- While venture capital and private equity are well-established funding options, crowdfunding is newer and growing faster

- Speakers at The Asian Banker Future of Finance Summit in Dubai explained how crowdfunding, tokenisation and new models for venture capital can help fill the gap

- Regulators are working on protecting investors while still enabling new funding models

Despite a need from small and medium enterprises (SMEs) for $4.5 trillion more in loans and the fact that at least half of the world’s labour force is working for SMEs, still, “nobody wants to finance SMEs”, stated Karma founder George Goognin. He explained that challenges for institutional investors and lenders are that SME lending is an unstructured market that is hard to consolidate and accurate financial information on SMEs is difficult to obtain. The gap is so bad, that many SMEs are failing due to a lack of funds.

Now, however, alternative financing is a growing option in a multitude of countries around the world.

Alternative financing has a wide array of products, from crowdfunding options such as invoice finance or direct lending to venture capital (VC) and private equity (PE) equity, shared Fundnel co-founder Sng Khai Lin. While VC and PE firms are well-established, crowdfunding is newer and growing faster. She added that because of the returns in the alternative finance sector and an increase in transparency, more non-institutional investments are going into this space, particularly online platform lending.

Venture capital and private equity

While VC firms still provide plenty of funding, the traditional journey of funding by friends and family, angels, VCs, and eventually PE, is broken, said Alain Falys, venture partner at Imperial Innovations. He cited two reasons: lack of liquidity in PE and a concentration of capital in a few cities, which does not fully reflect where innovation is actually happening.

For Paul Arik, managing director of digital ventures at Siam Commercial Bank, there are three key trends in the VC sector. First is the increasing stratification of venture funding. Whereas venture capital started out having only one methodology, venture funding splintered into geographical-specific, sector-specific and function-specific funding.

The second, while still at a nascent stage, is a shift towards greater inclusion in the venture space, particularly for increasing gender representation. “We see increases in female entrepreneurs,” he added. VC funds with female teams produce higher returns and greater growth.

The last point is how VCs monetise and monitor investments. VCs have long relied on traditional metrics such as internal rate of return and internal equity. Now there are sources of returns that may not be captured in traditional metrics and business alone doesn’t equal utility. The industry needs to develop metrics that capture the utility of services such as Amazon, Apple and Siri, which operate in a world of openness. Moreover, trends towards greater environmental, social and governance factors and social impact are not captured in traditional metrics.

Crowdfunding

Crowdfunding started in the UK in 2007, then developed rapidly in the United States. While crowdfunding only started in China in 2013, the industry there developed rapidly, led by the rise of China’s technology firms. China surpassed the US to become the world’s largest player and took a 37% share of the global market in 2018, according to Reuters and Orbis Research, while Europe and the United States were about 18% and 33%, respectively.

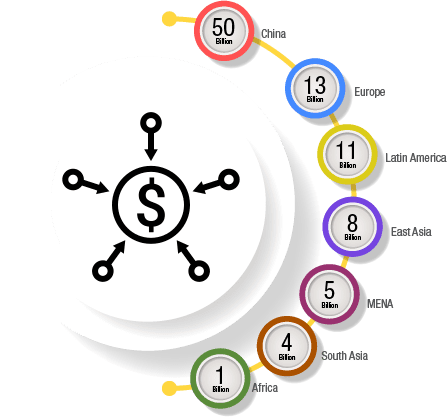

Crowdfunding has edged out bank financing when early-stage firms consider their funding options, according to consulting firm EY. While venture capital is still the preferred path to accessing growth capital, crowdfunding has passed bank financing to become the second favourite choice. Globally, said Kwek Hong Sin, founder of Sinwattana Crowdfunding in Thailand, the World Bank estimates that the volume of crowdfunding will reach $93 billion by 2025, as shown in figure 1

The World Bank estimates that crowdfunding volumes will grow to $93 billion by 2025 as this has become the second preferred funding option.

Figure 1: Estimated crowdfunding volume by 2025 (by region)

Source: World Bank

Kickstarter offers a donation-based platform while Fundnel offers debt, equity and hybrid alternatives. Funding Societies, the largest crowdfunding platform in Southeast Asia, has provided more than $600 million in loans and invoicing financing to SMEs in the region.

Platform crowdfunding has been a very beneficial alternative for financing, said Kwek, with some observers calling it transformative. Crowdfunding ranges from providing funds for startups and offering a platform for seed and angel rounds to providing loans to established SMEs. Startups that used to bootstrap with investments from friends and family can now go to a crowdfunding platform, which also validates whether their idea is likely to succeed. If they can’t raise funds there, the market is essentially telling the startup that it doesn’t have a good enough idea.

Tokenisation

A growing opportunity for alternative funding is tokenisation, said Dušan Stojanovi?, founding partner of True Global Ventures 4 Plus. “Security tokenisation is a subject that will change our industry.Tokenised real estate, equity and bonds will come.” While asset-backed lending has been used for decades, tokens offer a new way for funding.

One of the biggest challenges in venture capital, he explained, is that investors often need to wait 10-12 years to get liquidity. Security tokenisation is a fundamental change that offers liquidity far earlier. In real estate, for example, a fund could create hundreds of millions or billions of tokens securitised by real estate and sell them to investors rather than fixed percentages of the asset.

Regulation

While alternative financing vehicles such as crowdfunding and tokenisation offer a potential way to shift capital from silos to SMEs, regulation is needed to protect investors, said Lavan Thasarathakumar, secretary to the European Parliament All-Party Innovation Group.

The goal in Europe, he said, is to have a common set of rules so that a company would be able to solicit investors across the EU. It should cover many types of platforms, including rewards, debit, equity, and donations. To improve access to finance for SMEs, said Lavan, “We wanted to keep the campaigns under $8.89 million (€8 million),” to keep this regulation as lightweight as possible and give an exemption from providing a prospectus.

The regulations cover both direct investment in a specific project and intermediary investment through a platform that is offering a matching service. Companies must still provide a key investment information sheet, Thasarathakumar added, so that investors have a better understanding of the project and can make a comparison between projects. The result, he expects, is that investors and project owners know their money is at risk and are still well-protected by fair and clear communications.

The challenge with regulation, said Christian Hofmann, assistant professor of law at the National University of Singapore is how to protect investors. “This is one issue keeping regulators occupied around the globe,” for two reasons. First, he said, securities regulation is not tailor-made for crowdfunding. Instead, it is based on a company having been around for a while. “This is not what crowdfund platforms engage in. Platforms are for earlier stages.” Second, the disclosure-based regime in securities regulation is inadequate, as these companies have too little information to fill a whole prospectus.

In crowdfunding, neither a primary nor a secondary market exists and professional investors stay away at the early stages. Many jurisdictions also have difficulty allowing peer-to-peer lending because regulators see it as a banking activity.

While crowdfunding and tokenisation alone won’t entirely fill the gap in funding for SMEs and start-ups, they offer a critical new source of funds that wasn’t there before. At the same time they work to protect investors, regulators can help solve the funding gap by looking at options to grow the new sources of funding in ways that offer more opportunities for the small firms that need it the most.