- The COVID-19 pandemic has catalysed the surge of digital banking services in Hong Kong

- Mox and ZA Bank lead the competition in the digital banking industry

- Digital bank upstarts are years away from profits in Hong Kong

A growing number of customers are embracing digital platforms and services. This can be viewed as both an opportunity and a challenge for virtual banks. On the other hand, the growing awareness of digital platforms and services presents an opportunity for virtual banks – which have built their digital infrastructure from scratch – to offer bespoke products and an improved user experience to attract more customers.

There is a growing appetite for virtual banking in Hong Kong. Ninety-two percent of Hong Kong adults are aware of virtual banks, while 43% of non-virtual bank customers would consider using them. Sixty-five percent agreed that virtual banking is the future of banking.

Adoption of technological innovations was hastened across the banking sector

The pandemic has accelerated the adoption of technological innovations across the banking sector as a growing number of customers are embracing digital platforms and services. It has been observed that the global health crisis has catalysed the integration of technology with people’s way of living. A survey commissioned by Livi bank in Hong Kong late last year found that the pandemic had prompted a rise in digital adoption in consumers’ daily lives. Half of the consumers surveyed said that they shopped more online during the pandemic, with the majority (85%) saying that they were likely to continue their shopping habit post-COVID.

Traditional banks in Hong Kong have been preparing for the launch of digital banks for a few years. The pandemic has also acted as a catalyst for these banks to accelerate their digital transformation initiatives, narrowing the digital gap between traditional and digital banks.

Mox and ZA Bank lead Hong Kong’s digital banking

As acceptance of online banking surged in Hong Kong, three banks have taken lead of the market. Mox, ZA Bank, and WeLab are leading the digital banking in Hong Kong, accounting for around 86% of all virtual banking deposits. Hong Kong’s eight virtual banks had accumulated total customer deposits of HKD 15.8 billion ($2.03 billion) by the end of 2020.

ZA Bank was the first to launch in Hong Kong in March 2020. ZA Bank, which is run by a division of ZhongAn Online, an online only insurance provider based in Shanghai, offers personal and business loans and debit card services. ZA Bank reported in March 2021 that it had acquired around 300,000 clients during its first year of business. It also paid interest on reported deposits of HKD 6.04 billion ($780 million).

Mox, a virtual bank backed by Standard Chartered and its partners HKT, PCCW and Trip.com, has managed to surpass 100,000 customers as of April 2021. It has only been operational for about eight months when it reached the milestone. The digital bank intends to double its client base by the end of this year. It will be offering the typical personal loans, instalment payments, foreign exchange services, and wealth management services within a year. It received a total of HKD 5.2 billion ($670 million) in deposits. Starting from 19 July to 31 August 2021, the first 20,000 new customers who will open an account for the first time using the Mox x Tap and Go code will receive a cash reward as part of its Consumption Voucher Scheme (CVS).

Deniz Güven, CEO of Mox, said, “The CVS aims to accelerate both Hong Kong’s economic recovery as well as embrace digital payments by giving consumers digital cash for local spending. As a virtual bank, we believe there’s a role for Mox to play, especially on larger ticket items where customers can spend from a combination of their CVS funds and Mox Card”.

WeLab Bank, a virtual bank under fintech giant WeLab, reportedly had 10,000 new accounts in the first ten days of its launch, and had over 100,000 registered customers according to its Q1 financial result. Its parent company WeLab was reported to be seeking a $2 billion IPO listing in either the US or Hong Kong.

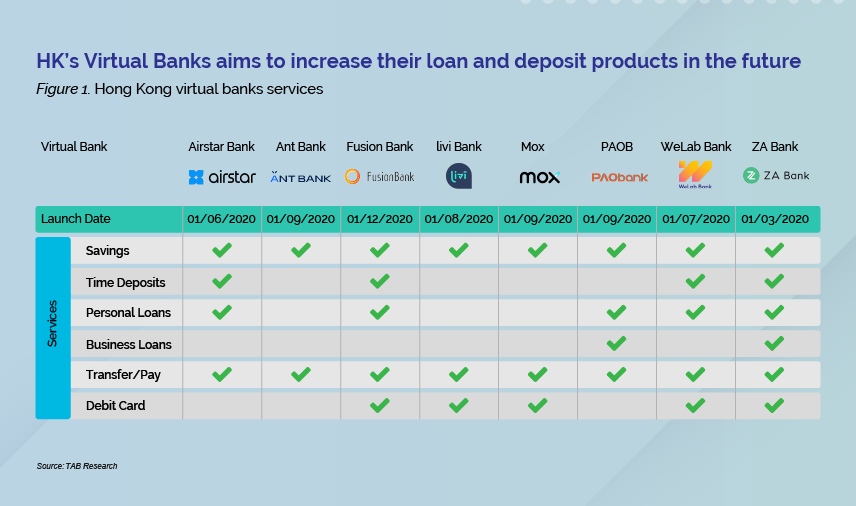

The virtual banks are expected to focus on offering more loans to their clients to boost revenue through interest income. In April, Mox Bank became the first virtual bank in Hong Kong to launch its own credit card services through its all-in-one Mox Card, while Airstar Bank launched a pilot corporate banking service offering in May. In terms of loans, four of the virtual banks had advances to customers as of December 2020, although the amounts for Mox and ZA Bank were negligible. Airstar Bank recorded a sizeable $71 million (HKD 557 million) of loans to customers, while Ping An OneConnect Bank had about $9 million (HKD 70 million).

Since early this year ZA Bank has already started to offer insurance products after it received a digital-only insurer licence from the Hong Kong Insurance authority.Mox has also began to offer its customers the option to flip between paying through debit or credit in its numberless payments card. Livi Bank, which recorded the least amount of deposits among the eight virtual banks at the end of 2020, was able to increase it by almost three times to reach $120 million in early July when it marked its first anniversary. It also integrated tokenisation technology into its debit card lineup through Mastercard Token Connect. This will give customers the ability to make payments without the need to enter card details, as well as improve security since card information is not directly stored on the merchant’s servers. Whether this is enough to entice more customers and keep up with the current leading virtual banks in Hong Kong remains to be seen.

Hong Kong’s virtual banks have yet to pose a serious threat to incumbent banks

As of December 2020 Mox's loss before taxation was $58 million (HKD 456 million), which increased by $24 million (HKD 191 million) from $34 million (HKD 265 million). ZA Bank on the other hand recorded a $25 million (HKD 194 million) loss in their 2020 year end report.

The two leading digital banks, Mox and ZA Bank, said they will start breaking even by 2024 at the earliest as they continue to build up operations and roll out new products.

"We are focusing on getting the highest market share, getting 4.8 stars by next year, getting the best NPS score, and the best feedback from customers. We also have our revenue targets but in terms of profitability, it’s too early to say something," said Guven.

Launching a bank, even a virtual one, is capital intensive and it typically takes years to scale up, achieve critical mass, and be profitable. Over a year after the first virtual bank was launched, they are gaining traction but have yet to pose a serious threat to incumbent banks such as HSBC, Hang Seng Bank and even Standard Chartered itself. However, incumbent banks are also making steps to keep up with the new competition. HSBC has removed its monthly fee for customers with deposits less than $643 (HKD 5000). Both HSBC and Standard Chartered have also announced plans to further integrate the greater bay area by allowing Hong Kong and Macau residents to invest in mainland China and vice versa.

Rockson Hsu, CEO of ZA Bank, in his interview with the Fintech Associatiion of Hong Kong highlighted that moving forward, a greater collaboration between banks and regulators would help improve banking products as well as asset quality. "The regulators are helping out especially with Commercial Data Interchange (CDI). That would help us virtual banks as well as traditional banks in terms of credit monitoring because one of the pain points is on the credit cost and we can have better ways to protect the bank and maintain asset quality. CDI is one thing the government is pushing through and hopefully that comes out smoothly."