- Vietnam’s banking sector undergoes a restructuring scheme to consolidate smaller banks

- VPBank’s active customers increased by 60%, reaching over two million by 2015

- VPBank plans to set up a standalone digital bank for the underbanked segment

Overview

- Vietnam’s banking sector – which had been fragmented into several small entities and plagued by high level of non-performing assets (NPAs) and other inefficiencies – has been undergoing a radical restructuring for the past four years. Under the banking restructuring scheme, the country aims to reduce the number of banks to less than 20 by 2020, and to form one to two large banks that have similar scales as other banks in Southeast Asia. The consolidation process has involved several mergers and acquisitions (M&As) and the number of banks has whittled down to 34 state-owned and commercial lenders from more than 40. Combined assets increased from VND5 quadrillion ($200 billion) to VND6.6 quadrillion ($264 billion) and the non-performing loan ratio reduced to 3.5% in 2015 from 10%.

- In 2016, the State Bank of Vietnam reduced the dong’s reference rate after it had decided to move to a more market-based methodology in setting a daily reference rate versus the dollar. The new methodology calculates the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day and prices of eight major foreign currencies at 7:00 a.m. in Hanoi. The eight currencies are from the U.S., China, European Union, Japan, Taiwan, South Korea, Thailand, and Singapore.

Vietnam Prosperity Bank Joint Stock Commercial Bank (VPBank)

- Vietnam Prosperity Bank Joint Stock Commercial Bank (VPBank) was formed in 1993, specialising on private banking. It is one of the first joint-stock commercial banks in Vietnam.

- Since it forged partnership with McKinsey and Company, VPBank has been focused on becoming a leading retail bank in Vietnam. Its customer base increased from around 200,000 in 2011 to more than two million in 2015. The bank aggressively pushed its organic growth by focusing on its retail and SME customer segments, while also giving importance on larger business customers.

- The bank also established household banking to serve the highly potential but underserved segment.

- In 2015, the bank’s number of active customers reached over two million, up by 60%. The number of new cards reached almost 350 000, including over 70 thousand credit cards.

- >As of December 31, 2015, deposits balance rose by over 20%; profit before tax reached VND3, 096 billion ($123 million); owners’ equity grew by 49%; and provisions were around VND3, 277 billion ($131 million).

Leadership Profile – Duc Vinh Nguyen, Chief Executive Officer

- Duc Vinh Nguyen has been the chief executive officer and member of the management board at VPBank since July 4, 2012. He also serves as director at VPBank. He previously served as vice chairman of Techcombank.

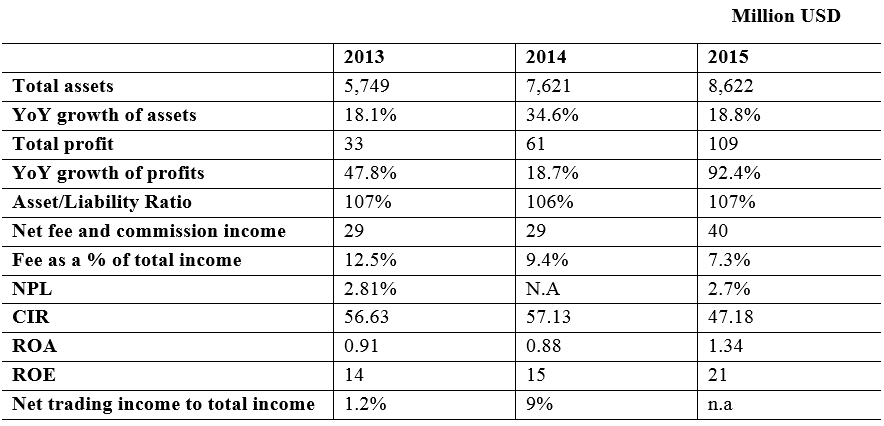

Financial Performance of VPBank in 2015

Analyst Comments and Ratings

- August 2015: Standard & Poor’s Ratings Services reconfirmed the “A–” rating (A–/Negative/A–2) of VPBank Group, underscoring the formidable creditworthiness of the bank.

- September 2015: Moody's Investors Service affirmed VP Bank’s B3/NP global local currency and foreign currency bank deposit ratings. At the same, it changed the outlook on deposit ratings to stable from positive. Moody's also affirmed the bank's baseline credit assessment (BCA) and adjusted BCA of caa1.The rating outlook changed to stable from positive.

Latest News on VPBank:

- May 2016: VPBank implemented a new digital solution using SAP’s Omnichannel Digital Platform. VPBank has also started discussions on the technology that will be used to set up a standalone digital bank for the underbanked segment.

- March 2016: The bank started discussions on plans to lists shares on the stock market in accordance with regulations of the State Bank of Viet Nam, which had asked all domestic banks to list shares on regular exchanges or the unlisted public company market by the end of this year. The bank is still waiting for guidelines from the State Securities Commission.