- Chinese tech giants have been forced to definancialise and now see themselves as technology enablers across a range of industries including banking and finance

- American big tech companies have been exploring a wide range of approaches to varying degrees of success, though partnerships with established players are so far providing the easiest entry points

- Japanese competitors are looking to cash in on retail and services brand names through payments solutions both at home and across Asian markets

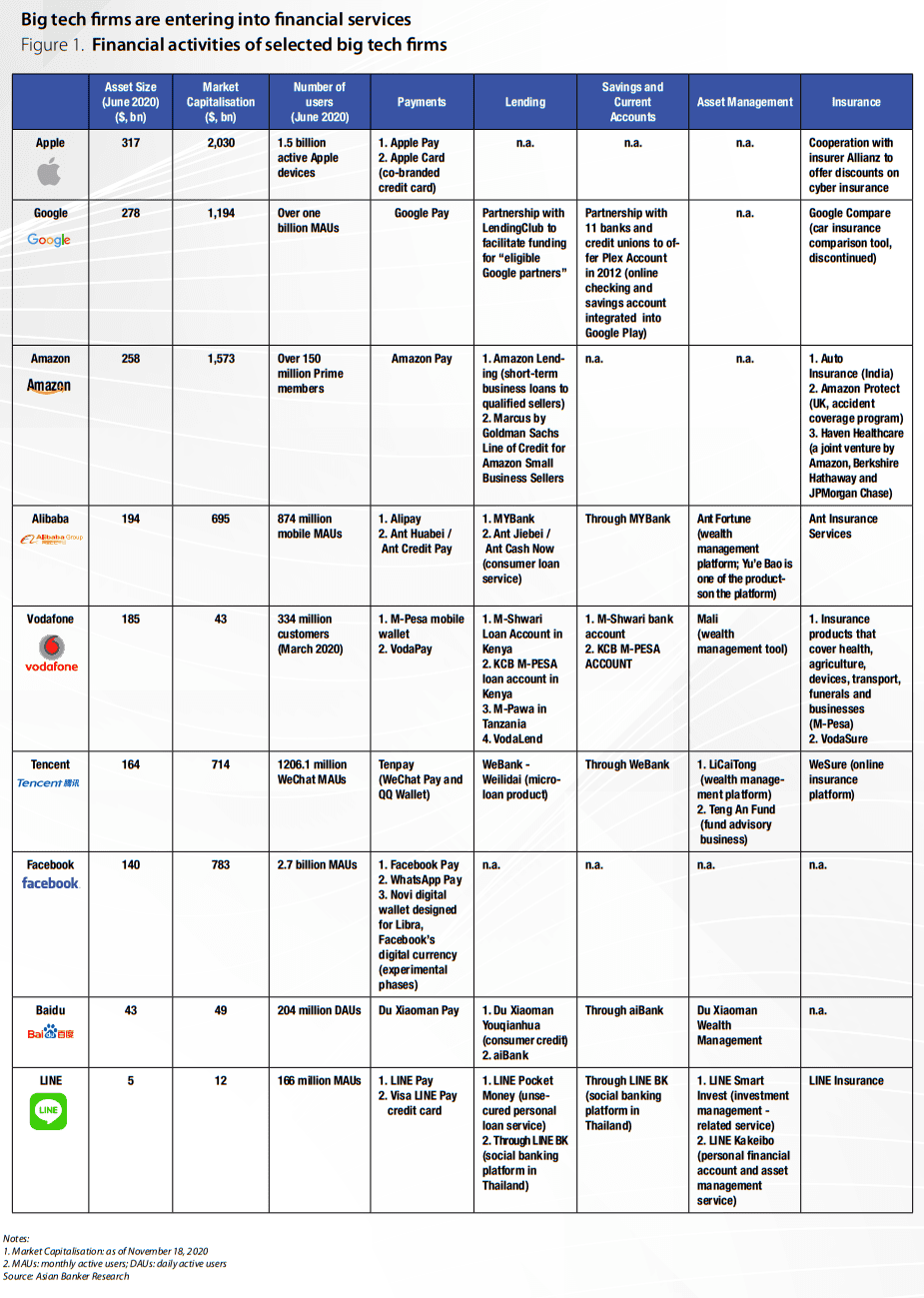

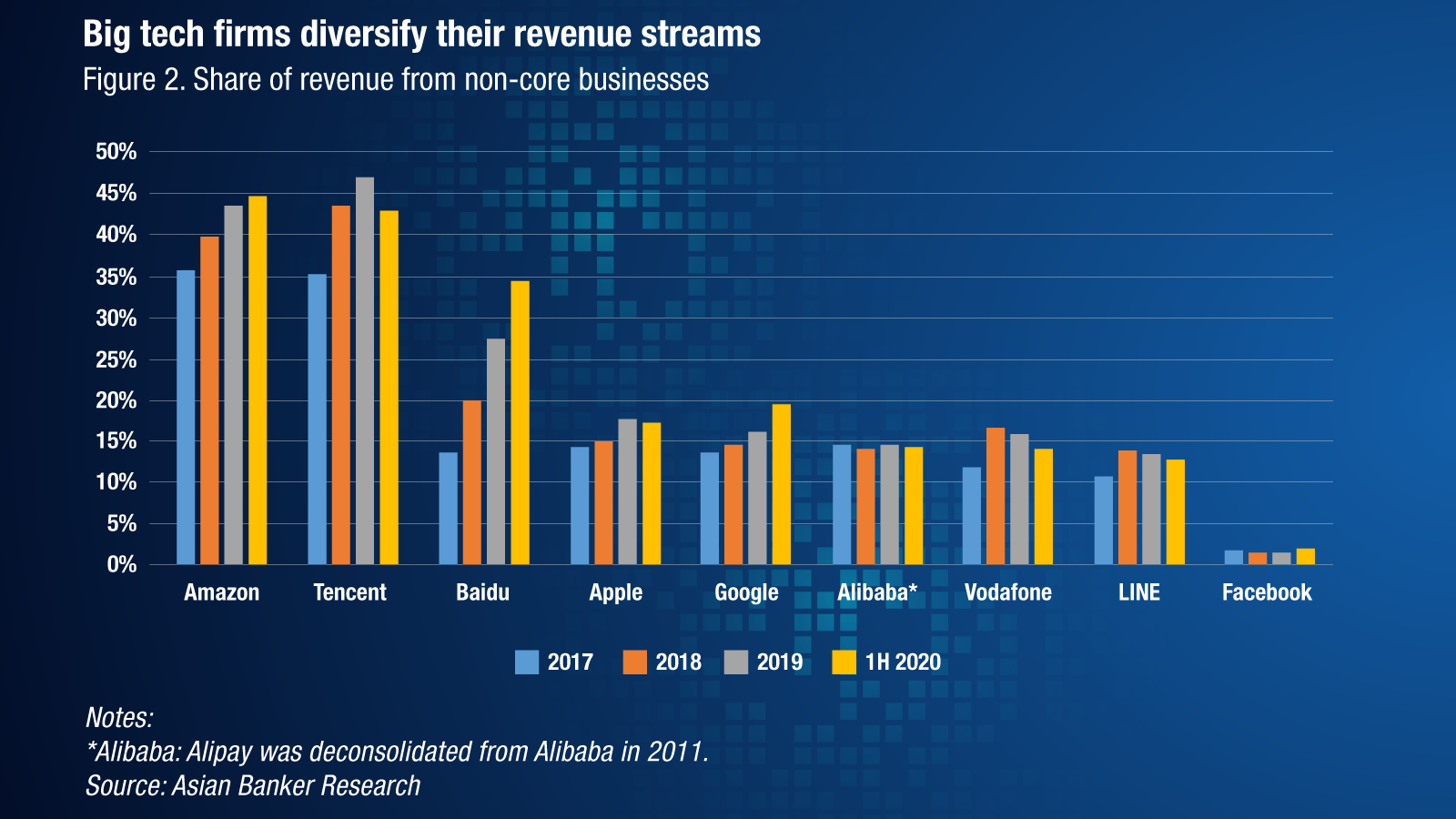

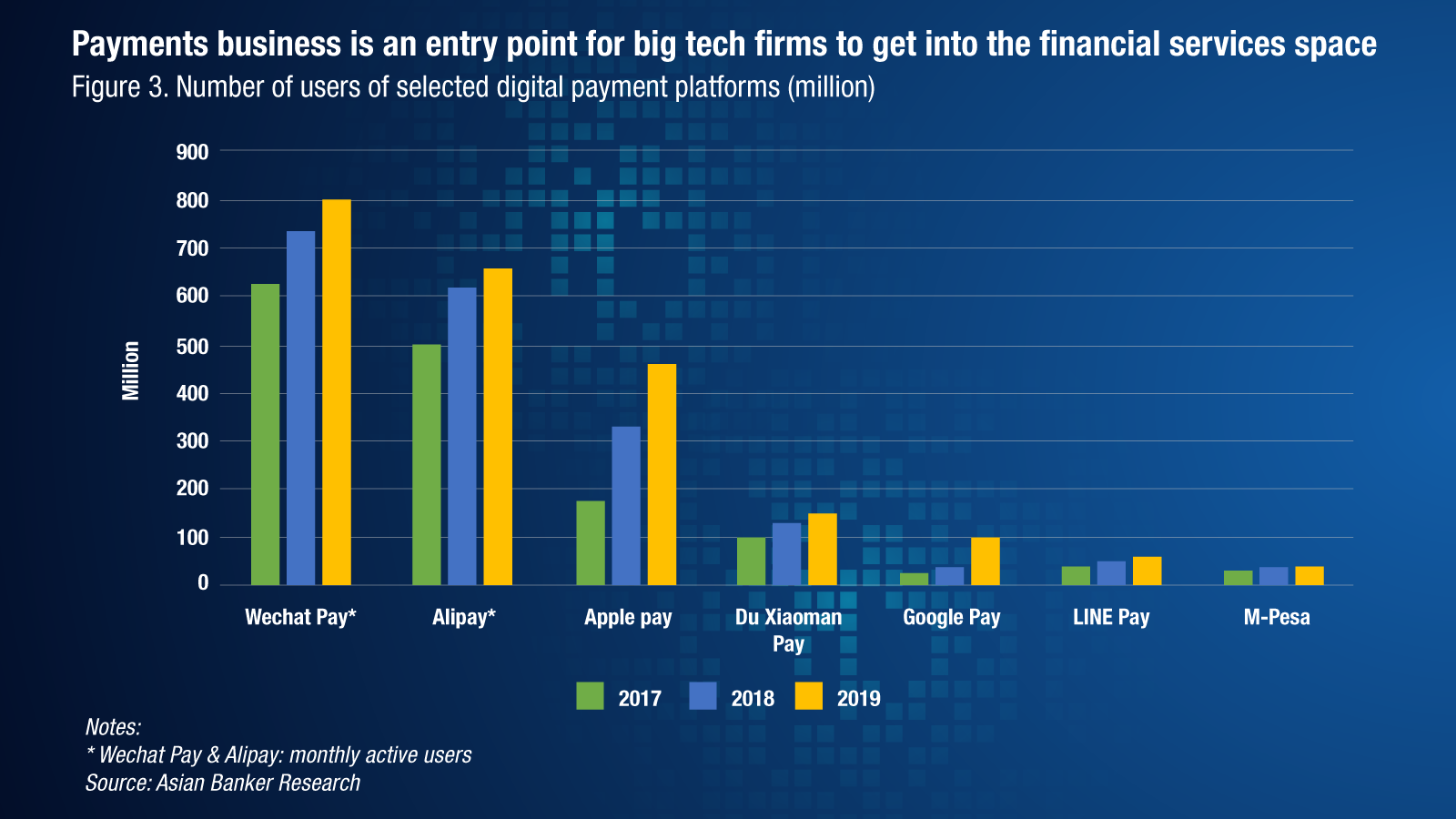

Before the COVID-19 pandemic hit, many thought 2020 is the year that big tech would truly crash the global finance scene. While some initiatives from tech giants have been put on hold, there is nevertheless a clear trend underway and traditional financiers are working hard to keep pace. With tech firms already having unrivalled amounts of customer data in their hands, banks have to reckon with their status as no longer the sole financial market force.

Yet as regulators are increasingly scrutinising big tech, we are beginning to see different regional approaches emerge. In Europe as well as Singapore and Hong Kong, digital banking licences have been introduced to build a well-regulated bridge between digital and traditional finance. China forced its tech giants to decouple their businesses and become technology enablers to established banks. Japanese firms are building businesses around retail and services as well as seizing opportunities in other Asian markets. In the United States banks have largely moved to build their own infrastructures, that is tech companies are looking to finance as a place to seek partnerships or disrupt, fearing being constrained by a more heavily regulated environment.

Chinese giants tread heavily but leave a light footprint

China’s biggest technology firms are nothing if not fast. The giants JD.com, Baidu, Tencent, and ANT Financial have all sought to capitalise on their incredible consumer data troves. Newer players in the payment space such as ride-hailing Didi Chuxing, food delivery giant Meituan Dianping, smartphone maker Xiaomi Corp., and even social media app TikTok are also looking to join in.

The opportunity is clear - bring a largely analogue banking population into the digital world and with it consumer bases that any other industry could only dream of. And the banks have been willing to pay for those dreams. Almost all of the medium-sized consumer and commercial Chinese banks have signed agreements with the tech giants in recent years.

But this came at a cost. Last year, Chinese regulators pushed for the big tech companies to definancialise operations and set up new entities to focus on providing tech services to traditional financial institutions, rather than become financial institutions themselves.

A slew of rebrandings followed with JD Finance becoming JDD, Baidu’s financial arm spawning Du Xiaoman Financial, and in June this year the biggest of them all, Alipay’s Ant Financial, renamed as Ant Technology.

To outsiders, this could be seen as a setback. For the Chinese firms, they feel that they now have a state-backed mission to further the technological adoption needed to lead the country through the 21st century economy.

JDD says that it was the first internet company to position itself as a fintech company. It is eager to point out that it considers that industry is not confined to finance, though it services some 700 finance firms. Vice president of JD Digits, Xie Jinsheng, said that the business is now an “emerging technology company that leverages AI to drive industry digitisation”. “For financial institutions, an important issue of digitisation is to reshape business processes by leveraging data. This improves efficiency and scales in development,” he said.

Xie Jinsheng,

vice president,

JD Digits

Simon Hu,

CEO,

ANT Technology

Xie added that JDD is applying the full force of technology such as AI, big data, cloud computing, Internet of Things, and blockchain to promote and optimise the reach of financial institutions whether through architecture, risk management, business processes or customer management. “Digitisation not only promotes industry convergence but also provides a basis for financial institutions to broaden service boundaries and cover a wider range of clients. The financial institutions of the future must build an open, collaborative, and mutually beneficial financial service system.”

The firm is banking much of its financial enabling future on JT, a technology platform that provides full value chain digital solutions for asset management. The product works in capital markets to help some 600 financial institutions improve asset operations efficiency.

JDD points to the maturity of its financial integration particularly in solving supply chain finance for SMEs, China’s first internet credit payment product, and more recently, a cloud solutions product. Its more recent offerings, however, may point to the firm’s true growth angle and a key value proposition to challenge Tencent and ANT Technology.

ANT Technology is perhaps the clearest indicator of the Chinese market and that the definancialisation drive is seeing the nation’s key tech firms apply its technology to wider society. “We want to help digitise the services industry,” said ANT Technology CEO Simon Hu. “We want to share the technology and resources we’ve developed as an online financial platform with more companies in finance, local services, public services and other countries. We’ve been pursuing the strategy to evolve ANT into a tech company with an open-platform strategy for many years.”

ANT has the ambitious aim to increase its revenue from local merchants and finance from around half of its current base to 80% in the next five years. Hu wants its 600 million monthly consumer users to look beyond Alipay as a payments service and see it as an everyday services app for things such as travel bookings, financial management and shopping. For businesses, they can offer advanced AI and blockchain solutions. To that end, ANT Technology has led the world in blockchain-related patent applications in the last three years beating the second highest applicant fourfold.

It is unclear to date what the uncoupling of tech giants from financial firms means for ANT Financial’s previous lofty overseas ambitions. President Donald Trump’s previous blocking of its bid to acquire US firm MoneyGram led ANT to abandon its plans. They are likely not the only ones awaiting the swearing in of President-elect Bideon on 20 January 2021 before making further moves.

However, international regulatory opposition wasn't its only concern. ANT faced mounting scrutiny on the home front over its role in the financial sector. Its long anticipated $35 billion record breaking dual listing on the Shanghai and Hong Kong stock exchanges in early November was stunningly scuppered at the last minute amid news of an apparent rift between co-founder Jack Ma and financial regulators.

Alan Ko, head of fintech innovation at Tencent backed WeBank, said the firm will continue to target the long tail market of the unbanked and underbanked as “a connector connecting traffic and capital” through products such as WeChat Pay’s flagship consumer loan WeiLiDai that connects the technology and user base with over 70 banks at the back end. Tencent is the biggest shareholder of the digital-only bank with a 30% stake. Ko said that the scalability and stability of Tencent’s technology is their key asset and also the reason why the country’s banks are partnering with the tech giants rather than developing their own systems.

Alan Ko,

Head of fintech innovation,

WeBank

Sandhya Devanathan,

Managing director Asia Pacific,

“Look at the sheer volume. Last year our peak volume was more than 300 million transactions per day,” Ko explained. “In China, while online payment is getting more popular, the ticket sizes become smaller and people transact more frequently. People might easily have 10-to-20 transactions a day, or even more.” “As an online service, the traffic patterns are unpredictable. If you roll out a successful campaign or have killer promotions, your traffic may just sky-rocket,” he added.

While it’s clear that tech giants will continue to test new products and sign up new clients, the most interesting aspect to watch will be how the firms move to compete with each other now that the structural lanes have been made clear.

Launchpad India

We may see this taking place most clearly in other major Asian markets. ANT is soon to take a majority stake in India’s largest digital payment processor Paytm and it’s likely to be the first of many significant investments in emerging markets to come out of China.

Firms in the US and Europe are also putting significant resources into the subcontinent as a test-bed for their financial services initiatives. India’s less regulated and underserved financial services market is alluring to many of the tech giants, with the Indian digital payments market projected to be worth $135 billion by 2023.

Since entering the Indian market in 2016 with Amazon Pay, the world’s most valuable public company has expanded and diversified its offerings in the country, including auto insurance and gold investment products. The play for Amazon is loyalty, driving to subscriptions to its Prime programme. There’s also a significant unbanked population to tap into in the world’s second largest internet market, with an estimated 190 million Indians still not possessing a bank account.

They will face stiff competition in this space from Facebook’s WhatsApp Pay, which launched in early November 2020, is looking to capitalise on the messaging service’s 400 million registered users in the country, and Google, which is investing $10 billion over the next five to seven years.

Meanwhile, in October this year, UPI, the four-year-old payments infrastructure built by India’s largest banks, surpassed two billion transactions. India is purposefully taking a different path to China, with UPI’s open architecture allowing interoperability between systems, such as Walmart’s PhonePe and Paytm, opening its market to domestic and foreign competitors of all sizes. PhonePe remains the transaction leader in this space, edging out GooglePay with 835 million transactions in October 2020.

With hundreds of millions of digital wallets still up for grabs, one thing is for certain — competition will remain fierce in this lucrative market for many years to come.

Other Asian nations are dining in a digital buffet

Asian markets are seeing a variety of players come to the fore from China, Japan and the West often in partnership with established local players.

Hong Kong and Singapore, while already early adopters of international digital payments platforms such as WeChatPay, have seen their local businesses adopt a more European route channelling their strategy through banks and tech operators coming together to apply for digital banking licences.

Meanwhile in Japan, tech king Rakuten has been joined by messaging app LINE to leverage the obvious finance potential of their businesses both locally and across the region. Rakuten had led the way in breaking through underdeveloped markets with easy-to-implement payment terminals and infrastructure. That has allowed small merchants to start accepting multiple card brands and mobile wallets.

Interestingly, AEON Financial Services, a subsidiary of the largest retail conglomerate in Japan with businesses spread across 10 Asian markets, is moving in the other direction leveraging its existing retail and finance businesses in a rumoured partnership as a digital retailer with Softbank and Yahoo Japan that would rival Amazon. Mariko Sasaki, head of corporate planning at AEON Financial Services in Japan, said that AEON Financial’s tech strategy is consumer-led. “We are promoting digitisation of financial services to meet the growing needs of customers such as making cashless or contactless payment and nonface-to-face customer services, and are actively engaged in partnerships with external partners with new technologies,” he said.

In this area, Rakuten and LINE have shown themselves to be particularly nimble with the latter recently forming a partnership with WeChat to offer local payment services as well as Visa to integrate contactless payments and a prepaid digital card into its app. The app has over 200 million global users primarily in its core markets Japan, Taiwan, and Thailand.

LINE founder and co-CEO Shin Jungho has long been bullish about the firm’s move into finance claiming in 2019 that it is “a proven monetised model, the only problem is how fast we can secure a meaningful size of users.”

It already appears that they are on target, with a customer base of some 78 million users in Japan. LINE Thailand reached its first quarter growth targets in spite of the global economic slowdown affecting advertising revenue particularly from large and medium-sized businesses.

Disruption has not proved easy for American tech giants

The key difference in why Chinese tech companies have sought to enable, while American tech companies have sought to disrupt, is the American banks’ desire to develop technology from within. But while America’s new breed of tech giants have been the most bullish in their plans, it is notable that many of the grandest schemes are yet to launch.

In a white paper early this year, Facebook’s proposed Libra currency appeared to concede its ambitions under the weight of global regulators, and said that it would instead first create a series of single-currency stablecoins. Libra director of policy Julien Le Goc insisted that it was not backing down. “We’ve not abandoned the multi-currency stablecoin, adapting its DNA from the IMF’s special drawing fund, which remains an important design feature.”

Facebook is now looking to more realistic solutions for its ambition to become the digital payment service for the world’s unbanked population. In August, it announced the formation of a new payments group called Facebook Financial with Libra’s Novi wallet executive David Marcus at the helm. Marcus and his team will look after all payments projects including the Facebook Pay feature that will sit inside all of its apps and will drive WhatsApp’s payments efforts in key markets India and Brazil.

The apps are well placed to lead digital innovation in the big fintech space such as gamification. Led by Indonesia, Thailand, and Vietnam, Facebook’s research has found that 310 million, or some 70% of consumers in Southeast Asia, will go digital by the end of 2020, some five years earlier than previously forecasted.

“With five years of digital acceleration condensed into one, the impact of digital adoption on businesses has never been more apparent,” Facebook Asia-Pacific’s managing director of global gaming Sandhya Devanathan said. “It is vital for businesses to connect with consumers in ways that are frictionless and to replicate inperson interactions through social platforms, messaging, and short videos as much as possible to drive discovery and loyalty.”

Facebook’s research shows that the opportunities to merge finance, technology and retail have never been more clear and opening up new areas for data and marketing such as discovery commerce. It found that 68% of consumers don’t know what they want to purchase before they shop, while 62% of consumers learn about new brands and products from social media with short videos the medium of choice.

In spite of the possibilities for innovation opening up, many of its US-based counterparts are looking to more realistic solutions to capitalise on their market dominance in the near-term. The tech giants are finding a willing partner in investment giant Goldman Sachs and its Marcus brand looking to dominate the banking-as-a-service space. In August 2019, the Wall Street firm launched a credit card with Mastercard and Apple, though the product is more synonymous with an AI gender bias problem and high application rejections. Apple is pressing on with its foray into finance, however, recently announcing that ApplePay will enable the point-ofsale credit solution for instalment payments provider Afterpay, which activates the Afterpay card in the Apple wallet.

Goldman Sachs is leveraging the power of tech company consumer data by melding that with its digital underwriting platform. While Apple is consumer-facing, in June this year Goldman Sachs announced a corporate credit facility with Amazon for businesses that sell on the market platform. Amazon is expected to retain its existing inventory financing partnership with Bank of America.

“We continue to expand our digital consumer business,” said Goldman Sachs CEO David Solomon. He noted that the partnership with Amazon will allow the bank to “leverage our proprietary digital underwriting decision platform using data shared by Amazon’s third-party sellers to provide inventory and operational financing to support their growth. This partnership, which is being launched on a smaller scale at this moment, is another example of our innovation and our ability to partner with leading corporations to deliver differentiated value to our customers”.

David Solomon,

CEO,

Goldman Sachs

Laurence Thiery,

Head of financial services business and market development Asia Pacific,

Amazon Web Services

Aside from the obvious opportunities to tie into its marketplace, Amazon is pushing itself as the key web infrastructure for American finance firms through its Amazon Web Services (AWS). AWS now accounts for around 13.5% of Amazon’s total revenue. CEO Jeff Bezos has likened the cloud computing business to the utility companies of one hundred years ago.

The firm is positioning itself as the tech partner that provides both traditional banks and disruptive upstarts with a service guarantee to allow their clients to quickly pivot into the online space. Laurence Thiery, head of Asia Pacific financial services business and market development at AWS, agreed that the company is looking at the bigger picture when it comes to breaking into finance. “Organisations of all sizes, from fintech startups to the largest banks, broker-dealers, insurers, and market infrastructure providers in the world, use AWS services to transform their businesses, become more agile, and create value,” Thiery said.

“AWS enables organisations including HSBC, Standard Chartered Bank, Barclays, Goldman Sachs, DBS, Macquarie, Shinhan Financial Group, and HDFC Life to modernise infrastructure, meet rapidly changing consumer behaviours and expectations, and accelerate business growth all the while helping customers meet the most stringent security, compliance, and regulatory requirements.”

Google has been dabbling in financial capabilities since 2006. It continues to expand its mainstay Google Wallet and has also launched a car insurance and mortgage comparison service in Britain. It invested in P2P leader Lending Club last year. Along with Facebook, Google’s unrivalled consumer data means it is unlikely that they will stay bit-players in financial services for long. However, the early missteps of Apple and Facebook have shown that tech giants may need to take more calculated approaches to the market given the well-established regulatory regimes to which they are not accustomed.

Reaching for the sky

Just as payments have proven to be an easy entry point for younger big tech firms to get in the financial space, it appears that cloud, banking and finance as a service platforms are the routes for some of the more mature big tech firms in the US and China such as Microsoft, Amazon, Google, Huawei, and Alibaba.

It is estimated that this year around four in five Chinese banks will integrate fintech solutions from cloud providers. Alibaba Cloud recently announced that it would spend RMB2 billion ($298.5 million) this year to empower its global partners particularly in China and India, and accelerate partnerships in light of COVID-19.

In the US, Mike Blalock, general manager of the financial services industry vertical at Intel, said that the firm is leveraging its long-standing hardware reputation to partner with major finance clients. “We work with traditional end users in banking, insurance, and capital markets as well as emerging fintech startups to deliver innovation to the industry. Intel technology is delivered through an evolving and expanding partner ecosystem that spans original equipment manufacturers, cloud service providers, system integrators, and software vendors.”

Mike Blalock,

General manager financial services,

Intel

Connie Leung,

Regional business lead financial service Asia,

Microsoft

Once synonymous with computing hardware, Intel believes that its future in financial services is linked to three technology inflections occurring today - AI, 5G’s transformation of the network, and the rise of the intelligent edge.

“The top challenges in the industry involve compliance and regulations and responding to changing customer behaviours and expectations,” Blalock added. “Data becomes more valuable if it can be shared while maintaining security and privacy and Intel technology is enabling solutions for confidential computing.”

Their ‘good corporate citizen’ approach stands in contrast with many of the newer players that may speak to the same principles but their disruptive products inevitably draw them into closer scrutiny. Intel says that it is focusing on directing its developers to use its products such as distribution of its deep learning OpenVINO Toolkit to help developers understand how a neural network is reaching its decisions to enhance transparency of AI.

Microsoft’s public interest in buying TikTok to keep the Chinese social media app running in the US may have grabbed headlines this year but it also speaks to the firm’s broader strategy of working closely with governments and regulatory bodies across the globe for its growing financial services business.

Connie Leung, regional business lead for Microsoft Asia’s financial services division, said that the firm wants to “be a part of on-going discussions with the public sector,” and has recently joined the Veritas consortium led by the Monetary Authority of Singapore as an advisory member. It is in regular dialogue with the Ministry of Finance in Vietnam and Department of Financial Services in India to “develop proof of concepts with data and AI to improve regulatory implementations and operations in the financial services sector”.

"In the past eight years, Microsoft has also been actively engaging with over 120 regulators globally in the modernisation of regulations for adoption of technology such as cloud and AI by financial institutions,” Leung added. “We have seen significant uptake of cloud technology with the modernisation of guidelines issued by regulators. We will continue to work closely with regulators and customers to drive industry innovation particularly during the pandemic when technology is a key enabler for business continuity and agility.”

In addition to working with financial regulators, Microsoft is working closely with security agencies. “Every year we invest over $1 billion to build security in our core technologies and operate Microsoft Cyber Defense Operations Center (CDOC), a 24/7 cybersecurity and defense facility with leading security experts that protect, detect, and respond to threats to Microsoft’s cloud infrastructure, products and devices, and internal resources,” Leung said.

Keep watching this space

While the older US tech firms are settling on more seamless integration into the lucrative financial sphere, it is the giants namely, Apple, Google, and Facebook that are the likely disruptors to watch in financial services. In an environment that is both politically and economically uncertain, it is likely that we’ll have to keep watching for some time longer. That said, a static market is always ripe for a new competitor to rush in with drastic changes, though it seems certain that no one will risk a major new disruption until after President-elect Biden takes office in Janaury 2021.

The path for the Asian tech firms in financial services appears more straightforward for now. However, many of the limits and opportunities brought about by wholesale changes to the Chinese market have yet to be fully explored. Stricter regulatory regimes in Asia mean that we are unlikely to see any big surprises in the market without operators first working with regulators and existing structures for mutually acceptable evolution rather than revolution.