- Digital payments widen financial inclusion in Africa

- Supportive infrastructure and regulatory frameworks

- Payment providers explore new services

Digital payment platforms have played a vital role in expanding financial inclusion in Africa. Individuals who were once excluded from the formal banking systems can now access financial service such as savings accounts, loans, insurance, and investment options. This has also led to improved access to other services such as healthcare, education, and utilities.

Payment platforms have also been at the forefront of creating tailored payment solutions to address specific needs in the African market. Payment startups filled the service void left by traditional banks that failed to reach remote areas and cover several population segments.

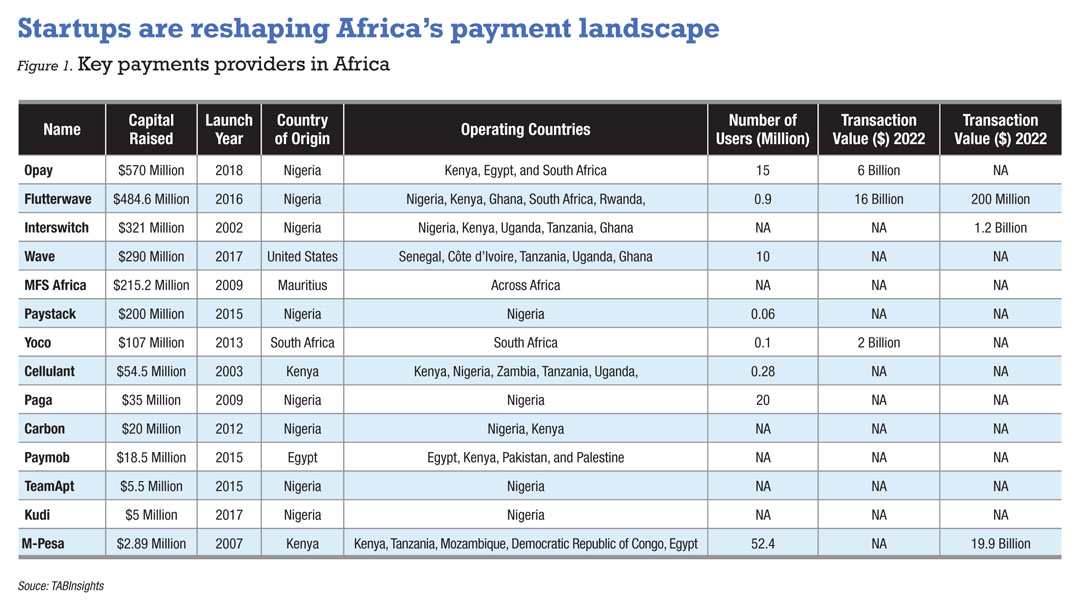

Fintech adoption has risen rapidly in Africa in recent years as the sector attracted more investments. In 2022, African payment start-ups secured $740 million in equity funding, a 55% increase from funding levels in 2019. Alongside the expansion of global fintech players, there has been an increase in new payment providers entering Africa, as well as specialised payment players focused on cross-border settlements and sector-specific solutions.

Fintech was the most funded startup sector in Africa in 2022, accounting for more than 40% of the total startup funding in the region. Nigeria received the largest volume of fintech funding, with investments of $666.4 million. It was followed by Egypt which cornered funding of $402 million. Meanwhile, South Africa secured around $132.6 million, and Ghana $96 million in fintech funding in 2022.

Supportive infrastructure and regulatory frameworks

Several countries in Africa have adopted the necessary infrastructure and policy frameworks to establish sophisticated electronic payment systems. Among these, Egypt, Ghana, Kenya, Nigeria, and South Africa were first out of the gate. Nigeria is expected to experience fast growth in electronic payments with real-time transaction volume forecasted to increase to 8.8 billion annually by 2026.

Other countries including Ghana, Ivory Coast, Kenya, Senegal, and Uganda are also expected to see annual growth in electronic payments by more than 20% annually. These countries are actively enhancing their electronic payment infrastructure and fostering an enabling environment for digital financial services.

Payment providers explore new services

Payment platforms in Africa are exploring more innovative solutions and diversifying their services to incorporate international payment wallets and tokens. Some platforms focus on niche markets by offering industry-specific payment solutions, while others are evolving into comprehensive marketplaces that connect buyers and sellers of products and services in an ecosystem.

As competition heats up, payment providers constantly look into ways to gain competitive advantage in the region. Some platforms use their geographical or language advantage to dominate specific regions with standardised compliance and currency. Regional coverage is another advantage for payment providers such as PesaPa that positioned itself as the gateway to East Africa. CinetPay, meanwhile, leads in West Africa.

Some payment providers offer tailored services to specific industries such as airlines, travel and tours, hotels, e-commerce, healthcare, and education. Cellulant and Flocash, for example, focused on managing airline transactions. Through their partnership with Kenya Airways in 2017, Cellulant offered various mobile and bank payment options for online bookings.

Other payment providers such as Remita and Xpress Payment are well-known for enabling government institutions to streamline payment processes and enhance financial management.

The role of payment initiatives goes beyond domestic transactions. By facilitating cross-border payments, platforms streamline cross-border transactions, reduce costs, and improve settlement times. Cross-border payment providers such as DusuPay provide businesses with payment solutions across Africa. These initiatives help enterprises overcome the challenges of fragmented payment systems and currency conversions.