- There has been a rise in digital platforms for asset and deposit products, with banks ready to launch full-blown e-KYC process

- Prior to Thailand's national e-payment reform, local banks resisted threat to fee-based business model

- Changes in competitive dynamics among first- and second-tier banks, and financial technology will induce more innovation in Thailand's retail banking industry

The period 2013 to 2016 were considered the worst for the Thailand retail financial services industry in regards to income and loan growth. The country’s vital export sector, a key driver of the economy, contracted by a compound annual growth rate of 5% between 2012 and 2016. Key industries such as the automobile sector laid of employees, while the agricultural small and medium-sized enterprise (SME) sector, comprising more than two-thirds of the country’s SME base, suffered heavy losses.

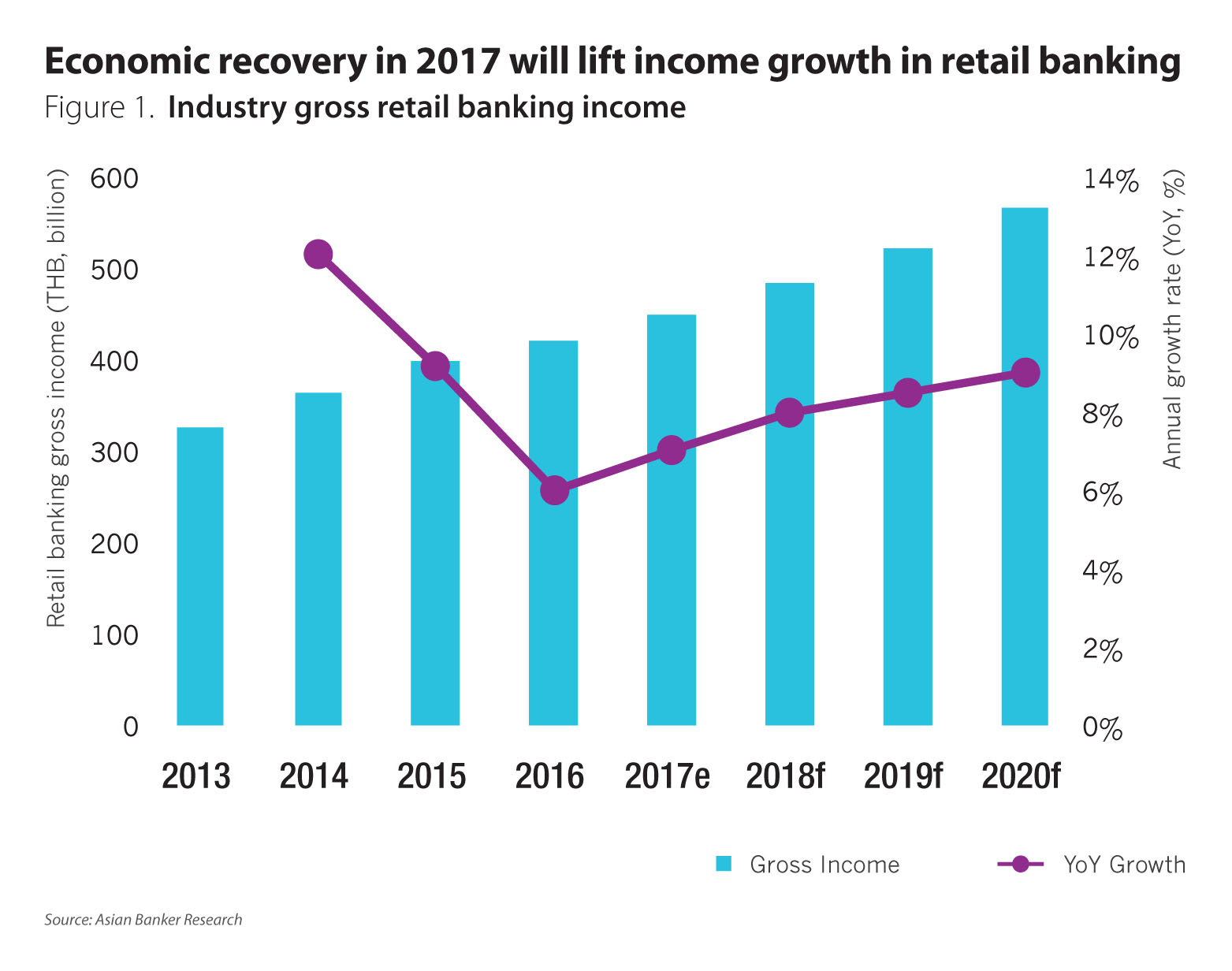

As a result, annual retail loan growth slowed from over 20% in 2012 to 5% in 2016. Growth from gross income in retail banking sunk from 15% in 2013 to 6% in 2016. At the same time, the industry reduced their exposure to car loans between 2012 and 2016, while higher yielding personal loans increased.

Banks in Thailand have developed a stoic response to those credit cycles, changing domestic politics, and global economic woes by managing well their jaws and credit cost. There is no reason to get worried as the economy is on a path to recovery and could grow up to 3.4% in 2017, according to the Bank of Thailand (BoT). The annual industry growth income in retail banking is expected to range between 6.5%-7.5% in 2017 (Figure 1).

It will take time until 2018 to see the economic recovery working through the financial services industry. Fresh non-performing loans (NPLs) growth in retail lending peaked already during the first quarter of 2017 and there are signs that the SME sector may stabilise in 2018. Non-performance loans incurred by SMEs continue to grow at a sustained rate in the first half of 2017. BoT already made several rounds of cuts for personal and credit card loan charges, due to increasing household debt, growing faster than the average household income in recent years. Credit cards and personal loan charges are capped to 20% and 28% per annum, respectively. By the start of September 2017, the ceiling for interest charged on credit-card loans was reduced from 20% to 18% per year. In addition, NPL from credit card’s personal loans rose from 4.5% in 2011 to above 7.6% during the third quarter of 2016, according to BoT’s 2016 Financial Stability Report.

Responses to deteriorating profitability

For several years since 2012, retail banking profitability in the country deteriorated. Smaller foreign banks struggled to stay afloat, forcing them to change their business models and accelerate investment into digitising front and back offices. In some cases that meant to exit the consumer banking market altogether. HSBC left in 2013 and Standard Chartered eventually exited in 2017, selling its consumer banking operations to TISCO financial group.

Still, other peers thrived and gained higher market share. CIMB Thai’s consumer banking business turned into its first ever more material profit in 2016 driven by automobile lending and personal loans. The bank cut down on cost and closed 30 underperforming branches, bringing its network to 91 branches, and it expects its annual retail banking loan growth at 11% this year. Meanwhile, UOB Thai outperformed the market in relative growth for its total credit card billings and assets under management growth, showing robust efforts in credit cost and expense management. Kiatnakin, on the other hand, has transformed from a car leasing company into a more balanced universal financial service provider after merging with Patara Securities in 2012.

Banks resisted threats to fee based business model

In early 2017, Thailand launched its national digital-payment system that levies much smaller transaction fees than the nation’s banks. Fee income from money transfer and payments will gradually decrease. The industry expects that fee income for banks may drop by about 3% to 5% in the short term, though lower cash transactions in the long term will generate cost savings. Clearly, banks did not like it, considering it a threat to their fee based business model.

Banks in Thailand are among the highest fee income earners in Asia. A portion to total retail banking income as charges are levied on almost every single transaction. On average, banks generate 41% of gross retail banking income from fees, with a large portion originating from transactional fee income. KASIKORNBANK is among the highest earners making more than 50% of retail banking income from fee income.

There were factions within the industry reluctant to promote any e-payment scheme that saw them loosing fee income. There were signs that the industry is now up for a change on how it considers to earn fee income. A growing number of banks have realised that charging fees for everything is not any more in best interest of the customer.

“In January 2017, TMB Bank launched a new mobile banking application for SMEs called ‘TMB Business TOUCH’ together with our TMB SME One Bank account, making us the first bank in the market to launch a dedicated SME mobile application to serve SME customers. The market charges fees between $211 to $453 (THB7,000 to THB15,000) per year, whereas we charge $15 (THB500) and do not require any minimum balance. In fact, we did away with most of the transactional fees and are the only bank that offers this,” said Rachakorn Chayapirad, head of domestic transaction banking, TMB Bank.

Levelling the playing field

Thailand’s e-payment landscape had not been changing as rapidly in the past few years as in other countries despite banks putting effort in marketing their mobile banking propositions. According to a MasterCard survey on e-wallet adoption across Asian markets between 2013 and 2015, Thailand had one of the lowest adoption rates, which is below 10%, trailing countries such as Vietnam, Indonesia, Malaysia and the Philippines.

BoT has been pushing the national e payment agenda since 2015, forcing banks to rethink their strategies. E-payments worth less than $151 (THB5,000) made through PromptPay will be free of charge as opposed to the $0.749 (THB25.00) levied by banks.

Prior to the reform, smaller banks in the country have struggled to gain more significant transaction volume and user base in the mobile banking and e-wallet space to whom they could sell value added services at a better margin. Only the biggest banks with large pool of retail banking clients and direct access to deposits could leverage mobile payments. There has been no shortage of payment initiatives in the financial technology (fintech) space but they too remained largely market irrelevant.

The only significant non-bank player in the e-wallet space is True Money, part of the Ascend Group, which is considered the largest e-wallet player in Thailand with six million registered customers as of end 2016. The company started as a back end payment app for True Corp, primarily offering mobile top up and bills payment and later expanded to other services.

The company has partnered with 7-Eleven, which has more than ten million walk-in customers daily, in offering retail payments. “Our transactions are free of charge and the number one usage in our wallet are peer-to-peer payments. We started collaborating with 7-Eleven in the fourth quarter of 2016 to provide retail payments,” said Punnamas Vichitkulwongsa, chief executive officer, TrueMoney.

Vichitkulwongsa also believes PromptPay will be valuable to local customers. TrueMoney has also been involved in the development of various technologies that it believes will allow it to better serve its clients.

“We consider PromptPay a major advancement for financial transaction services since our customers will have better access to an incoming and outgoing payment channel with the same security and speed as that offered by financial institutions. Going forward, we are developing the standard QR Code in order to serve customers across all platforms,” Vichitkulwongsa stated.

Part of the obstacles for larger adoption was that merchants in Thailand don’t like the increased payments transparency, especially that charges levied by the banks and payments providers such as Visa and MasterCard were not compatible for small sized payments.

Nevertheless, the ongoing reform in the national e-payments system will likely change the game. BoT was ahead of most Southeast Asian regulators, realising in early 2015 that if payment platforms are left to market forces, market participants will establish their own proprietary closed-loop systems, benefitting only a handful of large banks.

Two years later and after some delay, PromptPay was introduced to banks in the first quarter of 2017 and will be expanded to non-bank wallet providers during the second stage. PromptPay leverages the country’s national citizen identification cards or mobile numbers, while the source of funds is the PromptPay debit or debit cards on mobile phones. This will help all players compete on services and customer experience while leveraging on the same cost efficient infrastructure. Initially, BoT was planning to support the roll out of more than 500,000 electronic data capture terminals but soon realised that the cost component and acceptance for merchants was not a viable option. Instead, it began emphasising a standardised QR code framework, which links merchants’ accounts, banks and consumers in a single open ended ecosystem. It is expected to be launched in the fourth quarter of 2017, and will also allow the industry to negotiate with Visa and MasterCard a more competitive fee structure.

With PromptPay and QR code, consumer adoption may accelerate. As of March 2017, 27 million citizen IDs have been used to sign up for the PromptPay service, and more than six million mobile phones have been tied to bank accounts for the service, according to BoT. Transactions via PromptPay's P2P averaged 100,000 daily, up from 20,000 to 30,000 in the previous months.

According to most banks, the pace of adoption is increasing, therefore merchants, which are also customer-driven, will need more solutions. Thailand counted 21 million registered mobile banking subscribers by end of 2016, based on a working population of 39 million, according to BoT. Registered mobile banking subscribers in Thailand surpassed internet banking subscribers in 2015.

Thailand’s payments structure visibly moved towards digital payments prior to PromptPay (Figure 2). In particular, digital payments grouped under the In House Fund Transfer section, which reflect e-commerce payments, became a much larger portion. Online Retail Fund Transfer, which is the interbank fund transfer section, increased its portion from 1%in 2010 to 5% in 2016, according to BoT. Driven by PromptPay, this portion is expected to increase substantially by end of 2017.

.jpg)

Currently, players develop or pilot their QR codes in line with the BoT framework on their own or in consortiums. At least two banks, Siam Commercial Bank and Bank of Ayudhya experiment in the BoT sandbox.

Thailand is the number one tourist destination for Chinese tourist in Asia, hence Alipay and WeChatPay are already in the market with QR code payments, largely serving Chinese tourist. Still, there are signs that both are testing the ground to expand further in Thailand.

KASIKORNBANK, which has already developed a mobile app supporting QR code payment for the Thai market and aiming to support 200,000 shops and retailers by end of 2017, announced a partnership with Alipay beginning of September.

Has PromptPay the necessary elements to become a success story in Thailand? Fintech payment providers from Vietnam to India race to replicate the success story of Alipay and WeChat Pay in China, but what is often overlooked is that the QR code micropayments success in China grew out of a their popular messaging platforms in the first place. Those prerequisites are not necessarily present in other countries where Facebook Messenger and WhatsApp are the platform of choice for consumers.

It will be interesting to see whether a stand-alone standardised QR code payment system in Thailand can become a catalyst for faster e-wallet adoption, which would bode well for other countries looking into the same direction.

In Kenya, a lack of regulations in the payments space and a single national citizen ID allowed Safaricom to acquire 40% of Kenya’s adult population on the M-PESA platform within two years after launch in 2007. India showed that a unifying national payments platform and the standardisation of citizen ID were critical components to speed up adoption in mobile payments. On the contrary, the fragmentation of payments platform has stifled mass adoption such as in the case of Singapore.

Thailand resembles to a certain extend those critical success drivers. The key to faster adoption is mix of strong national infrastructure, a single ID system, a unifying national payments platform and a viable commercial case for merchants and banks in the micro payments space. It may be too early to tell whether PromptPay is able to emulate the success of active usage elsewhere, but it has in place a few elements needed to become the platform of choice in Thailand.

Digitisation of products and services

While banks are working on full-fledged digital platforms for their asset and deposit products for new to bank customers, they can be applied for on mobile and internet for pre-approval or pre- screening rather than a full straight through end to end decision engine. This is proving costly, manual labour and paperwork intensive at the backend. The laws in Thailand do currently not accept electronic signature in courts and the National Credit Bureau of Thailand (NCB) does not accept e signatures either. Technically, the banks are ready for e-KYC and they are experimenting already at BoT’s sandbox to allow customers to fully allow account opening and purchase online which requires an interface with the BoT, NCB, and other banks databases and potentially is based on blockchain technology. At the front end, banks are working with fintech players to test a mobile ID submission. Some in the industry are hopeful that by beginning of 2018 electronic identification and verification will be given a green light from the regulator and ministry of finance to be launched commercially.

In the mortgage and housing loan business, a full-scale digital end-to-end application process is still some years off the agenda, although banks recognise that they need to reinvent the on boarding process and the customer journey. The industry is plagued by a high rate of reworking of cases. By improving service level agreements, a better focus on relationship management, improved management information systems and better market support for developers and customers alike has advanced some banks' market share. In Thailand, 80% of market volume comes from developers and the top developers own 50% of the market volume.

Banks need to set criteria for customers and developers on sales, promotions and products to succeed. Frontline staff mobility, instant pre-approval and decision-making at the developer’s site, which will become increasingly critical, are essential as well.

Device mobility to be present at the customer’s place is already in the making in the SME business, in particular for a few smaller banks. The industry estimates there are 2.7 million SMEs with a sales turnover between 10-100 million. Only a few hundred thousand are properly incorporated and most of them are already banked with the big four banks owning 70%-80% market share. A limited branch network coverage hasn’t allowed mid-tier and smaller banks to carve out their slice in this segment.

Yet, with growing digital adoption among businesses and entrepreneurs, e-KYC at the doorsteps and PromptPay as payments infrastructure, the competitive landscape may also change SME banking in the coming years. Most SMEs have sole proprietary status, a huge market of micro mom and pop shops that has for long been untapped. With digital this may become the next battle ground for banks.

In Thailand, retailers present 30%-40% of SMEs and most are servicing companies. That’s why some banks place their bet on mobile application for servicing this segment. These banks believe that a robust and easy to use digital platform will make the branch less relevant.

Rise in digital product and service innovation

The payments landscape might change dramatically in the next years. Banks have resisted any threat to its fee-based business model, but BoT’s strong stance on pushing for a national e payment system is finally opening up the field. While PromptPay will level the playing field for small players and payments fintech companies, vis-à-vis the big four, the overall, industry adoption rates for e-wallets may not replicate the speed of scale witnessed in other markets. More competition in payment will induce the necessity to focus on the customer and we may see more service and product innovation to follow, given the absence of it in the past. Mobile applications for a couple of business lines are in the pipeline and should e-KYC be given the green light by the regulator in 2018 it will further accelerate the digitisation of products and services.