• Cross-border payments and remittances fuelled by regional trade growth and digitalisation

• Interoperability key to maximising full potential of digital payments

• UAE’s Buna cross-border multicurrency payment system

The Middle East is seeing a transformation in cross-border payments and international remittances, driven by the surge in regional trade, rapid digitalisation, and a shift in labour and capital mobility. Migrant workers rely heavily on international remittance services within and outside the region to send funds to families in their motherland. To keep the economy humming, member countries of the Arab Monetary Fund (AMF) are enhancing intraregional cross-border payments with the goal of making services more inclusive.

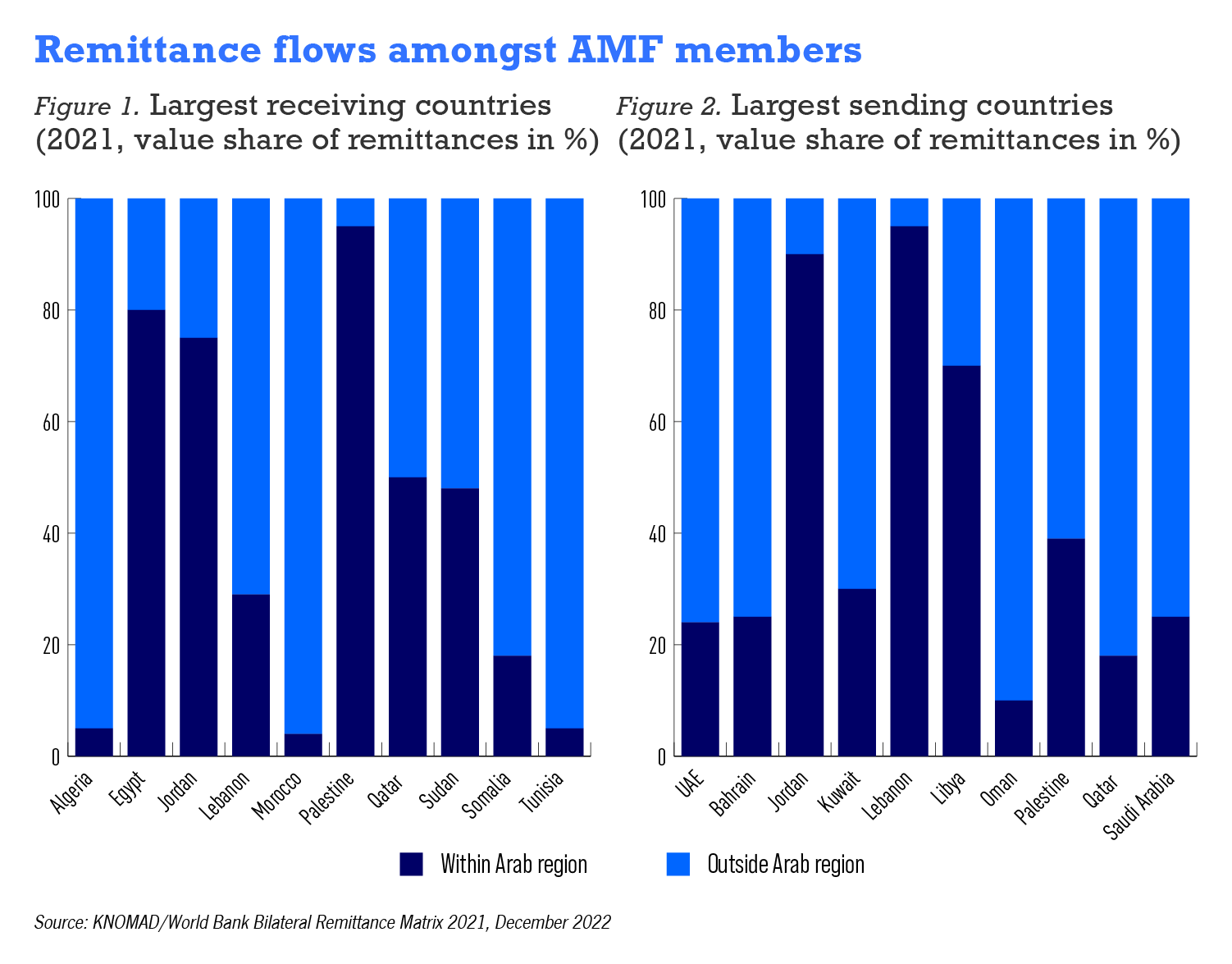

According to the Bank for International Settlements, countries like Lebanon, Egypt, Jordan, Morocco, and Tunisia experience substantial inflows of remittances. Kuwait, Oman, and Saudi Arabia, on the other hand, are significant senders of remittances. Additionally, Algeria, Morocco, and Tunisia rely significantly on remittances from countries outside the Middle East and North Africa regions because of economic partnerships and trade relations with global partners.

One of the primary objectives of policymakers in the AMF is to improve the efficiency, speed, and cost-effectiveness of cross-border payments while addressing financial compliance, and strengthening the oversight of payment systems. This aligns with the goals set by the G20 to enhance the effectiveness of cross-border payment systems worldwide.

One of the primary objectives of policymakers in the AMF is to improve the efficiency, speed, and cost-effectiveness of cross-border payments while addressing financial compliance, and strengthening the oversight of payment systems. This aligns with the goals set by the G20 to enhance the effectiveness of cross-border payment systems worldwide.

Interoperability key to maximising full potential of digital payments

Despite advancements, interoperability remains a critical challenge in the region’s payment systems. The lack of a standardised framework leads to inefficiencies for users when conducting transactions. For example, banks with a local presence can access payment systems directly, while non-banks cannot. Addressing this issue is key to unlocking the full potential of digital and mobile payments in the Middle East.

Hence, policymakers are focusing on interoperability, extending operating hours for real-time gross settlement systems (RTGS), and expanding access to payment systems—this, whether through direct or indirect means, is fundamental to achieving cross-border goals.

Creating multilateral platforms or linking payment systems is another approach to enhancing cross-border payments. This strategy can reduce overall costs, increase transparency, and speed up transactions. Interlinking arrangements allow banks and payment service providers to conduct transactions directly without relying on one payment system or using intermediaries such as correspondent banks.

To improve the speed in cross-border payments, the operating hours of RTGS systems need to be aligned. In the Middle East, RTGS hours are shorter than the global average. However, they align with major currencies like the US dollar. There’s also some overlap with Asian RTGS systems, which is important for remittance corridors.

UAE’s Buna cross-border multicurrency payment system

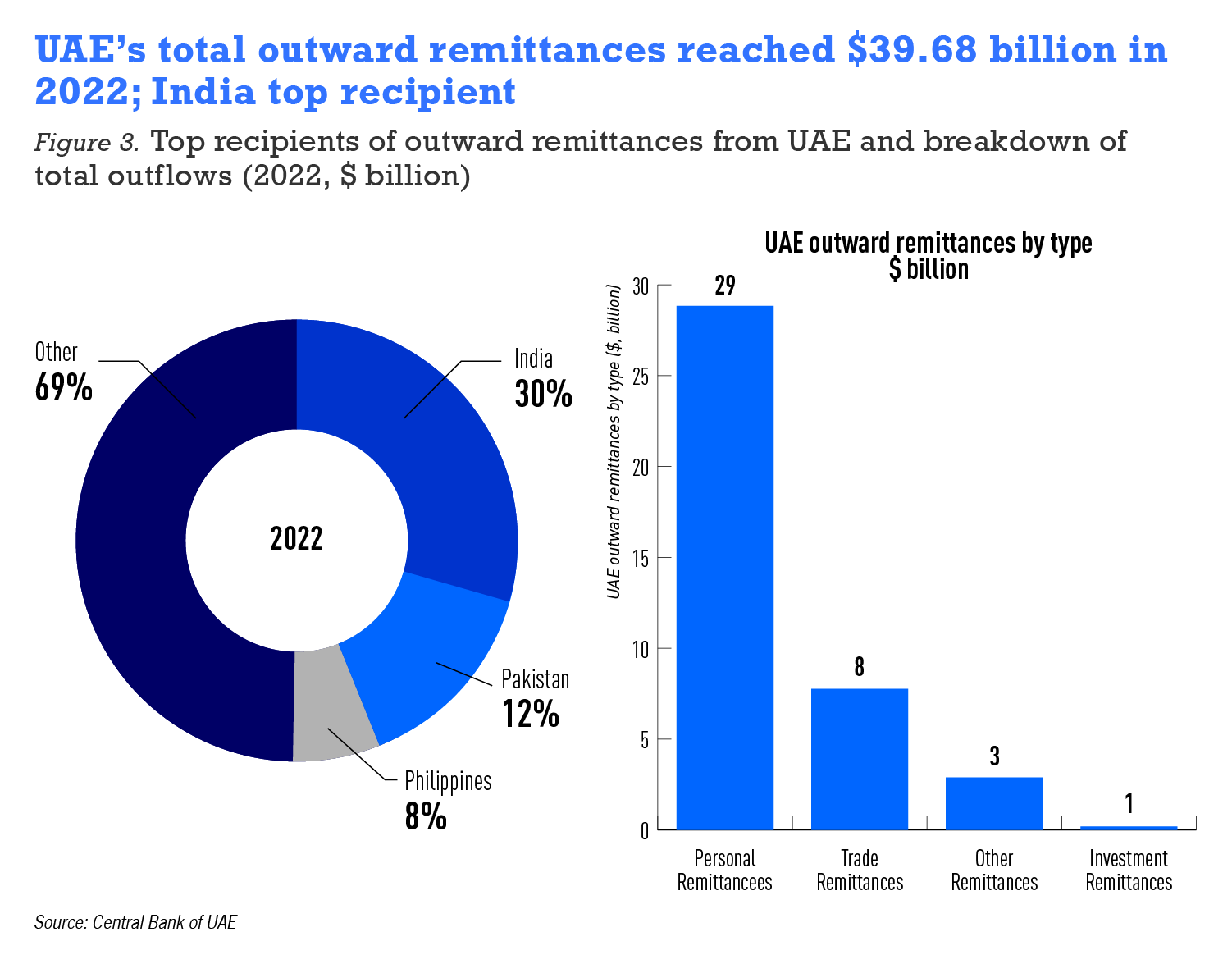

The United Arab Emirates (UAE) has a robust remittance market, fuelled by the region’s diverse expatriate community. They make up 88% of the total population here and contribute significantly to international remittances. According to the Financial Stability Report 2022 of the Central Bank of the UAE, outward remittances surged to AED 145.7 billion ($39.67 billion) in 2022. India emerged as the top recipient country, receiving 31% of remittances, followed by Pakistan at 12% and the Philippines at 8%.

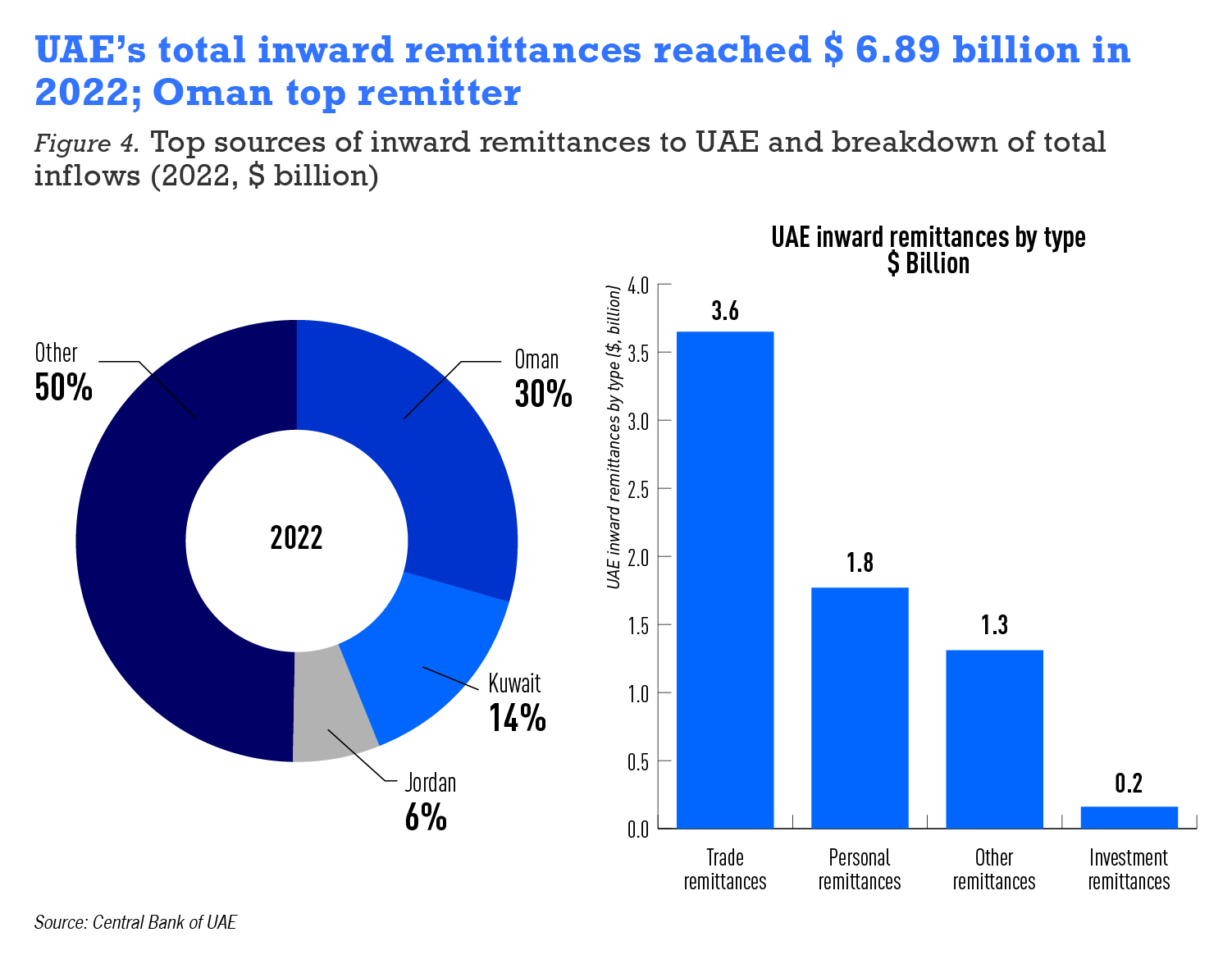

Total inward remittances to the UAE amounted to AED 25.3 billion ($6.89 billion). Among the top contributors to this inflow were Oman accounting for 30%, Kuwait for 14%, and Jordan for 6%.

The UAE’s position as a global remittance hub is driven by its strategic geographic location, robust infrastructure, and a business-friendly environment. Its well-established financial services sector, including banks and money transfer operators, facilitates seamless cross-border fund transfers for individuals and businesses. Its digital infrastructure and adoption of innovative fintech solutions have also played a significant role in modernising the remittance sector and enhancing efficiency.

The country’s attractiveness to international migrants is attributed to the diverse job opportunities across sectors such as finance, construction, hospitality, and technology. This wide employment market attracts talent from all over the world and generates substantial remittance flows as money moves to native countries.

In 2018, the AMF introduced Buna, a cross-border and multicurrency payment system in the UAE. It went live in 2020, facilitating seamless transactions across currencies such as AED (UAE Dirham), SAR (Saudi Riyal), EGP (Egyptian Pound), and JOD (Jordanian Dinar), as well as major international currencies USD and EUR.

Buna provides a centralised platform for commercial banks, central banks, and other financial institutions to send and receive payments in real time. This model simplifies the process, offering a single point of connection for international payment systems seeking links with participating AMF member countries. Payment systems like Buna play an important role in cross-border payments by enhancing financial connectivity and promoting economic growth in the Middle East.