The transformative potential of generative artificial intelligence (GenAI) and large language models (LLMs) to streamline processes across the value chain and accelerate automation had led to rapid adoption across the financial sector. Compared to analytics-focussed traditional AI, GenAI stands out for its ability to generate new content and innovation based on natural language inputs.

GenAI applications across business operations are already showing improvements in operational efficiencies by saving costs and time, innovation in processes, and reducing manual workloads for employees. However, given the infancy of the technology and the reliability of the outcome and inherent risks, most financial institutions (FIs) have use cases primarily for internal business users rather than customer-facing roles.

GenAI use cases focus on operational efficiency

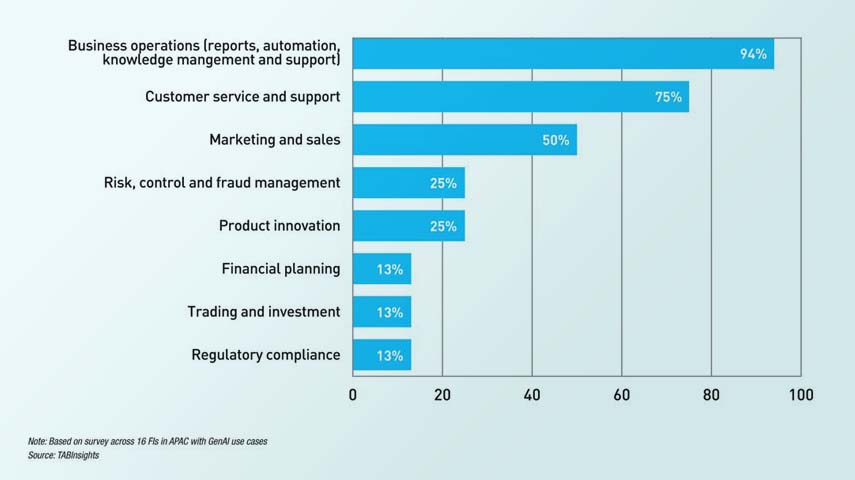

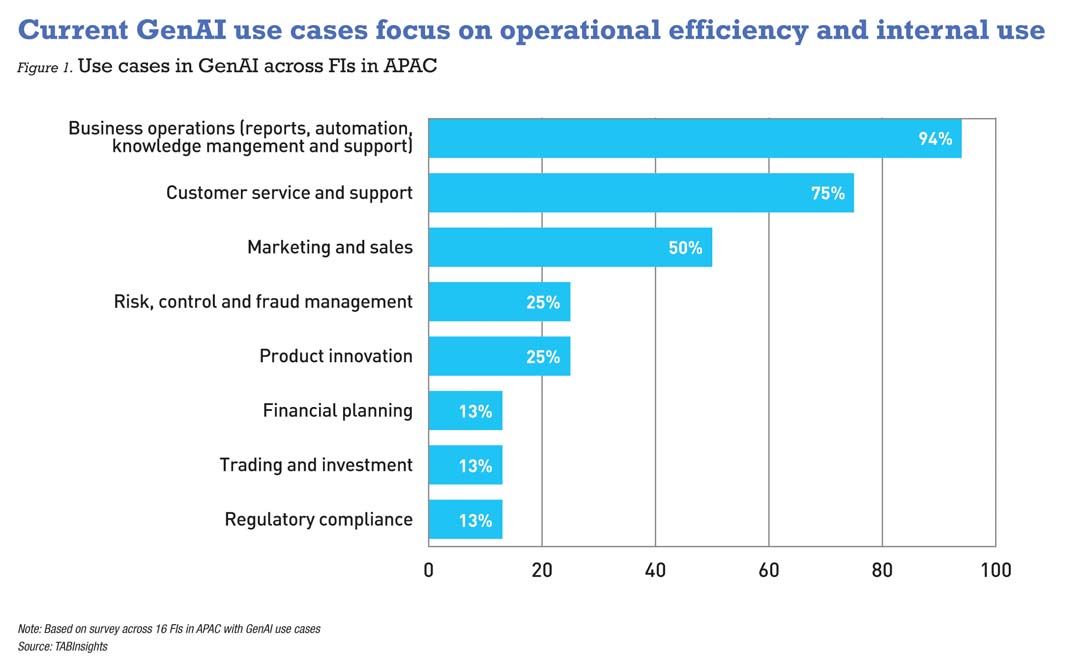

The Asian Banker conducted a survey across 16 FIs that are already exploring GenAI use cases in the Asia Pacific (APAC) region. It reveals that FIs have rolled out GenAI applications across eight broad operational domains. Some 94% of FIs have implemented GenAI to strengthen internal operational efficiency, 75% have use cases in customer service and support, and 50% use it to improve marketing and sales.

Operational efficiency, doing more with less: GenAI is revolutionising operational efficiency by automating processes, redefining employee roles, and boosting productivity while cutting costs and time. This frees employees to focus on complex tasks requiring human judgement and critical thinking.

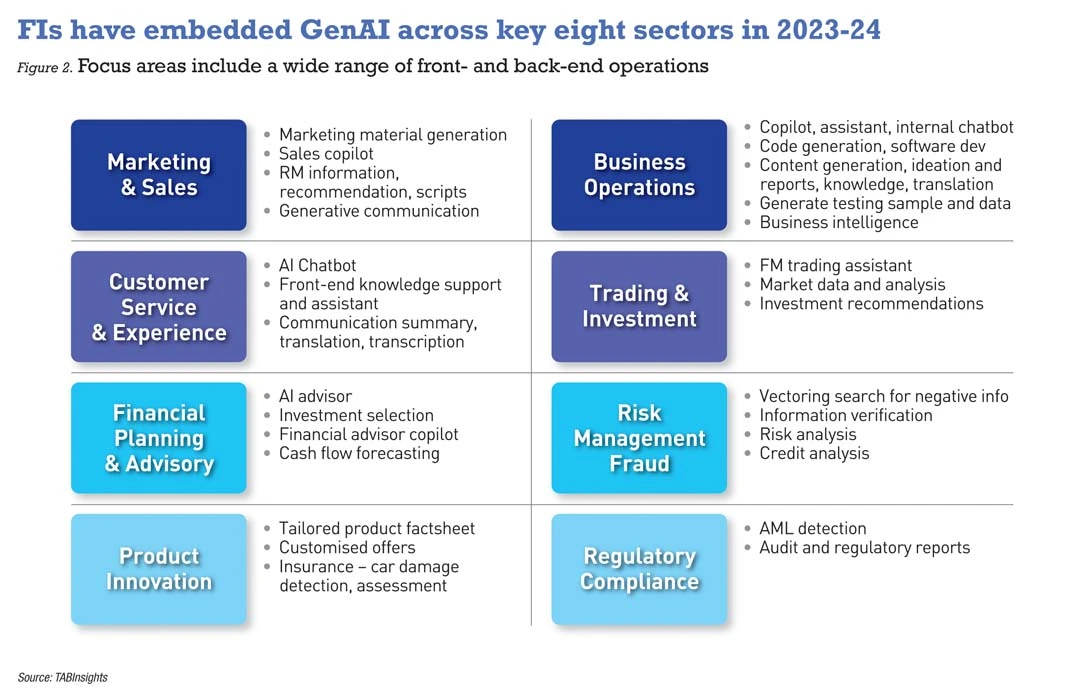

Several FIs are using GenAI to write and enhance code, develop knowledge bases, test data, and accelerate software development. GenAI is being explored for accelerating the migration of legacy programming languages such as COBOL. Some FIs have improved developer efficiency by about 20% and saw a decline in development time.

OCBC introduced a coding assistant that increases developer efficiency by 20%, and a chatbot that efficiently navigates the bank’s vast internal resources of more than 150,000 pages. Indonesian payment company DANA uses GenAI for AI-augmented software development with GitHub Copilot chatbot for customer service, product development, and areas like document creation.

AI-powered assistants and internal chatbots provide faster access to information, support business tasks, writing, research, and report generation. GenAI also enables intelligent documentation, content automation, and speech-to-text capabilities for quicker transcripts and summaries. Its speech-to-text technology is being used to transcribe and summarise calls in real time and analyse sales calls. Multi-language support is enabling FIs in Vietnam to improve communication and translation.

Customer service enhancement: FIs are leveraging GenAI solutions to enhance customer service by providing a knowledge base and internal chatbots that enable efficient query resolution and improve customer interactions. GenAI can parse through unstructured data and automatically identify customer intent and boost contact efficiency and conversion rates. Some banks have integrated real-time transcription and call summarisation, cutting average call handling times by about 20%. GenAI is also being tested for streamlining customer journeys, such as through automated form processing.

Marketing and sales: Half of the survey respondents have implemented GenAI to boost marketing and sales, improve communications, and personalise customer interactions. GenAI is being used to create tailored scripts, enhance customer profiling, and enable hyper-personalised nudges. Some FIs are exploring niche applications like personalised wealth advisory and investment recommendations based on news analysis. In collections, the ability to predict repayment probabilities and prioritise efforts in collections has increased efficiency by over 40% for some FIs.

Risk management and compliance: GenAI is transforming risk management by enhancing the detection of suspicious activities, improving regulatory compliance, and boosting cybersecurity. FIs are using it for intelligent risk analysis, assisting credit approvals, and streamlining documentation checks and policy comparisons, reducing credit due diligence time by up to 80% for some FIs. In regulatory compliance, some banks use it to generate anti-money laundering and audit reports, detect market manipulation, and monitor high-risk activities.

Additionally, GenAI is being explored in financial planning, cash flow forecasting, investment analysis, and human resource functions like onboarding and policy inquiries. In investments, it is finding use in synthesising news, evaluating impact, and identifying investment opportunities. In insurance, for instance, Kasikornbank is using AI for automated vehicle damage inspection and assessment from photographs.

As FIs implement new use cases, they need to look beyond the hype and decipher the best applications and processes for GenAI. For instance, for areas like prediction, forecasting, and recommendation engines that are more analytics-focussed, traditional machine learning (ML) models may still be a better fit. FIs should strategise the combination of traditional AI and ML with emerging GenAI capabilities for best outcomes.

Challenges intensify in GenAI

The discussion with selected FIs in APAC reveals some of the major hurdles they face in GenAI.

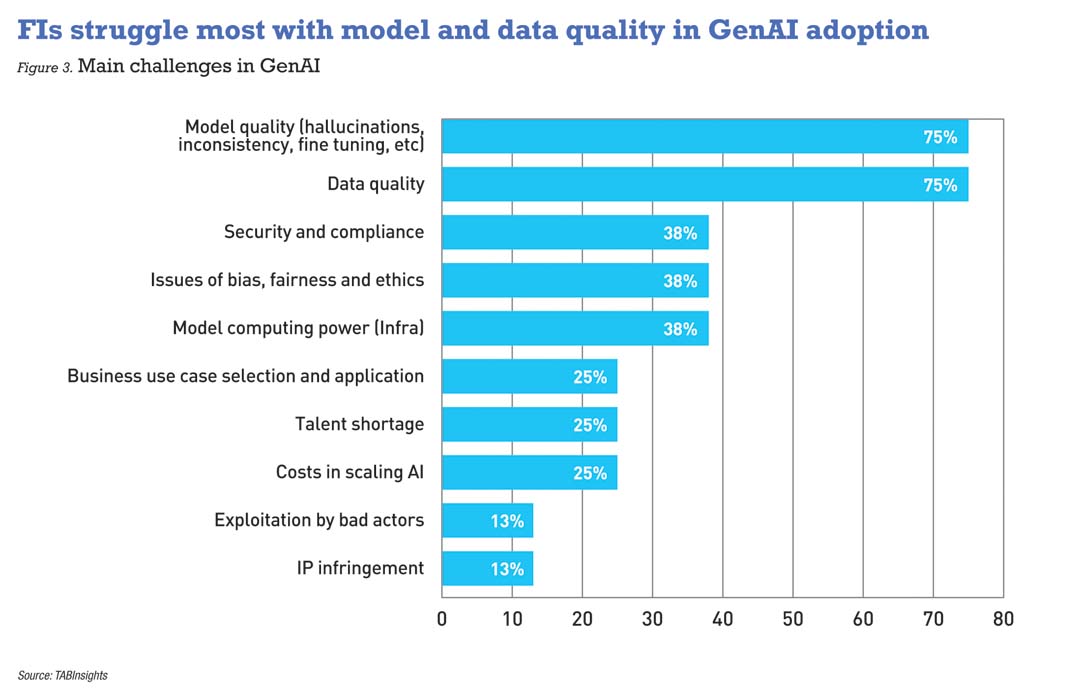

Model quality and AI hallucinations: As FIs explore new use cases, ensuring model quality and preventing AI hallucinations—where the AI generates incorrect or nonsensical information—emerges as the topmost challenge for 75% of FIs.

Some FIs face challenges in models’ capabilities to meet their unique needs, and a degradation in performance as they adapt these models for specific use cases. This issue may arise if the models are trained on outdated or incomplete data. Some FIs encounter the issue of ‘catastrophic forgetting’ where a model loses previously learnt information upon being exposed to new information. This is more common during fine-tuning or training of foundational models to meet specific requirements.

Some FIs are now adopting a retrieval-augmented generation (RAG) technique to check hallucinations. This combines LLMs with information retrieval systems, providing them with updated and relevant information to improve the accuracy of responses.

Data quality and infrastructure: Data quality, the key driver for the efficacy and reliability of outcomes, also remains a challenge for the majority of FIs. This needs vast amounts of reliable, relevant, and unbiased data to train models. Safeguarding data confidentiality, security, and privacy is paramount, and requires robust data governance and risk frameworks. To address this, some banks are implementing federated learning technology with encrypted data to train models.

FIs need a data foundation with the right data architecture, real-time data pipes, scalable cloud-based storage, and model engineering capabilities. Several FIs are already investing in Kubernetes and cloud-based storage systems to scale data capability. To strengthen the core foundation, FIs are transitioning to microservices architecture and agile core systems. For efficient development of ML models, some FIs have adopted ML operations (MLOps) practices.

Francis Ng, CIO, OCBC Hong Kong, shared that the bank is into its third year of data programming that started with a basic focus on structured data. In the second year, the bank progressed to a data lake, and in the third year, focused on real-time data. The bank is exploring actionable insights in areas such as marketing technology, and fraud management. He stressed that if banks don’t have the data strategy, GenAI is not going to help much.

Regulatory compliance, security, and ethical AI: Over one-third of FIs shared challenges in compliance and security. Regulators are mandating AI to be more explainable, transparent, unbiased, and ethical. The EU has implemented the AI Act, defining rules for different risk levels and transparency requirements. The blueprint of the AI Bill of Rights in the US suggests ways to make AI more transparent, less discriminatory, and safer. Singapore has existing requirements for fairness, ethics, accountability, and transparency in AI and also released the Model AI Governance Framework for GenAI.

Given this evolving regulatory landscape, robust governance frameworks within FIs are essential. All pilots must undergo risk assessments, and applications need human oversight. FIs must also prepare for risks such as the potential exploitation of AI by malicious actors and the rise of AI-enabled fraud, and risks to infringement of intellectual property rights.

Talent and leadership: The rapid advancement of GenAI requires a highly specialised skill set across AI and ML development, data engineering, and cloud computing. The scarcity of digital talent remains a significant concern. Overall success requires strategic impetus from bank boards to leaders throughout the organisation, and from dedicated product owners to champion development and investments.

Norman Sasono, CTO of DANA, remarked that initiatives cannot be sporadic, departmental-level efforts to be transformative; FIs need a capable team, along with the vision and direction from leadership to scale AI.

Costs and investment concerns: Costs in scaling GenAI are emerging as another concern. There is a significant investment needed to scale GenAI, often difficult to justify because of a lack of data to demonstrate the impact and return on investment. FIs are implementing sporadic productivity use cases as tactical wins.

Simon Wong, assistant general manager and head of IT Architect at China CITIC Bank International in Hong Kong, pointed out that GenAI cannot be based on a traditional funding model with a ‘set budget’ because banks do not know what results they will get from GenAI. CITIC has focused on trial and error, starting with smaller budgets and investing if things work out. He added that the challenge of innovation with AI and GenAI is also on the appetite for long-term investment, the applications, and features, versus resilience.

Charting future growth

The transformative potential of GenAI has undoubtedly created some hype, but in the final analysis, FIs must plan strategically based on the technology fundamentals and capabilities of both traditional AI and GenAI. They will need a broader strategy to drive business value, as GenAI has the potential to become an engine for innovation and growth rather than just a tool for automation and productivity. It can enable more personalised and tailored offers, investment recommendations, dynamic pricing, real time scoring, customising, and improving the relevancy of campaigns.

Focussing on just discrete use cases can detract from larger investments in foundational capability to solve more complex business problems. Scaling AI will require long-term investments, a holistic way forward, a solid data foundation, and an AI platform with risk management and model development capability. To shift to AI-driven processes, scaling will require a deliberate approach through impact analysis and reengineering of processes. GenAI is also likely to have an impact on workforce roles. The possibility of job displacement will need a calculated and balanced plan of action. FIs will need to identify the right opportunities for deployment, build awareness among employees, provide education and training, and foster a culture of innovation.