- Fintechs CCB and OneConnect face financial challenges

- Significant disparity in tech investment among large and small banks

- Regulators encourage fintechs to expand services globally through tech transfer to boost profitability

China’s bank-backed fintechs, including CCB Fintech and OneConnect, are facing profitability challenges and seeking growth through technology transfer and expansion, both domestically and internationally.

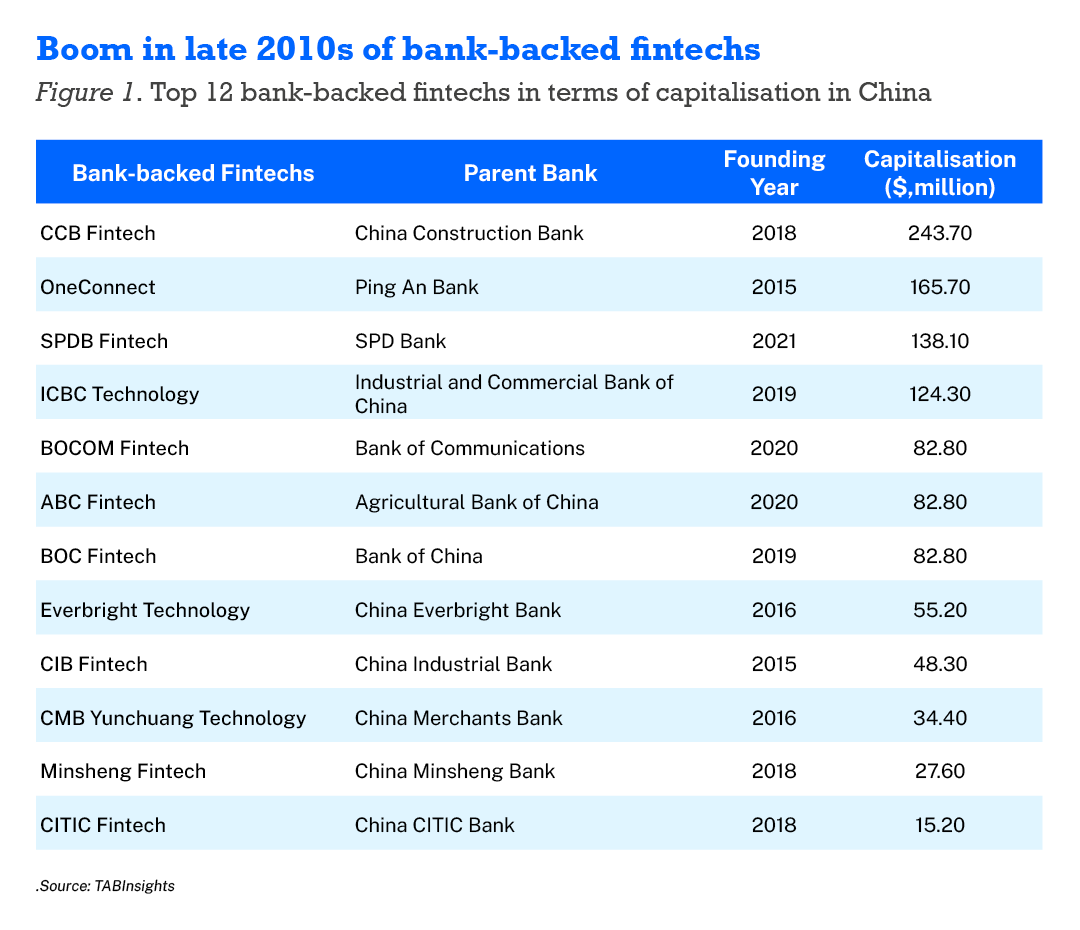

Since the late 2010s, China’s major state-owned banks and joint-stock commercial banks have established around 20 fintech subsidiaries, mainly owned by their parent banks. Senior executives often hold dual roles in both the parent bank and the fintech subsidiary, ensuring close ties.

Bank-backed Chinese fintech boom in the late 2010s

Establishing fintech companies ensures independent operations while better serving parent banks and expanding external business. Banks aim to transform their tech research and development (R&D) departments into profit centres by disseminating and transferring financial-grade IT services to peer banks and enterprises.

However, these fintech companies face significant profitability challenges due to high initial investment costs. For example, CCB Fintech serves both the business needs of China Construction Bank and the fintech development of other banks, resulting in substantial investments in high-level technical personnel and R&D.

Taking the two largest bank fintechs as examples, both CCB Fintech and OneConnect Financial Technology have struggled with profit growth over the past three years. OneConnect has incurred losses of RMB 363 million ($50.1 million) in 2023 for six consecutive years, accumulating over RMB 7 billion ($0.97 billion) in losses. CCB Fintech also reported losses in 2018 and 2019 totalling over RMB 730 million ($100.78 million), while net profit in 2023 was just RMB 2 million ($276,109).

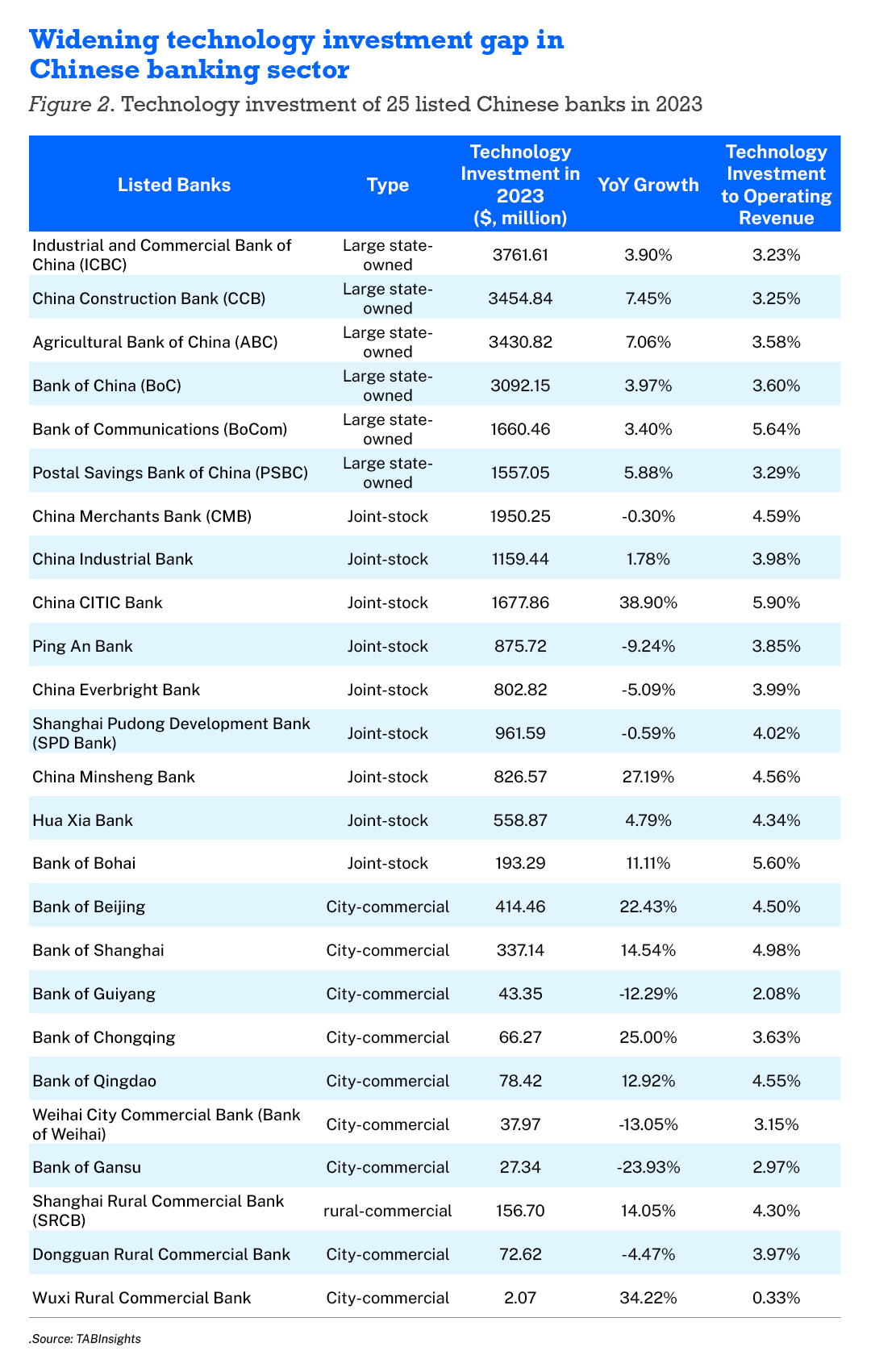

Widening technology investment gap in Chinese banking sector

As the big banks enhance their fintech capabilities, a significant gap in technology investments has emerged between large banks and city and rural commercial banks in 2023.

A total of 25 listed banks reported their fintech and information technology investments in their annual reports, amounting to RMB 197 billion ($27.2 billion). The six largest banks collectively invested RMB 122.82 billion ($16.96 billion), equal to 3.48% of operating income, up from 3.30% in 2022. Despite this increase, the growth rate slowed from 8.42% in 2022 to 5.38% in 2023.

Nine national joint-stock commercial banks reported fintech investments totalling RMB 65.24 billion ($9.01 billion), with the percentage of operating income rising from 3.91% in 2022 to 4.35% in 2023. However, growth rate here also decreased, from 9.35% in 2022 to 6.84% in 2023.

By comparison, 10 city and rural commercial banks together invested RMB 9 billion ($1.24 billion) in technology, with an average of RMB 896 million ($123.7 million) per bank, up from RMB 796 million ($109.9 million) in the previous year. ICBC’s technology investment alone equals the combined total of the last 14 listed banks on the list. This highlights the substantial investment gap between these smaller banks and larger counterparts.

Given that there are more than 4,500 banks in China, the actual investment gap would be even more pronounced. The disparity in technology investments between these 25 listed banks and the thousands of smaller, unlisted city and rural commercial banks underscores the challenges and differences in financial capabilities across the banking sector. This stark contrast highlights the need for increased investment in technology to bridge the gap and support the development of smaller financial institutions.

Regulators promote technology transfers

The push for technology transfer aligns with broader regulatory efforts to enhance risk management and compliance technology like anti-money laundering (AML) and anti-fraud. The National Financial Regulatory Administration (NFRA) in May 2024 encourages “technology-leading financial institutions to provide risk management tools and technical services to small and medium-sized financial institutions”.

Small and medium-sized banks stand to benefit significantly from these technology empowerment initiatives. In the face of competition from larger banks expanding into their markets, these institutions are increasingly embracing comprehensive digital transformation, especially in customer acquisition and digital marketing.

A survey conducted by the Internet Finance Association of Small and Medium-sized Banks (IFAB) indicates that in 2023, 86.25% of respondent banks have integrated technology empowerment into their overall development strategies; 37.5% have advanced to the deeper implementation stages of their tech strategies; and 17.5% have completed deployment, achieving notable results.

From core banking system revamps, cloud deployment, and intelligent risk management to branch digitalisation, large bank-backed fintechs are providing solutions and services to digitally transform their smaller peers.

For instance, third-party clients, including city and rural commercial banks, contribute 20% and 35.6% of total revenue for CCB Fintech and OneConnect, respectively. Meanwhile, OneConnect has significantly reduced its reliance on parent Ping An Group, with revenue from Ping An decreasing by 17.2% in 2023.

However, domestic competition is intense, not just among the 20 bank-affiliated fintechs but also from agile and tech-savvy internet giants like Tencent, Alibaba, and Huawei that have dedicated teams and solutions targeting smaller regional banks. This competition has driven OneConnect to set its sights on fintech proliferation in overseas markets to boost revenue. Revenues from overseas customers increased from RMB 133 million ($18.4 million) in 2022 to RMB 182 million ($25.13 million) in 2023, a growth of 37.2%. Clients include SB Finance in the Philippines and Numou, an SME digital financing platform in Abu Dhabi.

China’s bank-backed fintech companies possess distinct strengths in capitalising on the proliferation of fintech at home and abroad, primarily due to a deep familiarity with native banking operations and compliance. This expertise allows them to navigate regulatory requirements more effectively, enabling them to develop business scenarios that differentiate them from non-bank fintech firms.