- Most efforts to collectively digitalise trade remain siloed or in a closed loop, exacerbated by the lack of agreement on legal frameworks that bind global trade

- Active collaboration on technology standards, platform and initiatives can move the industry away from digital islands

- Governments are updating legislations to harmonise their domestic legal frameworks that enables the use of electronic transferable records

While COVID-19 has accelerated the trade finance digitalisation journey for corporates and their suppliers, shipping agents and logistic partners, banks, fintechs and governments, truly effective digitalisation remains a challenge. The paper-heavy, multi-party, and multi-process nature of trade finance makes the task of effectively digitalising a trade ecosystem significantly complex. Furthermore, the myriad of rules and regulations covering multiple countries and industries that creates differing standards, legal frameworks, practices and technologies, renders the effort towards end-to-end trade digitisation siloed.

To address these challenges, stakeholders play a critical role to move the industry away from fragmented processes and ‘digital islands’. Corporate and transaction banks have embarked upon various means of digitalising their front and back-end operations by investigating technologies such as artificial intelligence, machine learning, blockchain and distributed ledger. They are also making significant investments in solutions such as e-signatures and intelligent document recognition to simplify processes.

However, technology alone is not enough. It has to work in tandem with the adoption of legal harmonisation and standardisation, and this is where cross-jurisdictional and regulatory initiatives play a pivotal role. With technology as a catalyst, the greater adoption of the United Nations Commission on International Trade Law (UNCITRAL) Model Law on Electronic Transferable Records (MLETR), and open initiatives such as International Chamber of Commerce (ICC) Digital Standards Initiative (DSI) or electronic Uniform Customs and Practice for Documentary Credits rules, and Singapore Infocomm Media Development Authority TradeTrust aimed at digitalising the bill of lading (B/L), will play a crucial role in overcoming the challenges to achieve the holistic digitalisation of trade.

Lack of legal framework and common standard as impediments to full trade digitisation

While many institutions and end-users recognise and have made some progress to digitalise trade, most of these efforts remain fragmented or in closed loops, resulting in only a fraction of the market being truly digitised. For the efforts to scale, they need an enabling legal environment that must recognise the electronic transferability of the documents such as bills of exchange and B/L.

Tod Burwell,

President and CEO,

Bankers Association for Foreign Trade (BAFT)

Peter Jameson,

Head of Asia Pacific trade and supply chain finance,

Global transaction services,

Bank of America

Highlighting key challenges that the industry collectively faces to fully digitalise trade finance, Tod Burwell, president and CEO of Bankers Association for Foreign Trade (BAFT), noted, “Digitising documents is the easiest part, but the law must recognise both digital records and digital transfer of ownership across trading borders”.

Peter Jameson, head of Asia Pacific trade and supply chain finance, global transaction services at Bank of America, highlighted that as documents with specific legal rights are subject to physical movement between carriers, buyers, suppliers and their banks, it is not clear if the same rights hold for documents in electronic formats. He said, “A legal framework that affords the same protection across jurisdictions for digital transactions as it does for paper-based transactions hinders the process of fully digitalising trade”.

So Lay Hua,

Group head of transaction banking,

UOB

Miho Takahashi,

Managing director and head of Asia Oceania,

Transaction banking,

Mizuho Bank

So Lay Hua, group head of transaction banking at UOB, identified the reasons behind the lack of proliferation of digital islands as opposed to a single global system. “The challenges boil down to two main issues, legislation and standardisation. When many digital trade tools involve electronic documents, where not all jurisdictions have laws to recognise electronic documents, this hampers the scalability of many solutions”, she expanded.

Despite movement restrictions imposed by governments during the pandemic, heavy reliance on paper documents is still the norm, noted Miho Takahashi, managing director and head of Asia Oceania, transaction banking at Mizuho Bank. She cited disparate legal requirements as the key reason and stressed that regulations worldwide need to catch up with relevant technologies to reap the benefits. She said, “Electronic B/L is not recognised in several key jurisdictions and with the increasing need to conclude transactions virtually, there is an urgency for wider legal recognition of e-documents”.

Vinod Venkat,

Head of global receivables and trade finance,

Wells Fargo

Li-Sar Oon,

Regional head of trade finance product management,

Deutsche Bank

Vinod Venkat, head of global receivables and trade finance at Wells Fargo, stated that while the technology needed to digitally conduct trade business has been around for more than two decades, the biggest challenges in trade finance are non-technical in nature. “The key challenges are legal and regulatory variations among different countries in their treatment of paper versus digital records”, he noted

As stakeholders have their own interests and areas of expertise, it is unlikely that one platform will meet the needs of an entire ecosystem. With each stakeholder trying to cater to their own specific goals, it is no surprise that the industry efforts to digitalise remain highly fragmented. Li-Sar Oon, regional head of trade finance product management at Deutsche Bank, pointed that in the absence of a more standardised industry-wide approach, digitisation efforts in the industry has been focused on individual players’ internal processes. She added, “Challenges result from solutions created in isolation by consortia, industry groups, or regulators, which undermines the value of digitisation and prohibits any progress”.

In this context, several digital trade finance platforms led by private organisations or governments have emerged, thus creating digital islands. “Although there are many fintech players in the market with numerous solutions for trade finance, none is widely adopted, which makes it difficult to establish a common standard and hard to promote mass adoption of any technology”, commented Takahashi.

Financial institutions also face challenges to differentiate and connect with fintech and their own systems, leading to solutions not being seamless and end-to-end, noted So. “There are many fintech solutions available in the market and each fintech solution purports itself to be slightly different with a different agenda”, she added. “Therefore, it is crucial to have an open and interoperable connectivity framework that different fintech solutions can connect to, enabling businesses to have the flexibility to work with different fintech providers”, she advised.

Kai Fehr,

Global head,

Trade and working capital,

Standard Chartered

Yap Kwee Hong,

Head of global trade finance,

OCBC Bank

Kai Fehr, global head, trade and working capital at Standard Chartered, opined that for digitisation of trade finance to deliver benefits in full, it must be standardised across markets and across all parts of supply chains. He said, “Right now, digitisation initiatives are fragmented across digital islands and a few closed loops, which leads to only a fraction of the market to be truly digitalised”.

Given the vivid functions to global trade, most service providers focus on their individual specialisation, for instance catering to financial aspects or whatever brings value to their customers. However, they cannot afford to operate only within their universe and must have knowledge of what lies ahead or before their specialisations. For example, non-trade finance functions such as shipping and logistics are equally important, underpinning the need to collaborate. Yap Kwee Hong, head of global trade finance at OCBC Bank, advocated for collaborative efforts of different trade stakeholders along the customer value chain. She said, “This typically will involve non-bank stakeholders, like logistics and shipping firms, for instance and the biggest challenge is therefore bringing all these stakeholders together under established standards to achieve the scale required for adoption”.

“In order to connect disparate solutions and platforms, standards to facilitate interoperability are critical to reaching scale”, also pointed Burwell. Thus, widespread adoption of digitisation can only occur on greater interoperability, which must be supported by legal harmonisation and common standards.

Active collaboration as a means to driving standardisation and interoperability

Prior to the digital acceleration during the pandemic, industry bodies, banks and third-party fintechs were already collaborating to establish platforms or portals, albeit with varying degrees of progress. The pandemic did not only encourage greater acceptability of digital channels within the entire corporate ecosystems but also highlighted how the industry had become heavily reliant on paper and isolated in digitising within their silos.

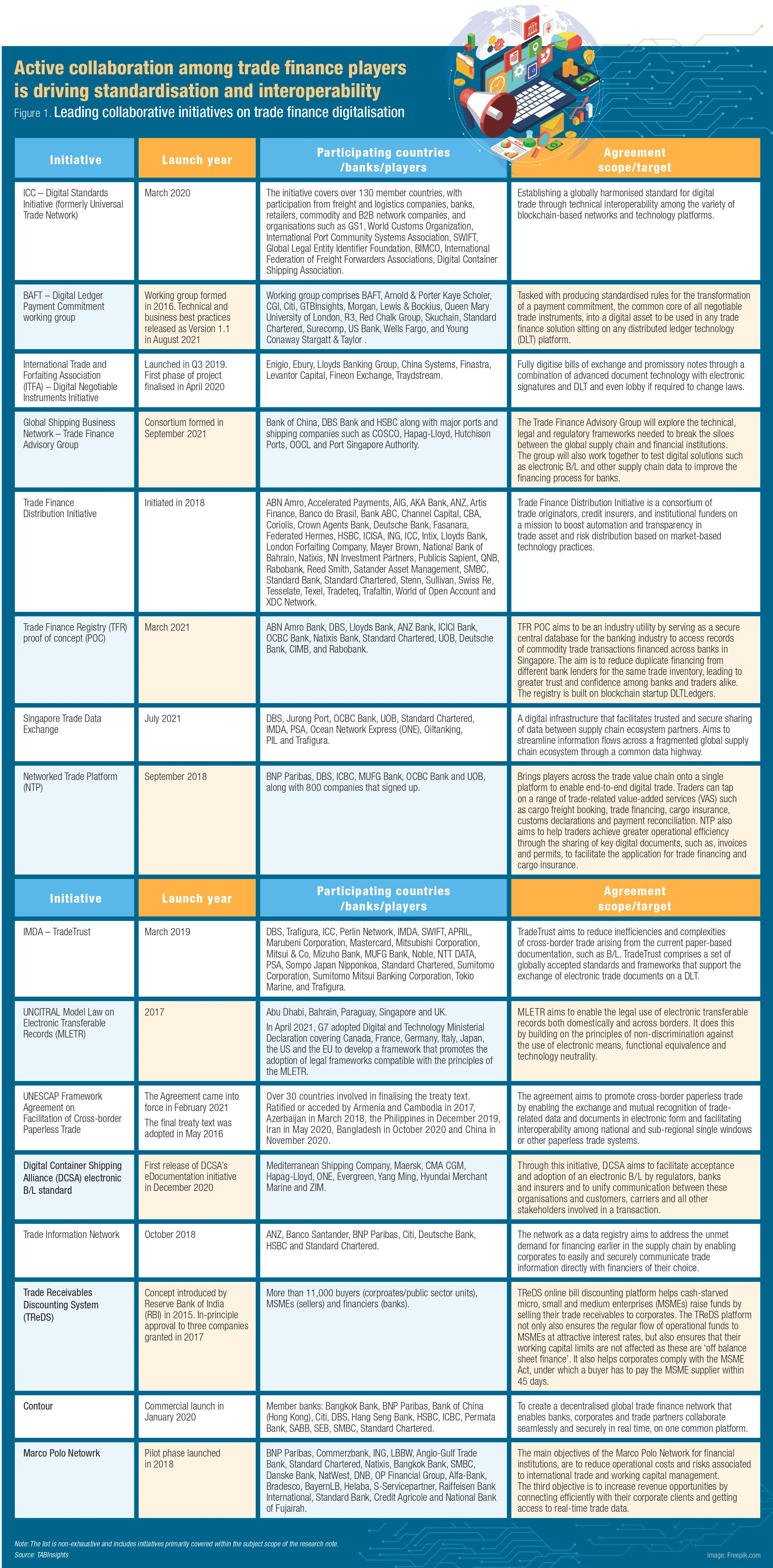

ICC launched the DSI in September 2020, a collaborative, cross-industry effort that aims to standardise digital trade and promote technical interoperability among various digitalisation initiatives (blockchain-based networks or technology platforms) that have emerged over the past few years. Since its launch, it has been advocating for legislative reform and engaging with alliance partners, standard-setting bodies, industry participants and governments to establish capabilities that help transition from paper to digital.

“BAFT was part of the pre-cursor to DSI that brought together various blockchain consortia, banks, technology providers, industry bodies and others to address the approach to interoperability. With ICC’s already established standards for digital trade, DSI will play a critical role in this going forward”, said Burwell.

Venkat highlighted BAFT’s Distributed Ledger Payment Commitment (DLPC) as an example of output from the industry engagement. The DLPC outlines standards for negotiable payment commitments done on a distributed ledger and has already been used in live transactions between different blockchain platforms.

Several banks are also actively engaging with industry bodies or participating in private or regulator-led initiatives that seek to drive the industry towards digital trade. In September 2021, Bank of China, DBS and HSBC joined Global Shipping Business Network’s Trade Finance Advisory Group, which will explore technical, legal and regulatory frameworks necessary to break the siloes that exist between physical and financial supply chains. The group will also collaborate to test digital solutions such as electronic B/L and other supply chain data to improve the financing process for banks.

In April 2019, 14 banks including ANZ, Crédit Agricole, Deutsche Bank, HSBC, ING, Lloyds Bank and Standard Chartered came together to promote common data standards for trade finance through the Trade Finance Distribution Initiative (TFDI). In 2020, TFDI had attracted several banks and non-bank parties such as trade originators, credit insurers and institutional funders to enable banks to better manage risk, improve balance sheet management and increase financing capacity.

Deutsche Bank recognised that proper governance is crucial for interoperability. “We leverage our representation at ICC, BAFT, International Trade and Forfaiting Association, FCI and European Banking Authority to advocate and raise critical points for informed policy and regulatory decisions”, highlighted Oon.

The bank has also been actively participating in industry initiatives such as the proof of concept (POC) on SWIFT FileAct and the formation of the Trade Finance Registry (TFR) Singapore to drive business and technology changes. The working POC on TFR comprises over 14 banks and provides a secure central database for the banking industry to access records of trade transactions financed across banks in Singapore, with a goal to mitigate potential duplicate financing. “The incorporation of fraud monitoring activities can allow banks to leverage on a common pool of data for transaction monitoring instead of investments, which otherwise must be deployed per bank, and TFR Singapore has a good potential for commercialisation, starting with the banks”, explained Oon.

“Mizuho is also embarking on various digital initiatives led by the regulators in several markets, for example Networked Trade Platform, TFR in Singapore, Trade Receivables Discounting System in India”, added Takahashi.

OCBC Bank noted that collaborative efforts of different trade stakeholders along the customer value chain are needed to achieve the scale required for adoption. “As collective action is needed to truly digitalise trade, the bank actively supports industry initiatives, including Singapore Trade Data Exchange (SGTraDex), which is a digital infrastructure that facilitates trusted and secure sharing of data between supply chain ecosystem partners”, said Yap. SGTraDex is expected to be fully rolled out in early 2022 with current industry participants including DBS Bank, Jurong Port, OCBC Bank, UOB, Standard Chartered Bank, Singapore's Infocomm Media Development Authority (IMDA) and Trafigura.

To support its push for greater standardisation, UOB takes an all-inclusive joint public-private partnership approach, which involves co-creation, designing and testing before the commercialisation of the end products. “We collaborated actively and implemented new digital solutions with public led initiatives such as SGTraDex, where we have a stake as a founding member, as well as the Networked Trade Platform and Trade Finance Registry”, exemplified So. This approach eases data exchanges, ensures authenticity and acceptability of digitised trade data by all players across the wider ecosystem.

Standard Chartered addresses the effectiveness of business networks in three ways. Apart from co-creating with customers and working closely with regulators such as the IMDA and Monetary Authority of Singapore, the bank has been working with industry bodies such as BAFT, ICC and supranational organisations such as the Asian Development Bank and the International Finance Corporation to create lighthouses for trade that can be easily adopted globally, according to Fehr. The bank has also partnered with Linklogis, China’s largest deep-tier supplier financing platform and is invested into Contour, a blockchain-based open industry documentary trade platform.

Wells Fargo is investing in standard messaging templates in application programming interfaces (APIs) to support electronic messaging between the bank and its trading partners’ systems. “When developing electronic messaging guidelines, Wells Fargo looks at industry and third-party software company best practices and standards in order to maximise interoperability”, added Venkat.

(click to enlarge image)

Meanwhile, SWIFT is also enabling interoperability between thousands of banks and corporates to tackle challenges presented by the creation of digital islands. It is working with its partners to develop a catalogue of trade-based APIs to tackle frictions arising from different standards and specifications. Prior to the pandemic, SWIFT and a group of trade banks were working on a proof of value (POV) to facilitate digital presentation and exchange of underlying documents. In rapid response to tackle paper burden of trade during the pandemic, it accelerated the POV into a live, fee-free service for corporate-to-bank and bank-to-corporate Letter of Credit (LC) presentation.

SWIFT’s Memorandum of Intent with Singapore’s IMDA along with 17 international corporations including ICC, ports and municipal authorities combine to create TradeTrust, an interoperability framework to enable exchange of digital trade documentation, notably the B/L. Collaboration with other government and regulatory bodies ensures that the effort is not restricted to Singapore or financial supply chain siloes, according to SWIFT in its paper, Digitising trade – now or never.

“TradeTrust is an example with great potential to provide a fintech agnostic utility in facilitating the digitisation of paperless LC workflow among various stakeholders within the trade ecosystem”, said So. Australian Border Force (ABF), IMDA and Singapore Customs, along with industry participants – Australian Chamber of Commerce and Industry, Australian Industry Group, ANZ Bank, DBS Bank, Standard Chartered and Rio Tinto, concluded a blockchain trial in August 2018 to prove trade documents (Certificate Of Origin in this instance) can be issued and verified digitally across two independent systems, reducing cross-border transaction costs. The trial successfully tested the interoperability of two digital verification systems – the ABF’s Intergovernmental Ledger and IMDA’s TradeTrust reference implementation.

While the number of digital islands will remain and even grow as companies and their service providers digitise within their own silos, having standards will facilitate the connectivity between those islands, which is paramount to enabling broader digital trade.

Digitising customer journeys first before digitising trade

Digitising trade flows is not simply a matter of digitising bank processes, innovation in technology platforms or the regulatory push. Above all else, the core of the transaction starts with buyers, suppliers and what banks and platforms can do with their data.

While Bank of America is exploring collaborative initiatives, such as the Marco Polo blockchain trade finance network, to explore transformative solutions for global trade, it has in parallel been actively digitising customer journeys around onboarding, transacting and servicing. “Firstly, it is critical to digitalise our own client interactions – if you can’t capture data at the point of entry, then you can’t drive digital trade”, asserted Jameson. Its customers are able to manage trade and supply chain transactions through a single, online solution on CashPro Trade, which supports a wide range of digital trade documentation and processes.

Mizuho Bank launched an Exports Digital Solution, a paperless solution for export transactions and is using machine learning to capture data for anti-money laundering screening from transactional documents. “We are enabling the clients to submit documents electronically where ever possible and the bank has embarked on the initiative to accept digitally signed document services, which would hasten the onboarding processes”, informed Takahashi.

OCBC Bank observed that corporates are going digital when it comes to trade applications via internet banking portals. “Transactions start with buyers and suppliers and the digitalisation will therefore need to take place where they buy, sell and operate. Therefore, we centre our decisions on the customer journey by first identifying pain points in the operating environment and ecosystems, and then addressing them”, added Yap. The bank significantly reduced the processing time to issue a Banker’s Guarantee from one week to one day by partnering with Singapore Customs’ electronic Banker’s Guarantee programme.

UOB is in the process of launching an integrated trade finance system that connects its customers with their domestic and cross-border buyers and sellers. With the enhanced infrastructure, the bank is able to assist customers in managing their purchase order, invoicing and financing requirements online. Citing an example, So said, “UOB was the first to pilot the use of Singapore’s national digital identity system Singpass’ digital signature to confirm transactions and product applications”.

Standard Chartered puts co-creation with customers and partnerships at the core of its trade digitisation strategy. It has partnered with Linklogis, China’s largest deep-tier supplier financing platform to utilise their digital blockchain-enabled platform and improve access to finance across supply chains in the market. The bank has also invested in Contour, a blockchain-based open industry documentary trade platform. “The recipe for success and to not get lost in all the digital hype, it is to always work with your client to drive innovation”, suggested Fehr.

Legislative harmonisation is necessary to digitalise trade

Digitalising trade through technology is not a means to an end. Legal barriers add complexity to electronically transferable documents as questions arise over the authenticity, reliability and security of the intangible (digital) version of documents, for example, B/L and bill of exchange. The key challenge therefore is around the acceptability of digital documents by established laws, whose rules for paper may trace back decades.

“There needs to be use-case relevance to a significant number of players within a specific industry or ecosystem, as well as an established legal framework that provides businesses with confidence that their interests are protected”, said Yap.

Furthermore, Fehr highlighted that common law and regulations need to adopt an e-trade friendly regime when it comes to electronic titles. “We are still far away from electronic B/Ls being adopted across all markets and region”, pointed Fehr.

Venkat noted that the secret sauce for any solution to achieve critical mass or adoption apart from the amount of time and resources required is legal support. “Important aspects of this assessment are whether the solution includes legal support in majority geographies, and the amount of time and resources required to onboard trading partners”, he said.

To address these challenges, governments are updating legislations to harmonise their domestic legal frameworks with UNCITRAL’s MLETR. MLETR enables the legal use of electronic transferable records, both domestically and across borders. As MLETR builds on the principles of non-discrimination against the use of electronic means, it may in future accommodate the use of new technologies such as registries, tokens and distributed ledgers, and become a critical component of paperless trade environment. “Adoption of MLETR across the globe will likely become the most important throttle to broad global adoption of digital trade”, added Burwell.

Countries are accelerating the adoption of MLETR into their domestic legislations. In 2019, Bahrain was the first country to carry forward reforms that recognise electronic documents as legally enforceable, followed by the UAE and Singapore in February 2021.

In the UAE, the Abu Dhabi Global Marketplace (ADGM) enacted the Electronic Transactions Regulations 2021, which confirms that electronic signatures, contracts, records and documents are legally enforceable in ADGM as the traditional non-electronic/physical versions. Similarly, Singapore passed an amendment to its Electronic Transactions Act 2010, which now recognises the digital versions of B/Ls, promissory notes and bills of exchange as functionally equivalent to paper-based transferable documents or instruments. “Singapore is among the very few advanced markets in the region to adopt MLETR and others need to follow quickly”, emphasised Fehr. Meanwhile, the UK Law Commission is currently undertaking formal public consultation to either align the UK to MLETR or find an alternative by 2022.

On a multilateral scale, the United Nations Economic and Social Commission for Asia and the Pacific’s (UNESCAP) Framework Agreement on Facilitation of Cross-border Paperless Trade aims to accelerate the implementation of digital trade facilitation measures. The framework incorporates a network of over 50 countries, with China the fifth country to ratify the agreement in November 2020. The agreement has the potential to cut trade costs by more than 20% in Asia’s developing economies, according to the latest regional trade facilitation report by the Asian Development Bank and UNESCAP.

Closing the trade finance gap

Despite the obstacles in adoption, digital solutions are proving to save time, add transparency and further mitigate risk in trade processes. However, these may not be enough to drive the industry to truly achieve end-to-end digitalisation. Oon acknowledged that other elements are crucial if success is to be achieved. “Interoperability means more than just connecting platforms and participants. The governance, business rules and platform security are crucial elements for success”, she added.

Commenting on the many digital trade platforms that have mushroomed, So noted that communication and interoperability among them is a must to solve key pain points. “Some of these trade platforms were created to solve very targeted pain points in the entire supply chain cycle, and could result in more complexity for adoption by supply chain players if such platforms do not connect seamlessly with each other”, she warned.

While the pandemic has put a spotlight on the inefficiencies, frictions and risks arising from manual trade processes, it has also created opportunities that aim at collectively digitising trade. “Once ubiquitous, the expectation is that digitisation will not only lower costs and eliminate friction, but will also lower trade barriers and make it easier for smaller companies to participate, thus reducing the trade financing gap”, said Burwell. As the industry collaborates and interoperates to eliminate fragmentation, standardisation and legal harmonisation will play a critical role in enabling it to achieve its purpose of closing the trade finance gap.