The retail financial services industry continues to undergo a rapid process of digital transformation on its ability to connect with and service customers virtually. The desire to provide uninterrupted, safe and secure services emerged as the principal objective of retail institutions. The restrictive measures during the health crisis have completely altered traditional customer engagement process and necessitated a rethink of how retail banks can provide contactless and seamless support to customers.

Although the competitive advantages of digital capabilities and cost advantages were leveraged particularly well by Chinese entities, the pandemic-induced disruption continues across key markets in 2021. This is reflected in the top 10 retail bank ranking evaluated from this year’s programme for the Best Retail Bank in 2021. Overall, almost 490 submissions from 138 banks and non-bank retail financial services players located across the Asia Pacific (APAC) were received. Given that customer experience has become a priority of retail players as users engage across various digital touchpoints, The Asian Banker ran its BankQuality Consumer Survey and Ranking for the second year. It involved 11,000 bank customers in 11 markets across APAC.

Resurgence of new solutions from incumbent banks revitalises the customer journey

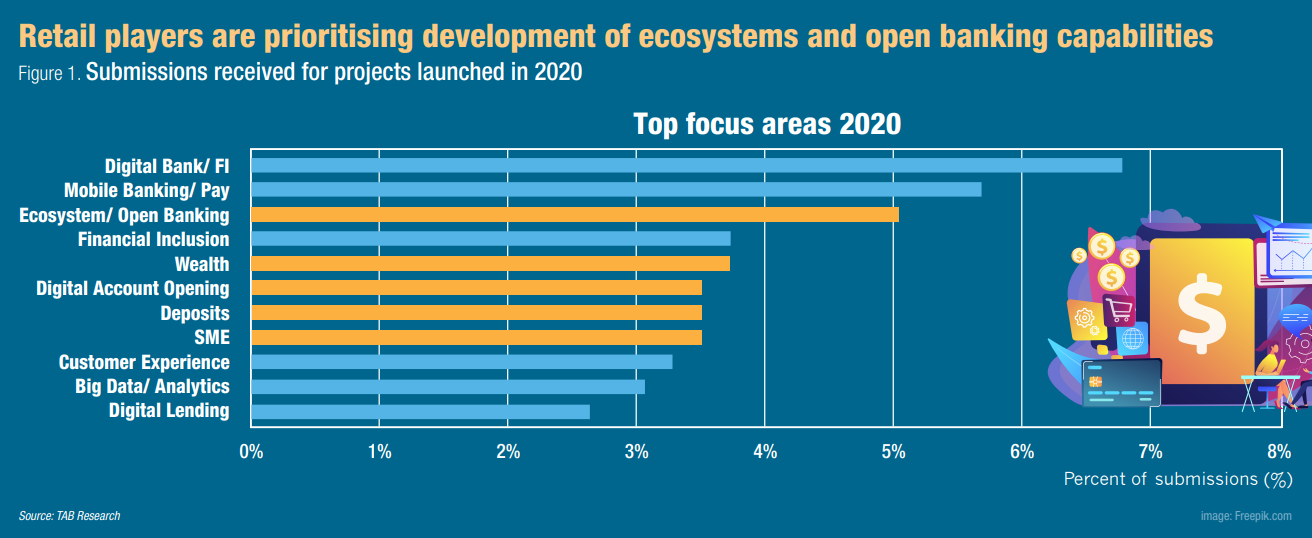

The principal interest for various retail players in 2020 remained centred on product-level award categories, while institutional bids under the Best Digital bank category remained equally popular. A key discernible shift that emerged from various retail players is centred on their priorities to introduce ecosystem/open banking initiatives and digital account opening solutions which is at a relative variance with the priority areas of the preceding years (see Figure 1).

Retail financial institutions struggled to defend their market position as increase in digital sales was largely insufficient in offsetting revenue loss from conventional brick-and-mortar channels. The franchise strength however was effectively built through further integration with prevailing ecosystems as retail players prioritised platform development. Digital onboarding developed as a key game-changing service differentiator throughout markets in APAC as retail providers looked to address challenges emanating from the service disruption as well as manage threats by various non-bank platforms operating within market.

Interestingly, financial education also emerged as a key consideration specifically targeted at millennials and the Generation Z segment to strengthen financial decision-making on managing personal wealth and control of credit. On the payments front, banks continued to build their e-wallet propositions and introduced buy now, pay later (BNPL) schemes while deepening the integration of QR-based infrastructure within the broader payment ecosystem.

Retail leaders continue to consolidate digital engagements while seeking sustainable growth

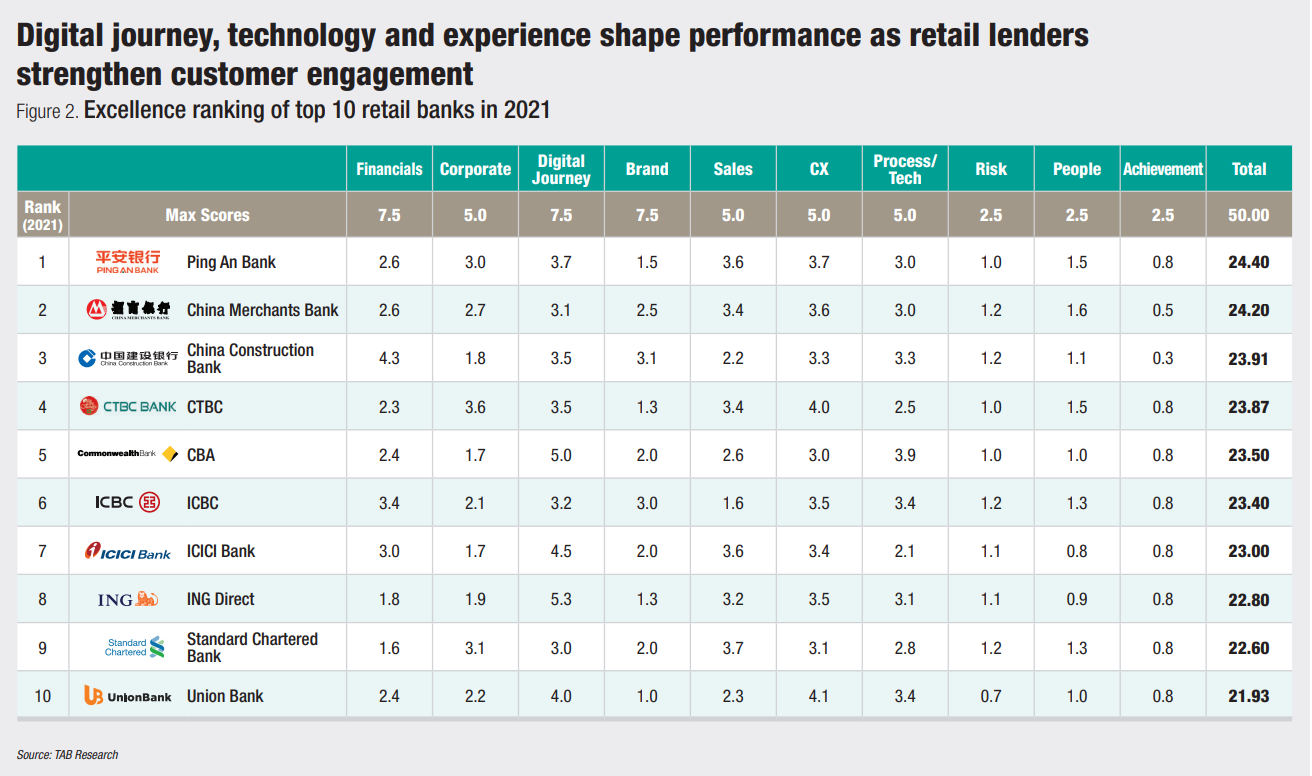

This year saw continued modifications to the Excellence programme as the balance scorecards used to assess institutions were refined to reflect new performance benchmarks, while institutional response to the COVID-19 global pandemic remained a key consideration. China’s Ping An Bank took the overall lead in this year’s programme. It scored high in customer experience, sales, and digital transformation journey while steadily building its position via application of open banking.

More than one-third of new to bank customers in 2020 were acquired via open banking as the bank deployed a light business model to enable a better customer experience reinforced through utilisationof advanced analytics and artificial intelligence (AI). Ping An Bank’s Open Banking 1.0 platform was put into production at the end of March 2020. It built financial and non-financial scenarios based on customer needs with over 1,300 APIs and 394 products on the platform, leveraging its existing strategic relationships with various ecosystem partners.

As institutions transition to an increasingly hyper-personalised product/service environment, retail players will be hard-pressed to leverage emerging technologies centred on big data capabilities, predictive analytical tools and AI to effectively compete with customer experience standards established by the larger technology platforms.

The desire to provide uninterrupted, safe and secure services emerged as a priority to institutions as repositioning by incumbents focused on delivery of new retail solutions continued. This year’s standout is Taiwan’s Cathay United Bank that successfully deployed a virtual customer assistant to handle clients’ problems. It also implemented a full digitalisation process to give customers the ability to apply for all insurance and banking services using the internet banking and KOKO platforms (digital bank). Korea’s kakaobank extended its services which enabled customers to check balances in other bank accounts on its mobile application through open banking services. It also cut its Western Union overseas international transfer fee to help aid customers amid the pandemic.

Platform development and super-apps shape customer-bank digital interactions

On the digital banking front, there has been a continued shift towards the development of platform-based business models and a rush to enable open banking capabilities. To date, most of them remain too product centric and most e-commerce offerings are often undifferentiated banner placements. Retail banks have tried to mitigate their losses via digital engagement and sales such as Australia’s CBA but for the most part digital capabilities could not compensate for the loss of its traditional business as COVID-19 cost remains high and loan demand remains subdued. Conventional retail players have either registered a decrease or stagnating top line revenue and overall retail ROE compared to previous years. Comparatively, it was pure digital players that have seen continuous strong revenue and profit momentum as compared to traditional banks. kakaobank comes to mind as its operating profit almost doubled in 2020 as the bank positions itself to launch an IPO in 2021.

WeBank has excelled in its scale of digital capabilities and also in strong digital infrastructure projects. WeBank is the first bank in China to build a fully autonomous and controllable distributed ledger system that supports hundreds of millions of users and dozens of use cases increasingly also beyond banking. The entire platform supports more than 360 million transactions per day. This reflects a broader trend where blockchain-based applications with retail banking use cases are increasingly becoming mainstream.

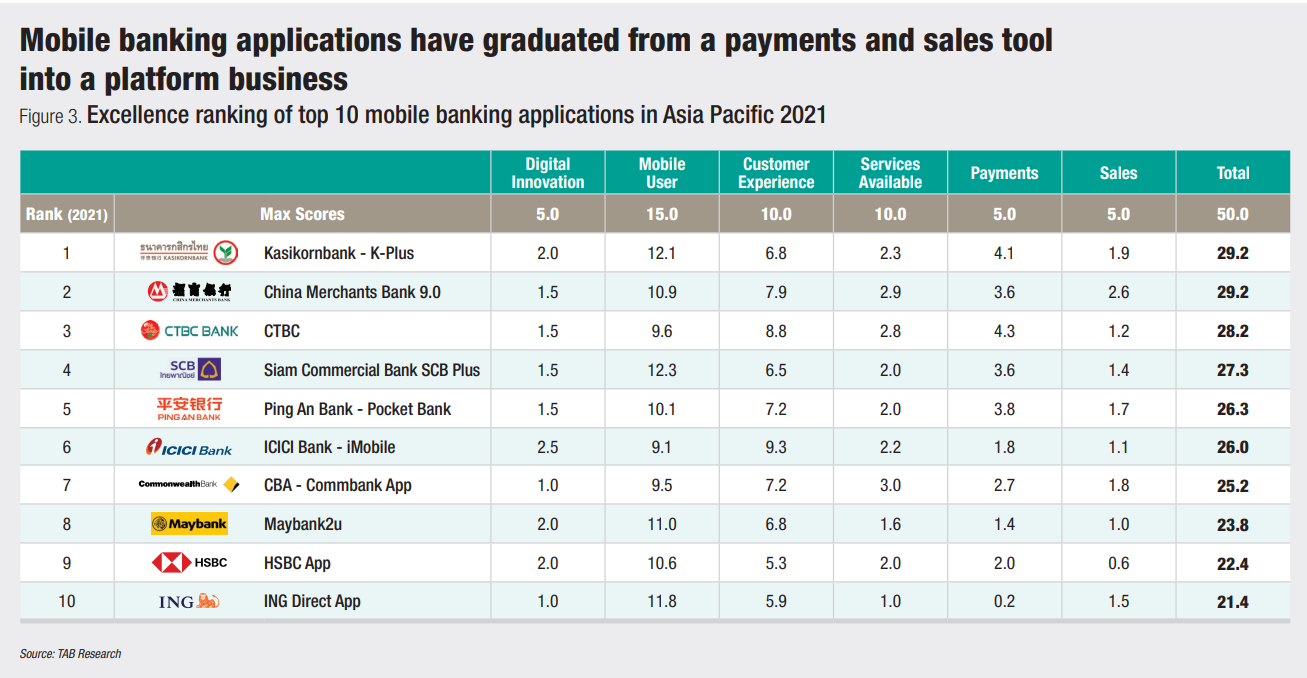

From a mobile banking perspective there is now increasing evidence that strong mobile banking apps are not exclusively reserved to mature markets in Asia. Strong user and service adoption in conjunction with effective mobile platforms are being rolled out across Asian markets (see Figure 3). Mobile banking applications have transitioned from being mere tools or channels of engagement to a platform with the services being rendered having gone beyond the scope of pure finance and trading to embedding financial scenarios and specific use cases crucial in addressing customer pain points.

Examining mobile banking applications for an emerging market bank, Kasikornbank’s K-Plus shows a very high mobile user rate and engagement level in 2020. It is also the first time in Thailand that a bank has fully and seamlessly connected its legacies to a non-bank’s platform (LINE platform), which is among the top two messaging platforms in Thailand.

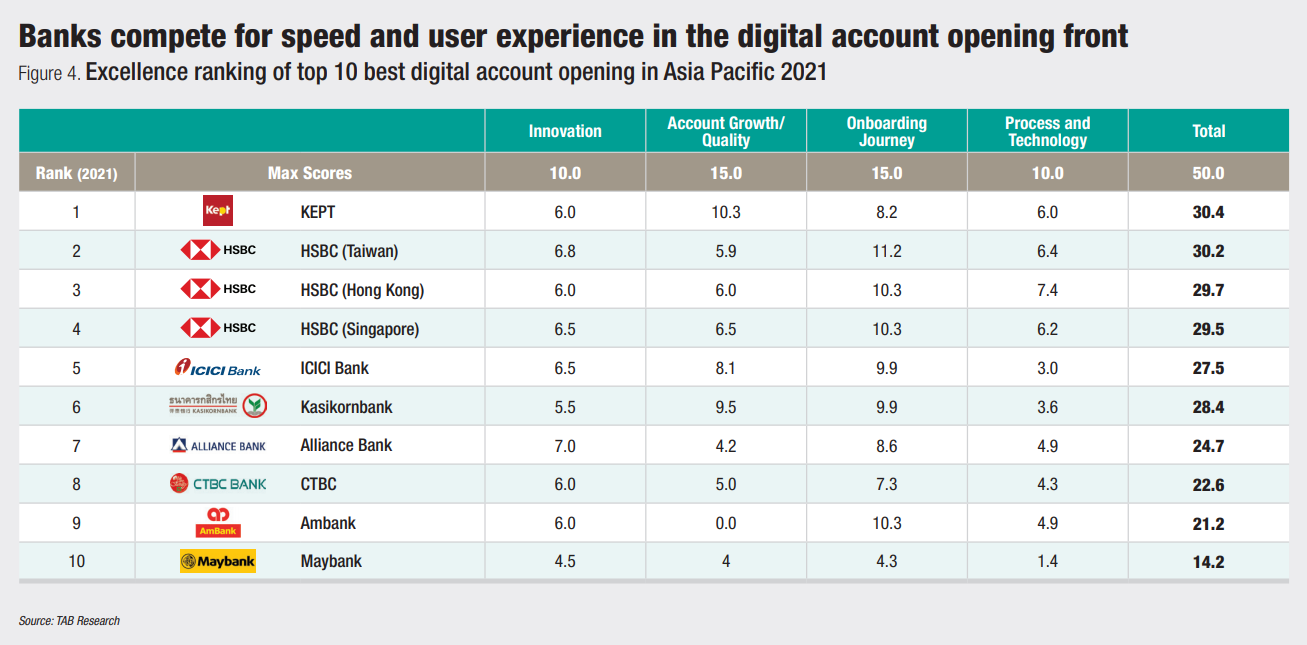

The digital onboarding engine KEPT by Krungsri has facilitated 130,000 new customers and registered 700,000 instalments and outranks other digital account opening platforms in the region (see Figure 4). The platform analyses the savings behaviour of consumers and also provides customers a practical tool to manage their money and save more effectively through the concept of one wallet. Customers can have better control of their expenses by setting a spending budget in the KEPT wallet.

Conventional retail players continued to witness rapid declines in footfall at their physical branches in 2020, forcing the industry to adapt quickly with re-engineering of operational workflow processes on an end-to-end basis. Despite an uncertain environment, the crisis created winners with institutions having the requisite digital capabilities in place prior to the pandemic and being able to quickly pivot to virtual engagement with customers.

Emerging challenges likely to reshape retail finance

As the industry transitions to an increasingly hyper-personalised product/service environment, retail players will be hard-pressed to leverage emerging technologies centred on big data capabilities, predictive analytical tools and AI to effectively compete with customer experience standards established by the larger technology platforms. There will also be an increased reliance by retail players across markets towards moving to a cloud-based IT infrastructure to support and complement the service initiatives and operational enhancements.

Non-bank players that have made inroads into the financial value chain beyond the ongoing and sustained disruption in payments will continue unabated. In Asia, OVO and Paytm are specialising as value aggregators and have been rolling out services in wealth and insurance as the plethora of digital wallets on offer are transforming payment options for consumers and merchants alike. Building ecosystems around certain business lines and differentiation of specialised apps for wealth management and SME banking is also on offer now.

Finally, the rise of crypto as both an investment class and store of value represents a game-changing shift in the evolution of money towards a digital and cashless society. The associated implication it represents in financial transactions is likely to have a deep and wide impact not only on retail financial services but beyond.