- Cross-border RMB trade settlement the most widely used product with significant growth in RMB cash management

- RMB progressively integrated into cross-border trade contracts by Chinese and overseas firms

- Geopolitical stability and key factors in expansion of RMB’s international use

The increased use of the Renminbi (RMB) in global trade raised some chatter over 2023 around the RMB becoming a stout contender against the US greenback, maybe even with the possibility of replacing it. The latter scenario emerged in part to insulate against the US sanction on cross-border payment excluding Russian banks from the Swift network. RMB internationalisation is also taking place around the development of the e-CNY, the central bank digital currency issued by the People’s Bank of China.

Beyond traditional multilateral or bilateral arrangements, central banks are actively exploring alternative avenues to the dollar-dominated financial infrastructure by harnessing technology. Their goal is to provide faster, more affordable, and secure cross-border payment and settlement solutions.

According to the Bank for International Settlements (BIS), CBDCs have the potential to reduce cross-border payment costs by up to 50%, enabling near-instant settlement of funds.

In 2022, BIS and four central banks embarked on a groundbreaking journey with Project mBridge. This initiative marked the successful pilot of CBDCs by commercial banks for real-value cross-border transactions. Across Hong Kong, Thailand, China, and the United Arab Emirates, 20 banks joined forces on the mBridge platform, executing a total of 164 payment and foreign exchange transactions valued at over USD 22 million. Among the various digital tokens tested, the e-CNY, featuring in 72 payment and foreign exchange transactions, emerged as the most actively-used token.

As successful pilots have already demonstrated the potential of CBDCs in cross-border transactions, particularly in terms of cost efficiency and liquidity improvement, the future holds the promise of even greater RMB usage in cross-border settlements.

However, the real story behind RMB internationalisation is one of China’s decade-long endeavour to build a global network and infrastructure for RMB clearing and settlement, to open and integrate China’s financial and capital market to the world, and to partner with countries around the globe in facilitating trade and investment. The Belt and Road Initiative (BRI) best manifests the country’s stoic venture.

Over the past decade, the BRI has experienced rapid growth, with China extending its financial investments and forging collaborative partnerships across 152 countries. These countries are signatories of the BRI memorandum of understanding that spans an extensive maritime trade route as well as the land-bound Silk Route from western China across Central Asia to Europe.

In the past 10 years, the overall cross-border trade volume amongst BRI countries achieved an annual growth rate of 8.6% from 2013 to 2022. In 2022, trade volume hit a record high of RMB 13.8 trillion ($1.9 trillion) with a year-on-year (YoY) growth of 19.4%, according to China customs data.

Currency for reserves, settlements, financing

The survey results show that both Chinese and overseas companies, and FIs continued to expand the use of RMB in cross-border trade settlements, cross-border investment and financing. This outcome aligns with the macro-level trend. Notably, as the comprehensiveness of RMB-based cross-border financial transactions continues to broaden, there is a significant increase in the demand from Chinese and overseas companies for RMB-based asset and liability management. The findings show significant increases in the use of RMB-based cross-border trade financing, offshore RMB financing, and cash management among the institutions compared to the previous year’s survey.

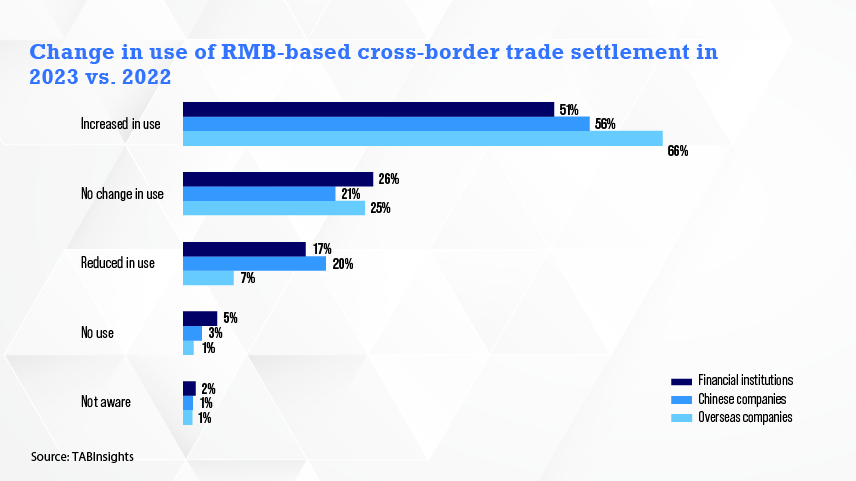

More than half of FIs (51%), Chinese companies (56%) and overseas companies (66%) reported that they have increased the use of RMB in cross-border trade settlement, with around another quarter reporting no change in use. 17% of FIs, 20% of Chinese companies and 7% of overseas companies reported that they reduced RMB use in cross-border trade settlement, compared to 2022’s survey result.

RMB-based cross-border cash management was most widely used by overseas companies, with a 58% adoption rate and YoY growth of 37%, followed by 53% of FIs at a slightly higher YoY growth rate of 49%. It was used by less than half of Chinese companies at 49%, but grew by a strong 39% YoY.

RMB increasingly integrated into cross-border trade contracts

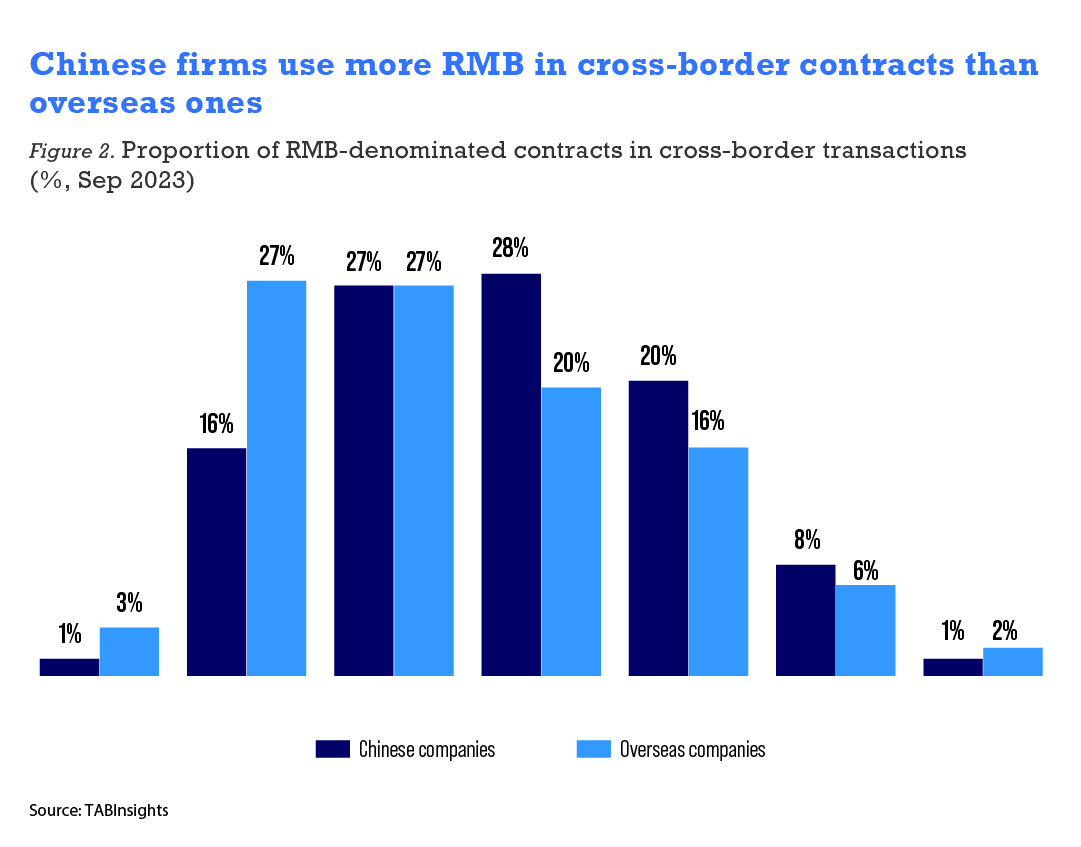

This year, there was a focus on understanding the use of RMB for contracts in cross-border trade. Similar to the situation with RMB trade settlement, more than half of Chinese and overseas companies used RMB in their trade contracts.

Some 54% of overseas companies denominated their contracts in RMB. Of these, half had less than 10% of contracts in RMB, and the other half between 11% and 20%. A marginally higher proportion of Chinese companies, or 55%, used RMB for cross-border trade invoices and contracts; 27% used RMB for between 11% and 20% of contracts, while 28% used it for between 21% and 41% of contracts. Both groups expected to continue to use RMB for cross-border trade contracts, with adoption rates above 20%, and all with positive growth at various levels.

Compared with last year’s survey results, the respondents’ selection of main challenges affecting RMB internationalisation continued to focus on the ongoing geo-political tension, China’s uncertain economic prospects, and RMB exchange-rate fluctuations. However, the sentiment among the three sets of survey respondents is evolving.

The results of this year’s survey show that geopolitical tension in general was one of the biggest challenges for all respondent groups. It was also the top challenge for overseas companies this year for 50% of respondents, compared to 45% last year. Some 56% of Chinese companies also found geopolitical tension the biggest challenge this year, though the number has dropped from last year’s 74%. For FIs, the statistic stayed the same from 2022 to 2023 at 62%.

About 55% of FIs, 54% of Chinese companies and 49% of overseas companies all cited the volatility of the RMB to be the second biggest challenge, up from 53%, 48% and 34%, respectively, last year. It is worth mentioning that Chinese and overseas companies had diverging views on the impact of China’s economic outlook: 49% of Chinese companies this year regarded the uncertainty in China’s economic outlook as a major challenge, a sharp rise from 37% last year; for overseas companies, this decreased from 53% last year to 35% this year. The view for FIs remained relatively constant in this regard at 53%, just 1 percentage point lower than last year.

Surveyed institutions were also asked about their prospects on using digital currencies to conduct financial transactions, and both overseas and Chinese companies showed increased interest compared to two years ago. The survey indicated that 80% overseas companies and 56% Chinese companies are willing to use digital currencies to conduct financial transactions compared to 62% and 30%, respectively, two years ago. Those who are undecided and not willing to use digital currencies dropped dramatically for both categories of respondents from 35% and 68% two years ago to 19% and 43%, respectively, this year. FIs are still more conservative compared to surveyed companies on adopting digital currencies in their transactions. Although 60% of FIs this year demonstrated interest in using the digital currency, it is two percentage points lower than two years ago, while those responding ‘still deciding’ and ‘not willing to use’ increased from 34% two years ago to 36% this year.

Certainly, having the requisite market infrastructure in place is essential to cater to this increased investor demand for quality RMB-denominated assets. The draft of policy initiatives that have helped liberalise China’s financial markets now include cooperation between the US and China on audit supervision, and upgrading the various stock-connect and wealth-connect programmes in the Greater Bay Area. It is perhaps the latter that has emerged as most significant, resonating most with 53% of FIs who intend to increase the usage of RMB owing to this programme.

Global RMB usage is shaped by geopolitics, macroeconomics, infrastructure, and technology. China’s financial market opening, innovation, and macroeconomic stability contribute to its growing international currency status. Despite challenges like geopolitical shifts and interest-rate differentials, the RMB is forging a new era of inclusive development.

Read the full report here: RMB Internationalisation Report