- Increased application of AI tools in banks

- Banks use AI in four key business areas

- AI adoption accelerates but banks struggle with transition

To offer seamless and hyper-personalised customer service, financial institutions (FI) must develop a deep understanding of customer needs and respond in a timely and efficient manner. This is where artificial intelligence (AI) plays a crucial role, enabling faster, more cost-effective and accurate decisions compared to traditional rules-based methods.

Although fintech companies were first movers in AI adoption, many banks are also beginning to embrace AI technology. However, banks face challenges when it comes to scaling advanced AI and real-time capabilities beyond selected use cases, hindering their ability to optimise AI to generate substantial business benefits throughout the organisation.

Increased application of AI tools in banks

Machine learning (ML) based self-learning models are one of the key AI technology capabilities that FI are focusing on. These models process large volumes of structured and unstructured information at high speed, providing timely, intelligent insights that enhance decision-making.

Natural language processing (NLP) has found increased adoption in chatbots and voicebots. NLP-powered bots understand and interpret human language for effective communication and improved customer interactions. Computer vision, fuelled by ML algorithms, allows for the interpretation and understanding of digital images and videos. Robotic process automation (RPA) is another AI technology. It automates repetitive, rules-based tasks using software bots, replacing labour-intensive human processes, improving operational efficiency and reducing costs.

Banks use AI in four key business areas

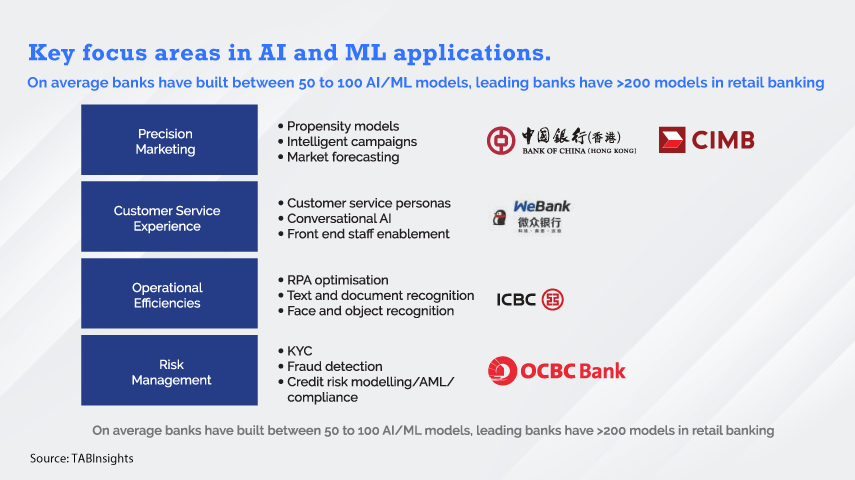

The Asian Banker’s discussion with leading banks across Asia-Pacific reveal that most banks use AI in four key business areas: precision marketing, fraud and risk management, customer engagement and experience, and operational efficiency.

By analysing transactions, interactions, and ecosystem data, banks can understand customer behaviour patterns better. This enables them to predict customer needs and preferences, and offer precise and personalised recommendations through intelligent campaigns. Banks aim to improve response, conversion, and click rates, as well as digital sales while lowering analytics costs and time. Multiple iterations and self-learning capability of models boost conversion rates in niche segments.

ML models also help prevent fraud, especially with growing cyber threats and regulatory requirements. According to a survey by The Asian Banker, 47% of FI in Asia have adopted ML tools for fraud detection, while another 37% are in the early stages of implementation.

AI adoption accelerates but banks struggle with transition

The Asian Banker's discussions with leading banks reveals that while the adoption of AI has accelerated, it still contributes less than 10% of total retail revenue in most banks. Real-time AI insights have the potential for higher sales conversion rates, but banks lumbered by legacy infrastructure continue to struggle with the transition.

Banks have focused on basic personalisation towards cross-selling and upselling using structured data and improving operational efficiency using AI. They need to progress towards hyper-personalisation using AI, incorporating more unstructured data and customer interactions data and move towards being insight-driven organisations.

To optimise AI, FI will need a robust and scalable real-time data framework, infrastructure that supports advanced analytics capability, and technology architecture designed for speed, agility, and scale. Efficient data architecture is necessary to integrate growing data volumes efficiently, accommodate real time data streams, and reduce latency of insights.

For more insights on building AI and advanced analytics capabilities in financial institutions, members of TABInsights can now access the full report here.