- Digital services a key driver of customer engagement and loyalty

- Rankings reflect the true voice of consumers

- Banks were also commended for helping consumers weather the COVID-19 crisis

Banks have always emphasised customer-centricity as part of their corporate strategy and product development. Over the years, banks have been vocal about shifting their focus from products to customers, especially in the fast-paced digital world. As technology evolves, the digital journey of players has also changed over time, adjusting to the expectations and needs of clients.

The emergence of fintech and the prominence of bigtech in the lives of consumers have also placed immense pressure on banks to accelerate their digital transformation journey in order to keep up with the standards being set by these platforms.

However, adapting to the digital era seems to be a major challenge, especially for traditional institutions who are lacking the agility due to legacy constraints. Although players have invested greatly on new technology to push forward their respective innovation strategies, the impact on customers will be the deciding factor of the success of these initiatives.

Similar to other industries globally, the retail financial services sector is transitioning towards a more platform-driven and data-dependent business model, leaving behind standalone distribution and sales networks. In this new digital arena, the key differentiator between winners and losers is the ability to build a loyal community of customers through strong engagement.

Thus, this year, we are heavily investing in our BankQuality™ platform, which aims to help banks identify gaps in their banking services and address customer needs by measuring customer satisfaction scores of banks across the Asia Pacific region. This will help banks provide better customer experience, improve product offerings and recalibrate business strategies in order to stay relevant in the rapidly evolving retail financial services landscape.

The inaugural BankQuality™ Consumer Survey and Rankings covered 11,000 bank customers in 11 markets across the Asia Pacific region, including China, Hong Kong, India, Indonesia, Malaysia, Singapore, South Korea, Taiwan, Thailand, the Philippines and Vietnam. The survey gathered feedback from consumers on their engagement, experience and satisfaction with their main retail banks.

Most importantly, as the world is still grappling with the impact of the COVID-19 pandemic, the BankQuality™ Consumer Survey and Rankings also gauged customer satisfaction on how banks have helped them during the crisis. This will help banks measure the impact and effectiveness of their COVID-19 responses. As customer experience and engagement transform, in line with today’s “new normal”, this captures the shift in consumers’ adoption of digital and contactless transactions.

Digital services a key driver of customer engagement and loyalty

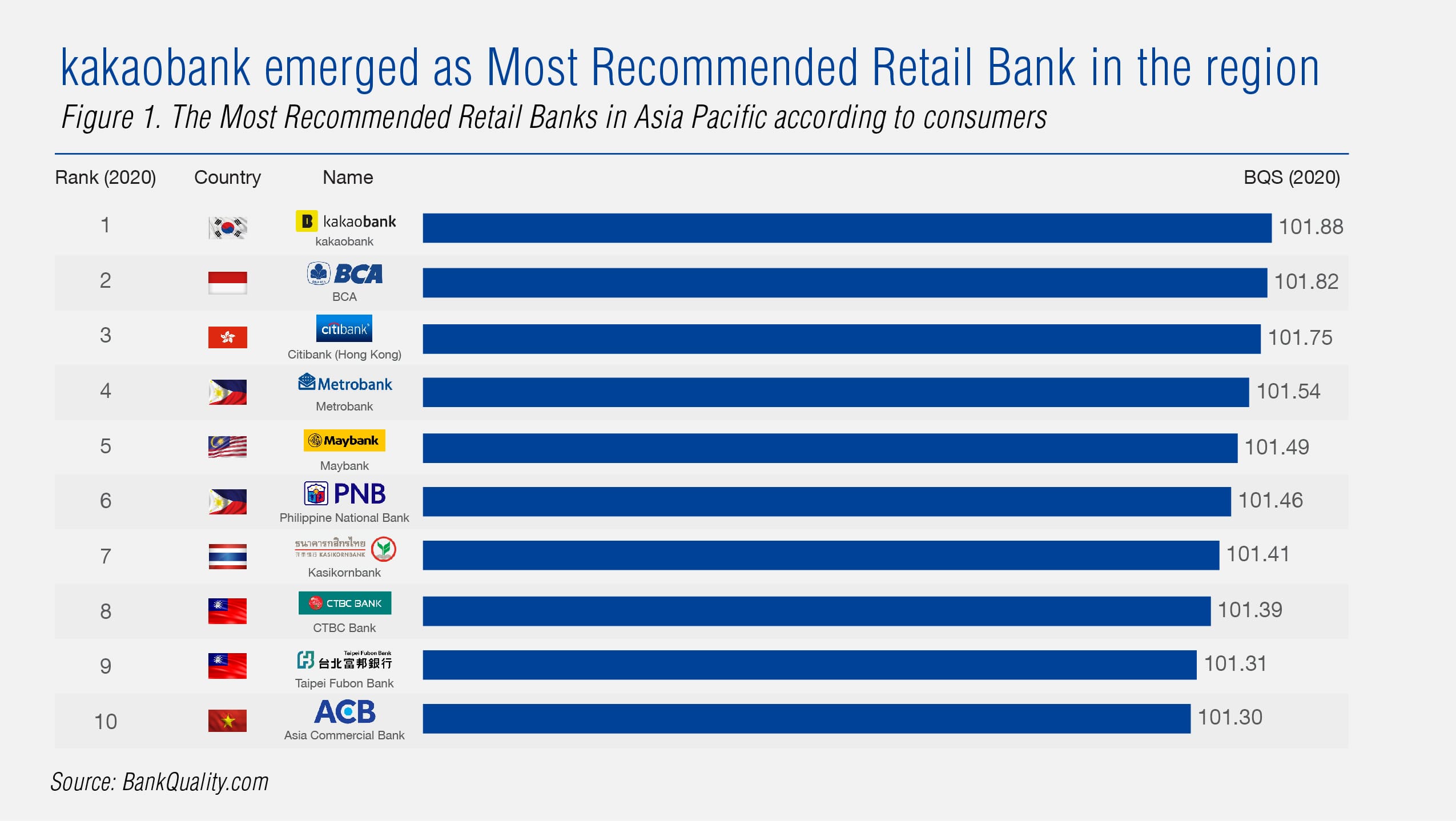

South Korea’s largest digital-only bank kakaobank was voted by consumers as the Most Recommended Retail Bank in Asia Pacific. Out of over 300 banks, kakaobank is the only digital bank that made the final cut and emerged top with an overall BQS of 101.88, surpassing traditional counterparts in the region. Rounding up the top five best retail banks in the region are: Bank Central Asia (Indonesia), Citibank (Hong Kong), Metrobank (Philippines) and Maybank (Malaysia).

To view the full ranking, visit https://www.bankquality.com/rankings/best-retail-banks-in-asia-pacific

While kakaobank has only been in operation for less than three years, it has already overtaken established competitors with the size of its user base and transaction volume. In a country of 52 million people, the bank rapidly grew its customer base to 12 million users as of March 2020, of which 10 million are active.

The bank has also accumulated $17 billion (KRW 21.3 trillion) in deposits and disbursed $14 billion (KRW 16.7 trillion) in loans. It first achieved profitability in 2019. A year later, it became the highest capitalised digital bank in Asia having a total paid-in capital of $1.6 billion, with Kakao Corporation as the largest shareholder with a 34% stake. The bank is also pursuing an initial public offering (IPO) by the end of 2020.

Rankings reflect the true voice of consumers

kakaobank received its licence in 2015. Its digital-only business was built from scratch within a year and a half, with a completely new IT system, infrastructure and human resources. By July 2017, the bank began operations and started to offer deposits and current accounts as well as loans and remittances through its mobile app. Convenience, service quality and speed proved to be its key differentiators.

At the time of kakaobank’s launch, South Korea had not seen new players in its financial landscape for over 25 years. No institution fully focused on mobile banking either. The timing proved right, as the platform registered 240,000 customers within ten days – more than what the entire commercial banking industry acquires in a year. Its first day of operations saw more than 300,000 loan account applications that overwhelmed its system, but the bank was able to immediately scale up since then.

kakaobank was recognised by customers for its mobile banking and digital services. Among an array of consumer financial services offerings, the digital bank was highly rated for its savings and current accounts, overseas remittance and digital wallet.

With its mobile banking app designed for easy path finding and usability, the bank is able to focus on providing convenience and speed for customers. It takes only ten seconds to transfer money to a friend and mere minutes to open an account, wire money internationally or receive a microloan.

Technology serves as the backbone of the bank, having built internal systems that provide agility for future upgrades. As kakaobank does not maintain a physical footprint, the bank invests heavily in its digital platform, system capabilities and product development. Last year, the bank enabled its customers to open stock trading accounts through its platform. It introduced credit card programmes in partnership with KB Kookmin Card, Shinhan Card, Samsung Card and Citi Card in April 2020. The bank also plans to set up a fintech lab this year to develop artificial intelligence-based technologies for various non-face-to-face financial transactions.

Banks were also commended for helping consumers weather the COVID-19 crisis

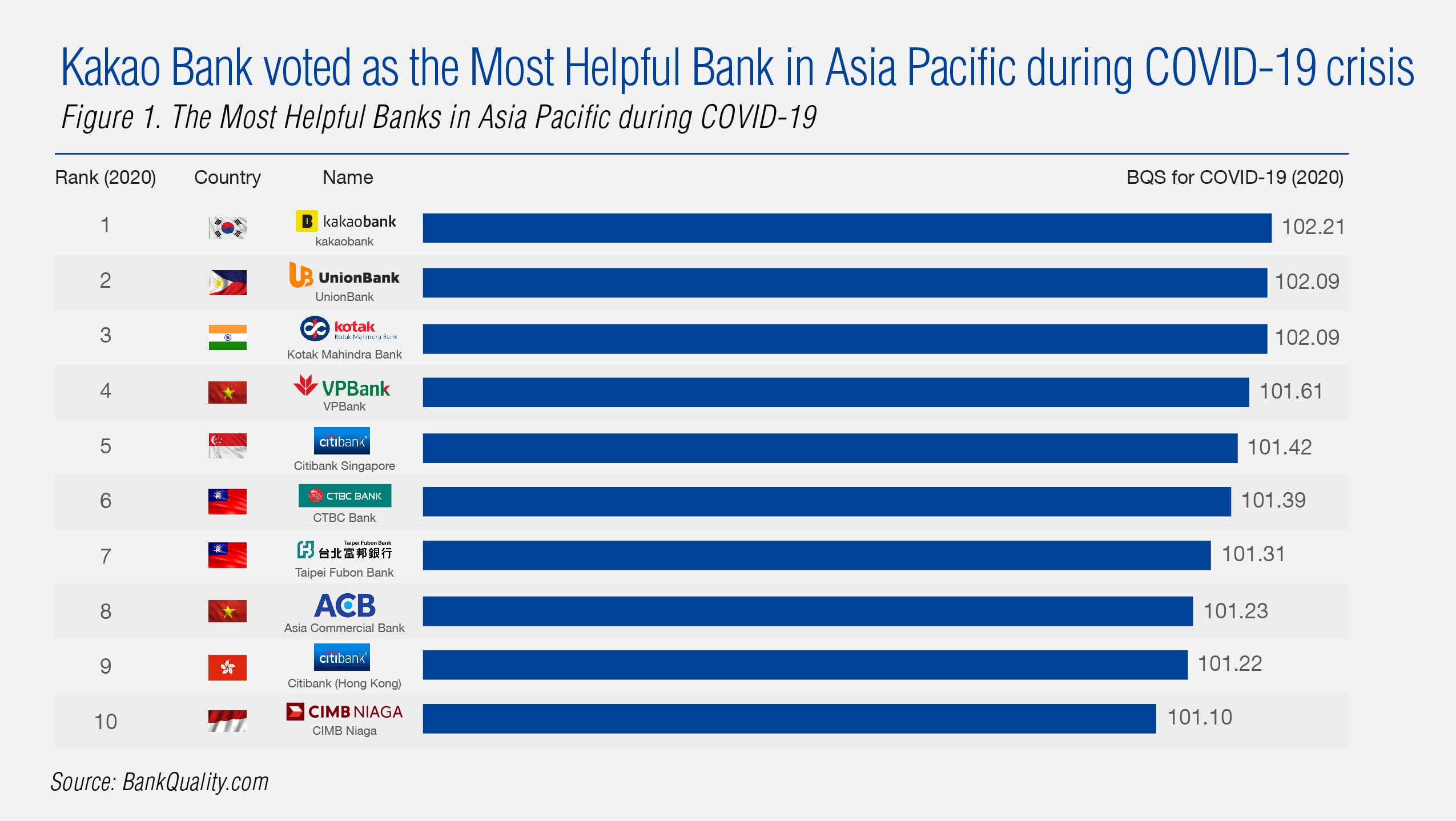

kakaobank was highly rated for supporting customers during the COVID-19 pandemic. It garnered a BQS of 102.21 for its COVID-19 responses, the highest in Asia Pacific.

To view the full ranking, visit https://www.bankquality.com/global-rankings/most-helpful-banks-in-asia-pacific-during-covid-19

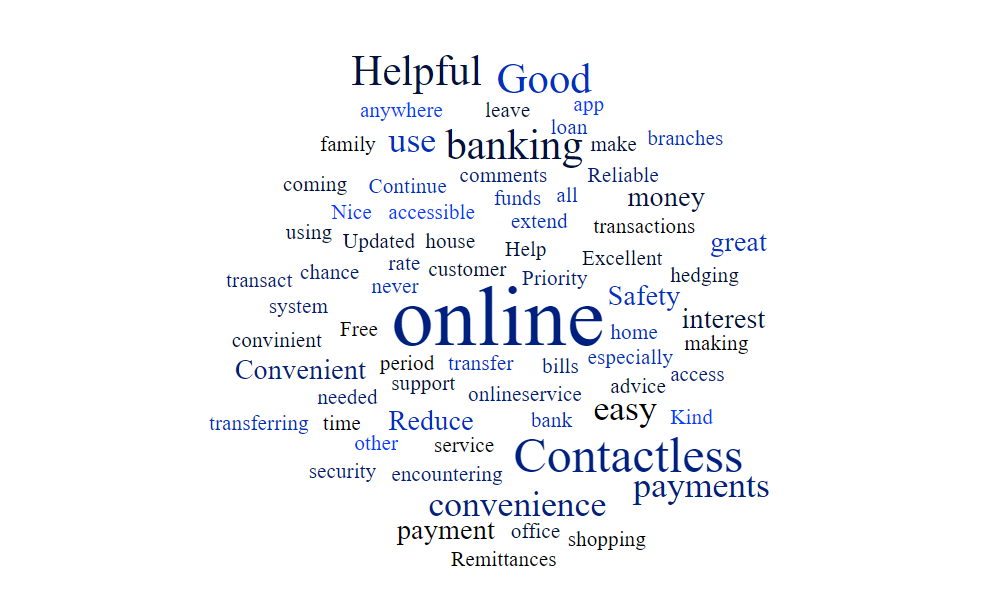

Customers praised, in particular, the contactless nature of the bank’s services and products, as it proved convenient and efficient for those who could not leave their homes amid the crisis. “Internet banking is comfortable”, “non-face-to-face service is convenient”, “no need to visit the bank” and “was helpful” were the common comments the bank received.

The bank’s digital business model places it in an advantageous position to assist customers during this time. kakaobank has rolled out initiatives to ease the financial burden of its customers, such as cutting its Western Union overseas international transfer fees from between $6 and $12 to a fixed amount of $5.

Rounding up the top five Most Helpful Banks in Asia Pacific during COVID-19 are UnionBank (Philippines), Kotak Mahindra Bank (India), VPBank (Vietnam) and Citibank (Singapore)

Among the 80 banks in this year’s ranking, UnionBank (Philippines), Kotak Mahindra Bank (India), VPBank (Vietnam) and Citibank (Singapore) all garnered the highest scores in their respective countries and make up the top five banks in the region. These banks leveraged their digital capabilities in easing the financial burden of consumers brought about by COVID-19.

UnionBank, with a BQS of 102.09, made banking accessible through its digital platforms and Bank on Wheels initiative. Kotak Mahindra Bank, also with a 102.09 BQS, made remote banking a top priority for customers during this time as it strengthened offerings, such as its digital onboarding platform 811. Meanwhile, VPBank promoted cashless transactions through preferential programmes, including free inter-bank real-time transfer and discounts of 10% to 25% transaction volumes on various e-commerce platforms. In response to COVID-19, Citibank in Singapore (BQS of 101.42) offered eligible clients with financial assistance, including interest and fees waivers, tenure extensions, alternative settlement arrangements and loan payment reduction programmes among others.

The COVID-19 crisis amplified the need to go online with banks’ digital promises under scrutiny

Figure 3. Reasons for rating the Top 10 banks as “Very Helpful” during COVID-19

Source: BankQuality.com

Although the bank and customer relationship has been evolving over the years, the uncertainty brought about by the pandemic has tested the ability and capacity of banks to respond immediately to the digital demands of customers. Lockdowns and social distancing measures put in place in each country are increasing the need for contactless transactions, thus speeding up the adoption of digital platforms.

Now, more than ever, banks have the opportunity to build trust and loyalty with their customers by showing reliability, efficiency and transparency in every touch point and interaction. It will be interesting to see who can successfully translate their digital engagement strategies into stronger customer relationship and business longevity.

The BankQuality Consumer Survey and Rankings 2020 Survey Methodology

- The online survey was conducted from 1 April 2020 to 30 April 2020

- The survey covered a total sample size of 11,000, comprising 1,000 respondents per market in China, Hong Kong, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam

- The respondents are between the ages of 18 and 65 years and hold at least one bank product

The BankQuality™ Score (BQS) is derived from the normalised net promoter score (NPS) of “main bank” institutions to a uniform scale of 0 to 1. A standardised z-score is then calculated from the normalised score, with mean set to 100, so that comparison can be made across markets. The final ranking excludes banks that achieved less than 30 “main bank” responses.