- Consumers voted for a different set of banks in 2023

- Incumbent institutions attracted a large base of loyal customers

- Inclusivity and adaptation to market and digital trends led to consumer satisfaction

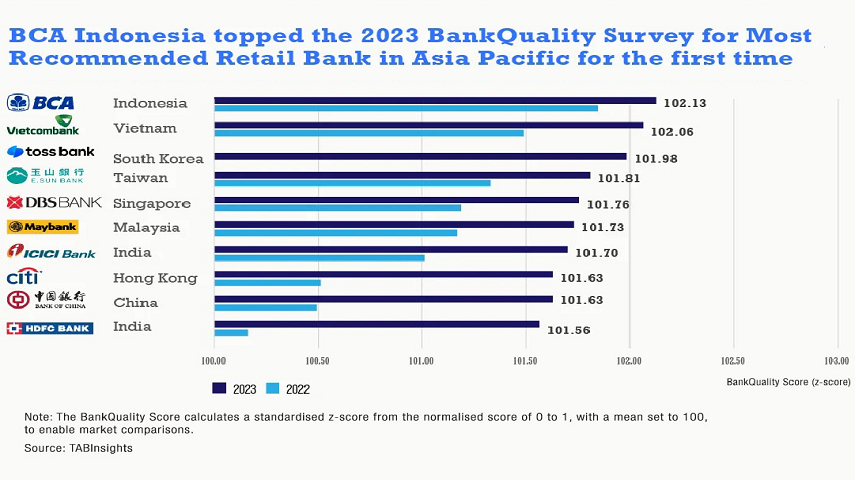

Bank Central Asia (BCA) Indonesia topped the consumer vote across Asia Pacific (APAC) markets this year with a BankQuality Score (BQS) of 102.13, toppling KakaoBank Korea.

This year’s BQS focused on the institutions’ established reputation, consumer preference and inclusivity. Consumers appear to be more aware of the products and customer service experience provided by their chosen and recommended bank, and commented on specific product and service offerings.

Consumers chose a different set of banks in both regional and national survey

BCA has a long-standing history in Indonesia. Its customers find it reliable, consistent and popular, and a trusted and helpful bank. Ongoing digital innovations and transformation across the financial and banking industry have pushed customers towards digital channels.

Vietnam’s Vietcombank changed the way its products and services were delivered to customers and jumped to second place in 2023. According to its customers, the bank provides suitable, stable and safe banking solutions.

The new entrant on the list, South Korea-based Toss Bank in third place, was voted for services that are reliable, dependable and secure. It is the sole digital-only bank in the rankings.The bank continues to address inclusivity and offers tailored services for different customer segments. It is the first bank in South Korea to allow foreigners to create a bank account. Following in the footsteps of TossBank, both BCA and DBS have also enabled foreigners to open local banking accounts.

Techcombank and KakaoBank were dethroned by Vietcombank and South Korea’s Toss Bank, respectively. UnionBank of the Philippines reclaimed its position from Bank of the Philippines. Vietcombank, E.SUN Bank and ICICI Bank entered the top-10 this year. Hong Kong’s Citibank, Bank of China and HDFC India remained in the top-10 list.

Long-established institutions attract large base of loyal customers

DBS Singapore topped the 2023 BQS as the Most Selected Main Bank in APAC. According to the survey, the bank is considered the safest bank in the country, garnering 65% of the total surveyed votes, 2% higher than last year. With over 12 million retail customers in 18 markets and a high customer retention rate, the bank has been repeatedly commended for its progressive and innovative solutions.

Consumers were more attracted to banks that provided superior customer service. Malaysia-based Maybank initiated a $4.89 million customer-service improvement programme launched in August 2022. It gathered 42.5% of the total surveyed votes and was noted for being a reputable and reliable bank. Maybank has over 6.9 million mobile users, over 380 retail branches and six investment banking branches in Malaysia.

Having many bank branches, automated teller machines and a strong presence despite uncertainties make a bank preferable. Kasikornbank (KBank) ranked as the third Most Selected Main Retail Bank in APAC. The bank has a large customer base of 21.3 million, up 9.3% year-on-year. KBank enhanced its appeal by launching K-Strategy that focuses on corporate social responsibility (CSR) and environmental social governance (ESG) initiatives.

Inclusivity and adaptation to market and digital trends high on customer agenda

Toss Bank, the first digital-only bank in South Korea, was the Most Recommended Digital Bank in APAC. This digital bank thrives on its strong reputation among South Koreans, with a keen focus on financial innovation and accessibility. In this category, KakaoBank ranked second and Paytm Payments Bank third.

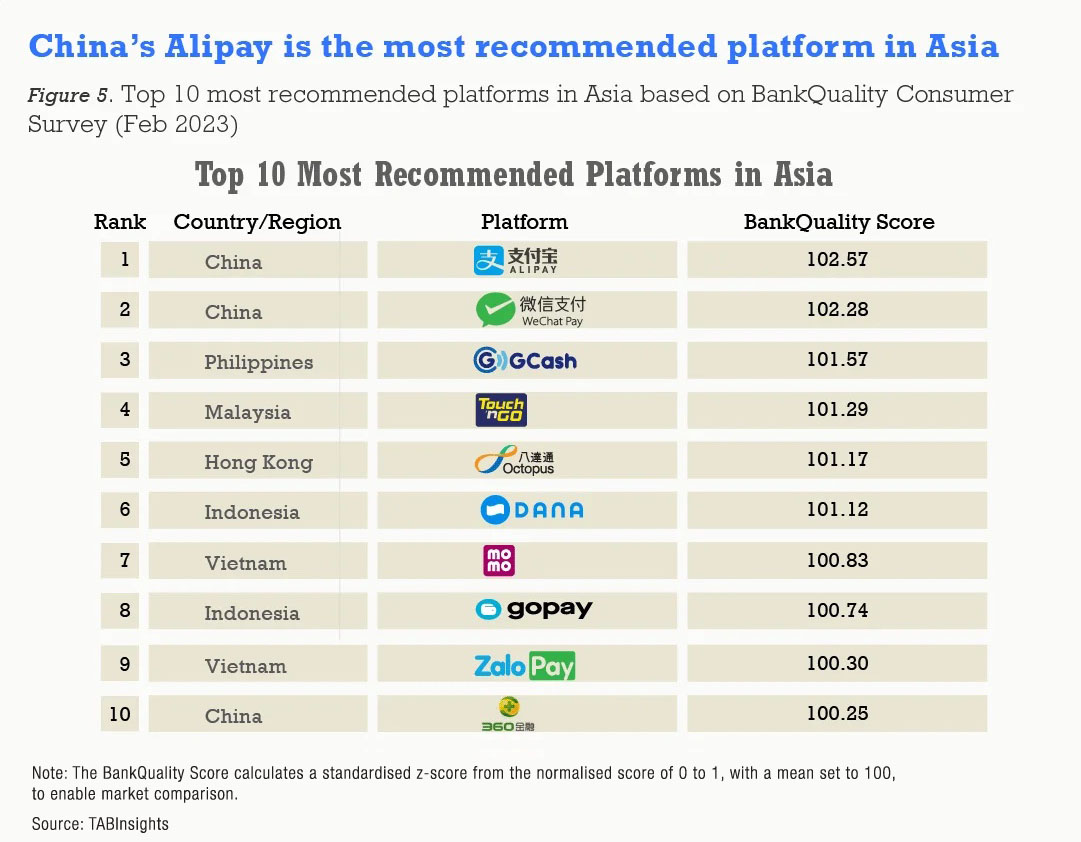

Alipay, with 747 million active users in 2022, made a major contribution to the Ant Group’s gross transaction value. Alipay was the Best Payment Platform in China, according to BQS responses. It was followed by WeChatPay, also from China.

Kasikornbank adopted CSR-linked initiatives that supports environmental sustainability, social development and community empowerment. This year’s BQS hinted that inclusivity is important to customers. Customers seeking more diverse and equitable services provide an opportunity to attract a broader customer base and improve customer satisfaction.

The BQS survey signals to the banks and financial services industry what customers value for their own satisfactory engagement with these institutions, and also sends a nod towards those that take a wider view around inclusivity and ESG responsibilities.