- The largest Australian banks have built powerful digital banking platforms that compensate the repercussions from the banking crisis and incoming new entrants

- Digital banking users continue to express confidence in those platforms

- Early user data from neo-banks are not convincing that consumers will give their customer mandate to neo-banks

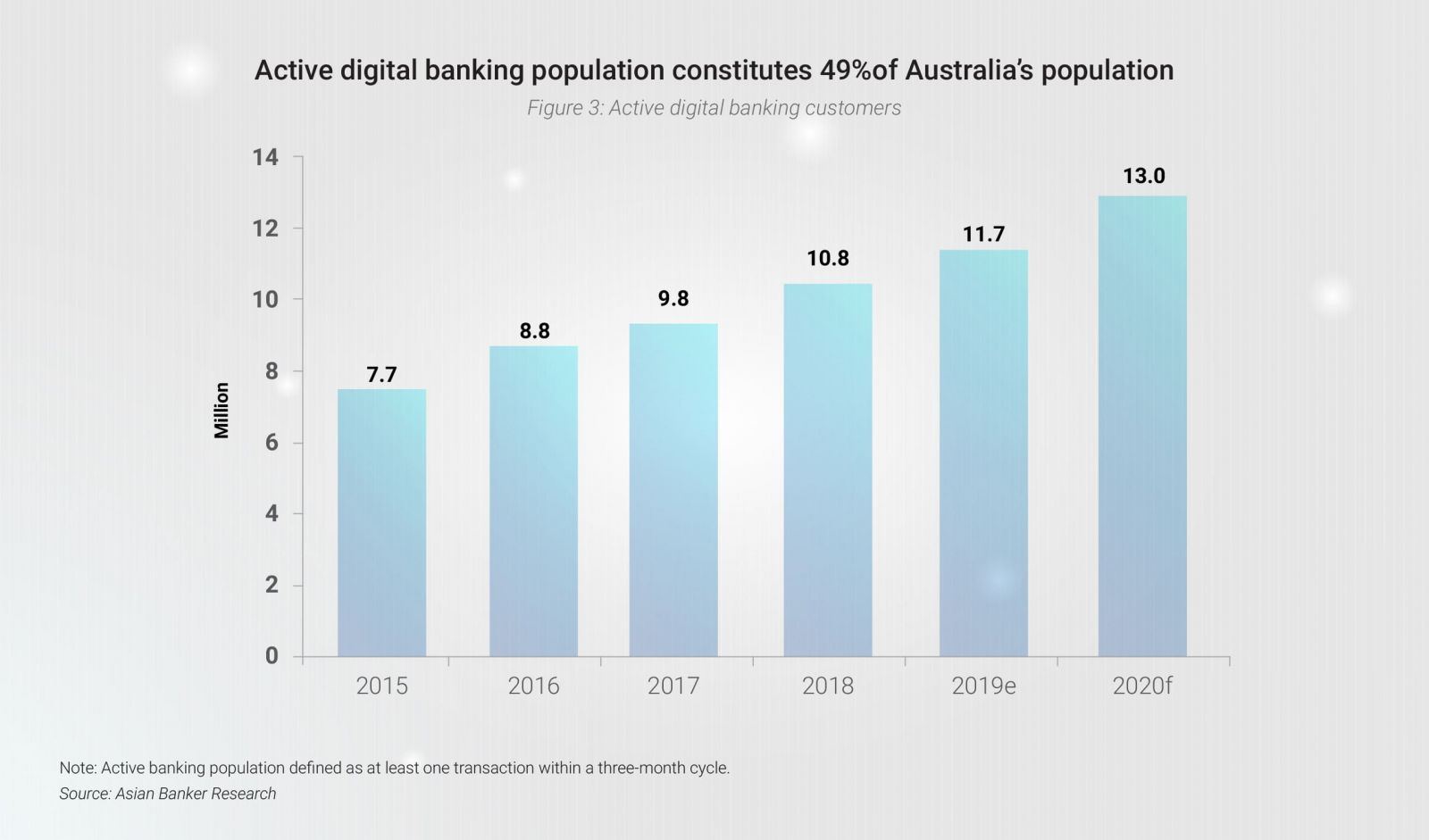

After the big four banks in Australia, namely Commonwealth Bank of Australia (CBA), ANZ, Westpac, and National Australia Bank (NAB) have seen a steep decline in their net promoter score (NPS) – an index measuring customer loyalty among consumers – the digital user growth in 2018 across banks has yet to reveal a clearer picture whether the digital active part of consumers will make the switch.

ING, the country’s fifth largest home loan lender, has more than doubled its customer acquisition from 163,000 customers in 2016 to 400,000 customers in 2018. Of the 700,000 interactions ING has with its 100% digital customers each day, 70% of that is through the mobile apps. While the big four are scaling back their product suite, simplifying their structure and processes, ING introduced five products in the last 18 years. Besides mortgages, checking and savings accounts, pension products and superannuation, it entered into personal loans in 2018.

In comparison, Up, the first fully-licensed and cloud-hosted digital bank of Bendigo and Adelaide Bank and the country’s sixth largest bank by assets, reached 20,000 users between its launch in October 2018 and December 2018.

Changes in the competitive nature of the industry come at a time when the incumbents are already one of the most digitised commercial banks in the Asia Pacific. Seven out of 10 banks in Australia allow new bank customers to open a current account via mobile banking.

Digital users are actually more satisfied with their big four banks’ digital platforms compared to the banks overall image and operation. For instance, CBA’s overall NPS score stood at 5 in January 2018 and dropped to 3.8 in February 2019 according to Roy Morgan. But its market leading mobile and internet banking achieved a NPS of 37.8 and 31.3, respectively as of June 2018.

CBA launched the opening of full transaction accounts in 2016, which can be opened in three minutes including instant access via cardless cash and mobile payments. At the front end, 55% of sales originates from consumers’ mobile devices, which positions the bank in the top league among large domestic banks in the Asia Pacific. But the reality is that customer expectations are rising, regulatory scrutiny is increasing and there will be a whole new range of competitors, which banks clearly see as threats.

Westpac, CBA, and ANZ also began to architecture its technology stack to allow for a faster innovation cycle. NAB has just started. Between September 2017 and March 2019, the bank removed 8% of its IT legacy applications and 8% of applications have been moved to the Amazon Web Services as part of its $1 billion (AUD 1.5 billion) transformation strategy. It will eventually see a 35% shift to the cloud of its total 2,600 applications.

Banks in Australia, which pursue a multi-brand strategy, have been integrating their various subsidiaries under a single retail banking platform since 2015 to leverage a better shared understanding of customers’ needs and expectations across brands.

The big four are in the midst of decluttering and simplifying their product and operational structure. The number and size of processing problems and the complexity of product design in the industry is so acute that it was highlighted by the royal banking commission. There are 408 operational steps at ANZ’s mortgage process and a large number of those steps are manual. According to NAB, it offered around 600 products in FY2017 which they reduced to 459 in FY2018 with a final number of 300 in the next five years.

Westpac will be rolling out its new Customer Service Hub for mortgages in 2019 and extend the offering out to third-party channels by 2020, which is part of the group’s $800 million spend on system upgrades, digital transformation and innovation. At St. George, mortgage applications can already be completed online or through mobile with specialist support available via live chat, personalised pricing and valuations and customers can stop and restart the process at any time. The bank has also started to offer mobile cheque deposits.

ING allows customers to set automated saving goals triggered by specific events. For example, a customer can save for a tropical holiday by transferring a certain amount from the savings account every time the temperature drops below a certain degree on a daily base.

There’s a visible trend showing banking combined as part of other (digital) services and this will accelerate in 2019. For example, NAB launched a partnership with realestate.com.au, combining property search with the home loan process.

Westpac and NAB are heavily invested via their capital venture funds into a series of fintech companies such as Valiant, a business loan market place that matches SMEs to the best lender or Slyp, which enables merchants to instantly send customers a smart digital receipt directly to the mobile banking app. The partnership is developing a range of smart receipt engagement modules that helps customers, merchants and banks to interact more meaningfully, including intuitive ratings, offers and seamless loyalty enrolment.