- The popularity of chatbots is slowly rising due to their improved capabilities

- The benefits of chatbots are driving usage well beyond early technology adopters, and banks are responding by offering increasingly capable chatbots

- Retail bankers will need to develop and implement a chatbot strategy more quickly than they might have previously expected

Chatbots (bots) are essentially intelligent software services that enable customers to have digital conversations, or chats, with a company online or on a mobile device so that they can obtain everything from products or service information to advice and recommendations. While some chatbots operate on a company’s website, those that operate on messaging services such as Facebook Messenger, Slack, or Telegram are becoming more popular.

What are chatbots and how do they work

If a consumer wants to buy shoes, for example, one option is to find a shoe store online and make a purchase based on the available information. If the online shoe store has a chatbot, however, the consumer can ask about the size, colour, style or other features and receive intelligent replies, as well as advice. That conversation with a bot is very similar to the experience they would have in a physical store.

When a consumer wants information about bank products or needs financial advice,bots can deliver similar support for consumers to manage their money. It is important to make a distinction, however, between “dumb bots” and “smart bots.”

Rules-based “dumb” bots only respond to specific questions. These bots are built with predetermined answers to predefined questions, which means they can only answer pre-programmed questions and have difficulty responding if a consumer asks a different question or uses words that could not be found in the rules.

“Smart” bots, on the other hand, use artificial intelligence (AI) and machine learning to deliver more complex and more useful responses. They can understand natural language and get smarter as they have more conversations with more customers, so they’re able to chat and answer questions almost like real people.

The rise of chatbots in retail banking and reasons for the shift

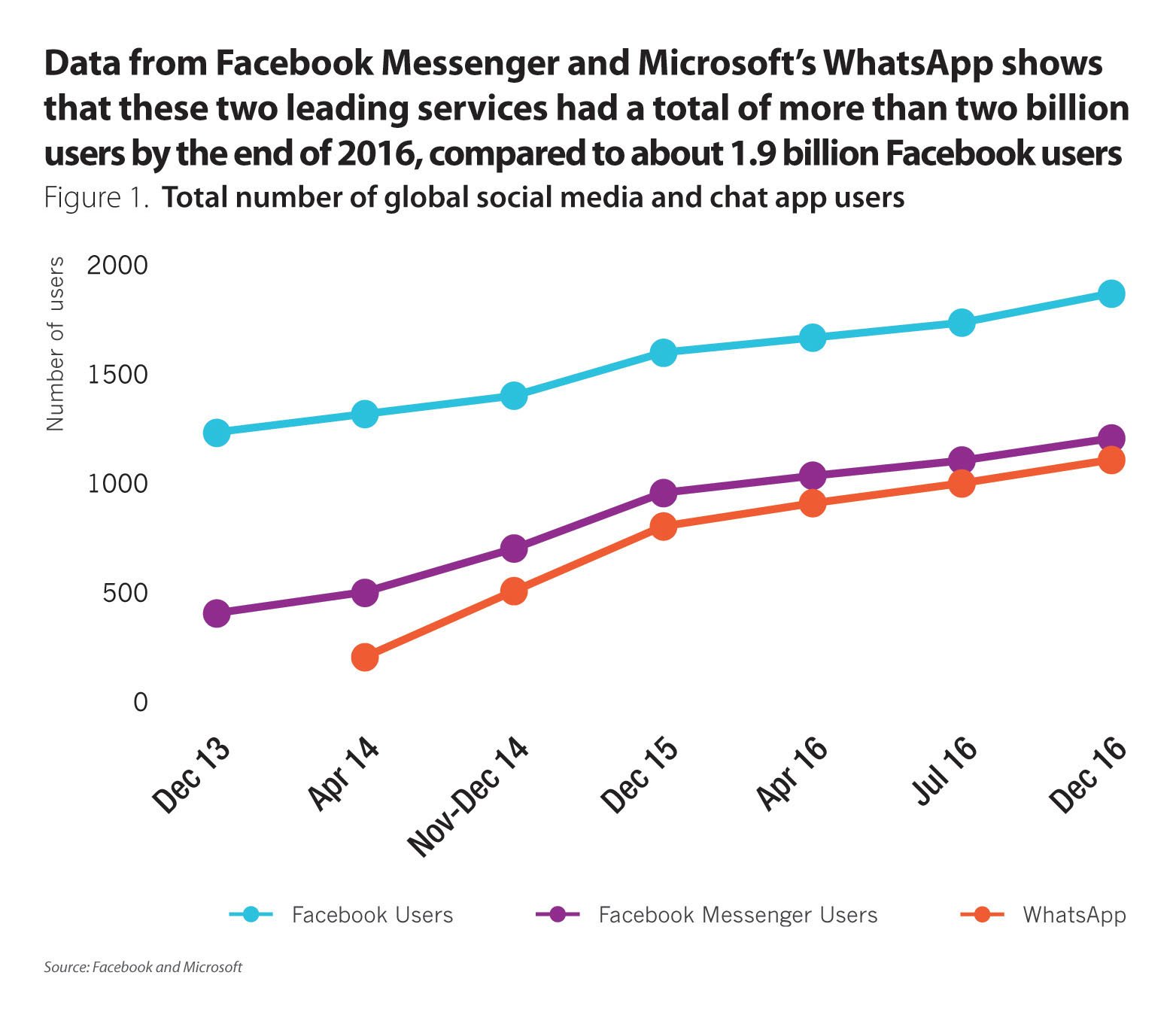

“Bots are the new apps,” Microsoft chief executive officer (CEO) Satya Nadella declared at the company’s Build conference in March 2016. “That’s the world you’re going to see in the years to come.” Indeed, bots are becoming more popular as their capabilities improve. A key catalyst has been a shift in consumer preference from social networks to messaging apps (Figure 1).

As customers become more familiar with chatbots, banks need to keep up with this technology, making them available to attract more clients in an increasingly competitive environment. The steady march of announcements about new services has continued relentlessly. Last year, for instance, American Express announced an Amex bot on Messenger that enables customers to receive real-time information about card benefits or services related to their purchase. A cardholder who buys an airline ticket can ask how to access the lounge at the airport or receive restaurant recommendations at their destination.

YES Bank in India also launched a chatbot that offers a “conversational smart banking” experience through Facebook Messenger, Twitter, Skype, Telegram or WeChat. The Indian bank is also working to develop advanced AI and multilingual proficiencies.

In October 2016, Bank of America announced that it would launch “Erica” (AmERICA), which it said will use AI, predictive analytics and cognitive messaging to help customers with services including making payments, checking balances, finding educational videos, and eventually, even receiving one-to-one advice.

This year’s Facebook F8 conference in April saw another flurry of announcements. Wells Fargo Bank launched a chatbot pilot which uses AI, for instance, and Western Union launched a money transfer bot in Messenger, which enables customers to send funds to 200 countries. Not to be outdone, American Express announced an upgrade to its own chatbot.

It’s not just banks that are rolling out chatbots, of course. Financial technology (fintech) firms are launching them as well. In the UK, for instance, Plum’s AI-powered chatbot on Facebook connects with a consumer’s current account, learns their spending habits and allows them to deposit small amounts into a savings account automatically every few days. Cleo lets consumers ask about their bank and card accounts so they can track spending and budget better.

Along with growing in number, bots are gaining in popularity. A recent survey by Personetics showed that more than three-quarters of bankers expect chatbots to become a viable commercial solution within two years, and almost half already have active chatbot projects underway.

Key drivers for increased usage of chatbots by retail banks

Consumers who use chatbots are getting used to the experience, realising that the access to fast answers 24x7 makes their lives easier. These benefits are driving usage well beyond early technology adopters, and banks are responding by offering increasingly capable bots.

Banks often started out by using chatbots to guide consumers through everyday banking interactions, from tracking spending to giving quick answers about balances. Leading banks are going beyond these simple interactions, however, to offer services such as helping customers set up a new account or answering questions about investments. Bank of America is well on its way to doing even more, saying that Erica will provide proactive guidance and anticipate customers’ financial needs.

Along with reducing cost, chatbots can also drive revenue by suggesting new products or services to the customer. While (24)7 forecasts that revenue will grow 30% over the coming year, growth could well increase at far faster rates in the coming years.

Beyond just financial benefits, however, chatbots offer more ways for banks to create trust and loyalty. To achieve greater trust, though, chatbots need to provide the same level of knowledge and communication stills – or better – compared to a real person and to appear as human as possible when customers chat. As long as customers have a positive experience, they’re likely to keep coming back and may even promote the bank to their friends.

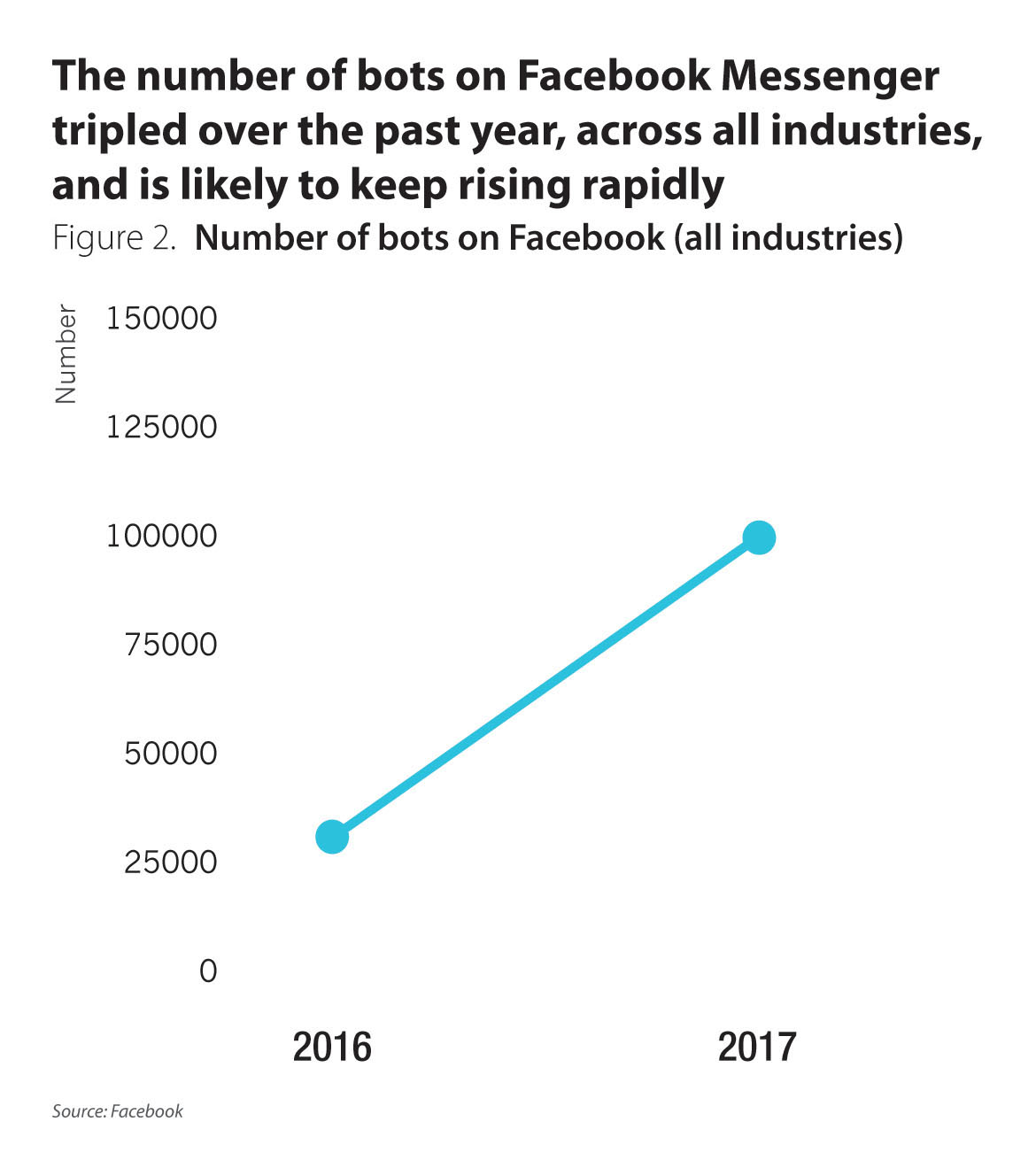

That rise in usage of chatbots doesn’t mean that they are an unmitigated success. Indeed, Facebook now suggests that some companies may be better off offering menus of questions rather than free-form questions. Although “the number of companies finding success (with chatbots) is probably higher than the number of companies launching apps and finding success,” Facebook Messenger Vice President David Marcus said at F8 in April, “we have a lot to learn.” Still, Facebook has said there are more than 100,000 bots on Messenger (Figure 2).

Key success factors at retail banks and obstacles to overcome

To take full advantage of chatbots and gain a competitive advantage, retail banks need to leverage best practices and prepare for the future.

A key success factor is making it easier for customers to receive insights, advice and analysis without having to search for information. To deliver this value, banks need to ensure that chatbots respond to customers’ requests accurately and provide helpful information.

If McDonald’s misunderstands a customer’s order and delivers three hamburgers, the results are unlikely to be significant problem. If a bank bot sends a customer’s money three times, on the other hand, the results can be catastrophic. Furthermore, banks need to make sure their bots don’t follow the path of Microsoft’s Tay bot, which started sending vulgarities and racial epithets shortly after it was launched on Twitter.

Banks also need to brand the chatbot, especially when customers access it via a third party such as Messenger, to highlight their brand and strengthen customer loyalty.

To build chatbots well, banks should identify the target audiences as well as usage channels, then develop a bot that delivers an excellent conversational experience for those audiences and augments conversations to add extra value. Software developers will need to develop a bot framework that orchestrates the conversation, control the interaction across the bank’s entire system, and ensure that the technology kkkis secure.

Beyond just launching a chatbot, banks will also need to train customers how to use it. Traditional advertising has often not worked, so banks can benefit from providing education through fliers, YouTube and social media as well as other channels that lead to people becoming excited about using the chatbot.

Case studies

HDFC

HDFC Bank in India has been exploring chatbots for at least three years, Nitin Chugh, the bank's country head for digital banking said. “We spotted early conversations going around, started to explore what was happening, and started a formal engagement program with fintechs.”

The bank’s initial bot-type service, launched more than two years ago, was based on a simple question-and-answer model. They quickly realised, however, that it needed to go to the next level and have a layer of AI on top.

As the bank moved on to the design stage for an enhanced chatbot, it found that traditional tools were not going be helpful and set up a separate team that started examining use cases and looked for fintechs with solutions.

After experimenting with 20-25 use cases, Chugh said, the bank developed a roadmap around a conversational user interface and set up a platform to deploy more services. Earlier this year, HDFC Bank launched an AI bot called “Eva”, which it says provides answers in less than 0.4 seconds. Along with a bot to respond to queries, the bank also launched a separate service on Facebook Messenger that offers ticketing for events or trains, mobile phone recharge, or even hailing a cab, like a concierge.

The chatbot is already making a significant impact, with usage having gone beyond early adopters and transactions on the bot on Messenger doubling every month. What the bank has found is important, Chugh said, is building capabilities on platforms that people are comfortable using and decluttering navigation so they can navigate easily to obtain answers.

Perhaps surprisingly, replacing people with chatbots was never a goal. Having seen that consumer interactions are shifting from branches and contact centres to digital, and that consumers are now using messaging rather than calls for 90% of their communications, the bank instead chose to use chatbots to augment staff capabilities, like answering customer queries.

Before long, Chugh said, he expects that chatbots will be able to make sense of emotion better by determining how customers type a word, the words they use, the time taken to type, or the force on the keyboard. The next step will then be towards advising people by using both chatbots and robo-advisors. Whereas the cost structure is too high to afford a relationship manager for someone with just $2,000, for instance, that person needs advice as much as someone with $2 million and chatbots can provide the service they require.

Wells Fargo

The goal for Wells Fargo bank’s chatbot, head of innovation and research and development Bipin Sahni said, is to be where its customers are. “Historically, if you look at banking, when we created branches, we said go to the branches. Then online, then mobile. If they’re on Facebook, we want to be on that.”

To be where its customers are, Wells Fargo partnered with Facebook Messenger for a proof of concept (POC) for its chatbot. Customers can enrol and select the accounts they want information for, then go on Messenger and do basic things such as checking their transactions or their portfolio. The bank quickly reached a total of 5,000 users for its POC.

The results so far are quite positive. “There’s a big reuse,” Sahni said. “It’s not that you just use it and don’t come back.” 16% of the users in the POC have used the chatbot at least ten times and 30% have used it three to five times. The demographics are also quite interesting, Sahni observed, as 45% of users are aged 18-44 and 4% are 65 years old or above. 5%-7% prefer the desktop version of Messenger. “We’re getting an understanding of how customers are using it, and how we can add value.”

When a customer asks a question that the bank is not prepared to answer through a chatbot, such as a brokerage-related inquiry, the bot sends the question to a personal care team. And along with customer service augmenting the bot, the bot augments customer service. For example, if customers are already logged in to Facebook, they don’t need to log in again. “If you’re more accustomed to this channel, why wouldn’t this become a way to do more?”

Once the chatbot pilot is successful, Sahni said, the team will think about how to expand further. In parallel, the bank is working on an algorithm for natural language understanding and on open source solutions. “As we expand internally, we make sure lines of business are ready to support this ‘Next Gen’ mode. You’ll see features and functions.” And as the market evolves, the bank is even looking at how to provide more capabilities such as travel advice so that customers don’t need to leave the Wells Fargo app at all.

Chatbots becoming vital tools for banks

While chatbots may have started out as a simple customer response device for retailers, they’re now starting to become a vital tool for banks. Beyond just using chatbots to respond to customers, leading banks are starting to use technology such as AI and machine learning so that their chatbots can make staff more efficient, augment rather than replace staff or online capabilities, and drive revenue higher. With chatbots become more familiar, driving competitive advantage, retail bankers will need to develop a chatbot strategy more quickly than they might have previously expected.