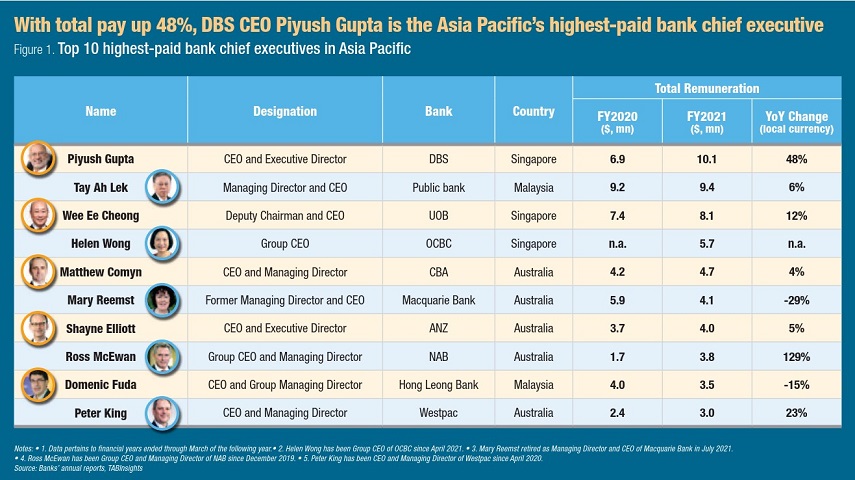

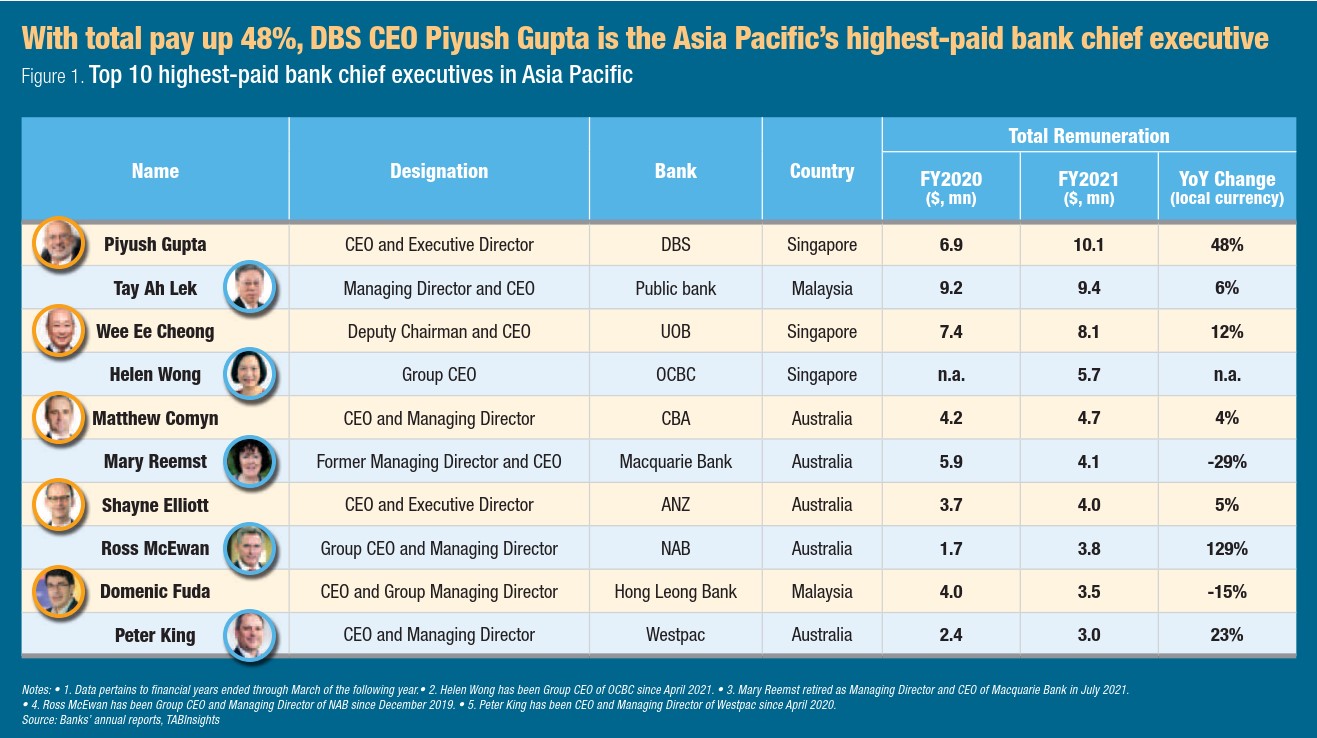

The highest-paid bank chief executive in Asia Pacific is DBS CEO Piyush Gupta, who received a total remuneration amounting to $10.1 million in 2021. He enjoyed a pay rise of 48%, following a 24% cut in total remuneration in 2020. DBS improved financial performance in 2021, with net profit surging by 44%. His base salary remained unchanged at $0.9 million, while the cash bonus and shares soared by 51% and 58% to $3.8 million and $5.3 million, respectively. The combined total remuneration of the top ten highest-paid bank chief executives in Asia Pacific reached $56.5 million in fiscal year (FY) 2021, up from $53.6 million in FY 2020.

Australia took the lead in the list of the top ten highest-paid bank chief executives in the region with five bank CEOs, followed by Singapore with three and Malaysia with two. Public Bank’s managing director and CEO Tay Ah Lek and UOB’s deputy chairman and CEO Wee Ee Cheong ranked second and third, respectively. Tay Ah Lek saw his salary rise 6% to $9.4 million in 2021. Wee’s total compensation in 2021 is $8.1 million, a 12% increase from the previous year. With total pay of $5.7 million in 2021, Helen Wong, who has been CEO of OCBC since April 2021, placed fourth. Hong Kong bank chief executives did not make it to the top ten. Brian David LI Man-bun and Adrian David LI Man-kiu, Co-CEOs of Bank of East Asia, were paid $2.4million and $2 million, respectively, while David Li Kwok-po, the bank’s executive chairman, received $2.7 million in remuneration.

Most bank chief executives received a pay rise

Ross McEwan, Group CEO and managing director of National Australia Bank (NAB), saw his compensation jump the most, at 129% in FY 2021, ended 30 September 2021. McEwan was only in the position for 10 months in FY 2020 and took a 20% cut in his fixed pay in the second half of FY 2020 due to the pandemic. He was paid a remuneration of $3.8 million in FY 2021, including a $1.1 million cash bonus and $0.9 million bonus in the form of deferred rights. Peter King, appointed as CEO and managing director of Westpac banking corporation in April 2020, received $3 million in remuneration in FY 2021, up from $2.4 million in FY 2020.

Commonwealth Bank of Australia (CBA) chief Matthew Comyn is the highest paid among the Australian banks, followed by Mary Reemst who retired as managing director and CEO of Macquarie Bank on July 2021. The total remuneration Comyn eared increased by 4% to $4.7 million in FY 2021, ended 30 June 2021. CBA has disclosed their executive remuneration for FY2022 and Comyn was paid 11% higher in FY 2022.Reemst’s total pay went down to $4.1 million, around 71% of which is related to the amortisation of her equity awards.

Among the top ten, Hong Leong Bank’s Domenic Fuda is the only bank chief executive that took a pay cut in FY 2021, excluding Reemst. Fuda earned $3.5 million in FY 2021, declining by 15% from $4 million in FY 2020. The bonuses, allowances and a defined contribution retirement plan he received went up by 9.5% to $2.7 million, while benefits in kind contracted by 51.5% to $0.8 million.

There remains a vast pay gap between the bank chief executives and staff

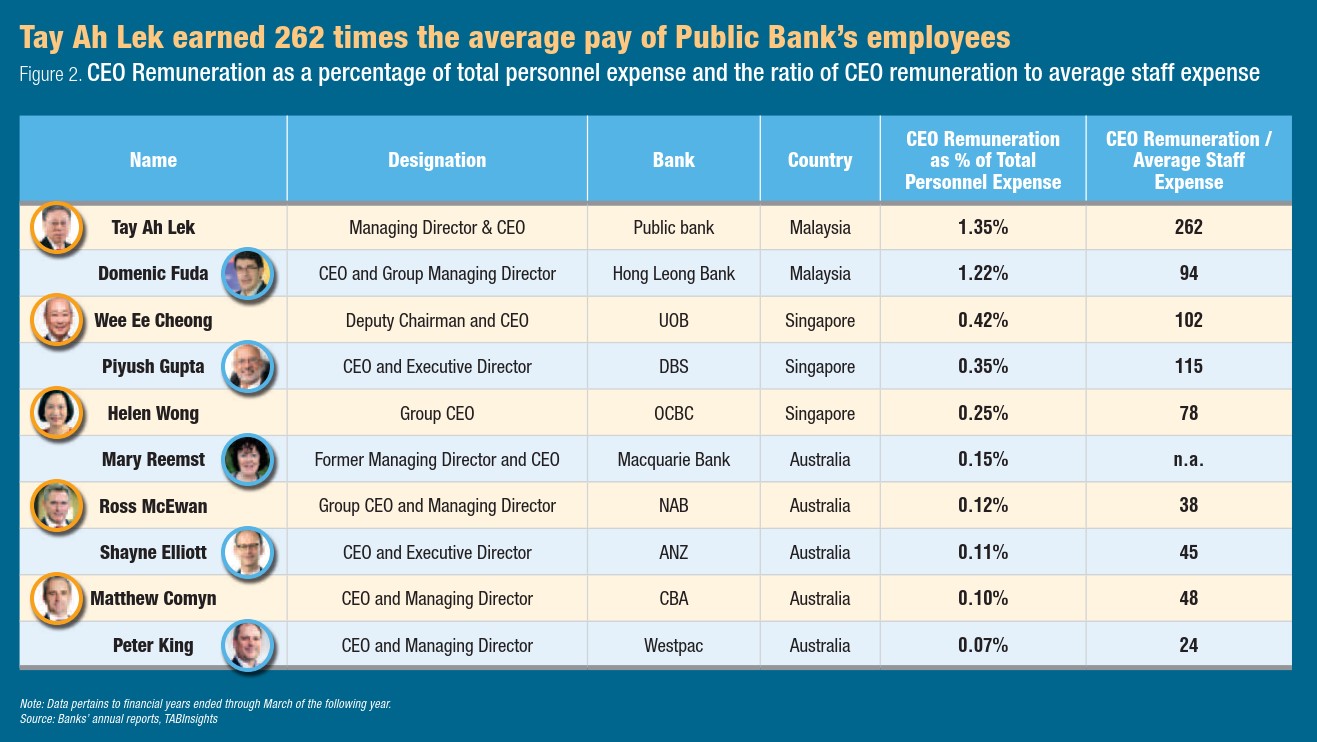

In term of CEO remuneration as a percentage of total personnel expenses, Tay Ah Lek and Fuda took the first two spots among the top ten highest-paid bank chief executives in the region, at 1.35% and 1.22%, respectively. The total remuneration that Tay Ah Lek earned in 2021 was 262 times the average annual pay of Public Bank’s full-time employees, which stood at about $35,900. The pay gap between Tay Ah Lek and the staff of Public Bank continued to widen. He earned 244 times and 250 times average staff expenses in 2019 and 2020, respectively. For Hong Leong Bank, the gap narrowed in 2021. The average staff expenses of Hong Leong Bank went up by 5.8% in 2021 to $37,450, compared with a slower growth of 1.3% for Public Bank.

The total pay Gupta received was 115 times the average of $87,540 received by DBS’s employees, while Wee made 102 times as much as the bank staff on average. Wee’s total pay accounted for 0.42% of UOB’s total personnel expenses, compared with 0.35% for Gupta and 0.25% for Wong. During 2010 and 2021, the remuneration of Gupta expanded at a compound annual growth rate (CAGR) of 4.9%. By contrast, average pay for DBS’s employees rose by 2.5% during the same period.

Australian banks had lower ratio of CEO remuneration to average staff expense and also CEO remuneration as a percentage of total personnel expenses. Reemst remained at the top of the list in Australia with a compensation that was 0.15% of Macquarie Bank’s total personnel expenses, down from 0.37% in the previous year. On the contrary, Westpac recorded a lower proportion of CEO compensation to total personnel expense, at 0.07%. The compensation that Comyn earned in FY 2021 was 48 times the average pay earned by the employees of CBA.