peer-to-peer (P2P) payment themes are relatively new payment rails that enable consumers, businesses and government agencies to make real-time, data-rich payments between accounts from participating financial institutions.

Network effects have to take place, however, to realise the full benefits of these platforms. Because as the networks get larger, the benefits increase disproportionally. The network effect is what can make it difficult for new systems to get off the ground and also entrench large networks, according to the Reserve Bank of Australia. The key success for these payment themes is the creation of relevant services that sit on top of the platform and its capabilities. These services vastly increase the consumer experiences.

In the Philippines, a transaction through InstaPay – the country’s P2P micropayment platform – can cost a customer between $0.20 (PHP 10) to $1 (PHP 50) per transaction with BDO Unibank, with the transaction fee going up as high as $1.97 (PHP 100), according to data from end of May 2019 by the country’s central bank. Yet the real cost of an InstaPay transaction to the banks is about $0.020 (PHP 1), based on the Asian Banker Research.

UPI India: Adding new features with UPI 2.0

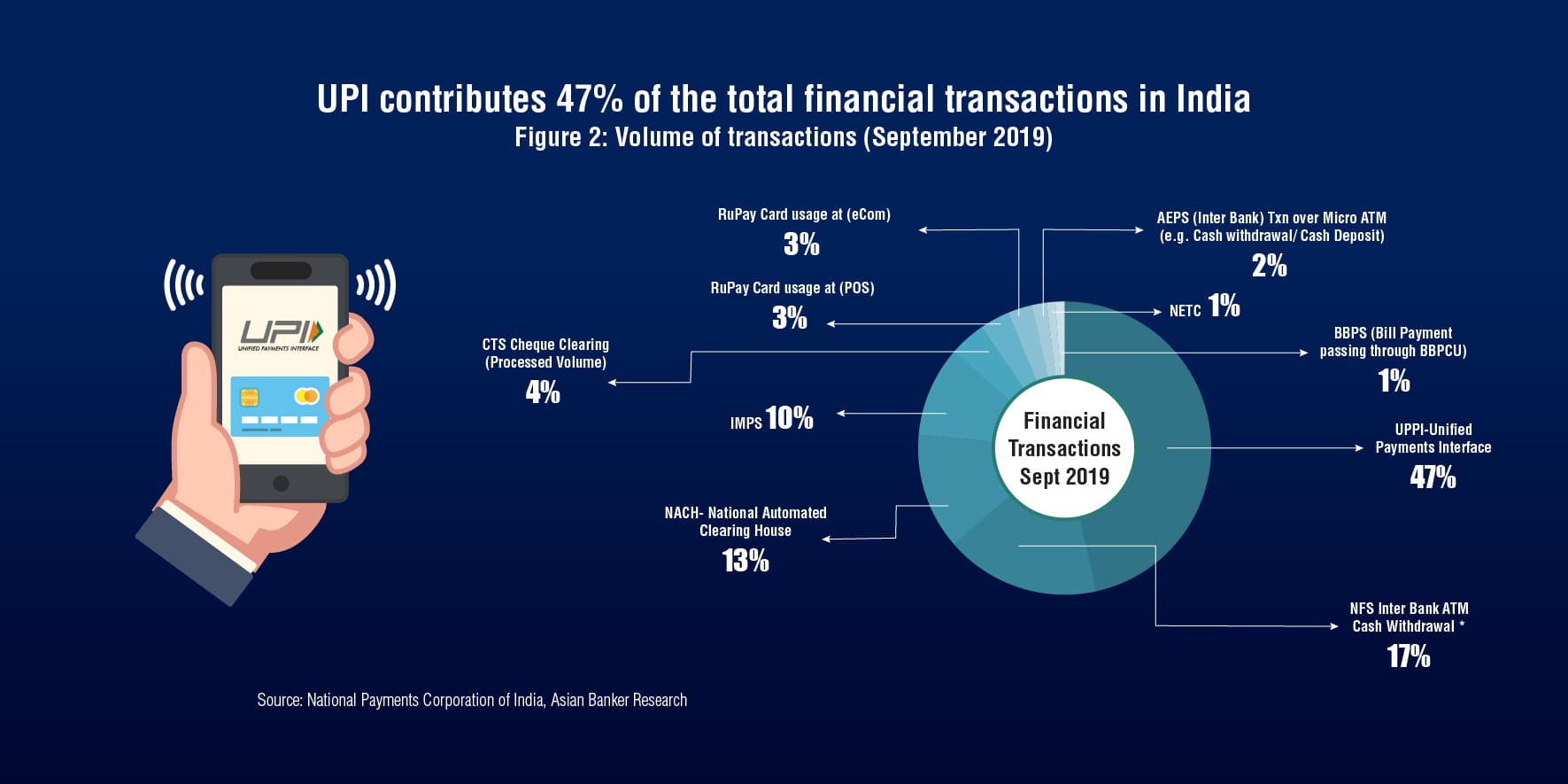

The transactions of India’s Unified Payment Interface (UPI) crossed one billion in October 2019 and has now more than 100 million users, three years after its launch, making it one of the fastest adoption of real time payment systems around the world.

India’s UPI facilitates fund transfer between two bank accounts without having to add a beneficiary, which is required if one wants to transfer funds using other net-banking modes like immediate payment service (IMPS) or national electronic funds transfer (NEFT). As of September 2019, 141 banks were connected to UPI. Each bank now provides its own UPI app.

UPI helps in low cost, high-volume payments. The cost of each transaction is less than a dollar (INR 0.45). However, if a payment is made from UPI to, say, a bank account using IMPS, NEFT or real time gross settlement, then a bank may charge the client for it. One can transfer up to $1,400 (INR 100,000 / 1 lakh) per UPI transaction.

The National Payments Corporation of India (NPCI), which operates the UPI platform, intends to expand the network globally by enabling acceptance of UPI in Singapore and the United Arab Emirates.

As a major service upgrade, NPCI launched UPI 2.0 back in August 2018 with several new features, including an overdraft facility, invoice-in-the-box feature and signed intent feature. It is expected that UPI 2.0 will further drive the average value of transactions through merchant transactions. Although fintech companies are not allowed to use the UPI 2.0 platform.

In addition to current and savings accounts, customers can link their overdraft account to UPI. There is also a one-time mandate allowing customers to pre-authorise a transaction and pay at a later date. This works seamlessly for merchants, as well as for individual users. The one-time mandate feature is the most important in UPI 2.0, making the payment experience much more seamless, say experts.

The invoice-in-the-box feature is designed for customers to check the invoice sent by a merchant prior to making the payment. This will help customers to view and verify the credentials and check whether it has come from the right merchant or not, to check the authenticity of merchants while scanning the quick response (QR) code. It notifies the user with information to ascertain whether the merchant is a verified UPI merchant or not. Transactions are processed faster since an app passcode is not required in the case of a signed intent. It also negates the chances of QR tampering. Customers will be informed via notification in case the receiver is not secured. As of August 2018, 11 banks have signed up to UPI 2.0, including most of the first tier banks.

PromptPay’s transaction numbers surge after dropping payment fees

A combination of lowered fee to no fee per transaction, plus industry collaboration on making signing up easier, and increased innovation activities by banks on the PromptPay infrastructure is driving usage.

The PromptPay QR code was launched in the last quarter of 2017, which added a convenient payment channel. This also helped merchants to receive payments more easily. Currently, there are about two million merchants that adopted the QR code payment theme.

In March 2018, PromptPay decided to waive all electronic payment fees. Prior to this, PromptPay’s service fee structure was already cheaper compared to a traditional bank wire transfer fee which is $81 - $3.90 (THB 25 – THB 120) per transaction, regardless of the amount and depending on the channel used. At PromptPay, a transfer fee of up to $162.40 (THB 5,000) will not be charged. Money transfers above $162.40 (THB 5,000) will be charged between $.065 and $.32 (THB 2 and THB 10) per transaction, depending on the amount transmitted. Waiving fees substantially boosted banks' online transactions but also individual money transfers via the PromptPay platform.

As of August 2018, PromptPay has grown to 44.5 million registered users representing 43% of Thailand’s total population. PromptPay consumer-to-consumer (C2C) transfers account for 31% of the total electronic money transfer transaction volume made by retail. More than 80% of all transfers are initiated by mobile devices. Over 80% of C2C transactions were transfers below $162.40 (THB 5,000).

Large businesses along with small and medium-sized enterprises can use the service with PayPay and QR code to increase the convenience and variety of payment channels. However, according to the Bank of Thailand, service features can be further developed to accommodate more business needs, such as the delivery of trading information along with payment information to facilitate quick reconciliation of the outstanding balance.