- Nedbank’s retail gross revenue increased by 6.4%

- Outperformed South Africa’s top five retail banks on international CX metrics

- Built capabilities enabled by digital transformation

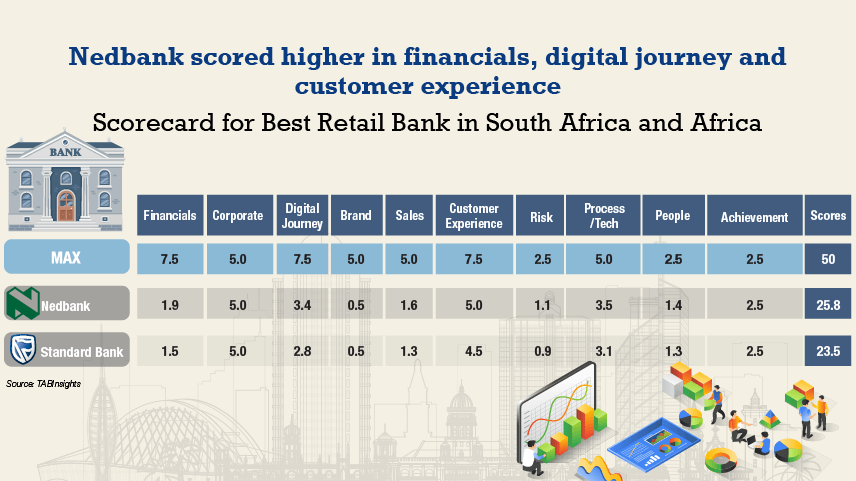

Singapore, 26 May 2022 – Nedbank, one of the largest commercial banks in South Africa was recognised for the second consecutive year as the Best Retail Bank in South Africa and Africa at the Excellence in Retail Financial Services International Awards 2022 presented by The Asian Banker.

Financial Performance: Nedbank’s retail gross revenue increased by 6.4%

Nedbank posted retail gross revenue of $1.29 billion in fiscal year (FY) 2021, up 6.4% from FY2020 when its gross retail revenue was $1.21 billion. The bank commanded a healthy return on equity (ROE) of 10.1%, a 9.3 percentage point year-on-year (YoY) increase in the previous FY which stood at 0.9%. It increased its retail contribution to total bank’s income to 38% in 2021 from 37% in 2020. The bank's cost-to-income ratio reached 61.4% in 2021 down from 62% in 2020. Nedbank’s net interest margin reached 6.01% in 2021 from 5.86% in 2020. Strong net interest income growth of 8% was enabled by robust average gross advances growth of 5%, including 10% on average in personal loans, 5% YoY on average in home loans, and 5% on average in vehicle loans. Market share of total retail loans, car loans and personal loans increased by 0.1%, 0.5% and 0.8% respectively. Nedbank also outperformed South Africa's "Big 4" banks on revenue growth, cost-to-income ratio (CIR) improvement, and headline earnings growth.

In comparison, Standard Bank's cost-to-income ratio increased from 63.3% in 2020 to 63.5% in 2021. The bank’s net interest margin reached 3.73% in 2021 from 3.7% in 2020.

Customer Experience: Nedbank outperformed South Africa’s top five retail banks on international customer experience metrics

Nedbank significantly improved cross-selling on its Eclipse onboarding platform with the launch of Everyday Banking in 2021. This enabled the bank to fulfil client needs easily at onboarding, and support improvements in cross-sell ratio. The bank leveraged the latest technologies, went paperless, digitised identity verification, and secured third-party data through application programming interface (API) to tailor product offerings.

On the Net Promoter Score (NPS), Nedbank has consistently improved for seven years and reduced the gap to reach number one in South Africa, from 35.3 points to 4.8 points in less than five years. Nedbank's NPS grew to 46.7% in 2021, and the YoY growth of 5.9% in 2020-2021 was second among the top five banks in the country. South Africa Client Satisfaction Index (SA-sci) stated that Nedbank improved its score from 81.1 points in 2020 to 81.9 points in 2021. Nedbank outperformed South African banking peers on digital sales, growing from 28% in 2020 to 32% in 2021 digital sales. Nedbank’s e-commerce platform, Avo, reached one million users within 21 months. Moreover, users of the Nedbank Money App grew 39% YoY to 1.6 million in 2021 from 976,000 in 2020.

Meanwhile, Standard Bank’s PayPulse solution enabled clients to pay anyone at any time. Customers could link up to three debit or credit cards from any bank to the service. This allowed them to pay for goods quickly and easily, send money to other PayPulse wallets, pay their municipal bills, buy airtime, pay for parking, and top up electricity credits. Meanwhile, South Africa Client Satisfaction Index (SA-sci) stated that Standard Bank scored 81.1 in 2021.

Key achievements: Building capabilities enabled by digital transformation

Nedbank’s client-centred growth strategy and execution plans focused on five core strategic levels:

- Creating leading financial experiences” by enhancing value propositions and client journeys.

- “Digital 1st and 1st in digital” by using digital channels to drive a lower cost operating model and improving customer experiences. 3. “Efficient and agile operating model” as part of digital transformation. Nedbank adopted the Scaled Agile Framework (SAFE) to ensure effective and efficient delivery of technology. 4. “Exploring new growth vectors” through digital ecosystems such as Avo (which reached over 675,000 users by December 2021) and enhanced growth in insurance funeral plan sales. 5. “Equipping people” by instituting several major initiatives for employees including leadership development, wellness, and improved benefits.

Standard Bank, meanwhile, built new businesses that created additional value for their clients. The bank’s LookSee platform leveraged its strength in mortgages to provide Consumer & High Net Worth (CHNW) clients with an expanded service offering, provide a market for business and commercial clients, particularly small and medium enterprises (SMEs), and create new revenue streams. The bank also invested in digital bank solutions for African SMEs focused on solving market-specific client needs. These include e-commerce solutions (SimplyBlu), flexible cash flow linked lending, alternative scoring methods to improve digital lending, and the new BizConnect platform to support start-ups.

About The Asian Banker

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com

You may visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/

To view the respective evaluation criteria, click here: https://awards.asianbankerforums.com/retailfinancial/criteria-country

For further information, you may get in touch with:

Chris Kapfer

Research Director

Tel: (+63) 90 6582 8117