- Half of the number of service disruptions in 2018 were to mobile and online banking channels.

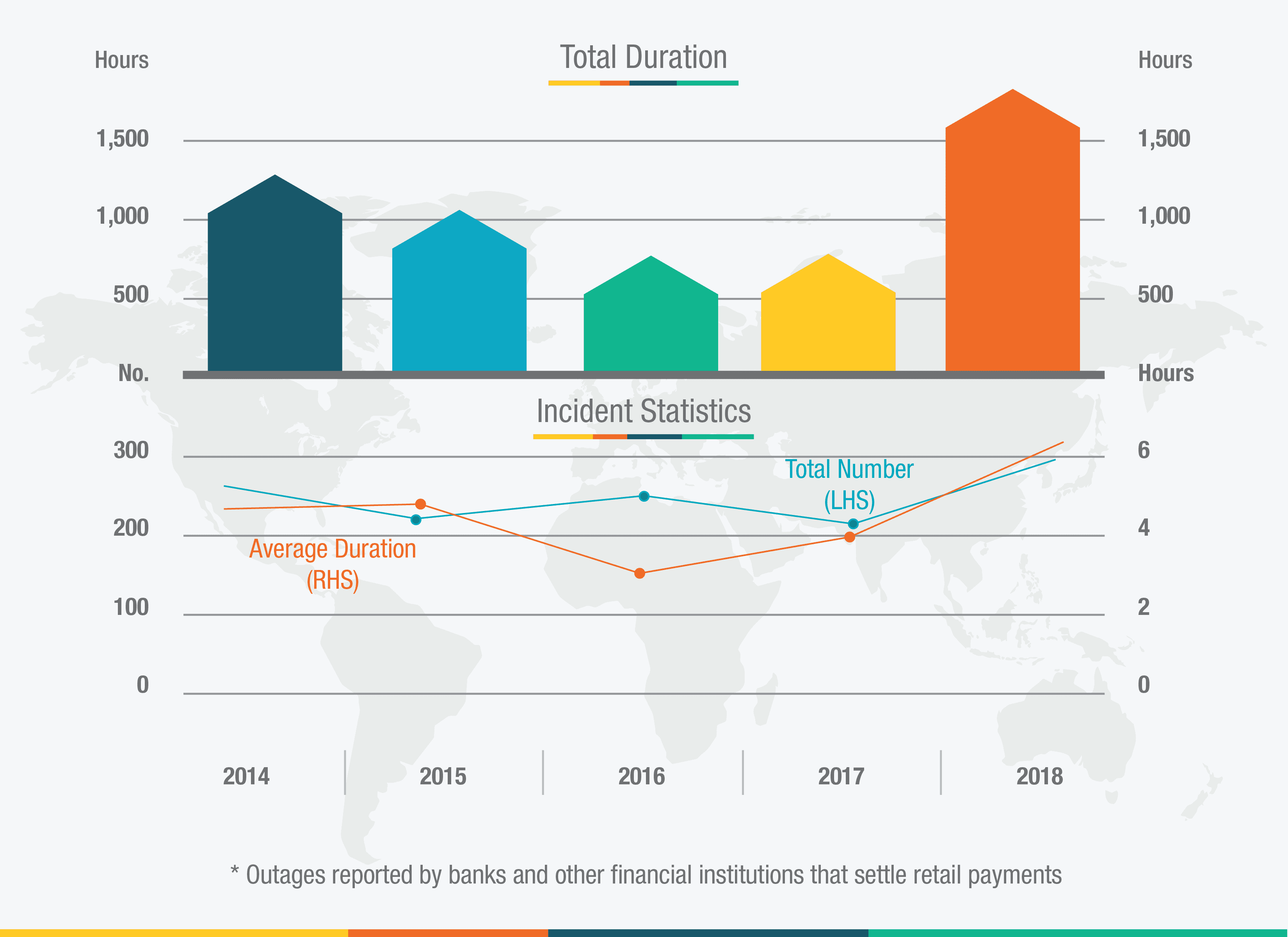

- Number of incidences rose from 200 to 300 in 2018. But average time to resolve incidences by banks rose from 3.5 to over 6 hours.

- Australian regulator will shift focus from mere monitoring to operational risk management.

In retail payments, regulators have been traditionally focused on efficiency and competition, yet outages that affect the ability of households and businesses – to make and receive payments, or access account information, and which can cause significant inconvenience and disruption – have become increasingly the center of attention. With the increasing use of electronic payment instruments, the resilience of these systems is becoming critical to day-to-day economic activity, said Michele Bullock, Reserve Bank of Australia (RBA) assistant governor, during a speech at the Central Bank Payments Conference in Berlin on 25 June. Ageing and complex systems within financial institutions pose a significant risk to the efficiency and resilience of modern payment systems.

RBA released data that cover retail payment incidents that – above certain thresholds – disrupt an operating site, retail clearing activity, and/or customer access to services and account information.

After an improving trend between 2014 and 2017, incidences rose sharply in 2018

Fig 1 Outages in Retail Payments

Source: RBA

Since 2018, there have been a number of high-profile incidents in Australia that have resulted in substantial customer disruption, according to the RBA. For example, Bullock said, a number of banks have experienced lengthy outages in their internet banking services, and there have been occasions when card acquiring services have been unavailable at the point of sale.

“Incidents were more frequent and services took longer to be restored. While I can’t show information for individual institutions, I can say that the higher level of retail outages was pretty much across the board,” she added.

Bullock went on to say that around half of the number of service disruptions in 2018 were to mobile and online banking channels, while card services accounted for around 10% of the incidents. Software failures where the most common causes of outages, which was attributed to an increase in complexity of the IT environment.