In the debate over the role and future of bank branches, ultimately the only opinion that counts is the consumer’s. Customers make decisions on primary banking relationship based on assumed need for multiple network point convenience, even though they may patronise one point most often.

In emerging markets, customers who are more predisposed to digital channels often take into account how to select a bank based on the perception of being able to go to a branch. Data shows that while consumers use physical branches less often than they once did, they still use them quite a bit, even as they have adopted digital banking. For instance, at JPMorgan Chase & Co US, about 21 million different customers will visit a JPMorgan branch each year, while the bank has more than 50 million digital users.

While physical branches remain relevant channels in the offline online mix, these are remoulded for a digitised future in cash-light economies and for technologies having a massive impact on how branch staff interact with customers. Banks imagine their branches with less teller, more self-service options and as advisory centres.

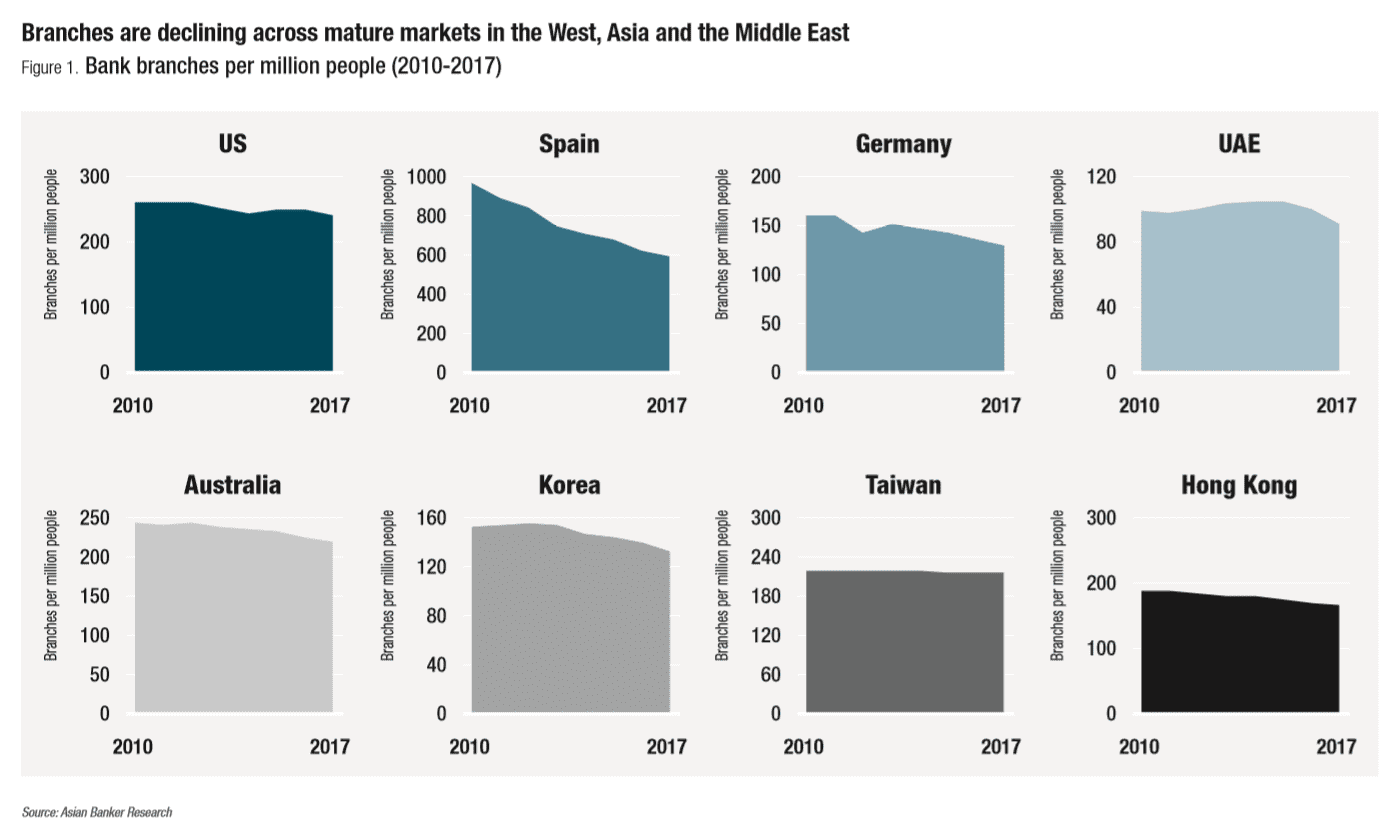

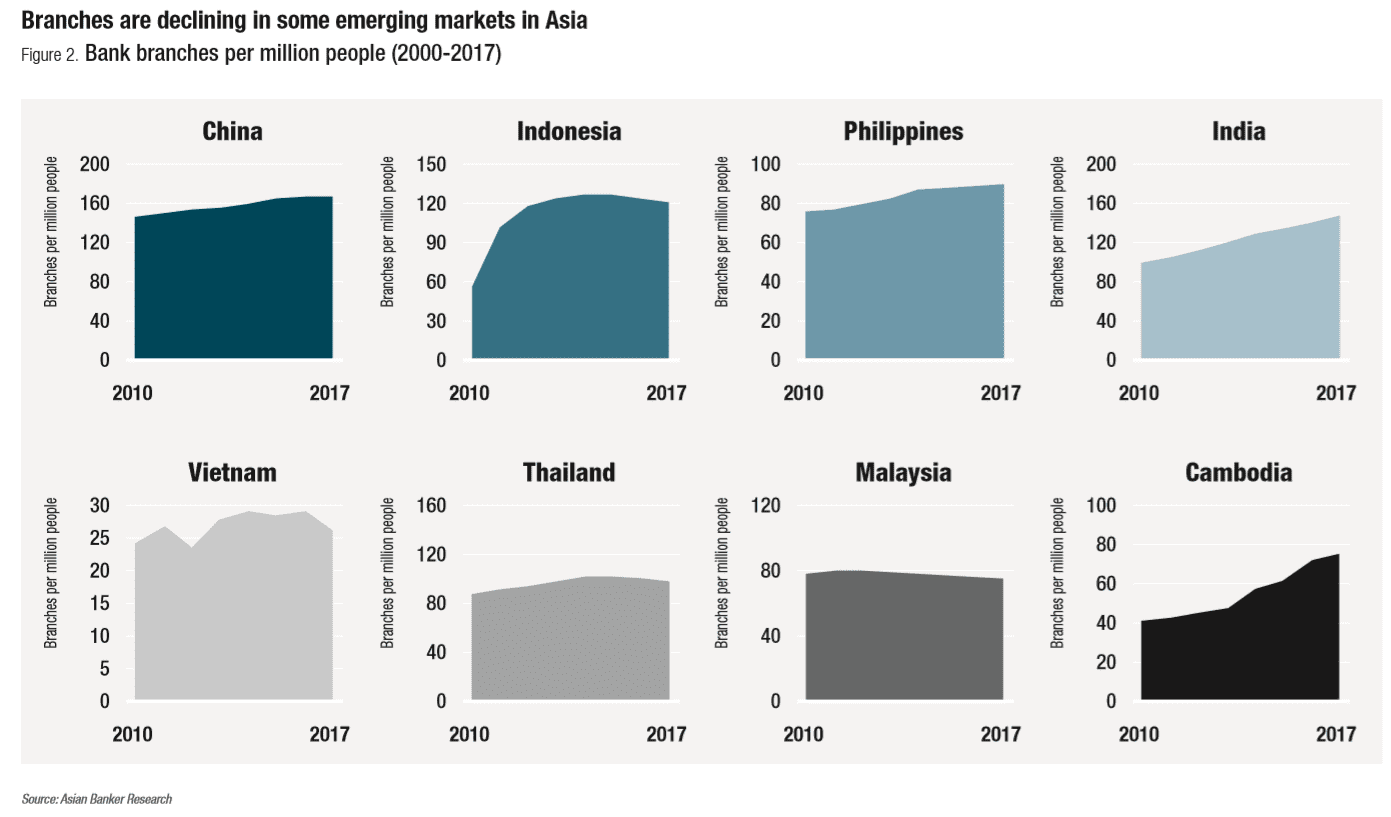

Yet the shift towards digital and the impact on branch networks varies by markets. In Malaysia, banks are cutting down the number of branches as they automate customer servicing and acquisition through artificial intelligence (AI) and chatbots, while Taiwan banks, which also launched chatbots and seemed farther down the line, are keeping their branches.

In Hong Kong and the United Arab Emirates, the trend has seen fewer number of branches, smaller and more efficient formats, and larger areas for customer self-service. In China and Thailand, banks believe that the fixed costs in branches help avoid becoming economically unsustainable in the wake of fintech competition.

However, despite branch declines across mature and increasingly emerging markets, banks also benefit from strong physical ‘franchise’ footprints compared to fintech/ tech companies. In India, regulatory risk led to a temporary shut down of digital onboarding with Aadhaar e-KYC in October 2018, leaving many pure digital players hanging in the dry. Elsewhere around the globe, a part of mid and smaller (foreign) banks continue to expand their physical presence across a couple of observed markets.

In the US, half of top 100 banks cut their network by more than 50% over the last five years

The number of bank locations in the United States peaked at 99,550 during 2009 but have declined annually to 88,070 branches by the end of 2018, according to the Federal Deposit Insurance Corp. More than half of the top 100 US banks reduced their footprint by more than 50% over the past five years, stated management consulting firm McKinsey & Company. The biggest 12-month decline occurred between June 2016 and June 2017, when more than 1,700 bank branches closed.

By 2018, branch decline has slowed down as banks have come to the end of their branch cutting programmes. HSBC will be opening 50 new retail branches and JPMorgan plans to open 400 new branches in the next few years across 20 US states. Deposits at the 25 largest US retail banks have doubled from 2004 to 2017, while their combined branch footprint shrank by 15% over the same period.

Beginning 2019, Bank of America listed 57% less job openings in branch-related jobs, looking for less than half as many people to fill its 4,600 retail banking outlets, according to web platform thinknum. Meanwhile, job openings in areas of automation, AI, machine learning and natural language processing doubled since 2019.

Australian financial services providers look for an integrated experience across channels(BOLD)

Commonwealth Bank of Australia (CBA) is the only one of the big four banks that slightly increased its branch network between 2010 and 2018 from 1,009 to 1,082. By contrast, Westpac reduced its branch network most among all big four by 19% to 1,006 branches in the same time period. However, in both cases, Westpac and CBA each recorded almost the same deposit growth from 2014 to 2018, as compared to the previous four years.

According to Australian market research company Roy Morgan, people using bank branches between May and October 2018, based on an average four-week period, declined by 27% compared to 2014. Leading banks already offer an integrated customer experience in their branches, online or by phone, where applications can be started and continued through any channel.

In Hong Kong, the first branch contact has to solve everything

The industry began to digitally transform their branches towards paperless and straight through processes as early as 2015, although in some cases, account opening still take between 45 minutes to one hour. Banks introduced instant ticketing, video banking, counter appointment services through mobile banking and video teller machines. The move towards digitised mini branches equipped with video teller capabilities impacted teller headcount, which has seen a reduction of 15%-20% since 2017. A pool of 200 video teller machines can be operated by 8-10 service staff. BOC HK launched finger vein authentication services at counters as early as end of 2017. Bank of China and HSBC/Hang Seng operate more than 200 branches each in the market.In a recent mystery survey conducted by the Hong Kong Monetary Authority on branch account opening by small and medium-sized enterprises (SMEs), it was revealed that 85% of bank clients were able to make account opening enquiries with an average waiting time of around 1.5 minutes. However, it was highlighted that the information and documentation requirements were not clearly set out and easily accessible online.

In the UAE, there is an emergence of teller-less digitised branches

The industry began as early as 2017 to enhance customer experience, turnaround time and to improve efficiency and productivity, serving as the first stop towards full digitisation. The pursuit was towards a ‘paperless’ workflow automated branch network. By 2018, the first teller-less digitised branches emerged. Banks increased accessibility by extending evening banking and Friday banking in mall branches and launched end-to-end tabletbased processes, enabling them to source accounts from new-to-bank as well as existing customers instantly. In March, Mashreq Bankd stated the bank will close 50% of its branches in 2019.

Fintech woes and profitability issues in China will force the largest banks to reduce branches

China’s branch growth dropped from 228,700 to 228,600 between 2017 and 2018 according to the China Banking and Insurance Regulatory Commission. The branch network of the big four mega banks declined by 0.5% in 2018, driven by lower profitability and an increasing fixed cost per branch. On the one hand, the “interest rate market” reform led to a sharp decline in the overall profit level of the banking industry, compounded by fierce nonbank competition in the retail financial sector. An increase in outlets and labour costs, hardware maintenance costs and equipment renewal investment demand have also been “passively” increased, adding to woes in profit margins. Banks are no longer willing to allocate the same amount of capital to its branch network compared to previous years.

In India, state owned banks slowed down in branch expansion

In India, branch expansion continues among private and state-owned banks but the focus is shifting from urban to semi urban and rural areas. State-owned banks have added fewer branches than their private sector peers in the last years with continued slow growth going forward. They have lost significant market share in deposits to private banks. Branches in India generate the entire deposit business and is also the key venue for 100% of the SME business. The expansion of self-service kiosk installations is an ongoing effort to reduce branch traffic. Tablet-based banking is not yet mainstream and only available in selected private banks. The focus going forward will be on institutionalising the sales process and leveraging technology at the front end.

HDFC Bank plans to add 600-800 physical stores per year for the next three to four years with the majority of new ones focusing on semi urban and rural geographies. The bank is partnering with 300,000 agencies which already provide up to 200 government services digitally to distribute the bank’s products.

In Thailand, banks consider branch cost unsustainable

In Thailand, over-the-counter transactions account for less than 10% of the overall retail transaction volume, but about half of the industry’s retail banking full time equivalent staff are deployed in branches. With a gradual opening of full e-KYC in 2019/2020 expected and new digital FIs already entering the market, banks are on the edge. Siam Commercial Bank in Thailand announced its plans in early 2018 to reduce its branch footprint by 65% until 2020, and to nearly halve the number of employees.

Industry branch numbers peaked in 2014 and have since been on a gradual decline. Some larger banks are in the process of modernising their retail banking platform that simplifies the customer experience in the branch, improve sales management processes, and revamp CRM systems. Remote queuing systems via smartphones are also emerging. Kasikornbank allows customers to start their onboarding journey for current accounts from their mobile app based on biometric capabilities, then complete the authentication process at any of its network points such as branches or partner locations.

Online offline strategies in a platform economy will drive branch strategies

In most markets, branch costs are becoming unsustainable fuelled by the shift in customer interactions towards digital. Banks either scale down, down size or build up their distribution channels via 3rd party market places, including agency banking. At the same time, banks empower their front liners with intelligent and integrated insights on customers while mobile solutions for branch staff help to serve the customer beyond the counter. Best banks are now redesigning customer journeys keeping in mind their convenience for seamless transaction. They are empowering staff with mobile solutions integrated with back end systems in real time for anytime and anywhere banking. A foreign bank in the Philippines introduced a tablet based digital on-boarding platform for direct sales and frontline employees. Currently available for credit cards, the redesign of the end-to-end journey benefitted both sales and back office processing teams and reduced application errors. In Thailand, a bank could increase its bank teller efficiency by 60% and reduce the cash collection time outside branches by 50% through a tablet-based teller function and online real-time deposit capabilities. All this will eventually support a move, though gradually, to a more consultative nature of the role of branches.