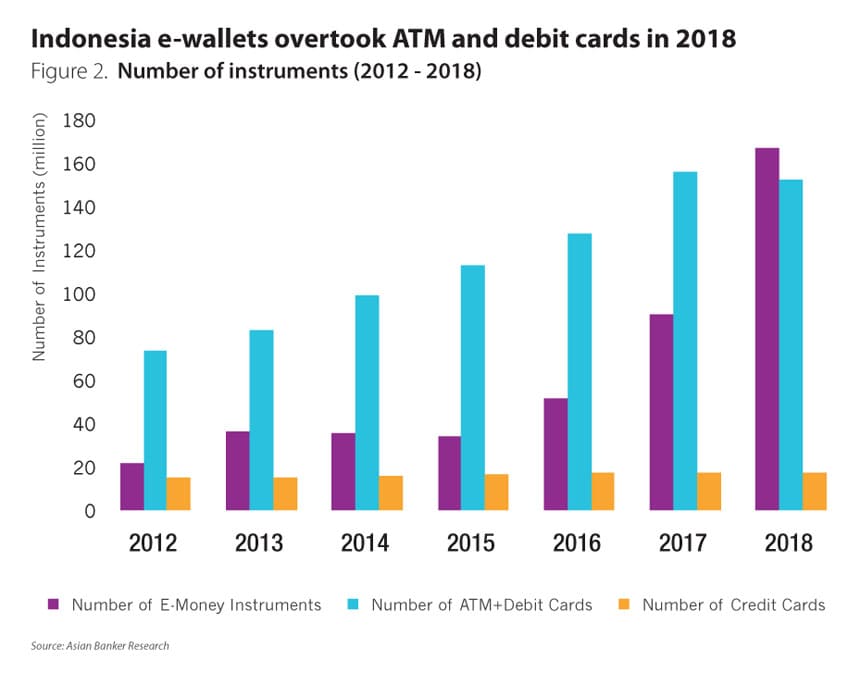

- Number of e-wallet instruments overtook other card based instruments in 2018.

- E-wallet usage highly uneven with mobile phone and data package top-ups are the top use case for mobile payment transactions.

- Companies resort to heavy incentive and cash back themes to attract and retain users.

In 2018, Indonesia proved to be fertile ground for mobile payment growth driven by massive adoption of e-payments from the largest fintech platforms. E-money transaction projections were initially pegged at $1.5 billion in transaction value at the start of the year but ended up tripling, hitting $3.32 billion (Rp 47.2 trillion) by year-end, an increase of 380% compared to 2017. It is expected that the total value could exceed $15 billion by 2020.

Mobile or e-wallet s essentially work like classic physical wallets and serve one purpose: to store money until such time it is accessed to pay for goods and services. According to the Indonesian Fintech Association, there are 31 e-payment providers that have secured licenses from Bank Indonesia.

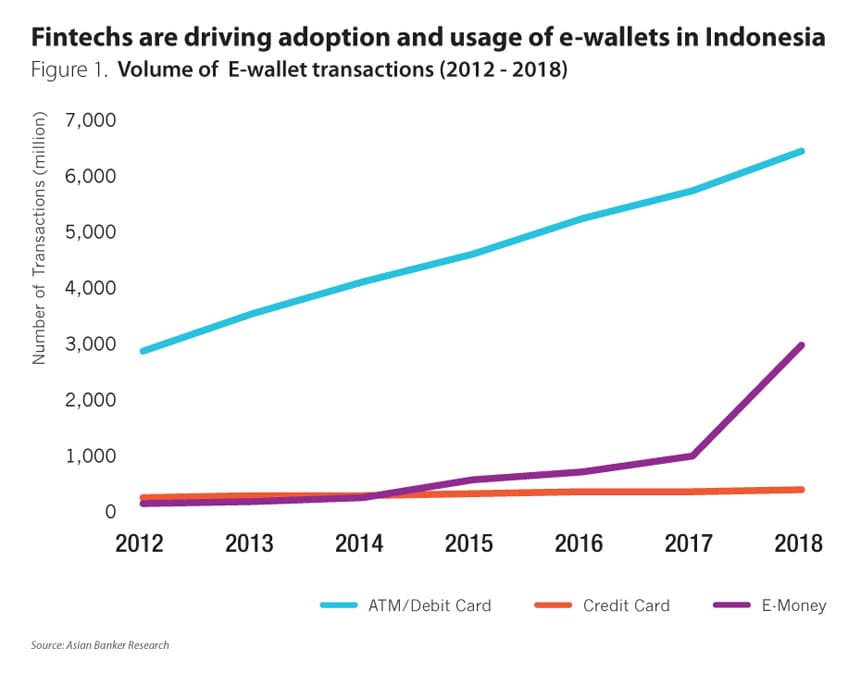

Fintechs are driving adoption and usage of e-wallet s in Indonesia

Figure 1. Volume of E-wallet transactions (2012 - 2018)

Source: The Asian Banker

E-wallet adoption received a further important catalyst in May 2019, when the Bank Indonesia, the country’s central bank, introduced Quick Response Indonesia Standard (QRIS) code system, allowing QR-code payments to be interoperable through a single standardised code.

Indonesia e-wallet s overtook ATM and debit cards in 2018

Figure 2. Number of instruments (2012 - 2018)

Source: The Asian Banker

With around 150 payments players, OVO by Grab, Go Pay, and LinkAja with OVO and Go Pay are leading the payments competition in regards to scale and volume.

Go-Pay is integrated into Go-Jek, the Indonesian-born ride-hailing giant riding on the back of its more than 900,000 drivers that shuttle millions of citizens daily. Commuting transactions alone contribute 30% of all cashless transactions in the country. Go-Pay processes more than 100 million transactions for its 20-25 million monthly users. Users can upgrade their accounts via a simple registration with the country’s central bank, increasing the balance limit from $140 (Rp 2 million) to $700(Rp 10 million, and allowing balance transfer between Go Pay users and cash withdrawal.

To Go-Jek, payments is a bridge to customer needs, a means to an end. When Go-Jek started it did not aim building a product, but about how it can give its users what they need. From the data and insights it generates by monitoring the actual real-time behaviour of its customers in their use of Go-Jek’s mobile app services, the company is able to innovate and to better address customer needs from which all their services are developed. Experimentation around life scenarios is so important that Go-Jek runs on average one new experiment every day to trial new features.

Go Jek also believes that growth comes through an open ecosystm. It partnered with Bank Tabungan Negara (BTN) to give loans to drivers so they can buy houses, with Bank Rakyat Indonesia (BRI) to leverage its 62 million users, and with Bank Negara Indonesia (BNI) to give government-subsidised loans to entrepreneurs. Another factor driving growth was that their teams truly understood the role and objective of each type of channel based on their vision for growth and the customers’ overall experience within the ecosystem. With funding from Tencent, Go-Jek continues to evolve into a so-called “super app” catering to its users’ daily needs, such as buying groceries and medicine, food deliveries, and even back massages, this number is expected to grow exponentially.

Top three largest mobile payment platforms in Indonesia

Figure 3. Number of users and merchants base as of end 2018

Source: The Asian Banker

Note: Go-Jek figures are app downloads

In the same vein, ride hailing platform Grab invested in OVO, after its own payment platform GrabPay failed to secure an e-money license. OVO, an Indonesian digital payment platform developed by local conglomerate Lippo Group, started as a standalone payment app but quickly broke through the market after it became the official e-wallet for Grab. Its offerings are similar to Go-Pay.

Telekomunikasi Indonesia and Bank Mandiri, BRI, BNI, and BTN have merged all its mobile payment services rebranding Telkomsel’s T-Cash into LinkAja, a single state e-wallet . However, the app is not fully operational yet and the official launch date after being postponed several times is now scheduled for June 2019. Telkomsel realised that the T-Cash platform which prior to merger had 25 million users of the T-cash e-wallet , could not survive as a stand-alone payments platform given the expansion of OVO and GoPay. Furthermore, the active rate of T-cash was very low at around 10%. It was reported in local media that the first wave of migration crashed LinkAja’s system. While OVO and Go Pay’s customer base is more concentrated in urban areas, LinkAja aims to play to its strength of having a large stablished user base in rural areas, but has yet to come up with a credible suite of financial services geared towards financial inclusion. State-owned oil and gas giant Pertamina is also expected to join. The company has around 7,000 gas stations nationwide, even in areas where bank branches do not exist.

Consumer-reported use cases for mobile wallets

A major use case among Indonesians, especially for smaller e-wallet s, is for mobile phone and data package top-ups, a mobile-centric activity that gives tech-savvy Indonesians further access into app-based transactions for goods and services as they go about a typical day: shopping, ordering food and hailing Ojeks.

E-wallet usage however is highly uneven and dependent on the area of lifestyle. When it comes to dining, ordering food online thru a plethora of apps, is almost always paid cashlessly. However, when within a physical restaurant, mobile payment is not the preferred way of paying the bill. The same preference can be seen in online e-commerce and offline shopping.

For daily travel needs such as hailing a taxi or Ojek to and from work, Indonesians prefer to pay thru e-wallet s while transportation expenses for leisure, such as plane or train tickets, they prefer to pay in cash or credit card.

Rosy outlook, bumpy road ahead

As much as 65.3% of Indonesian consumers are still choosing cash on delivery as payment method for digital purposes, according to eMarketer. With common interoperability standards and a pool of big fintech platforms could reduce this ratio significantly by 2020. Currently, e –wallets already make a big impact on how people pay for road toll stations and public transportation, but much remains to be done in regards to domestic remittances and a wider range of use cases beyond payments such as in micro-lending.

Top e-wallet players have also to figure out a way to wean off their costly discount and cash back programs to be able to attract and retain users. Maximum cash back themes per transactions among the top three can range between $0.7 to $4.2 (Rp 10,000 to Rp 60,000). In this context, the biggest players have an edge being backed by big-name investors and/or corporations with a lot of cash to burn. Go-Jek’s Go-Pay is backed by KKR & Warburg Pincus; OVO is backed by Lippo Group; LinkAja owned by Telkom Indonesia and the four major banks.