- Rethink traditional deposit business to compete effectively

- Digital wallets disrupt deposit business

- Digital tokens may drive innovation in deposit business

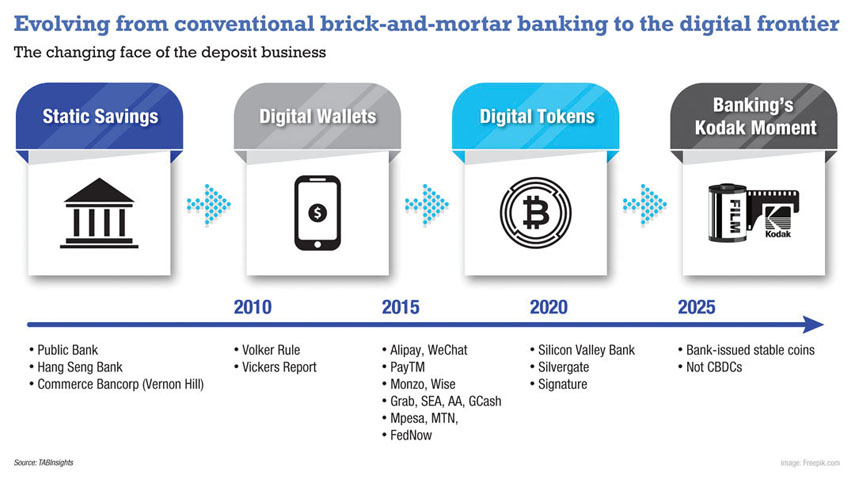

Banks have been great deposit collectors through the years. The deposit business in the traditional banking model was based on the principles of building close relationships with customers, offering basic savings services, but not without impediments, such as limited withdrawal options, maintaining minimum account balances and barriers to full withdrawal.

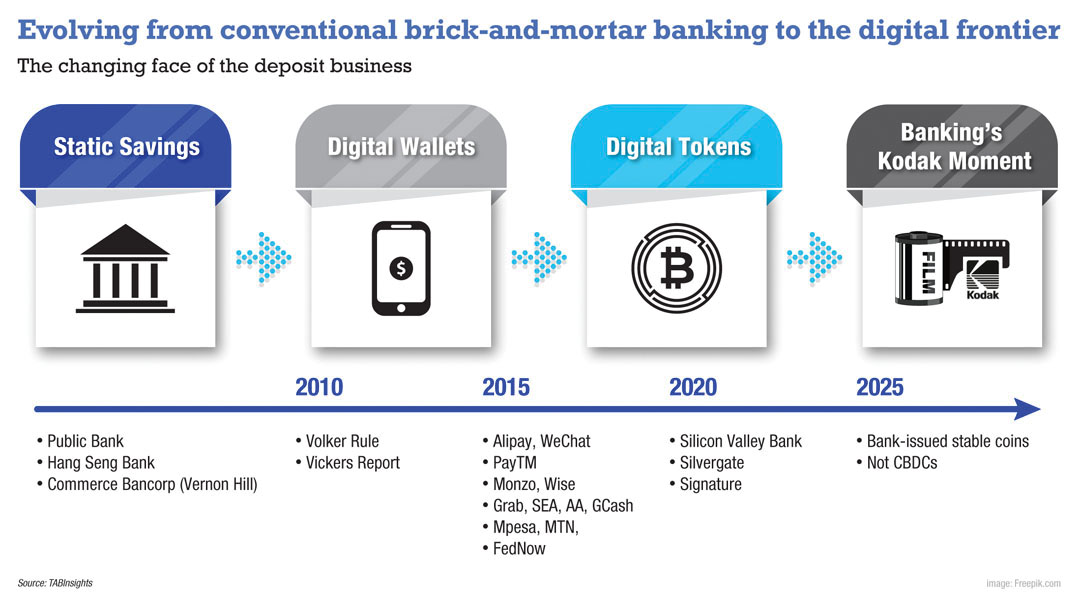

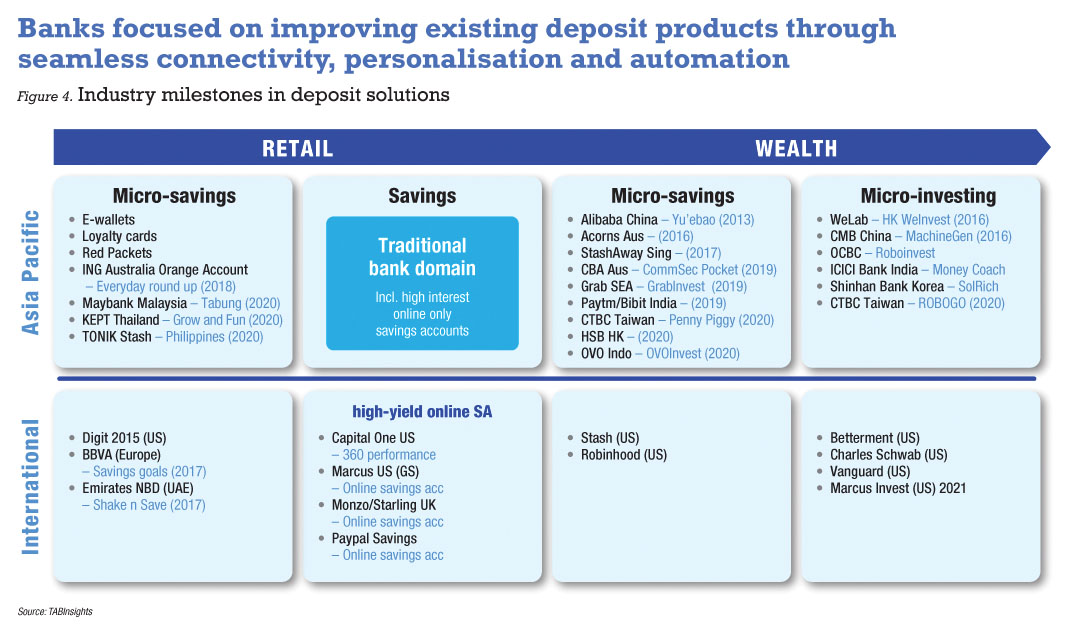

Banks diversify services to remain competitive in the wake of fintechs offering not only interest-competitive products but also catering to customer preferences, such as goal-based savings and budgeting tools, and a broader scope of functionalities and services around the savings account.

For instance, DBS Bank in Singapore has expanded its offering with a wider range of options on its digibank platform by including budgeting tools, investment options, and financial advisory options driven by artificial intelligence. Similarly, ICICI Bank in India included a ‘money coach’ feature with a personalised financial advisory that analyses the user’s transaction history, spending patterns, and financial goals. Other banks also improved the customer experience in their deposit business by focusing on ways to expand the customer journey with more digital capabilities.

Banks today are facing challenges in sustaining their deposit business due to the impact of digital technologies and the increasing popularity of digital wallets offered by platform players. By integrating digital wallets and mobile banking apps, customers can withdraw funds in seconds, access their accounts and initiate transactions directly from their smartphones.

Digital wallets disrupt the deposit business

Digital wallets have gained widespread use in Asia, surpassing traditional banking methods for small-scale transactions, e-commerce, and peer-to-peer payments. Digital wallets outperform markets in usage and transaction volume, with customers mainly transacting, transferring funds and storing money in digital wallets. Consumer interaction with traditional bank accounts has dropped, although it is still being used for larger transactions such as rent or mortgage payments, salaries, savings and investments.

By the end of 2022, the number of digital wallet users had reached 3.6 billion worldwide, and will peak at 5.2 billion by 2026, according to Juniper Research. The rise of digital wallets effectively disrupted the traditional deposit business, offering unprecedented convenience in accessing and managing funds, a digital ecosystem, and increasing added value for users, compared to traditional deposit accounts.

Globally, Alipay dominates the digital wallet market with 1.3 billion users, followed by WeChat Pay with 900 million and Apple Pay 507 million users. Since the COVID-19 pandemic, digital wallets have been used for transferring funds, making purchases, paying bills, and investing. While digital wallets do not pay interest on deposits, they provide added features like loyalty programmes and budgeting tools, providing greater control over financial management, enhancing independence and efficiency.

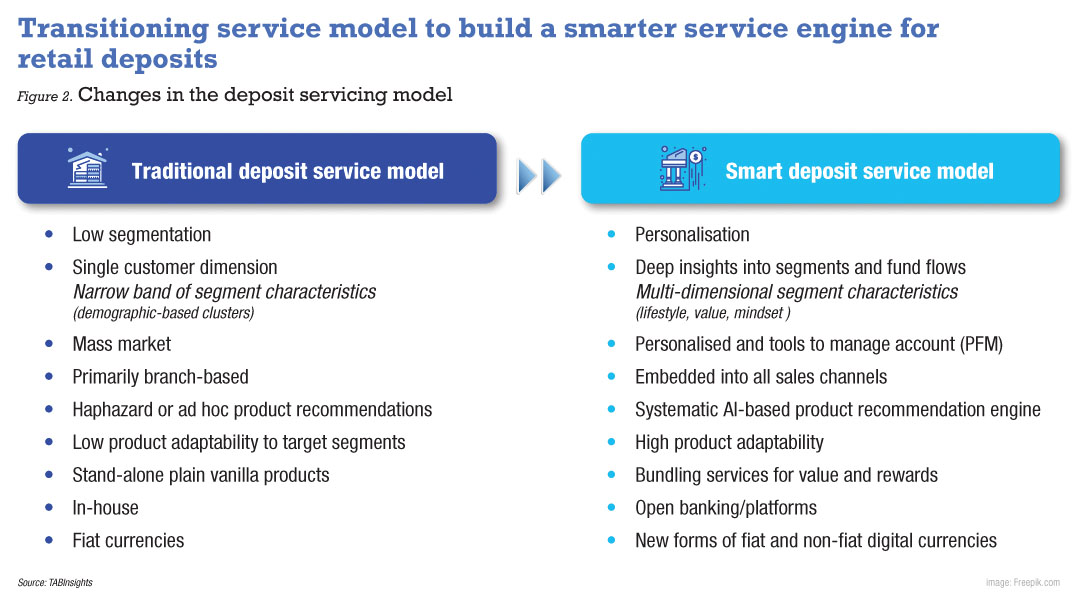

Banks are facing a potential decline in the deposit business due to wallets becoming more efficient deposit collectors. However, a regulated deposit ceiling prevents consumers from storing more funds on their wallets. Fintech platforms have lobbied hard with regulators to increase fund amounts in wallets.

Digital tokens may drive innovation in deposit business

Digital tokens have revolutionised the deposit business by opening new growth avenues, particularly in decentralised finance (DeFi) platforms. DeFi platforms leverage blockchain technology to provide users with alternative deposit options, interest earnings or engage in lending and borrowing activities. Users can directly deposit cryptocurrency assets into liquidity pools from their wallets, bypassing traditional banking intermediaries.

Digital tokens have significantly improved deposit business security by reducing fraud and identity theft risks. By using crypto algorithms, these tokens enhance customer data accuracy during identity verification, thereby reducing the likelihood of fraudulent activities.

Banks also face competition due to the fast-paced developments on digital platforms, such as digital currencies, blockchain technology, and DeFi, that shift financial services paradigms and challenge the traditional banking model.

Banks are obliged to rethink added value for customers, going beyond primary deposit services, to maintain market share and remain relevant. The rise of digital wallets, peer-to-peer payment systems and decentralised lending platforms have radically changed how the deposit business looks today. In the future, banks aim to leverage opportunities to develop bank-issued coins.

Failure to adapt and innovate could end in obsolescence and losing every competitive advantage to fintech players.