Macroeconomic situation in Indonesia

Indonesia encountered its weakest year in 2014 amid an unstable world economy. Compared with a 5.5% growth rate in 2013, Indonesia’s annual economic growth rate in 2014 was lower than expected and remained at 5.02%. Since the beginning of 2015, the Indonesian government has adjusted relevant policies and reforms, expecting the growth rate to remain unchanged in 2015 at 5.2% and to further accelerate to 5.5% in 2016. In February 2015, Bank Indonesia (BI), the country’s central bank, trimmed its benchmark interest rate for the first time in three years, from 7.75% to 7.5%. However, in the second quarter of 2015, the growth rate of GDP was 4.67% year-on-year (YoY), which was the slowest pace since 2009. This was somehow in tandem with what Bank Indonesia said about the Indonesia banking industry in 2015: its national banking industry will face a slower, but sustainable growth and the credit growth will still be expected to go down to 13%–15% in 2015.

Indonesian retail lending market

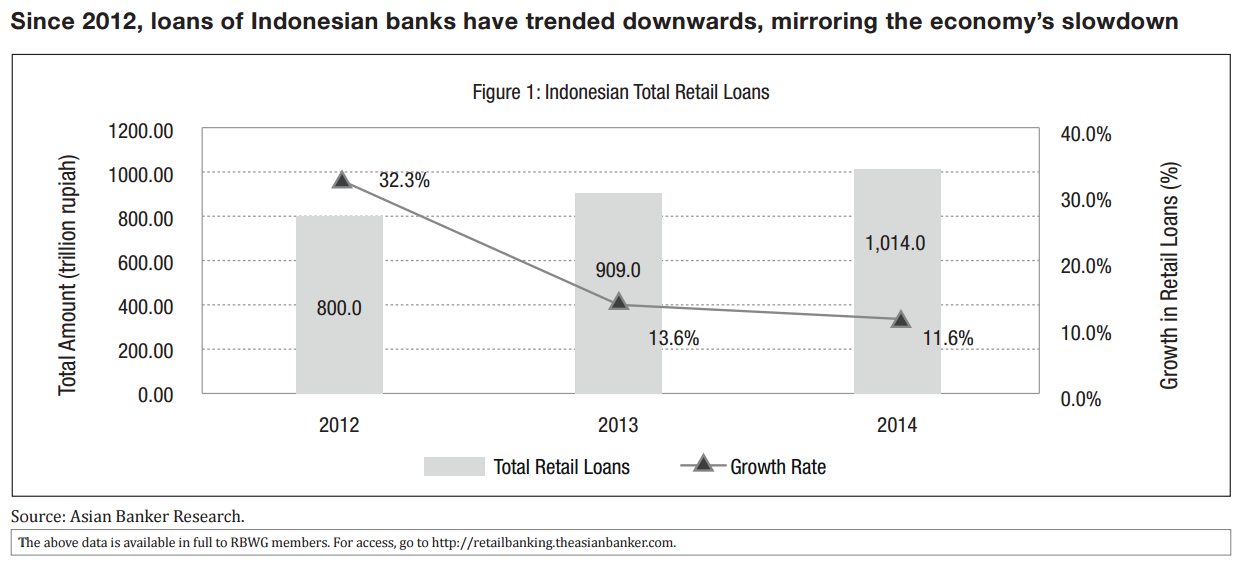

In 2014, loans across all the segments in the banking sector grew by 11.2% compared to 22.1% in 2013. This was a clear indication of the slowdown in the economy. Local, sharia, and state-owned banks expect to boost loans in 2015 by focusing on their retail consumers and increasingly on small and medium enterprises (SME). Alternatively, banks would develop fee-based income to compensate for decreasing loan growth. As retail loans are an integral part of the retail banking industry, mortgages and unsecured personal loans are considered key consumer products for bank revenue. TAB research shows that Indonesian total retail loans grew 11.6% YoY to Rp1,014 trillion, from Rp909 trillion since 2014. This growth was lower compared to that in 2013 when loans grew by 13.6% YoY (Figure 1). Although the Indonesian government has implemented some packages to boost the economy, demand for consumer loans still takes time to revive people’s purchasing power. Retail banking in Indonesia is all set to thrive in terms of increased growth in loans. This is mainly attributed to the growing earning potential of both lower and middle income classes.

Bank Mandiri performance

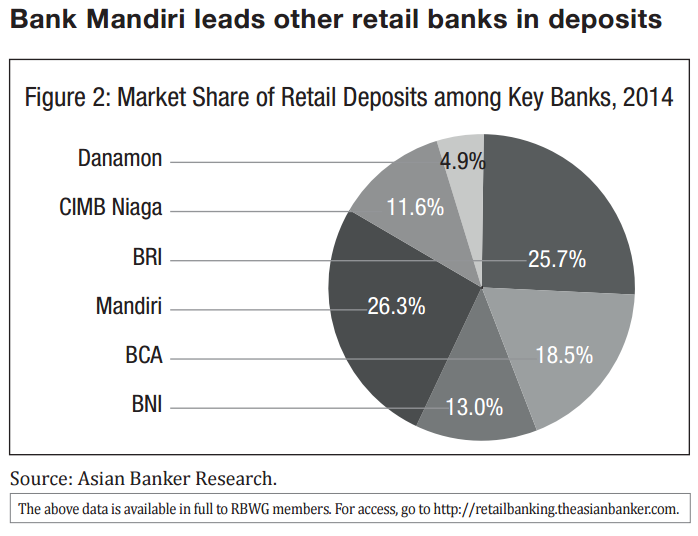

Bank Mandiri, the country’s largest bank by assets, has made use of its asset advantage to become an important player in retail banking. It achieved a 26.3% market share in retail deposits and a 10% market share in retail lending among key retail banks in Indonesia in 2015 (Figure 2). This increased market share has been achieved by a strategy of focusing specifically on micro and retail banking consumers and reaching out to the unbanked populations.

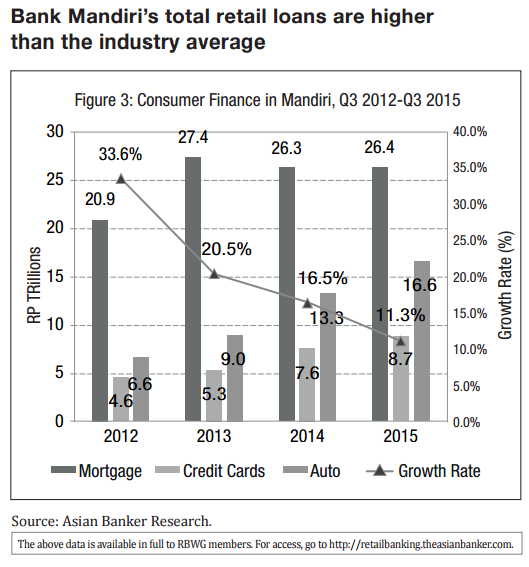

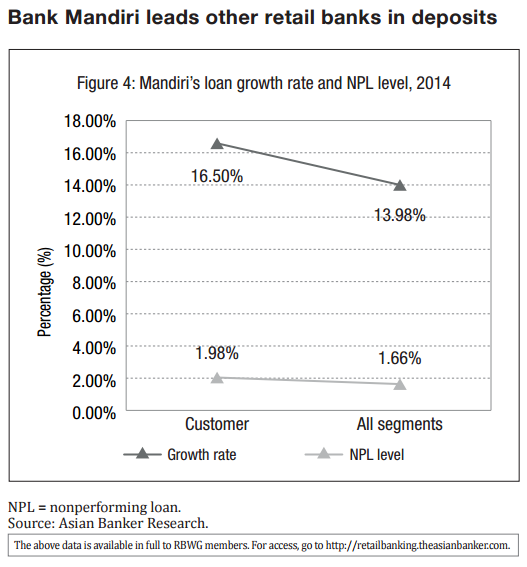

Despite fierce competitors like BRI and BCA in consumer banking and strict regulations of Bank Indonesia, consumer finance business continued to grow in 2014 and 2015. Total retail loans rose 11.3% to Rp69.5 trillion from Rp62.4 trillion in 2014, faster than the average national growth of consumer financing industry (Figure 3). During 2014, Bank Mandiri maintained fairly good credit growth along with the NPL ratio of 1.66% and increased growth in its overall loan portfolio by 13.98% YoY. Consumer loan segment grew above average, by 16.5% YoY but at a slightly higher NPL level of 1.98% (Figure 4). This achievement has contributed to the application of reliable and integrated credit processes, which includes the identification of prospective lending sectors, an accurate and strict underwriting process, a continuous credit monitoring process, comprehensive portfolio management, and the disciplined resolution of nonperforming loans. Mortgage loans did not perform well in 2014, with a negative 3.7% growth rate, and till Q3 2015, mortgage loans still maintained the same amount as in 2014. Not surprisingly, auto loans rose 47.2% in 2014 to Rp13.3 trillion as Bank Indonesia earlier lowered down payments for auto loans. Credit cards also recorded satisfying results in 2014. The total number of credit cards was up to 3.82 million in 2014 with 510,000 new credit cards. Because of unique marketing strategies, Mandiri cornered 18% of market share in total debit cards in force. Credit card growth in 2015 reflects potential penetration and can be further improved due to stimulus packages that government implemented in Q1 2015 to revive purchasing power and consumption.

BCA performance in retail lending

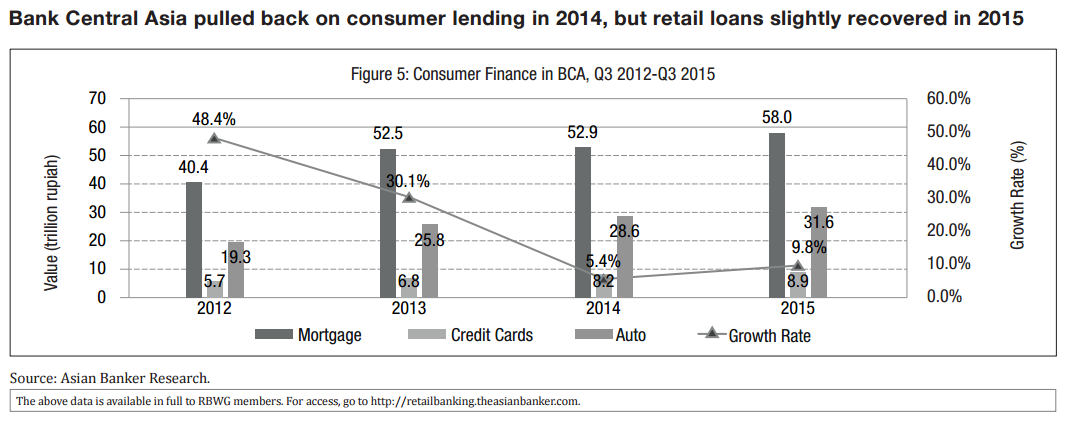

Bank Central Asia (BCA), the country’s largest private lender, pulled back on consumer lending in 2014 in line with the economy’s slowdown, higher interest rates, and tighter regulations. Throughout 2014, BCA recorded consumer loan growth of 5.4% with its credit quality maintained at a low NPL ratio of 0.7%, which reinforces the strength of its franchise. However, compared to a low growth rate of 5.4 % in 2014, this year witnessed a slight recovery of retail loans in BCA. Its aggregate consumer finance portfolio grew by 9.8% to Rp98.5 trillion in Q3 2015. Growth rates in mortgages and auto loans have remained the same despite the intense decline in credit card loans.

Mortgage lending

Mortgages remained BCA’s priority product in consumer finance with a portfolio growth of 9.5% in Q3 2015 to Rp 57.95 trillion, a 32.0% CAGR growth since 2007. The proportion reached 58.9% in total consumer lending while asset quality has remained at higher sustainable levels (Figure 5). A steady growth rate was supported by several strategies including reducing mortgage interest rates in Q4 2014 and a relaunch of a mortgage product called ”fix-and-cap”, enabling mortgage to be fixed at 8.88% for 3 years, to a maximum of 9.99%.

Credit cards

Credit cards remain an essential element in the bank’s product range, promoted as a cross-sell product for bank’s customers. In Q3 2014, BCA’s outstanding credit card balance grew 20.6% to Rp 8.9 trillion, securing the BCA as a leading provider of credit card services in Indonesia. The growth of the number of credit cards issued, yields a market share of 16.1% in 2014. BCA uses Electronic Data Capture as payment in Indonesia. With more than 13 million interconnected customers, BCA has an active usage rate of over 90%, resulting in an overall increase in credit card transaction volume of 18.0% to Rp 46.1 trillion in 2014. Although the growth rate of credit card loans was around 8.8%, BCA is recognised to be a leader in credit card business.

Auto lending

When it comes to consumer loans in BCA, auto lending has made up approximately 9%–10% of total consumer loans in 2014 and 2015. However, the presence of Loan-to-Value rules was introduced to prevent excessive consumer lending growth amid an uncertain economic situation and to establish a healthy consumer credit environment. The existence of new Loan-to-Value restrictions affected both the automotive industry and the growth of the auto finance industry in 2014. The number of the registered cars were recorded at 1.21 million units in 2014, down 1.8% from 1.23 million units in 2013. Meanwhile, total loans for car financing at the end of Q3 2014 and Q3 2015 stood at Rp 28.58 trillion and Rp 31.6 trillion, respectively. BCA adopted a risk-averse strategy in vehicles financing by prioritizing loans for the best-selling cars while penetrating a second-hand vehicle market for an optimal risk-return trade-off.

Digitising lending

Although retail lending industry in Indonesia is maintaining its momentum, banks like Mandiri and BCA encounter encounter bottlenecks in ensuring continuous growth in retail loans. TAB Research puts an eye on the digitalisation in Indonesia, the largest economy in Southeast Asia. There has been witnessed a shift towards a cashless society in Indonesia in its efforts to promote financial inclusion, branchless banking, and payments in the country. Currently, speaking of digitalisation in retail banking, BCA enhances customer comfort by providing e-statements and other credit card information digitally, autopay registration via SMS, easy conversion of transactions into installment facilities and online credit card applications. In 2014, BCA prepared the infrastructure to introduce PIN security for credit card transactions and conducted training to educate and socialize this feature among merchants and cashiers.

Mandiri dominates the lucrative e-money market in Indonesia with no less than four prepaid cards in circulation. As of end-2014, the bank had issued a total of five million prepaid cards. In 2014, the bank processed 143 million transactions. In October 2014, the bank launched Mandiri E-Cash, which allows users to register for an E-Cash account on their phones via USSD service. They can then use the same USSD number for top-ups, payments, and cash withdrawals from ATMs.

Under these circumstances, it seems retail banks in Indonesia haven’t embarked on digitalisation in retail lending. In the retail lending sector, we can consider digitised lending, combing retail banking with financial technology, as a new future solution. Digital lending can help create platforms for retail banks to form customercentric technology and help banks target newer customer categories as well. It would also correct for the inefficiencies found in the lending practices of traditional banking models. Interest rates will be individualised, the cost of underwriting loans will be less, loan decisions will not take long, and most importantly, small businesses would get an opportunity to acquire funds and can avoid shutdowns.

It is not that difficult to standardise loan products like mortgage loans, credit card loans, and car loans compared to corporate loans. Since formal financial institutions have connected only 22% of the Indonesian population, a huge potential for the financial sector still needs to be explored. It may be the next game-changing innovation in the retail lending industry in Indonesia.

.png)