- Thirteen out of the 22 markets experienced asset growth deceleration, including Bangladesh, China, India, Japan, Hong Kong, Thailand and Indonesia.

- Asset gap between the largest Chinese and Japanese banks has widened

- Out of the 500 largest banks, 85% of banks reported a rise in net profit in FY2021

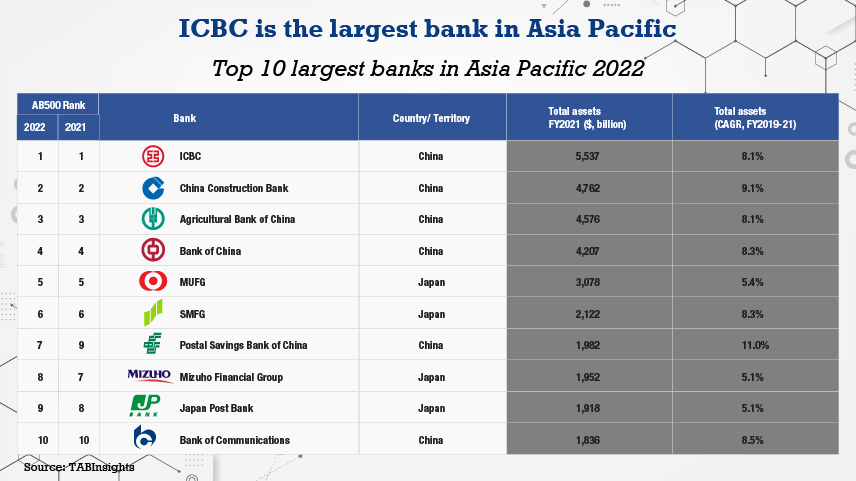

The top 20 largest banks in Asia Pacific are the same as last year, although there has been some modest movement within the rankings. This is according to The Asian Banker 500 (AB500) 2022, an evaluation of the 500 largest commercial banks and financial holding companies in the region for the financial year (FY) 2021, with a March 2022 cutoff.

This year’s evaluation covered 22 countries, territories and special administrative regions. The 500 largest banks combined had $76.4 trillion in total assets, $40.7 trillion in net loans, $52.8 trillion in customer deposits and $529 billion in net profit. Banks in China held the largest share of total assets, at 55.3%, followed by Japan (18.5%), Australia (4.5%), South Korea (4.0%), Hong Kong (4.0%), India (3.7%), Taiwan (2.9%) and Singapore (1.9%).

There were 29 banks with total assets greater than $500 billion, comprising 15 Chinese banks, five Japanese banks, four Australian banks, two South Korean banks and one each from Hong Kong, India and Singapore. The total assets of China Guangfa Bank and DBS Group topped $500 billion for the first time.

Commonwealth Bank of Australia (CBA) overtook Australia and New Zealand Banking Group (ANZ) as the largest bank in Australia. CBA expanded its total asset by 7.5% in FY2021, while the total assets of ANZ shrank by 6.1%. Bank Mandiri surpassed Bank Rakyat Indonesia as the largest bank in Indonesia. Bank for Investment and Development of Vietnam also overtook Vietnam Bank for Agriculture and Rural Development as the largest in Vietnam. Cambodia’s Advanced Bank of Asia made it to the list this year, as its total assets surged by 39.4% in 2020 and 28.3% in 2021. With total assets of $7.86 billion at the end of 2021, it became the largest bank in Cambodia.

Asset growth moderated

The 500 largest banks recorded a weighted average asset growth of 7.9% in FY2021, slower than 10.7% in FY2020. Thirteen out of the 22 markets experienced asset growth deceleration, including Bangladesh, China, India, Japan, Hong Kong, Thailand and Indonesia. Out of the top 20 largest banks in the region, only Bank of China, Bank of Communications and CBA saw asset growth accelerate in FY2021.

The asset growth rate of Chinese banks on the list averaged 8.3% in 2021, down from 10.8% in 2020, while their average loan growth fell from 13% to 12.1%. Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China, the four largest banks in China and Asia Pacific, posted a slower average asset growth at 7.2% in 2021, down from 9.6% in 2020. The total assets of Shanghai Pudong Development Bank and China Minsheng Banking Corporation, the ninth and 11th largest banks in China, only grew by 2.2% and 0.04%, respectively.

Banks in Bangladesh, Cambodia, India, Kazakhstan, Pakistan, Sri Lanka and Vietnam maintained a double-digit asset growth, while total assets of bank in Malaysia, Hong Kong and Japan grew slower at 4.1%, 5%, and 5.8%, respectively. The weighted average asset growth rate of Hong Kong banks declined from 9.2% in 2020 to 5% in 2021, while their loan

growth improved from 4.1% to 6.5%. Hongkong and Shanghai Banking Corporation (HSBC) saw asset growth slow from 8.7% to 5.2%. Its net loans expanded by 4.7% in 2021 after contracting by 1.4% in 2020. The total assets of Standard Chartered Bank (Hong Kong) increased by only 0.9% in 2021, compared with 16% in 2020.

Japanese banks slid down the rankings

The top 20 largest banks are the same as last year, although there has been some modest movement within the rankings. Mitsubishi UFJ Financial Group (MUFG) and Sumitomo Mitsui Financial Group kept their positions as the region’s fifth and sixth largest banks. However, the asset gap between the largest Chinese and Japanese banks widened, as the Japanese Yen fell sharply against the US dollar. Bank of China, the smallest among China’s Big Four banks was 37% larger than MUFG in terms of total assets at the end of FY2021, compared to 15% in the previous year. For Japanese banks, FY2021 refers to the financial year ended 31 March 2022.

Mizuho Financial Group and Japan Post Bank each slipped down the rankings from seventh and eighth last year to eighth and ninth this year, while Postal Savings Bank of China moved up two places to seventh. Postal Savings Bank of China registered the strongest asset growth among the top 20 largest banks, at 10.9% in 2021, followed by China Merchants Bank at 10.6% and Ping An Bank at 10.1%. The ranking of Mizuho Financial Group and Japan Post Bank is expected to fall further as the Japanese Yen hit a 24-year low against the US dollar in September 2022.

HSBC fell one notch to 14th, while China’s Industrial Bank gained two spots to 12th as its total assets grew by 10.5% in 2020 and 9% in 2021 to $1,354 billion. It’s expected that HSBC will be surpassed by China CITIC Bank and drop to 15th in a year or two.

Profit rebounded

Out of the 500 banks, 427 reported an increase in net profit in FY2021, reflecting an economic rebound from the COVID-19 pandemic. The aggregate net profit generated by the 500 largest banks amounted to $528.9 billion, increasing from $425 billion in the previous year. Overall, the Asia Pacific banks booked less loan loss provisions in FY2021,

which helped them achieve higher net profit.

Hong Kong was the only market that witnessed a reduction in aggregate net profit of banks on the list, except for Kazakhstan which saw First Heartland Jusan Bank drop off the list. Banks in Bangladesh, Brunei, Pakistan, the Philippines and Singapore also recorded a drop in their aggregate pre-impairment operating profit.

The aggregate net profit of the 19 Hong Kong banks on the list shrank by 5.5% in 2021. These banks recorded a 3.3% contraction in their aggregate operating income amid the low interest rate environment. This, along with the 8.4% rise in their aggregate operating expenses, led to the 12.9% reduction in their aggregate pre-impairment operating profit.

HSBC, Bank of China (Hong Kong) and Standard Chartered Bank (Hong Kong) saw net profit down by 4%, 12% and 34%, respectively.

The aggregate net profit of banks in Sri Lanka increased the most, at 80%, followed by Malaysia (73%), Australia (58%), the Philippines (56%) and India (53%). Sri Lanka and Vietnam are the two countries that saw banks’ aggregate pre-impairment operating profit rise the most, at 38.2% and 34.3%, respectively. The aggregate pre-impairment operating profit of banks in Malaysia, Australia and India was up by 5.1%, 5.9% and 10.9%, respectively, while the Philippines posted a 13.1% fall in banks’ aggregate pre-impairment operating profit. In addition, consolidation trends within the banking industry continued. The pandemic accelerated the consolidation process in China, helping small banks that face heightened pressure to gain scale and reinforce competitiveness to survive.

The merger of five local banks in Shanxi province created a larger bank and Zhongyuan Bank merged with three other local banks in Henan province. In India, HDFC Bank received in-principle approval from the Reserve Bank of India for the merger with its parent HDFC. Meanwhile, banks also pursued mergers and acquisitions to accelerate growth in other markets. Singapore’s UOB acquired Citigroup’s consumer banking businesses in Malaysia, Thailand, Indonesia and Vietnam.

Click here to see the Largest Banks in Asia Pacific 2022