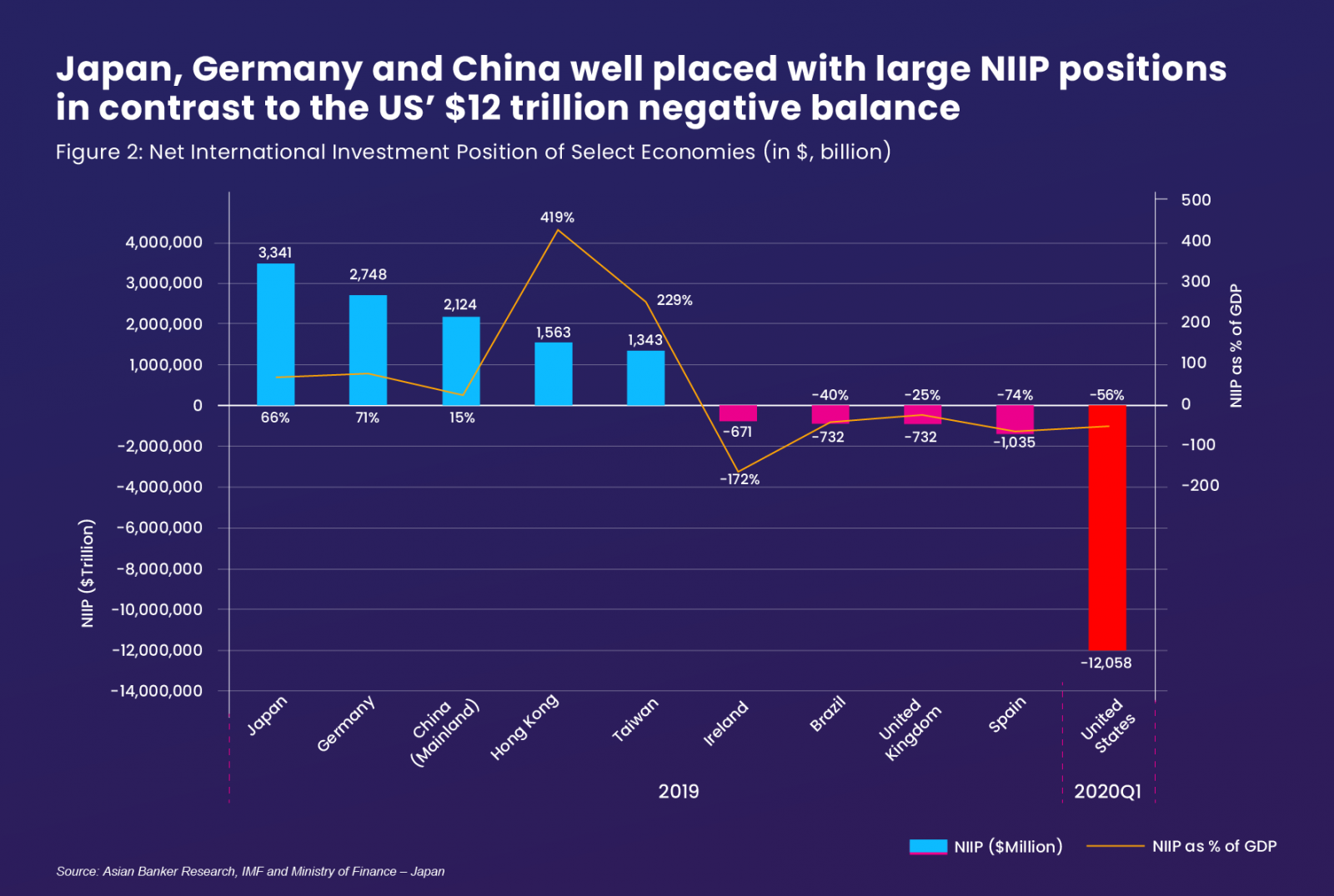

The US net international investment position (NIIP), which is calculated by the assessing the spread between the country’s external financial assets and liabilities continues to register a deteriorating trend in more than a decade. The US NIIP as a percentage of GDP has now touched 56% in the first quarter of 2020 and brings in to question both the sustainability of the US current account deficit and trajectory of US debt. This stark imbalance validates existing concerns of the financial condition and creditworthiness of the US as a habitual debtor nation given the sizable ownership of its assets by non-US entities.

Correcting the persistent current account deficits, the US has been registering especially due to the negative balance of trade is only part of the solution as long overdue structural adjustments needed to reform the US economy remain unaddressed. Essentially, the world has become less interested in what the US has to offer in terms of goods and services and is more inclined towards directing its flows to US equity and debt markets.

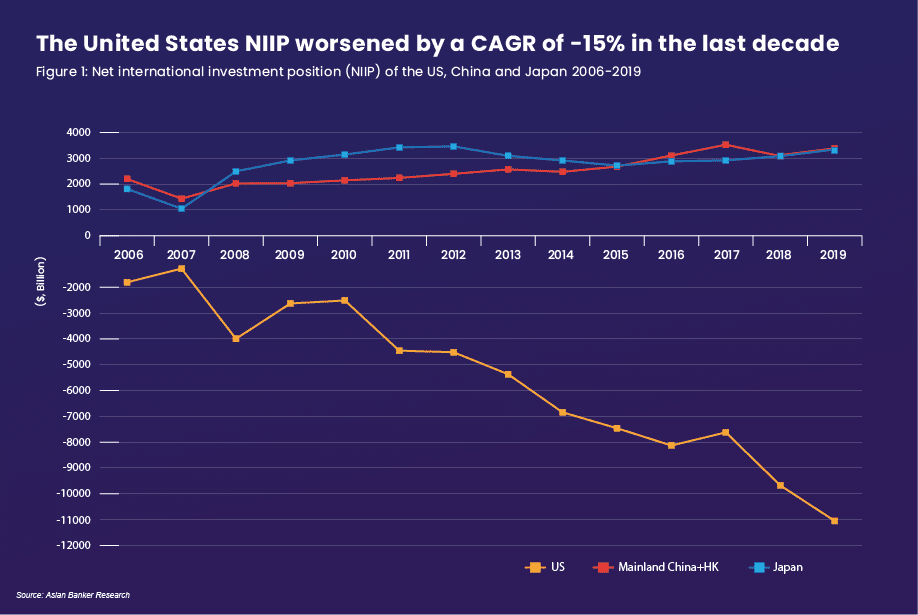

While this can partly be attributed to the strong dollar policy in place, the shifting of a significant component of the US’ industrial and manufacturing base overseas in the 2000s and the subsequent realignment of global supply chains has adversely impacted its NIIP. The strange paradox is that while the US continues to run a negative NIIP - its Net Investment Income (NII) remains positive, the reverse can be said of Japan and China.

Today, both Japan and China respectively lead in terms of holding US sovereign debt with $1.260 and $1.084 trillion in treasury holdings as of May 2020 and it is these types of large acquisitions of foreign assets that continues to play a favourable role in their respective NIIP positions. Moreover, both countries remain well positioned through relatively persistent current account surpluses.

Intriguingly, when assessing US external assets compared with its liabilities the differences are remarkable, not only from a value perspective but rather composition as well as its international assets are strongly skewed towards direct and portfolio investments while liabilities are in debt securities and other fixed income instruments.

It remains to be seen if the US will be able to plug the drain in outflow of return on foreign owned assets, what is clear is that unless the US treasury and corporates revise their debt profile and limit borrowings the bleeding will likely persist to dangerously unmanageable levels with potential knock-on effects globally. As the premier global reserve currency of choice, the US can afford to weaken the dollar to correct existing imbalances to the detriment of everyone else.