Global trade and supply chains are undergoing a marked transformation. Despite unprecedented geoeconomic challenges and market fragmentation, trade finance digitalisation is getting there, albeit slowly. The interplay of several factors such as the evolving business-to-business (B2B) and business-to-business-to-consumer (B2B2C) e-commerce models and embedded financing, emerging technology use-cases, and the pivot towards sustainable business practices have emerged as catalysts behind the transformation of trade finance.

Confluence of factors reshaping trade finance

The way businesses buy and sell is rapidly evolving. More than half of the new international trade in services is now being delivered and consumed digitally. In response to shifting consumer preferences, businesses are adapting to the new dynamics by going digital. For example, traditional manufacturing companies venturing into financing platforms show swift integration of physical and financial supply chains. Further integration with e-commerce platforms, underpinned by data analytics, can provide an end-to-end overview of the supply chain, allowing small manufacturers along the value-chain to optimise sourcing, production, and distribution.

Emerging use cases of technology within trade finance is also rising. The pace of technological innovation gathered significant steam with the pandemic acting as a shot in the arm for digitalising trade. In addition to wider adoption and use of digital trade finance platforms, conversion of the underlying document images into machine-readable text format through optimal character recognition technology is being deployed.

There is also a growing trend towards the use of application programming interfaces (APIs) for exchanging data within the trade ecosystem. That said, while the emergence of new technologies is promising, it’s not a panacea to transform trade. A major area of concern is the lack of standardisation, and fragmentation caused by numerous fintech solutions and blockchain platforms. These are infamously known as digital islands. Against a backdrop of growing fragmentation, the need for interoperability is greater, and so is the comprehensive legal framework underpinning those standards.

Calls are also growing louder for embedding sustainability in business practices along with transparency in the composition of supply chains. For instance, more conscious consumers and stakeholders are raising ethical concerns around where their coffee beans for their latte may be sourced from and which seed planters are employed. Regulators and policy makers are also demanding companies to take sustainability more seriously.

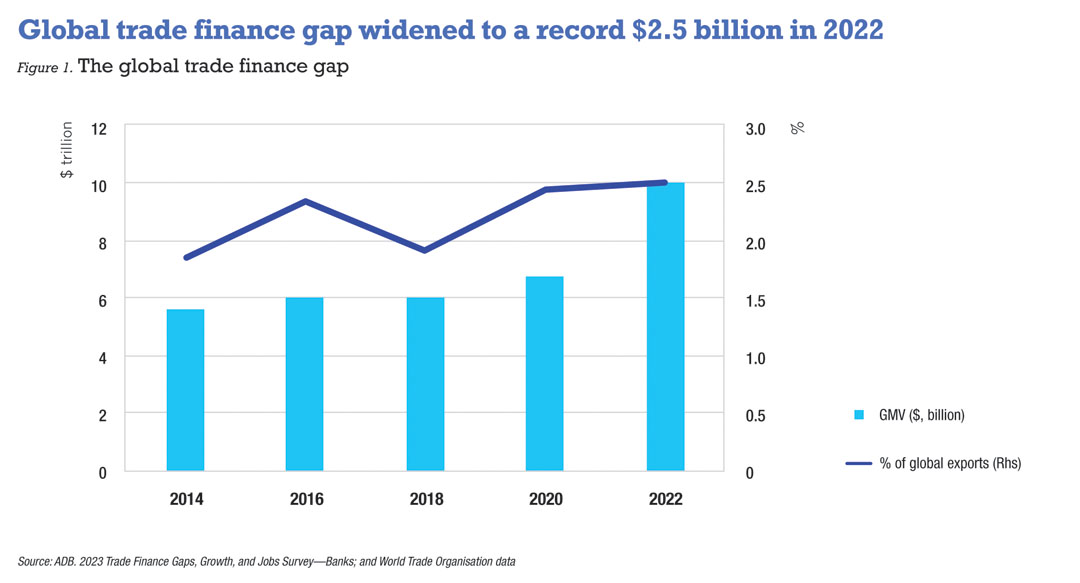

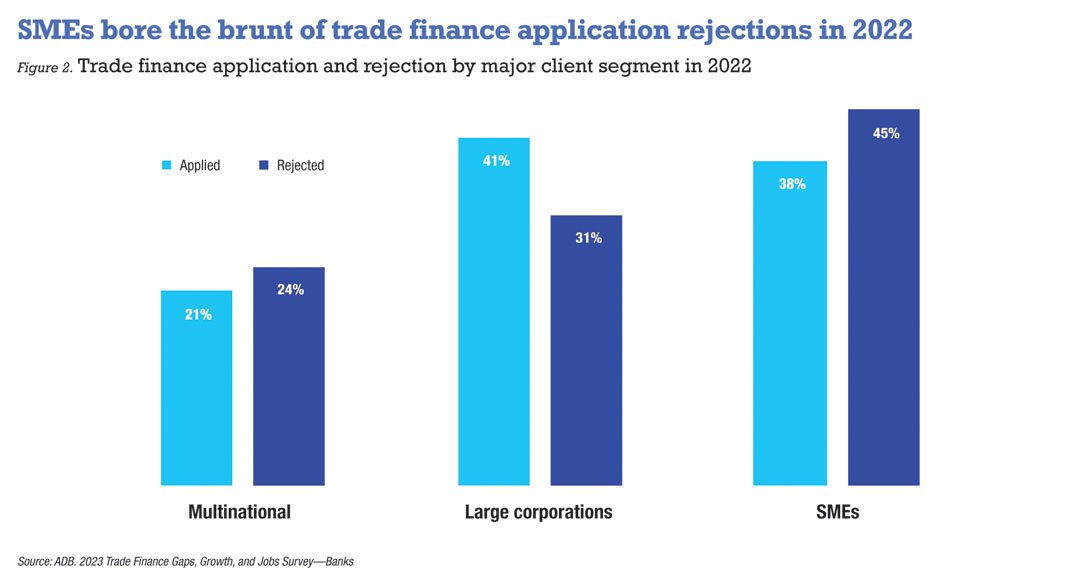

Global decoupling and geopolitical events increase counterparty risks, particularly affecting SME financing and exacerbating the global trade finance gap. Data from the 2023 Trade Finance Gaps, Growth and Jobs Survey by Asian Development Bank has already shown a material negative impact of this on SMEs. They disproportionately bore the burden of rejected credit applications (Figure 2). Figure 1 shows the global trade finance gap widening to a record $2.5 trillion in 2022 from $1.7 trillion in 2020 against a backdrop of tighter financial conditions, market uncertainties and geopolitical instability.

All of these factors collectively affect global trade finance. As these drivers transform the landscape, businesses are exploring new digital tools and solutions to adapt and thrive. Banks are responding by incorporating technology and innovation and exploring collaborative solutions to meet the challenges.

Banks offer multiple opportunities for trade digitalisation

Several global trade finance banks are exploring how the evolution of innovation, risk and technology continues to redefine global trade finance, and deliver priorities they are setting for their customers.

Recent black swan events—including persistently high interest rates and inflation—have not only heightened risk but also bolstered demand for trade financing. Given increased risks, players continue to implement more supply chain finance and open account solutions. Considering this, Bank of America (BoA) simplified its receivables and payables processing between counterparties and created the digital connection between buyers and suppliers. This eliminated paper-intensive trade finance resources and streamlined financing processes.

Geoff Brady, head of global trade and supply chain at BoA, described the drivers of its CashPro Supply Chain Solutions as initial steps of the bank’s trade and supply chain transformation journey. He explained: “We needed a solution that would create a digital connectivity between US-based buyers and suppliers in Asia Pacific. This necessitated it to be a global solution.”

Geoff Brady, Head of Global Trade and Supply Chain at Bank of America

BoA made several enhancements to its CashPro Trade and Supply Chain solutions. It added a new Trade Receivable Finance module which lets the supplier automate processes, including the uploading of invoice details and acceptance of discount on invoices. It also added a new Trade Risk Purchase module which automates the process for BoA to participate in supply chain financing (SCF) programs with other banks, further supporting the expansion of its own SCF portfolio through secondary participation.

Changes in consumer behaviour, disruptions in technology, transitions in environmental, social, and corporate governance (ESG), and geopolitical tensions, have forced banks to explore innovative digital tools that support customer resiliency. Recently, HSBC launched two new initiatives: HSBC TradePay and a new virtual card solution. HSBC TradePay allows customers to draw down trade loans and pay suppliers document-free, with loan processing under a minute. Corporate benefits include improved working capital and stronger relationships with their suppliers. In partnership with Oracle and Mastercard, the bank launched a new virtual card solution aimed at making faster B2B supplier payments and streamlining account receivables.

Looking at how to offer solutions by leveraging new tech to challenge old procedures and infrastructure, Vinay Mendonca, the bank’s chief growth officer for global trade and receivables finance said: “HSBC aims to provide solutions such as receivable finance to enhance liquidity and extend payment terms, supply chain finance to expedite supplier payments, and inventory finance for contingency management.”

Vinay Mendonca, Chief Growth Officer for Global Trade and Receivables Finance, HSBC

From a customer perspective, how they initiate a transaction and set up a limit matters. Hari Janakiraman, head of industry and innovation at ANZ Bank, discussed the acceleration in digitalisation of transactional and facility documents in the absence of a single trade window in Australia. There is also a growing demand for common and interoperable infrastructure among various platforms using APIs. The industry is also deepening direct connectivity with customers, using APIs to integrate into customer ecosystems. Janakiraman remarked: “We are seeing an increase in trade finance API capabilities for corporate-to-bank interaction and that includes Swift’s own guarantee capabilities.”

Hari Janakiraman, Head of Industry and Innovation, ANZ Bank

To drive uniformity in standards, the International Chamber of Commerce (ICC) and Swift released the first interoperable standard model API for bank guarantees and letters of credit. These aim to offer richer data, reduce friction, and tandardize processes. Swift and ICC operating standards are compatible with both MT798 and some elements of the future IS0 20022 format to minimise disruption to existing trade systems. The new API models also enable trade finance platforms, as well as corporates and banks to align all their trade data, bringing Global trade digitalisation to the edge of reality.

As corporates diversify their supply chain sourcing, there is a rapid shift in how banks are meeting their procurement and financing needs through innovation and digitalisation. To respond to greater demand for time-to-market, Standard Chartered Bank drives ecosystem connectivity and access to its financing solutions via third-party platforms and fintech partnerships. StanChart is involved in supply blockchain-based finance initiatives with fintechs such as Linklogis, Taulia and Demica. Samuel Mathew, group head of flow and financial institution trade at the bank briefly explained what goes behind these partnerships: “As a part of the investments into these partnerships, we look at scalability, the strategic sense, back-office efficiency and implications for operations.”

Mathew also happens to be on the leadership team of ICC as the vice-chair for ICC Banking Commission. He gave a forward-looking account of a planned pipeline of initiatives, saying: “ICC is also working on disclosures for supply chains and standards/frameworks for sustainability 2.0 within the textiles space.”

Samuel Mathew, Group Head of Flow and Financial Institution Trade, Standard Chartered Bank

As different banks roll out disparate solutions to put the industry on a collective path of digitalisation, the move is confronted by several challenges—emergence of digital islands being the most widely discussed. Digital islands emerge from stakeholders pursuing disparate agendas within their customer ecosystems, and these solutions don’t necessarily talk to one another. This challenge gets further compounded by disagreement on the application of a common, scalable, and interoperable technology, and legal barriers hindering the adoption of these standards.

Digital transaction laws to pave way for future reforms

The operation of many documents is important to international trade. These include bills of lading and exchange and are primarily legally premised on their physical possession, meaning digital documents are simply not an option. This is set to gradually change.

Sibos coincided with a significant development in the global trade finance industry: the UK’s Electronic Trade Documents Act (ETDA) became effective on 20 September, legally recognising digital forms of trade documents, including bills of lading. The proposed Electronic Trade Document Bill, based on a model law passed in 2017 by the UN International Trade group, gives electronic trade documents the same legal standing as the paper equivalents.

ICC has estimated that digitalising trade documents could generate $30 billion in new economic growth by 2024, and free up $270 billion in efficiency savings. Naturally, all eyes have been on the UK legislation bill to be enacted as the ETDA. Since the English law governs 80% of trade documents worldwide and 60% of global trade finance operates on English law, that would have a significant global impact not only on trade finance but insurance, customs, and so on.

Mathew sees positive prospects for trade digitalisation with the adoption of digital transaction laws. He added: “With the laws and legal systems falling into place, like in Singapore, which came up with the Electronic Transactions Act back in 2021, and UK coincidentally approving it, it comes into law in the UK. With that base of countries adopting the Digital Transactions Act, it will help digitalise trade as well.”

UK became the first G7 country to rubber-stamp the ETDA. The legislation is compatible with the UN’s model law on electronic transferable records (MLETR) that aims to bridge the trade finance gap by addressing the digital transferability of documents and instruments, such as bills of lading, warehouse receipts and promissory notes.

While the adoption of MLETR is uneven among G7 members, emerging countries have been quick to adopt it. Countries like Papua New Guinea, Belize, Kiribati, Bahrain, Paraguay, the Abu Dhabi Global Markets in the United Arab Emirates and Singapore have already adopted MLETR. India has expressed preliminary interest and China in collaboration with the Asian Development Bank, has indicated a strong interest in MLETR too.

Australia is also looking into expanding the regulation and signing the United Nations Commission on International Trade Law MLETR to support the use of digital trade documentation and bridging the gap on trade finance access in Australia. Janakiraman explained: “We are also advocating for MLETR in Australia and that is a work in progress. Right now, it’s at conversation level and we don’t have a timeline, but authorities do understand that it is important.”

Cracks in consolidation of fintechs, trade finance consortiums

Digitalisation of trade continues to follow a non-linear path, with many steps forward and the same backwards. The advantages are clear, and overcoming the numerous significant challenges is essential.

Take for instance the emergence of several bank consortiums. While they are built on robust collaboration and formed to address the industry’s ecosystem challenges, they have failed to balance difference interests, let alone achieve the scale and interoperability needed for long-term operational sustainability. Contour, a digital trade finance platform aimed at digitalising and streamlining the documentary trade process, joined the growing list of consortiums such as Marco Polo, we.trade and Tradelens that failed to maintain operations. The business models mostly relied on transactional fees to cover operational revenue but there are limitations to an upside on fees.

Bohani Hlungwane, group head of trade and working capital for corporate and investment banking at Absa Bank commented: “They have battled to reach the required scale for financial viability.” The fintechs are typically unable to attract volume through their platform and as a result are not able to generate sufficient revenue, and their main shareholders are no longer able to support it. Absa was the first African bank to join Contour in August 2023. Contour’s network boasted a growing network of 21 major trade banks including a range of partners in integration and documentation.

Bohani Hlungwane, Group Head of Trade and Working Capital, Corporate and Investment Banking, Absa Bank

Naturally, two questions arise: what went wrong and what does the collapse of consortiums like Contour mean for the industry and the future of collaborative trade finance? There is no single answer, but achieving true interoperability is far from easy, and more complex and deep-rooted than it appears. Hlungwane added: “The collapse of Contour highlights that whilst we have seen many innovative technologies and solutions emerging over the past couple of years, they have battled to reach the required scale for financial viability. This is mainly because of two key challenges—interoperability and global standards.”

On whether recent developments such as the entry of UK’s ETDA and standards addressing current digitalisation challenges will alleviate concerns, Hlungwane said: “The solution will not be as straight forward as this. Different markets and regulators are at different levels of maturity and focus when it comes to the adoption of UN’s MLETR, so this will progress at a relatively slow rate.” He was also right to point out that a correction was due in the fintech, platform and consortium space and that consolidation was inevitable. He added: “The view was always that at the height, there were simply too many fintechs emerging and this created a number of digital silos that compounded the challenge to create scale, and that gradually there would be consolidation.”

Then there are the inherent challenges of digitalising a complex and global industry. Creating a universally accepted platform based on acceptable and scalable technology that meets the needs of all stakeholders is a monumental task. Janakiraman observed: “Digitalising trade is hard and it’s not a race. Not one institution, entity or bank can do it alone. Since it’s an ecosystem, bringing everyone together takes time.”

New initiatives transforming future of trade and SCF

With global supply chains changing, banks are exploring technology and innovation to revolutionise the underlying finance functions.

StanChart is working on various digital trade initiatives, including improving client interactions, and providing transaction status transparency. It launched Trade Track-It, an open portal that addresses client inquiries about transaction progress and status of letters of credit and guarantees. Mathew said that since the launch of the portal, client enquiries have dropped by more than 20%.

As tokenised assets have seen significant interest and experimentation in recent years, the bank is also exploring blockchain and crypto technologies to tokenise trade assets of real-world value. Under Project Guardian, an initiative by the Monetary Authority of Singapore (MAS), StanChart launched a trade finance tokenisation pilot to digitalise the trade distribution market by transforming trade assets into transferable instruments. The solution aims to enhance liquidity in the trade finance sector. Mathew asks some valid questions: “How do we take real-world assets like trade assets into the bank’s balance sheet? How do you fractionalise and tokenise it and sell it to investors?”

The programme received strong interest from institutional investors, and there are plans for the tokens to be traded on exchanges in the future. Kai Fehr, head of global trade at StanChart said: “What we did with Singapore Stock Exchange and MAS to find the solution—how we tokenise the asset and make it an investable and tradable asset class. We’ve done a $520 million tranche, a senior and junior tranche, with different types of coupons.”

Kai Fehr, Head of Global Trade,

Standard Chartered Bank

As a part of its CashPro supply chain platform functionalities, BoA introduced Open Account Automation to expedite invoice approval and payments. It speeds up the time to approve an invoice from days to minutes. Open Account Automation collates data that exists within the supply chain ecosystem and delivers visibility, speed, and automation and allows for quicker decision making. The solution incorporates an ecosystem-centric approach. Brady clarified: “One of the things that we wanted to build into the ecosystem is flexibility. And flexibility means not just the different counterparties in the ecosystem but also sometimes the solution itself.”

On whether tokenisation will be a part of the solution in future, he commented: “The ultimate capability to transact using tokenised documents would be something that would be inclusive to the ecosystem, but this solution does not include tokenising documents upfront. We want it to be scalable, and the solution to grow as commerce evolves.”

ESG and sustainability on ‘must take action’ agenda

The need to promote sustainable business practices has moved up the corporate agenda. This is awakened by conscious consumerism, stakeholder activism and further spurred by increasing governmental and regulatory action.

With over 30 sessions dedicated to how financial services can be a force for good to foster sustainable business practices, ESG was high on this year’s Sibos agenda. TABInsights heat map analysis in Figure 4 also showed the increased importance of ESG and sustainability among respondents. It rose from single digit values to 16% to 25% in 2023.

Ole Matthiessen, head of corporate banking for Asia Pacific at Deutsche Bank observed that ESG has changed from being a key performance indicator (KPI) to an underlying driver of profitability. Deutsche Bank has integrated ESG deeply into its strategy, committing to direct EUR 500 billion ($535 billion) towards sustainable finance by 2025. The bank has assisted customers in structuring their KPIs and metrics besides facilitating investment financing for their transition. It is also aiding clients in incorporating ESG into their SCF programmes to incentivise suppliers.

Ole Matthiessen, Head of Corporate Banking for Asia Pacific, Deutsche Bank

Matthiessen said: “When we look one step further for our corporate clients, there is a huge focus for not stopping at green and sustainable financing, but really thinking about scope-3 emissions across the entire supply chain. We see more regions and communities adapting the need to be able to trace the carbon footprint of products to consume.”

For BoA, ESG is about working with the right partners and alongside customers and their suppliers. It implemented a sustainable SCF program for a stevia-manufacturing company in China. Based on Supplier Ethical Data Exchange audits, and an independent inspection and certification, the company’s farmers were rated gold, silver or bronze based on their ESG performance. This scoring is translated into tiered pricing with gold standard suppliers being offered the best financing rate under its SCF program. Brady explained: “We want to work with the right partners in the ecosystem that do sustainability scoring and understand what constitutes sustainability in different markets and in different industries, better than any one institution might by themselves.”

StanChart recognised that there was a dearth of—and demand for—sustainable loan products in the financial services industry to support sustainable trade loan growth. It launched a sustainable trade loan offering for the industry. It provides liquidity to support the underlying trade flows associated with sustainable development. Fehr explained: “As a bank-to-bank partner, we refinance liquidity, we provide balance sheet commitments to banks as part of our correspondent banking offering, but we didn’t have the product that supported their growth agenda and sustainable trade. So we looked into the mechanics and various frameworks and our answer to that gap was a sustainable trade finance loan for banks.”

Geoeconomics shape outlook for global trade finance

The current geoeconomics is shaping ‘what goods go where’ and this has added complexity to existing trade and supply chain flows. The good news is that despite the war in Ukraine and the lingering impact of the pandemic, trade volumes have held up in the first half of 2023, but the outlook remains dim.

The war between Israel and Palestine in addition to the intensification of bipolar trade tensions between China and the US could amplify vulnerabilities in commodity markets. This in turn can hamper international supply chains. As the world comes to grips with global decoupling, geopolitical events can heighten counterparty risks, especially cutting-off financing for SMEs. It makes the world for banks a riskier place to lend, potentially worsening the global trade finance gap.