- The country’s first internet-only bank paves the way for the industry to increase competitiveness in the retail banking sector

- Innovative digital financial products and services engage with contemporary consumers with a voracious digital appetite, as legacy banks and new entrants compete in a crowded retail environment

- Dominant banks are quickly moving to occupy the valuable mobile banking sector, deploying specialised branch services that cater to rapidly changing consumer expectations

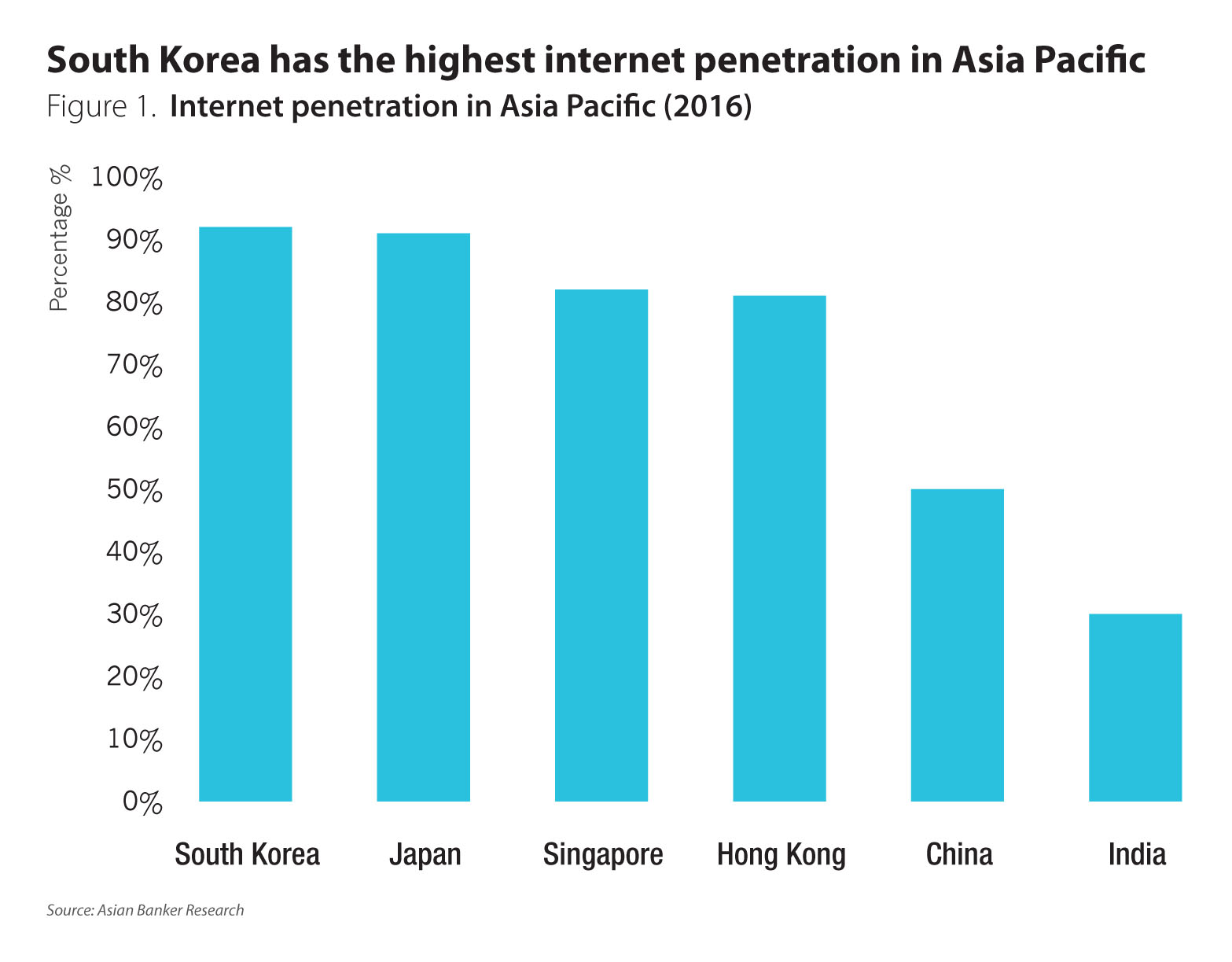

With more than 43 million internet users in South Korea, the country’s banking sector has taken a massive step toward the abolishment of brick and mortar branches with the launch of the country’s first internet-only bank that operates its business without face-to-face contact with customers. KBank is a consortium led by KT Corp., the largest fixed-wire operator, Woori Bank, Nautilus Hyosung, GS Retail, and Hyundai Securities. This move is part of South Korea’s efforts to foster the financial technology (fintech) sector, enhancing global competitiveness and anticipating the transfer of traditional retail onto the digital sphere. The country is in a prime position to target digital retail given its high mobile (88%) and internet penetration rates (85.7%), and it’s considerably developed high-income economy (Figure 1).

The South Korean economy has been affected by weakening global demand affecting its export sector, and local crises like the MERS virus have dampened tourism and domestic spending. By loosening regulation to encourage fintech development, the government hopes that innovation in the retail banking sector can help lift the economy and increase domestic spending, and open up an emerging sector to drive future economic growth. Changing socio-economic trends mean that younger South Koreans are looking online for financial services and products, like credit card applications, personal loans, and mortgages. The Bank of Korea has discussed an action plan for a ‘coinless society’ and such plans require a robust and well-constructed digital financial infrastructure to replace existing systems.

If banks hope to continuously engage with this demographic and adapt to changing economics, they must invest in digital banking channels to promote, distribute, and sell their products. Digital banking would complement the network of smartphone and internet infrastructure in South Korea, but banks must continue to expand their own digital products and services to meet the growing needs of the digital retail banking sector. This report profiles the propositions and products Shinhan Bank and KB Kookmin Bank have introduced as both banks compete for customers and market share in the internet retail banking sector.

Shinhan Bank

Shinhan Bank reported a 9% increase from 2015 in its retail banking asset size as of end 2016. Mortgage loans and personal loans took up the two biggest composition of Shinhan bank’s retail banking assets.

Retail banking revenues increased from $2.5 billion (KRW2.82 trillion) to $3.3 billion (KRW4 trillion) from 2013 to 2016 (Figure 2). Since 2013, retail banking assets have increased significant contribution to the asset growth for the bank overall.

And as the bank continues to expand and improve its retail banking performance, it has planned a five-year long-term strategic goal on retail banking to be carried out continuously until 2020. The bank identified areas which will improve their clients’ retail banking experience and profit figures in the long-term.

The first area Shinhan focuses on is an active client base expansion. The bank plans to achieve a 750,000-customer increase to its almost ten million active customer base in 2016. The current number of retail customers as of end 2016 stands at a figure of 24.59 million, with a 1.9% year-on-year (yoy) growth. By choosing to strengthen the segmented operations by customer group, including workers, women, and individual business customers, Shinhan will secure customers through enhancing leadership in the individual savings account (ISA) market and in bank account shifting. In addition, Shinhan will continue to attract new customers through credit card sales and cross-selling.

Cross-sell ratio for mass retail banking stands at 10.17%. Shinhan aims to acquire one million credit card bill settlement accounts. Another area of focus would be increasing non-interest profit. Shinhan will grow the number of household and corporate loans centering on healthy assets from which earnings are secured, and will continue to improve interest margins from loans by increasing key liquid deposits. Retail non-interest margin increased to 1.49% in 2016 from 1.13% in 2015. Key liquid deposits increased by $700 billion (KRW 8 trillion) in 2015, led by rises in active customers and credit card-affiliated store settlement accounts and by the inflow of stable funds from public institutions. The number of new credit cards issued amounted to 293,000 cards, since the launch of Shinhan Card in 2007, contributing to a significant increase in non-interest income. Shinhan is to generate more earnings from funds, bancassurance, equity-linked trust (ELTs), credit cards, foreign exchange, housing funds, and commissions, with a focus on increasing non-interest income to diversify the retail revenue structure. Current composition show mortgages and personal loans holding the largest percentages in Shinhan’s retail banking assets.

The launch of a new sub-brand, Sunny Bank, is Shinhan Bank’s transformation to lead the digital banking era. Sunny bank is an online banking platform that aims to expand the client base to younger generations. Automobile finance market is also one of the areas Shinhan has aimed to lead.

The launch of Sunny MyCar Loan in February 2016 has been used by people planning to buy new cars, extending $352 million (KRW 400 billion) of car loans amount for that year. The Sunny MyCar service includes automated document submission service for scrapping, used car physical check-up service and used car inventory search service based on big data. Customers can use the service without visiting bank branches; the loans also carry low, fixed rate interest guaranteed by Seoul Guarantee Insurance.

Overall, auto car loans figures for Shinhan increased by 5.30% in 2016, which was strengthened by the setting up of the mobile dealer networking system, according to the bank.

In addition, Shinhan is the first bank in South Korea to introduce digital kiosks with palm-print identification technology. These kiosks were installed in domestic branches, enabling 24-hour non-face-to-face banking services for retail clients. Features include the ability to open a new account, issue debit cards, print bank statements, manage funds through online banking, and pay fines and taxes using QR codes. The kiosks also allow near field communication- (NFC) based payments. With these functional capabilities, customers’ interactions with branches’ staff would relate to advanced products such as mortgages and specialised investments that require human interaction and unique documentation.

KB Kookmin Bank

KB Kookmin Bank expects to grow its largest retail banking customer base to 29.77 million by 2016, about half the country's population. The bank’s business network is the most extensive as well, comprising around a thousand branches nationwide, despite recent trends that show falling numbers of branches this corresponds to strategic efforts to specialise and re-orientate towards new consumer needs. The bank holds total deposits and loans at $203.17 billion (KRW231.2 trillion) and $206.7 billion (KRW235.2 trillion), respectively, up by $9.67 billion (KRW11.0 trillion) and $11.25 billion (KRW 12.8 trillion). The two figures represent approximately 21% and 19.5% in market share, both the largest within the industry.

Accompanying the release of attractive savings-related products introduced between 2015 to 2016, KB Kookmin created close to 840,000 new accounts, of which more than 564,000 accounts stemmed from "KB Kookmin One", offering diverse reduced fee services depending on the account users' transaction volume. Another product worthy of note is "KB DIY Instalment". This product consists of a wide range of options and benefits adjustable to customer preferences which attracted in excess of 29,000 accounts and over $20.21 million (KRW23 billion). The year-end balance as of 2016 of the new savings products combined is expected to gross over $1.58 million (KRW1.8 trillion). To enlarge the customer base and to secure loyal customers, KB Kookmin expanded the preferential services of the KB Star Club system, with focus on highlighting the benefits involved. KB Star Club consists of KB’s loyal customers who will get special services based on their transactions with KB’s bank, credit card, securities and insurances subsidiaries. The customers are offered differentiated financial transaction and non-financial services including discounts at beauty and rent-a-car outlets. The members of KB Star Club are also insured against financial fraud such as phishing or hacking as well as for public transportation accidents.

Due to South Korea’s fierce competition to maintain banks’ market shares, KB Kookmin has also launched Liiv, a mobile financial platform made for daily life. The application comprises of a calendar, personal ledger, travel card and banking service, allowing users to manage their money without cash transactions. Users can purchase mobile gift certificates and use the application as a travel card. Through its “go Dutch” function, users can also easily split bills and transfer money. Funds transfers can be done simply with information like account personal identification number (PIN) and the receiver’s account number. The Liiv application also allows users to withdraw money at KB branches or cash machines without cards or bankbooks.

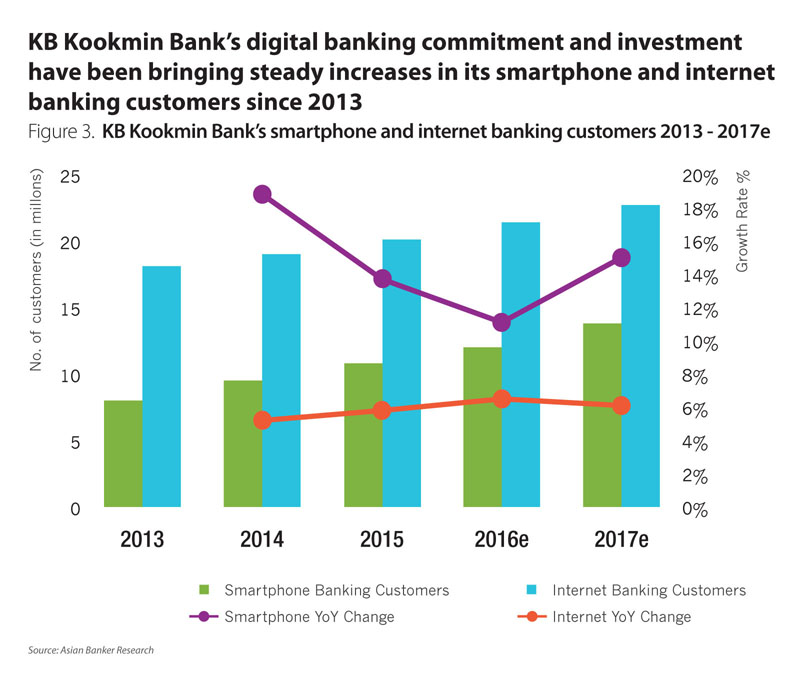

An attractive function of the app is that it allows users to change foreign currencies when the rate is favorable for them and let customers keep the money within the application for future use. The number of smartphone banking customers looks set to continue recent growth trends to reach 12 million and the bank is estimated to reach a 25% of market share in smartphone banking by the end of 2016 (Figure 3). Amid the increases in the volume for internet banking, KB Kookmin Bank adopted services to strengthen security such as PC-designation service, security-based SMS, phone-based authentication system for internet banking and anti-phishing personalised service.

KB Kookmin’s first attempt at fintech enhances the user convenience and security by implementing the smart one time password (OTP), allowing a password to be automatically entered into a smartphone that has NFC feature installed. This enhancement is more convenient than the existing token-type OTP where a password had to be entered in mobile banking.

Also, being the first bank to develop a mobile housing subscription in the banking sector, KB Kookmin enables customers equipped with a smartphone to subscribe to a housing unit they prefer without visiting. As a result of such substantial and practical customer satisfaction management, KB Kookmin was ranked first at the National Customer Satisfaction Index (NCSI) nine times in the banking sector.

KB Savings Bank, another branch of the KB Financial Group, also launched "KB Good Loan Mobile App", reflecting customer needs, while improving product feasibility and accessibility. KB Savings Bank extends micro-credit services at a low interest rate to assist in stabilising the economic livelihood of the ordinary citizens. The bank introduced "KB Good Conversion Loan", a credit loan conversion product for customers who took out a credit loan from other financial institutions so that they could lessen the burden from their high interest debts. KB Savings Bank’s KB Good Loan was introduced to customers struggling to have loan extensions at a counter of KB Kookmin Bank.

The way forward

With the South Korean government encouraging fintech in the retail banking ecosystem, and consumers and financial institutions quick to adapt, the launch of a variety of digital banking platforms for financial services will allow online retail services and products to be rolled out, bringing new economic growth in a struggling retail banking sector. Relaxed regulation is putting banks high on competition with each other and with new internet-only banks, as both contend for retail business and improved customer experience on digital platforms. South Korea’s bid to develop a capable fintech ecosystem has roused a struggling retail banking industry that was dominated by legacy banks and limited innovation. Recent shifts have certainly placed banks on their toes in exploring new retail product ideas and channels to ensure their own ability to retain current customers and to attract new ones in the future.